In the world of options trading, two crucial factors can make or break your trading experience: option volume vs open interest. These metrics not only gauge the liquidity and activity of an option, but also play a pivotal role in shaping your trading strategies. But what exactly is option volume vs open interest, and how do they differ? More importantly, how can you use these factors to your advantage in the ever-changing landscape of options trading?

Embark on a journey with us as we delve deep into the realm of option volume vs open interest, unraveling their intricate relationship and uncovering how they can be harnessed in the pursuit of successful trading strategies. From factors affecting these metrics to their roles in trading strategies and liquidity assessment, we’ll leave no stone unturned in our quest to provide you with a comprehensive understanding of these vital aspects of options trading.

Short Summary

Option volume and open interest are key metrics used to measure liquidity, activity, and depth of options.

Liquidity indicators like option volume and open interest can provide traders with potential trading signals that guide them to make informed decisions.

Examining popular options for their volumes & open interests helps investors gain insights into market trends & behavior of other participants.

Understanding Option Volume

Option volume is the total number of contracts transacted in a given day, reflecting the level of trading activity for a specific contract. In essence, volume serves as a barometer of market engagement in a particular security, with higher trading volume suggesting a promising opportunity to invest. As volume increases, the bid-ask spread tends to decrease, leading to more efficient pricing.

Highly liquid options like SPY, VIX, QQQ, and IWM are popular among investors due to their ease of trading and favorable pricing. Volume plays a crucial role in determining how liquid an options contract is, giving investors a better understanding of the market’s interest in a specific option.

Factors Affecting Option Volume

Several factors can influence option volume, such as the price of the underlying security, time to expiration, volatility, interest rates, and dividends. Market sentiment, for instance, has a direct impact on option volume, as positive sentiment encourages investors to purchase options, resulting in increased volume.

Liquidity and volatility also play significant roles in determining option volume. High liquidity allows investors to rapidly transact, thus increasing option volume. Similarly, as volatility increases, the attractiveness of buying and selling options rises, leading to higher option trading volume.

Understanding Open Interest

Open interest is a metric used to measure the total number of open option contracts in the stock market between two parties. This provides an insight into the liquidity and depth of the option. A high open interest indicates a greater number of market participants actively trading the contract, making it easier to trade the option and exit at a reasonable price, especially when dealing with illiquid options or stocks.

When the volume surpasses the open interest on a given day, it indicates that trading in that option was extremely active that day. Open interest provides valuable insight into the level of activity or interest in a given strike price, and its daily fluctuations can help traders understand the market’s direction.

Factors Affecting Open Interest

The primary determinants of open interest are new positions, closing orders, and exercised options. When new contracts are initiated or opened, open interest increases. Open interest decreases when an equal number of buyers and sellers close their positions in existing contracts. This happens when both parties don’t want to renew the contract.

Another factor that affects open interest is the relationship between closing orders and new positions. Closing orders offset and diminish the contract’s open interest as the contract is no longer extant, while new positions augment open interest as they create fresh contracts in the market. If both parties have orders of the same number of contracts, one an opening order and the other a closing order, open interest remains unchanged.

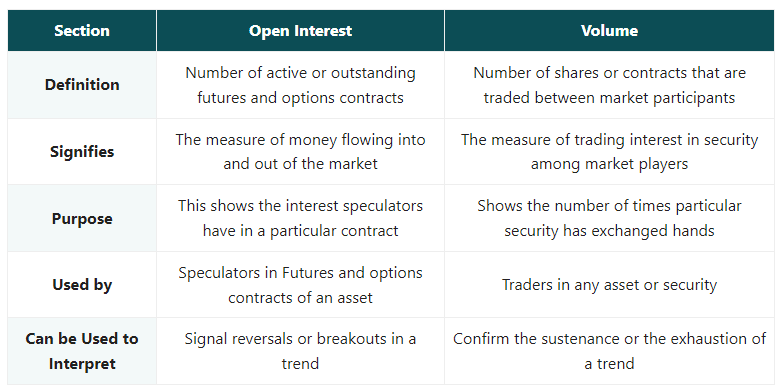

Comparing Option Volume and Open Interest

Image by wallstreetmojo.com

Although both option volume and open interest provide essential information regarding liquidity and activity in the options market, they serve different purposes as liquidity indicators. Volume captures the activity and liquidity of a contract on a given trading day, whereas open interest provides a comprehensive view of ongoing interest.

