Options trading can be a powerful tool in the hands of an informed investor, offering both risk management and the potential for significant profits. One key aspect of options trading that is often misunderstood is the concept of Out of the Money (OTM) options, or as some may say, “OTM means” options that are not in a profitable position. In this blog post, we will delve into the world of OTM options, from their definition and characteristics to trading strategies and real-world examples. By the end of this comprehensive guide, you will have a solid understanding of what OTM means and how they can play a role in your investment strategy.

Short Summary

Out of the Money (OTM) options have no intrinsic value and offer potential for high returns.

Understanding call and put options, intrinsic/extrinsic values, time decay & market volatility are essential to successful trading.

OTM option scenarios must be analyzed in order to make informed decisions that maximize returns while minimizing losses.

Defining OTM: Out of the Money Options

An Out of the Money (OTM) option is a type of options contract that has no intrinsic value and is not profitable if exercised at the current market price. To understand what makes an option OTM, it’s important to first grasp the basics of call and put options. These are the building blocks of the options market, allowing investors the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date.

A call option gives the buyer the right to purchase an underlying asset at an agreed-upon price, while a put option provides the right to sell an underlying asset at an agreed-upon price. An OTM call option has a strike price that is higher than the current market price of the underlying asset. Conversely, an OTM put option has a strike price that is lower than the current market price of the underlying asset. In both cases, the option’s strike price is unfavorable for the buyer to exercise the option, making it a risky and potentially rewarding investment.

Understanding Call and Put Options

Call and put options are the two main types of options contracts that investors can trade. A call option gives the buyer the right to purchase an underlying asset at a predetermined price (the strike price) before a certain date (the expiration date). It is essentially a bet that the price of the underlying asset will rise.

Conversely, a put option provides the buyer the right to sell an underlying asset at a predetermined price before a certain date. Such an option is a bet that the price of the underlying asset will fall.

The classification of an option as in the money (ITM), at the money (ATM), or out of the money (OTM) is determined by the relationship between the option’s strike price and the current market price of the underlying asset. The call option is Out of The Money (OTM) when the underlying price is below the strike price. It means that the option will expire worthless. The strike price for a put option is the predetermined amount of money at which an option holder can choose to buy or sell. If the underlying price is above this strike price, the option is out-of-the-money (OTM).

Related Article: Call Options Explained

How OTM Differs from ITM and ATM

Options can be classified into three categories based on their intrinsic value and profitability:

In the money (ITM),

At the money (ATM),

Out of the money (OTM).

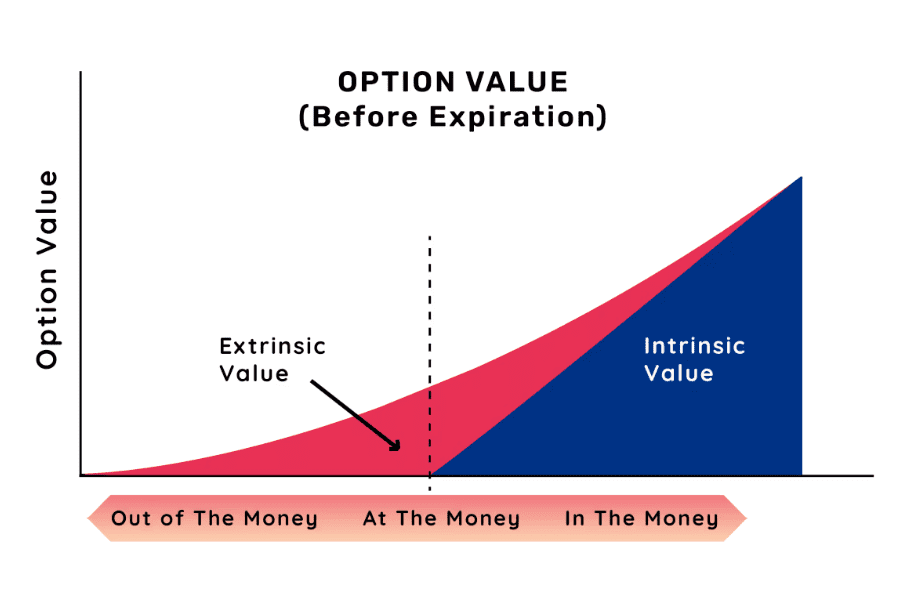

The intrinsic value is the amount by which an underlying asset exceeds its strike price. This difference between its current market price and strike price can be used to establish the intrinsic value. If the intrinsic value is positive, the option is ITM, meaning it is profitable if exercised at the current market price. If the intrinsic value is zero, the option is ATM, indicating that the strike price and the price of the underlying asset are equal or nearly so. Finally, if the intrinsic value is negative, the option is OTM, meaning it has no intrinsic value and is not profitable if exercised at the current market price.

