Options trading has evolved into a complex and dynamic financial landscape, with retail traders seeking every possible advantage to make informed decisions. One such crucial element that plays a pivotal role in understanding market sentiment and potential price movements is “Options Order Flow.” In this analytical and insightful article, we delve deep into the intricacies of Options Order Flow, offering retail traders a comprehensive guide to navigate this powerful tool effectively.

Key Takeaways

Options order flow provides details of transactions by institutional investors, revealing trading volume, potential opportunities, and insights into market trends, which can guide traders in making strategic decisions.

Key trading elements such as tracking institutional trades, analyzing block trades, interpreting sweep orders, and examining dark pool prints can offer traders valuable insights into market sentiment and potential price movements.

Combining technical analysis with options order flow can create a powerful strategy for more informed trading decisions, while historical data insights optimize trades by identifying patterns and trends for strategy development.

What is Options Order Flow

Options Order Flow refers to the real-time flow of buy and sell orders in the options market. It provides traders with invaluable insights into the activities of institutional investors, market makers, and other participants. By analyzing options order flow, retail traders can gain a competitive edge in predicting potential price trends and identifying trading opportunities.

General Components of Options Order Flow

Bid-Ask Spread Analysis

The components of options order flow, specifically the bid-ask spread analysis, provide valuable insights into market liquidity and the cost of executing trades.The bid-ask spread is the difference between the highest price a buyer is willing to pay for an asset (the bid) and the lowest price a seller is willing to accept (the ask)

This spread is a key indicator of market liquidity, with a narrow spread indicating high demand and a wide spread suggesting low demand. Analyzing the bid-ask spread can help traders identify potential entry and exit points. Entry points are the price points suitable for investing or purchasing a security, often determined by a well-studied trading strategy.

Exit points, on the other hand, are the price points at which an investor decides to sell an asset. Several factors can affect the bid-ask spread, including the volatility of the underlying asset, time to expiration, and overall market conditions.

For instance, bid-ask spreads often widen when the underlying stock begins to see heightened volatility. Another aspect to consider when assessing the liquidity of an option is the existing open interest, which represents the total number of contracts that remain open and not yet settled. A higher open interest indicates more interest from investors, making the option more liquid. The cost of executing trades is also a crucial factor to consider.

Implied Volatility Analysis

The components of options flow and the relationship between implied volatility and options flow are crucial to understanding options trading. Larger implied volatility means higher option prices. This is because higher implied volatility indicates that greater option price movement is expected in the future.

During times of high volatility, options can be a valuable addition to any portfolio as part of a prudent risk-management strategy or as a speculative, directionally neutral trade. Options can also be used to protect an existing stock position against an adverse volatile movement.

Implied volatility is directly influenced by the supply and demand of the underlying options and by the market’s expectations. As expectations rise, or as the demand for an option increases, implied volatility will rise. Options with elevated implied volatility levels tend to command higher premiums.

Volume Analysis

Volume analysis refers to the examination of the number of contracts traded in a security or an entire market during a given period. High trading volume often indicates strong investor interest and can lead to more significant price movement. Volume is a measure of the total number of contracts that have been traded in a day. It can be higher than open interest because contracts can trade hands multiple times without creating a new contract.

Liquidity is another crucial aspect of options order flow. The daily trading volume is a primary indicator of options’ liquidity. Higher volumes often mean that the option contract is more liquid, making it easier for investors to enter or exit positions at their desired price levels. A higher trading volume can also lead to narrower bid-ask spreads, reducing the cost of trading.

Market sentiment can be gauged by analyzing both volume and open interest together. High volume and high open interest in the options market often reflect heightened activity and interest in an options contract. This can provide a more robust confirmation of the prevailing market sentiment, which could bolster your confidence in your investment decision

Market Depth Analysis

Market depth is a critical component of options flow, as it provides insights into the liquidity and potential price impact of trades within the market. Market depth refers to the market’s ability to absorb relatively large market orders without significantly impacting the security’s price. It is often visualized through an electronic list of buy and sell orders, organized by price level and updated in real-time to reflect current market activity.