Understanding the distinction between volume and open interest is vital for investors, as it helps them make well-informed trading decisions. For instance, high volume in conjunction with a price movement suggests a promising investment opportunity, while high open interest indicates an active secondary market, increasing the chances of obtaining option orders at favorable prices.

Liquidity Indicators

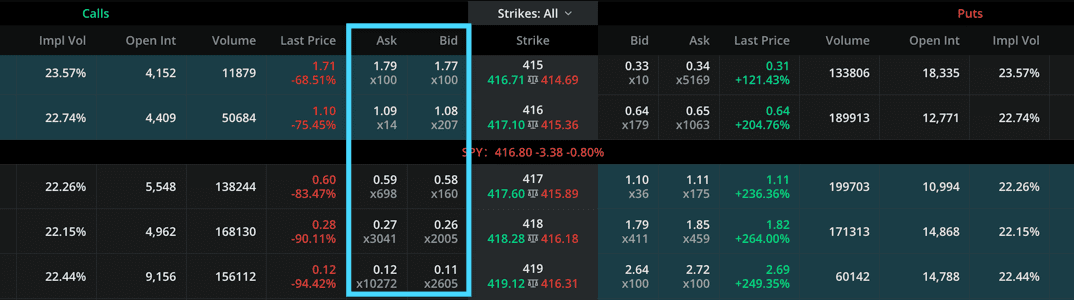

Liquidity indicators, such as volume and open interest, are essential metrics for options traders, as they provide a measure of the ease with which options can be traded at desirable prices. High liquidity generally corresponds to higher trading volume and narrower bid-ask spreads, making it easier for traders to enter and exit positions.

By using liquidity indicators like volume and open interest, options traders can assess the market depth, bid-ask spread, and tools like Liquidity Zones to ensure they are trading in liquid products with minimal trading costs. This enables active option traders to execute their strategies effectively and make better-informed trading decisions.

The Role of Option Volume and Open Interest in Trading Strategies

Option volume and open interest are essential metrics that demonstrate the liquidity and activity of options and futures contracts, and they play a pivotal role in shaping trading strategies. By leveraging volume and open interest data, traders can identify potential trading signals, such as when volume is greater than open interest or when there is considerable open interest but low volume.

For example, high open interest coupled with low volume could indicate that the market is in a state of consolidation, with buyers and sellers in balance, possibly preparing for a breakout in either direction. Conversely, high volume but low open interest can suggest an imbalanced market, with either buyers or sellers dominating, indicating a likely market movement in the direction of the dominant force.

Potential Trading Signals Using Volume and Open Interest

By analyzing option volume and open interest, traders can identify potential trading signals that can help them make better-informed decisions. For instance, when volume is higher than open interest, it suggests the market is in an imbalanced state, with either buyers or sellers having a greater presence, indicating a potential market movement in the direction of the dominant force.

On the other hand, high open interest but low volume may indicate a market in consolidation, with buyers and sellers in balance. This could be indicative of the market preparing to break out in either direction, providing traders with potential opportunities to capitalize on upcoming market movements.