While ITM and ATM options possess intrinsic value and may be profitable if exercised at the current market price, OTM options are characterized by their lack of intrinsic value and their unprofitability if exercised at the current market price. However, OTM options also have the potential for the highest percentage gains on the same movement of the underlying stock relative to ITM and ATM options.

Understanding the differences between ITM, ATM, and OTM options is essential for investors seeking to navigate the options market successfully.

The Importance of Intrinsic Value

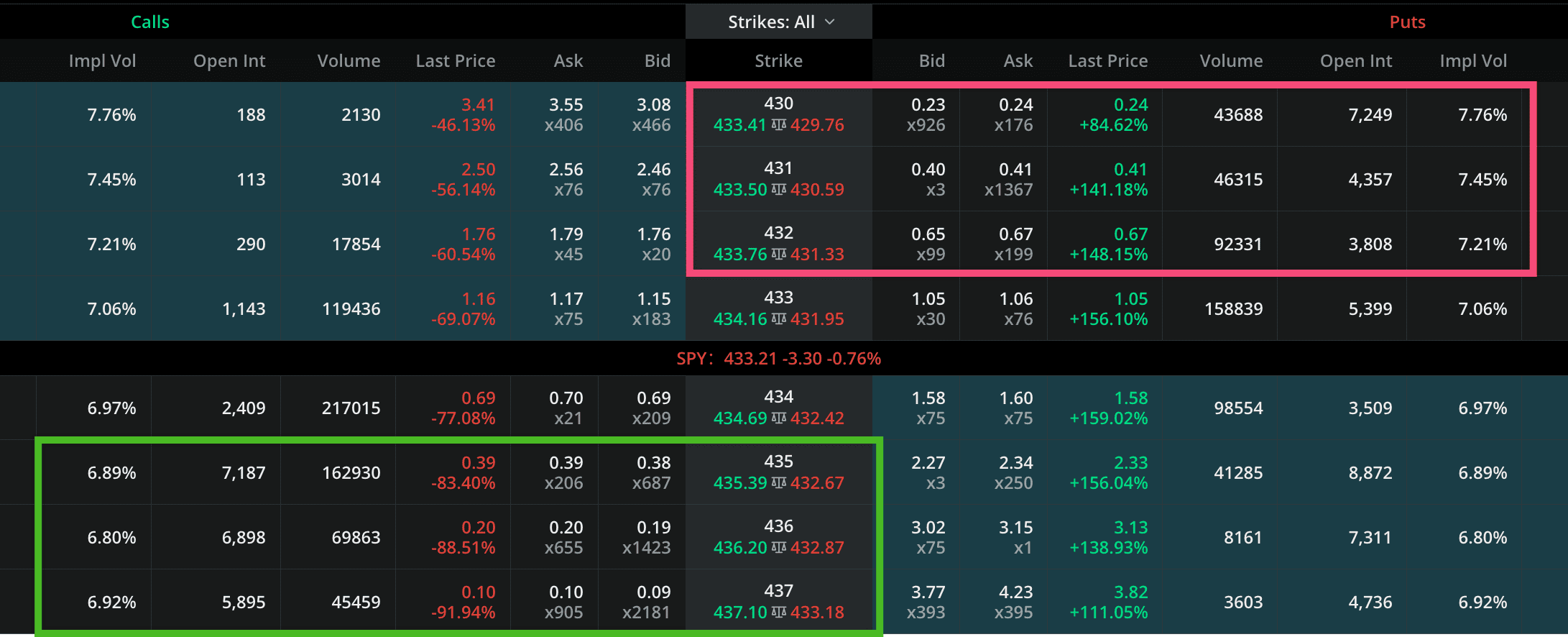

Image Source: Market Data

Intrinsic value is a vital concept in options trading, as it dictates the profitability and classification of an option. It is the actual value of an asset determined by its fundamental characteristics, rather than its market value or price. The intrinsic value of an option is the gap between its strike price and the prevailing market price of its underlying asset. Calculating this disparity will give you the intrinsic value.