Traders analyze market depth to understand the supply and demand dynamics at different price levels, which can help in identifying potential support and resistance levels. This type of analysis can also provide insights into the potential price movement of a security and help traders make more informed decisions.

Technical Analysis

By combining technical analysis with options flow, traders can validate their technical readings with the actual market activity reflected in options trading. For instance, a bullish chart pattern accompanied by a significant uptick in call option purchases could reinforce a trader’s decision to take a long position. Conversely, if options flow contradicts the technical signals, a trader might reevaluate their strategy.

This synergy allows traders to make more informed decisions by considering both the historical price action and the real-time betting of market participants. It’s important to note, however, that while this combination can be powerful, it is not infallible. Traders should use these tools as part of a broader, well-rounded trading strategy that includes risk management and considers other market factors

Different Types of Order Flow

Sweeps

Sweep orders are a type of market order used to execute a large order quickly across multiple exchanges. Traders use sweep orders when they want to avoid the fragmented environment of the market and are willing to pay a premium for this convenience.

These orders are split into numerous smaller orders that are executed at the best possible prices across different exchanges. The urgency and size of these orders often indicate a strong directional bias, making them an important indicator in options order flow analysis.

Sweep orders are often used by institutional investors who need to execute large orders quickly without significantly impacting the market price. They are considered aggressive due to their multi-exchange nature and the speed at which they are executed

Split Orders

Split orders are similar to sweep orders in that they involve dividing a large order into a series of smaller ones. However, unlike sweep orders, split orders are filled on a single exchange. This strategy is used when market liquidity may be insufficient to satisfy a large order. Split orders can help to avoid large fluctuations in the market price of a security.They are also used to avoid signaling an investor’s intent, as large orders can move markets.

Block Trades

Block trades are large orders, typically made by institutional investors. These orders often consist of more than 10,000 shares of a security or a total market value of more than $200,000. To lessen the impact on the market, these large orders are often broken up into smaller ones.

Block trades are privately negotiated and executed outside of the open markets. They are significant because they represent a substantial investment by large financial institutions, which can provide insights into institutional sentiment towards a particular security.

Spotting Unusual Options Activity

In the world of options trading, staying ahead of the curve often means spotting the unusual before it becomes the norm. This section will delve into real-world examples of spotting unusual options activity (UOA), a phenomenon that occurs when the trading volume in an options contract significantly exceeds its average. This surge in activity is often driven by institutional investors and can signal potential future price movements. Let’s take a look at some real world examples:

