High-quality dark pool data. All in real time

Cheddar Flow scans thousands of trades in the dark pools and intelligently identifies them for you.

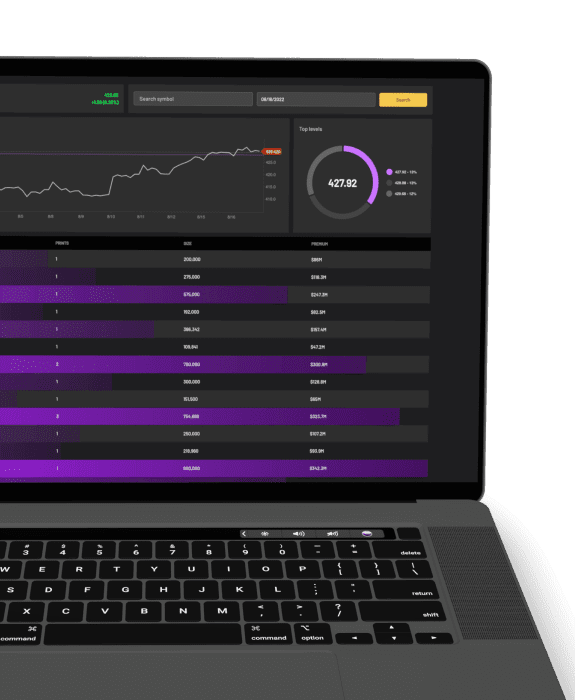

Detailed data and analytics

Cheddar Flow’s dark pool data powers you with advanced information to make trading decisions. Monitoring dark pool activity provides insight into the largest orders made through private exchanges.

Combining live charting with support and resistance levels allows you to assess the direction of the stock. The order flow graph allows you to spot institutional volume and premium at each price level.

Granular dark pool history

Cheddar Flow provides the unique ability to view dark pool history. This dark pool data can be used to search and back test all dark pool trades made using Cheddar Flow’s database. The ability to go back in time and view dark pool activity can uncover trends and unique insights that are made possible using our rich database.

Exporting and analyzing data

The ability to export dark pool data can be incredibly useful to recognize trends and back test custom models. Cheddar Flow allows the exporting of dark pool data that includes intraday, historical date ranges, and the entire market data per symbol. Exporting dark pool activity can be used to identify patterns and trends in stocks of interest.

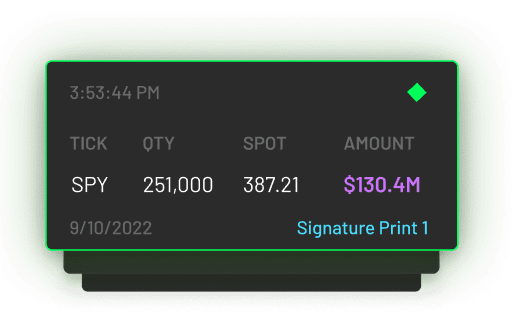

Detecting high value signature prints

Dark pool signature prints are unique dark pool trades that are delayed by 24 hours. These dark pool orders are traded internationally and mainly cover the major ETFs like SPY. Dark pool signature prints represent a large bet being made on the market direction.

This dark pool activity can be very useful when thinking about making a bullish or bearish bet on a stock or the market.

Looking for more information on dark pool data?

View our extensive resources to learn more about how you can implement dark pool data into your trading strategy.

Dark pool print orders can only be found on private exchanges and are only accessible to institutions.

It is essential to understand the importance of dark pool levels for the indexes and individual tickers.

Certain dark pool orders have a “magnetic” effect on the price of SPY. Learn more about these orders.