Assessing Option Liquidity

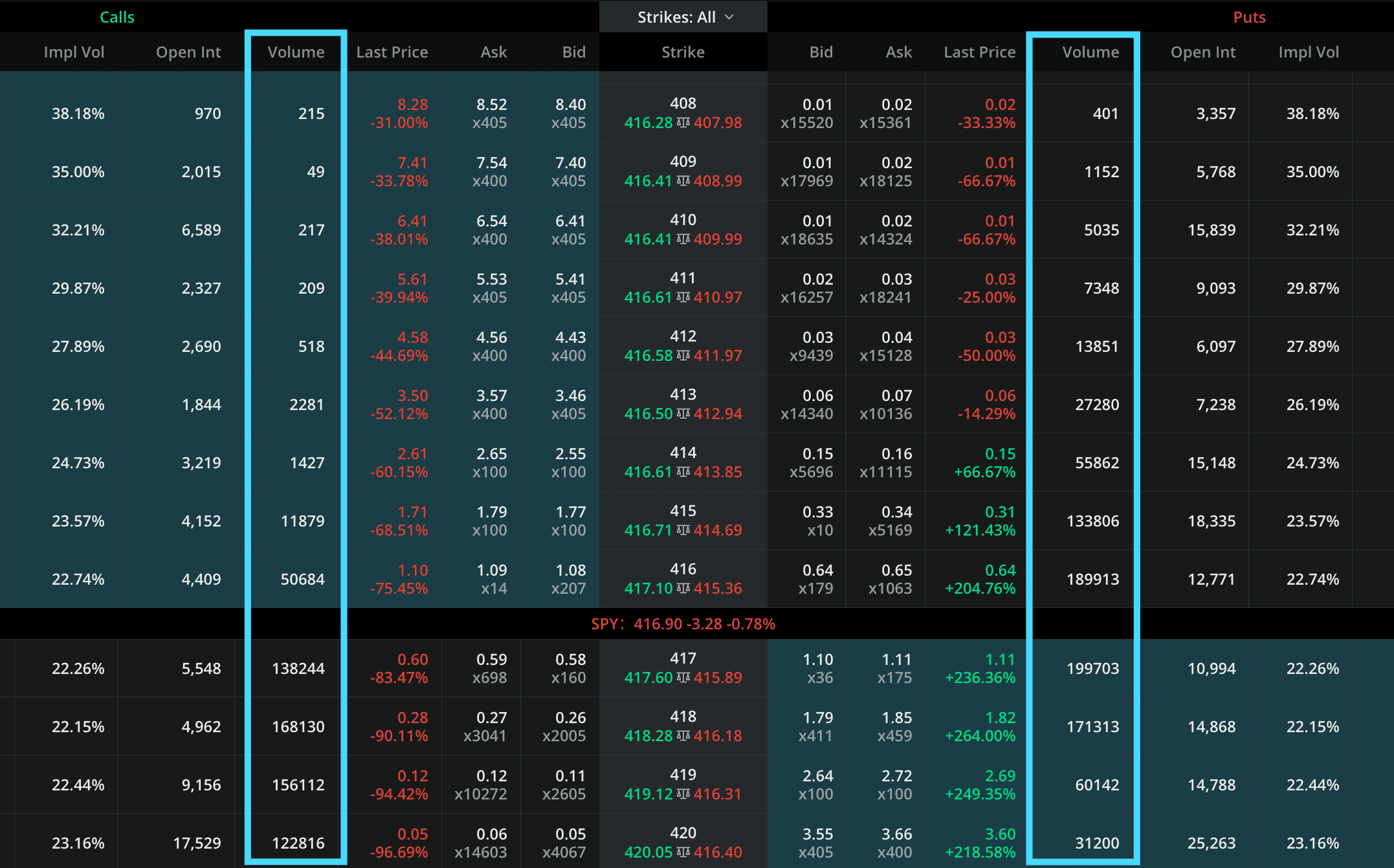

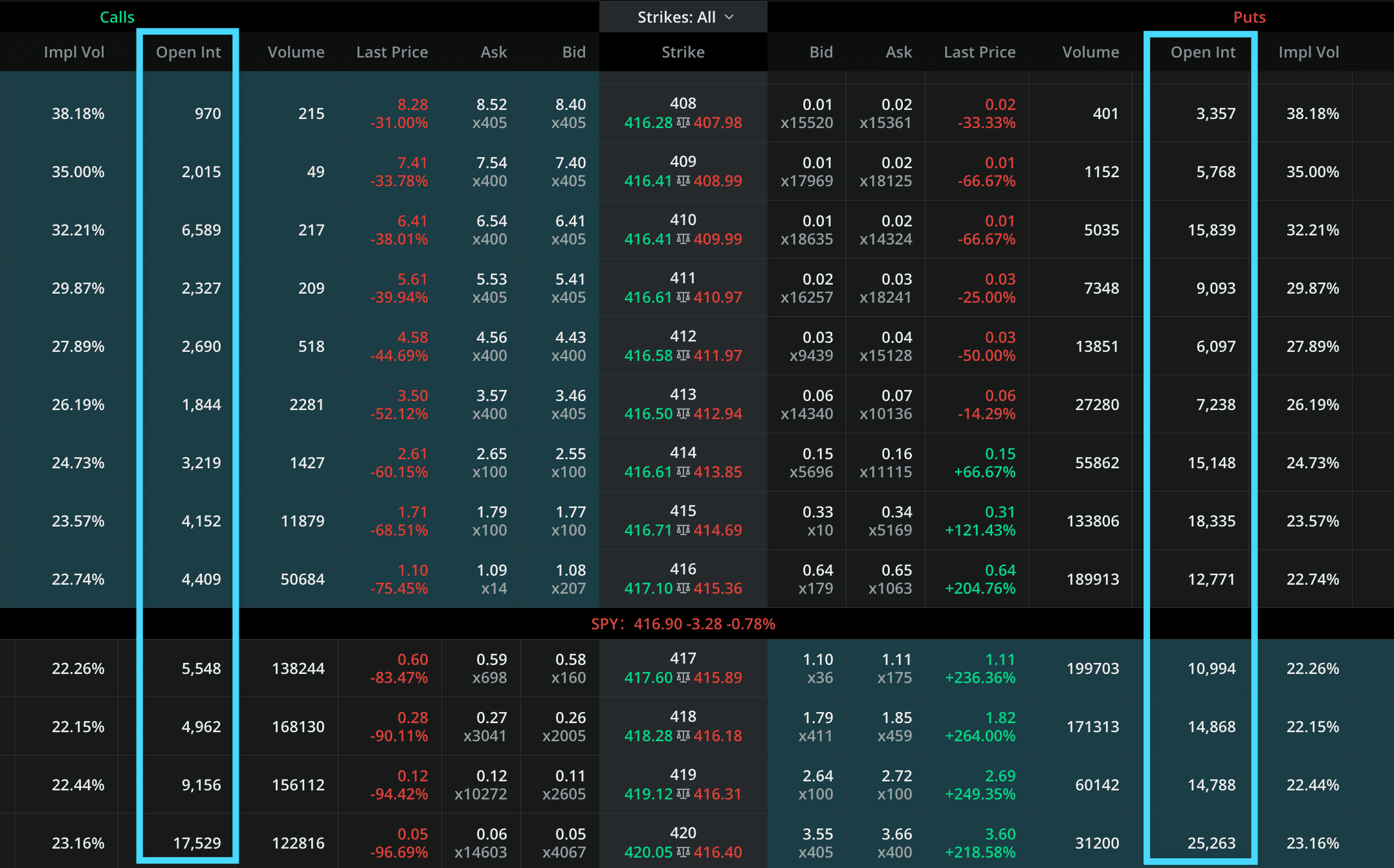

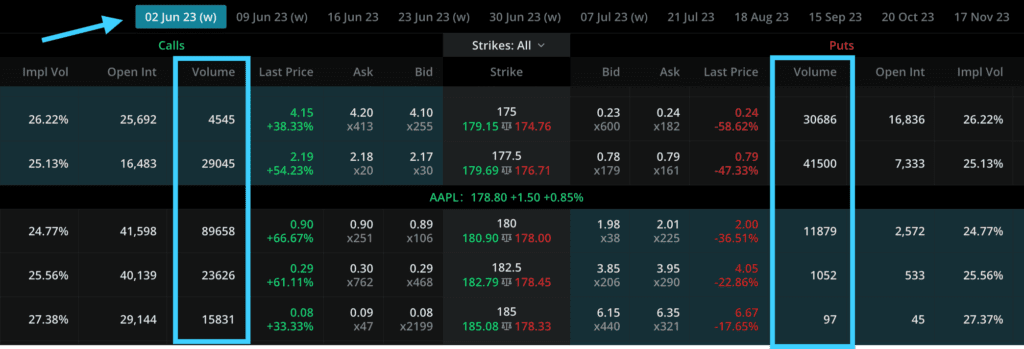

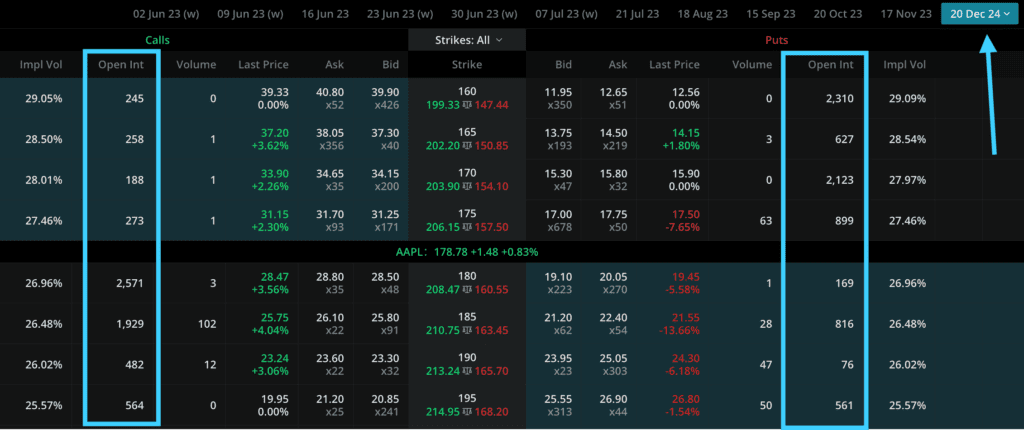

Assessing option liquidity is of paramount importance for options traders, as low liquidity can lead to wide bid-ask spreads, impacting trading accounts and making it more challenging to exit positions at desirable prices. To assess option liquidity effectively, traders should examine the daily volume and open interest of the option contract, with higher liquidity indicating higher trading volume and narrower bid-ask spreads as shown in the example above.

It is recommended that options trading have a minimum daily volume of 100’s, preferably 1,000’s, and a minimum open interest of 1,000’s. By ensuring these minimum levels are met, traders can improve their chances of trading options at favorable prices and avoid being caught in illiquid products with high trading costs.

Analyzing Option Chains for Volume and Open Interest

Option chains are tables that display available options on a particular security, including listed calls and puts with a given maturity date, sorted according to strike price, expiration date, volume, and pricing information. Analyzing option chains for volume and open interest allows investors to gain insight into which options are the most liquid, ensuring they trade in products with minimal trading costs.