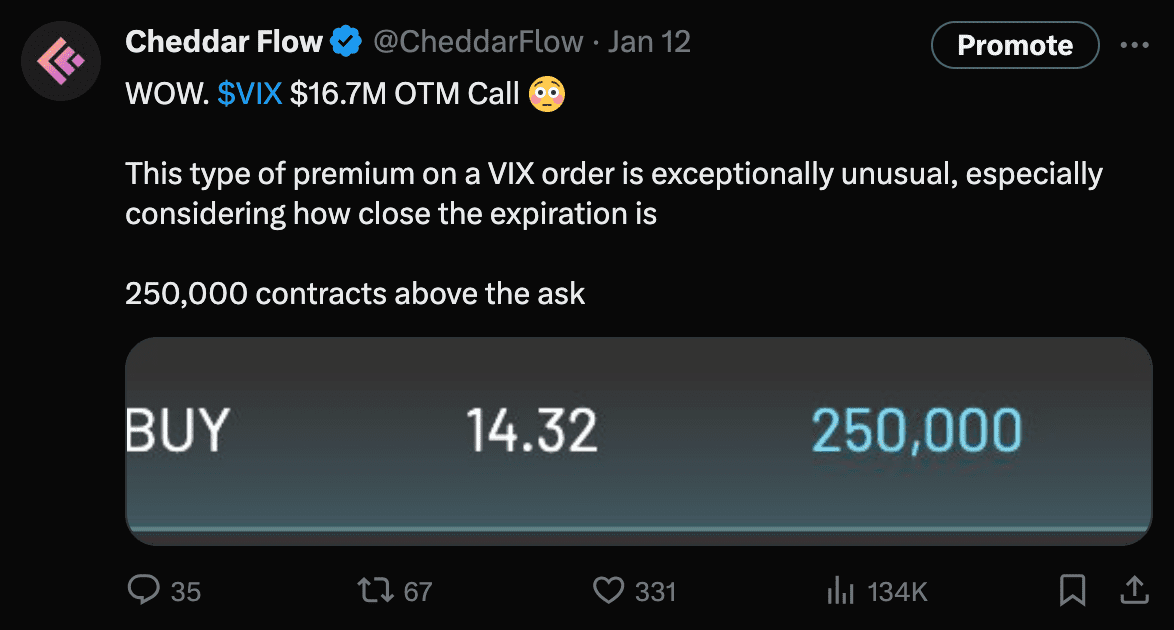

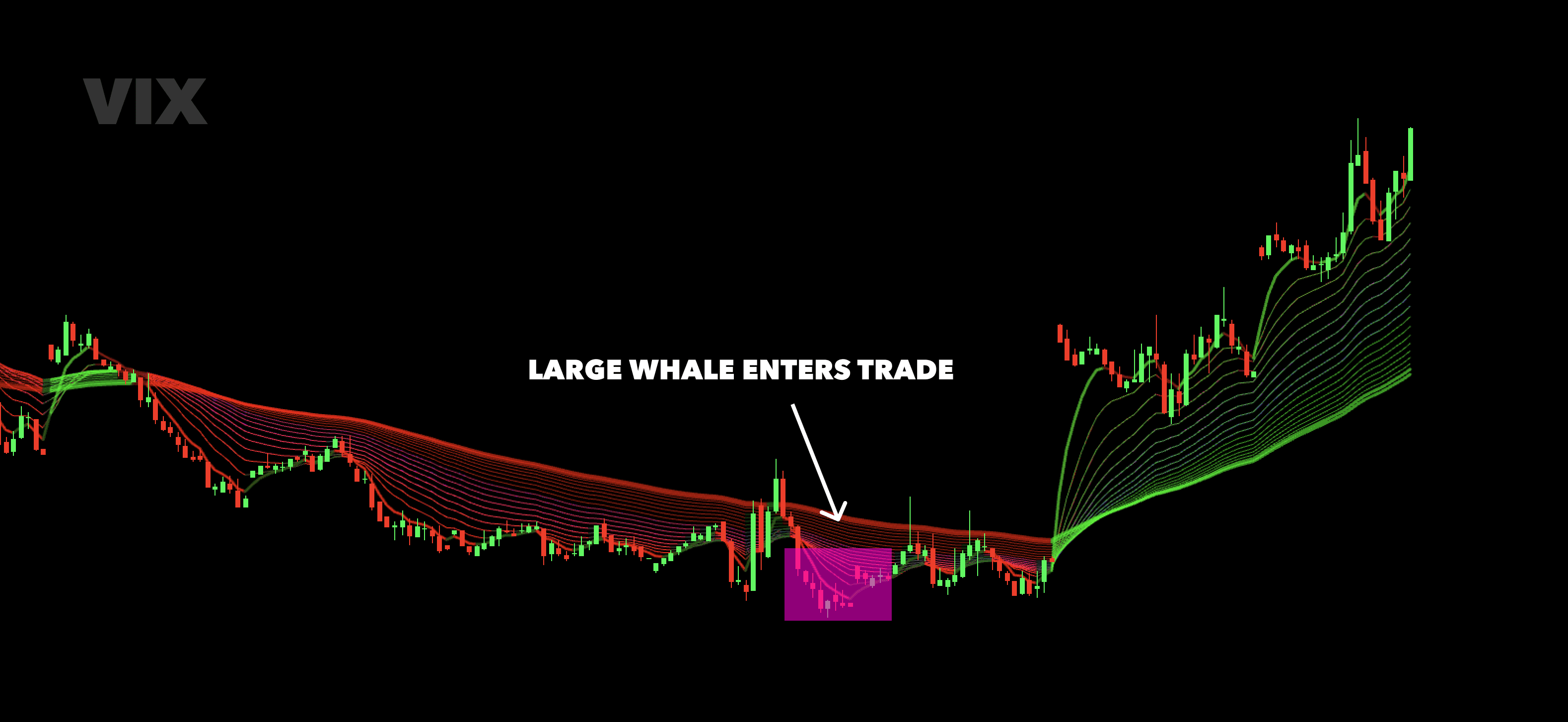

The $16.7 Million VIX Whale

On January 12th, 2024, A trader purchased 250,000 contracts for a $16.7 million out-of-the-money call with a strike price of 17, set to expire on February 14th, 2024. This event is notable due to the rarity of such a large purchase, which subsequently caused a flurry of activity in the market as other traders reacted, potentially hedging their positions or mimicking the large trader’s bet.

This was a highly unusual trade, given the current state of the Volatility Index (VIX). The VIX has been suppressed for a considerable period, particularly since its low point in October. The market has been consolidating within a specific range, and the trader’s bet on a strike price of 17 within the next month is unusual, considering the VIX hasn’t reached that level since the first week of November.

The trader’s strategy doesn’t necessarily require the VIX to hit 17 for them to profit. If the desired increase in volatility occurs within the next week or so, they could still profit even if the VIX reaches a lower price. However, the fact that the trader is targeting such a high strike price, especially for an out-of-the-money call, is noteworthy and could indicate an expectation of significant market volatility in the near future such as the CPI report that is is set to be released a day before the expiration date of the trade and fourth quarter earnings reports of companies.

So what happened? As of January 17th, less than a week of trading, the VIX reached its highest level since November 14, 2023. This resulted in the whale profiting over 60% on the trade and netting them over $10,800,000.