If the intrinsic value is positive, the option is classified as being in the money (ITM). If the intrinsic value is zero, the option is classified as being at the money (ATM). If the intrinsic value is negative, the option is classified as being out of the money (OTM).

The significance of intrinsic value lies in its ability to determine the profitability of an option. If the intrinsic value is positive, the option is more likely to be profitable, whereas if the intrinsic value is negative, the option is less likely to be profitable.

Extrinsic Value and Time Decay

In addition to intrinsic value, options also have extrinsic value, which is the portion of an option’s price that is not directly associated with the underlying asset’s value. Also known as time value, extrinsic value is computed by determining the difference between the market price (premium) of an option and its intrinsic price. Extrinsic value represents the additional value of an option beyond its intrinsic value, taking into account factors such as time to expiration and market volatility.

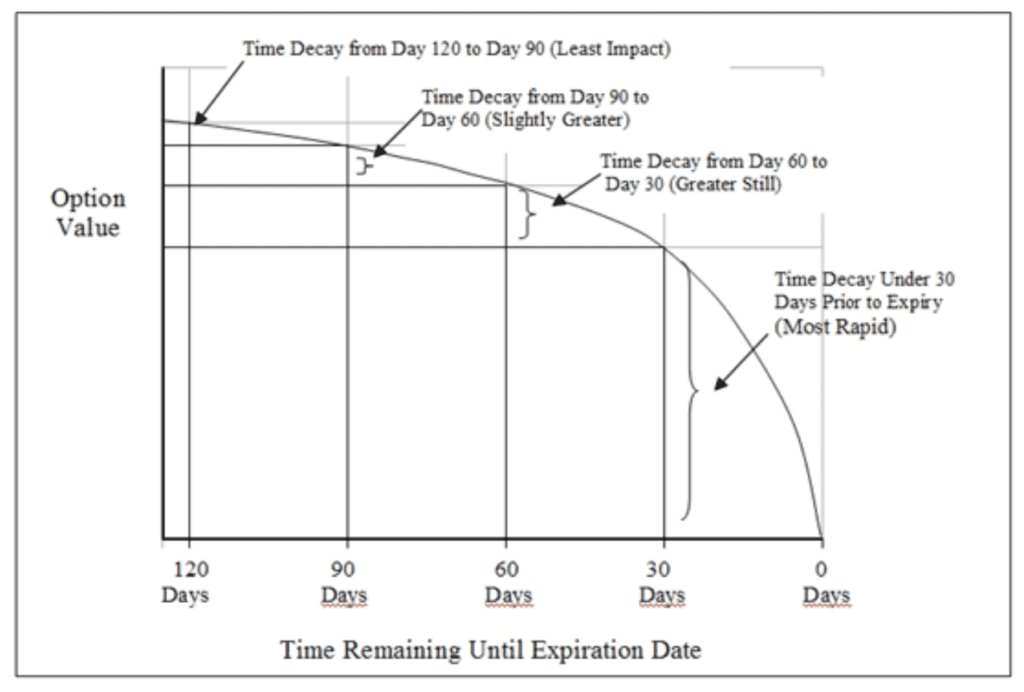

Over time, the extrinsic value of an option decreases due to a phenomenon known as time decay. Time decay is the rate at which the extrinsic value of an option diminishes as the expiration date draws nearer. This is a critical concept for options traders to understand, as it can significantly impact the profitability of an options trade.

An awareness of both intrinsic and extrinsic value, as well as the effects of time decay, is essential for making informed decisions in the options market.

Related Article: What Is Theta In Options Trading

Trading Strategies with OTM Options

There are various trading strategies that can be employed when working with OTM options, such as hedging and speculation. Hedging strategies involve using OTM options to reduce the risk of an existing position, while speculation strategies involve using OTM options to bet on the future direction of the underlying asset. In both cases, OTM options offer potential benefits as well as risks, making them an important tool for investors with different objectives and risk tolerances.

Some investors may use OTM options for leverage and volatility-based trades, aiming to capitalize on significant price movements in the underlying asset without having to commit a large amount of capital. By employing OTM options in these types of trading strategies, investors can potentially achieve greater returns than with other investment opportunities, such as mutual funds.

Leverage and Volatility-Based Trades

Leverage is a trading mechanism that allows investors to use borrowed funds, often from their bank account, to increase their exposure to the market and acquire larger trading positions. With leverage, investors can potentially achieve significant returns on a minimal amount of capital.