Understanding the data presented in option chains can help traders make well-informed decisions, as high volume and open interest indicate that the option is liquid, while low volume and open interest suggest that the option is illiquid. By analyzing option chains, traders can make better-informed choices and execute their strategies more effectively.

Case Study: Examining Volume and Open Interest in Popular Options

To illustrate the real-world implications of volume and open interest, let’s examine popular options like Apple (AAPL). Analysis of AAPL options reveals high volume in the short-term contracts, while open interest in the long-term contracts is substantial, likely due to long-term strategies or stock replacement tactics. High volume in near-term cycles suggests that traders are actively engaged in options trading, possibly due to short-term events or news affecting the underlying stock.

On the other hand, significant open interest in longer-term cycles indicates that investors may be employing longer-term theories, such as hedging strategies or stock replacement tactics, to minimize risk and maximize potential gains.

Summary

In conclusion, understanding the nuances of option volume and open interest is crucial for any options trader looking to maximize their chances of success in the market. From factors affecting option volume and open interest to their role in trading strategies and liquidity assessment, we’ve explored the vital aspects of these metrics and their impact on options trading.

With Cheddar Flow’s option order flow platform, you can automatically filter and compare volume and open interest on real time option contracts that are hitting the tape.

Frequently Asked Questions

Is volume or open interest more important in options?

When deciding which option is more important, both volume and open interest should be taken into consideration. Open interest offers important insights into liquidity while high trading volumes suggest increased activity.

Both factors should be considered when trading options.

What is the difference between option volume and open interest?

Option volume indicates the activity in a particular options contract during a trading day, while open interest reflects the total number of contracts that are still open at a given strike price and expiration date. Volume helps traders understand the current sentiment around an asset, while open interest provides insight into the amount of activity over time.

Can volume be higher than open interest?

Yes, volume can be higher than open interest. This occurs when an existing contract trades multiple times without new contracts being created. Thus, it is possible to have more contracts traded in a given day than the total open interest of those contracts.

How can an option have volume but no open interest?

An option can have volume without open interest when all of the outstanding contracts for that option are bought and sold within one day. This happens when the options contracts are not heavily traded and there is only one market participant trading them.

Open interest, on the other hand, tracks the total number of option contracts still outstanding on the market. Thus, while an option may be actively traded, there can be no open interest for it due to a lack of sustained market activity.