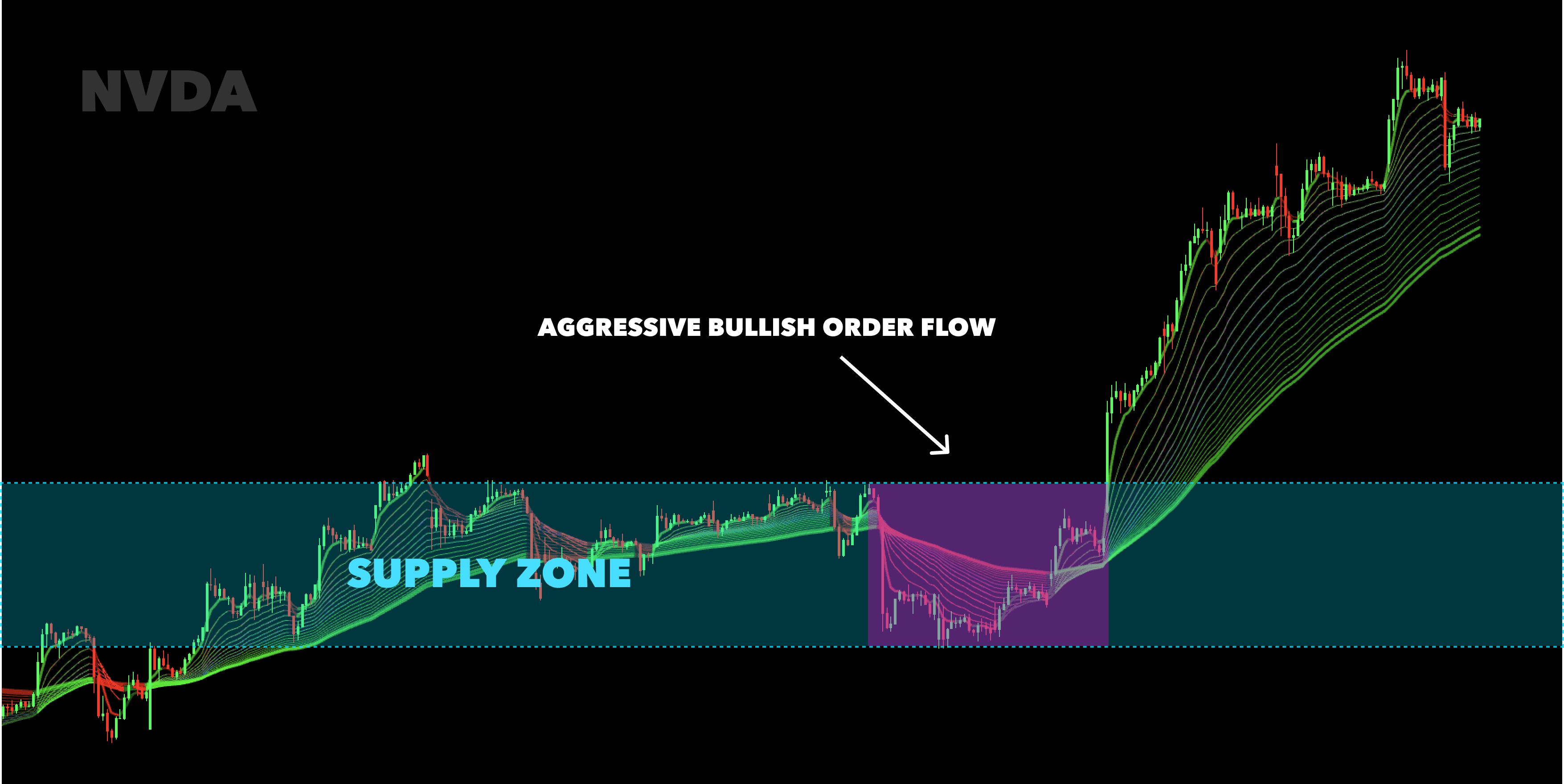

Aggressive Bullish Order Flow on Nvidia

Between January 5th and 10th, there was a significant amount of bullish flow characterized by a high volume of put options being sold at the bid and call options being bought above the ask. This unusual activity was in focus as it suggested a strong bullish sentiment among traders. It was also particularly unusual for the contracts being out-of-the-money, such as a 510 call for the February 16th expiration, which had a premium of $1.4 million.

So what happened? The bullish flow was directly correlated with the price movement of Nvidia’s stock. On January 5th, the stock was approaching a key supply zone, and on the following Monday, it broke out of this area and continued to rise throughout the week. Overall, this type of order flow activity is described as “excessively bullish” and is seen as supporting the breakout from the above chart example.

Make sure to check out our trading with the flow video where we directly break down NVDA’s unusual options flow in more detail.

Top 10 Options Flow Strategies

To effectively use options order flow, you should consider the following:

Observe and Learn: Start by observing the options order flow without immediately putting real money on the line. Understand the basics of how options flow works and get a feel for the type of flow that fits your trading style.

Understand the Intent: Try to comprehend the intent behind large options trades. Look for catalysts, recent news, or upcoming earnings that might explain the order flow.

Technical and Fundamental Analysis: Use options flow as a confirmation factor alongside your fundamental and technical analysis. When all three align, you’re likely facing a high probability directional trade.

Wait for Optimal Entry Points: Don’t chase trades right away. Wait for the stock to break past key resistance levels or fall back to support levels for a better entry price.

Look for Changes in Flow: Pay attention to new names or tickers where the flow has changed direction. This can indicate fresh trading opportunities.