OTM options can be utilized to capitalize on market volatility and leverage, allowing investors to take advantage of significant price movements in the underlying asset without having to commit a large amount of capital. This can provide investors with greater exposure to the market and the potential for higher returns.

Volatility-based trades involves purchasing an option when the implied volatility is low and selling when the implied volatility is high. OTM options can be especially attractive for volatility-based trades, as they have the potential to generate substantial profits if the underlying asset moves in the anticipated direction.

Related Article: Buying On Margin And The Risks Involved

Risks and Rewards of OTM Options

Trading OTM options involves certain risks and rewards that investors must carefully weigh. The potential risks of OTM options include the risk of time decay and the possibility that the underlying asset will not move in the direction anticipated by the investor. Additionally, OTM options have a lower probability of profit and increased volatility in comparison to the underlying stock.

On the other hand, the potential rewards of OTM options include the possibility of large returns if the underlying asset moves in the direction expected by the investor. Experience and risk management are critical factors when trading OTM options.

Factors Influencing OTM Option Prices

Several factors can impact the price of OTM options, including the underlying asset price, time to expiration, implied volatility, interest rates, and the strike price. However, two of the most significant factors that influence the price of OTM options are market volatility and time to expiration.

Market Volatility and Option Premiums

Market volatility is defined as the frequency and magnitude of price fluctuations, whether upward or downward, of a financial asset over a specified period of time. It serves as an indicator of the risk or uncertainty associated with the price of the asset.

Increased market volatility typically results in higher premiums for out-of-the-money options. This is because higher volatility increases the probability that the option will move into the money before the expiration date, making the option more valuable to the buyer.

Time to Expiration

The time remaining until an option contract expires, known as time to expiration, is another crucial factor that can influence the price of OTM options. In general, the longer the time to expiration, the more expensive the option price will be. This is because the longer the time until expiration, the greater the possibility that the option will move into the money and become profitable.

As the expiration date of an option approaches, its intrinsic value decreases due to time decay. This can result in a lower option price, particularly for OTM options that have no intrinsic value.

Practical Examples of OTM Options

To illustrate the potential uses and outcomes of OTM options, consider the following real-world examples. Suppose an investor purchases a call option with a strike price of $135 when the underlying asset is trading at $130. The strike price of this call option is higher than the current market price of the underlying asset. Therefore, it is considered out-of-the-money (OTM). If the price of the underlying asset rises above $135 before the expiration date, the option will move into the money and become profitable.

Another example involves an investor acquiring a put option with a strike price of $120 when the underlying asset is trading at $125. The strike price of this put money option is lower than the current market price of the underlying asset. Hence, it is considered to be out-of-the-money (OTM). If the market price of the underlying asset falls below $120 before the expiration date, the option will move into the money and become profitable.

Summary

In conclusion, Out of the Money options offer investors an opportunity to capitalize on market volatility, leverage, and speculation while managing risk through hedging strategies. Understanding the concepts of intrinsic and extrinsic value, as well as the factors influencing OTM option prices, is crucial for making informed decisions in the options market.

By carefully analyzing various OTM option scenarios and employing sound risk management practices, investors can potentially achieve significant returns while minimizing potential losses. Armed with the knowledge and insights gained from this comprehensive guide, you are now better equipped to navigate the world of OTM options and incorporate them into your investment strategy.

Frequently Asked Questions

Why do people buy OTM calls?

People buy OTM calls as a way to speculate on the price of a stock without having to purchase the stock itself. It is an attractive option for investors who are bullish or uncertain about their predictions, since the cost of buying the call is substantially lower than purchasing the stock outright.

This strategy offers the potential to generate profits from an anticipated increase in the underlying stock’s price at a fraction of the cost.

How do OTM options make money?

OTM options provide investors with the opportunity to make money if the stock rises in value before the expiration date. If the market moves as predicted, they can earn a profit by exercising their option and buying or selling the asset at the strike price.

Otherwise, the investor will only be able to realize the value of the premium.

What is the difference between call and put options?

Call options give the buyer the right to purchase a security at a specific price within a certain period of time, while put options provide the holder the right to sell a security at a predetermined price within a set timeframe.

Consequently, call options appreciate in value when the price of the underlying asset rises, while put options increase in value when the price of the underlying asset decreases.

How does market volatility affect the price of OTM options?

As market volatility increases, it has a direct impact on OTM option prices, as the chance of those options expiring in the money increases. This in turn leads to an increase in premiums for OTM options.