Consider Multiple Data Points: For a higher chance of success, look for trades where options flow, technical indicators, dark pool activity, and news sentiment all agree.

Out-of-the-Money Activity: A sudden spike in activity for options that are far out of the money, such as a stock trading at $100 while there’s a high volume of call options with a strike price of $150. This might suggest that some traders anticipate a major positive catalyst for the stock.

Use the Right Tools: Utilize platforms like Cheddar Flow to monitor options order flow, which can provide insights into institutional activities and help predict market movements.

Skip Complex Strategies Initially: If you’re new, it might be beneficial to skip trades that are part of complex strategies like spreads, as they can be harder to interpret.

Monitor Implied Volatility: Be aware of the implied volatility (IV) levels when entering trades, as high IV can decrease contract value if it reverts to the mean.

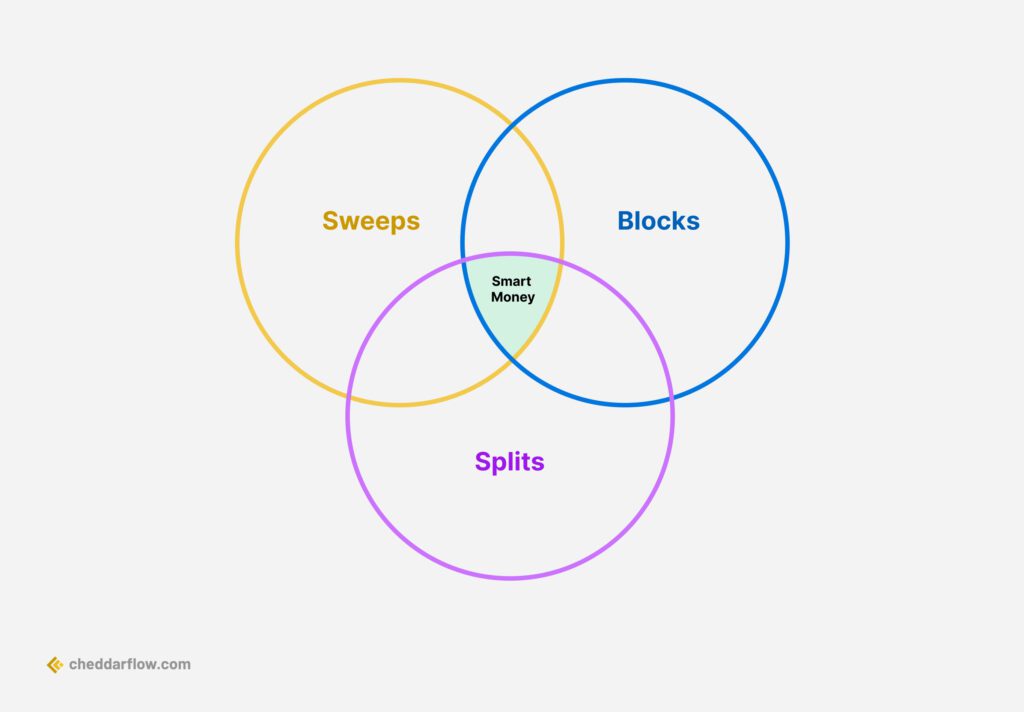

Smart Money vs. Retail Traders

In the context of options order flow, “smart money” refers to institutional investors, market makers, funds, and large traders who have access to more information and resources than retail traders. They often have the ability to see public information before retail traders do and can execute trades with more urgency and in larger volumes. They also have the ability to split large orders across multiple exchanges to stay under the radar, a strategy often seen in sweep orders.

On the other hand, retail traders are individual investors who typically have less capital, fewer resources, and less access to information compared to institutional investors. They often rely heavily on technical analysis and may not have the same level of understanding or ability to analyze options order flow as institutional investors.

For example, smart money might use their resources to execute a large volume of options contracts, indicating a strong sentiment about the future price movement of the underlying asset. This could be seen in the form of a large sweep order, which is broken into smaller orders and executed across multiple exchanges. This type of activity can signal momentum and urgency, and is often used by smart money to enter the market during periods of weakness, when retail traders are selling.

Retail traders, on the other hand, might execute smaller, less frequent trades based on their individual analysis or sentiment. They often rely on retail brokerages, which route their orders to financial intermediaries known as wholesalers for execution. These wholesalers receive payment for order flow (PFOF) in return, a practice that has seen a rapid increase in recent years.

Retail traders can, however, leverage options order flow to gain insights into smart money activity and potentially improve their trading strategies. By understanding and utilizing options order flow, they can gain valuable insights into smart money sentiment and potential market moves.

Tools and platforms like Cheddar Flow can help retail traders track large purchases in specific options contracts and follow the smart money.

Common Mistakes to Avoid in Options Order Flow Analysis

Options order flow analysis is a critical tool for traders looking to understand market sentiment and the actions of large institutional investors. However, there are several common mistakes that traders should avoid when analyzing options order flow:

Not Understanding the Data: A fundamental mistake is not fully comprehending the order flow data. This includes not knowing how to interpret large trades, the difference between various types of options strategies (such as spreads, condors, etc.), and the significance of trades occurring at different price points relative to the bid-ask spread.

Ignoring the Overall Market Trend: Traders sometimes focus too narrowly on the order flow of individual options without considering the broader market trend. This can lead to misinterpreting the data and making trades that go against the prevailing market direction.

Targeting Illiquid Options: Trading in options with low liquidity can lead to slippage and difficulty in executing trades at desired prices. It’s important to target liquid tickers and options to ensure smoother order execution.

Not Considering Hedging and Spread Trades: Institutions often use options for hedging purposes, and many option trades are executed as part of a spread or complex strategy. Not taking these factors into account can lead to a misunderstanding of the true market positioning.

Failing to Use Options Flow Data Effectively: Options flow data should be used to inform trading decisions, not dictate them. Traders should use their own analysis and intuition in conjunction with flow data to make informed decisions.

By avoiding these common mistakes and approaching options order flow analysis with a comprehensive and informed strategy, traders can improve their chances of making profitable trades.

Summary

This article illuminated the path to mastering the market through options order flow, revealing the importance of following institutional trades, leveraging real-time data, understanding the synergy of technical analysis and options flow, and following the smart money. With the right tools, knowledge, and strategies, navigating the market for strategic trading becomes a journey of continuous learning, growth, and success.

Frequently Asked Questions

What is option order flow?

Option order flow involves tracking institutional investors’ activity in puts, calls, and shares to predict future movements in a particular stock, index, or ETF. This can help in understanding probable future biases in the market.

How do option orders work?

Option orders work by granting the holder the right (but not the obligation) to buy or sell an underlying asset at a set price on or before a certain date, based on whether it is a call or put option. The contract may be executed, sold, or expire worthless.

Is order flow a good indicator?

Yes, order flow analysis can be a good indicator for short-term trading, as it helps predict order imbalances at future price levels, providing more precision and confidence when entering the market.

What are block trades and who typically carries them out?

Block trades are privately negotiated large options transactions typically carried out by institutional investors. It is important for traders to monitor and analyze these trades as they can move the market in the opposite direction.

What are sweep orders and how are they executed?

Sweep orders are divided across multiple exchanges to quickly and discreetly execute trades, engaging all available counterparties to prioritize the best prices until the order is filled.

Please note that the information provided in this blog post is purely for informational purposes and should not be considered as personal financial advice. The content does not offer a comprehensive statement of the subject matter discussed and does not constitute investment advice, nor does it constitute an offer to buy or sell.

Though this post aims to offer valuable insights into options order flow and trading strategies, conducting personal research and understanding trading risks remains paramount.