A call sweep in options trading is when a trader will instruct their broker to fill its order at the best price possible, “sweeping” all liquidity on the market. Typically these large orders can be broken up into smaller orders across multiple exchanges to quickly fill their order.

Why Traders Use a Sweep To Fill Their Order

Market participants will use a sweep order in options trading because there is an urgency to get into that trade. A sweep order combined with buying above the ask can show extreme urgency. For example, option traders will use this order combination when they might have non-public information about a stock like earnings or other price-moving news. These large orders are typically executed by institutional traders with deep pockets who prefer speed and precision execution.

Because of the large notional value, traders will use a sweep to fill an order because sometimes a single exchange may not have the best prices available for the order size. There are 6 different options exchanges in the United States, all posting different bid to ask spreads for stocks and indices. For example, a market maker at CBOE (Chicago Board Options Exchange) might be willing to sell you 500 $SPX 4000c for $2.90 while at BOX (Boston Options Exchange) will sell you the same contract for $2.85.

Examples of Call Sweeps

On January 11th, 2023, a trader swept above the ask $2.6 million (2,009 contracts) of the $TSLA 120 strike expiring February 17th. In less than a month, Tesla stock rallied 86% and the value of this order was nearly $22 million.

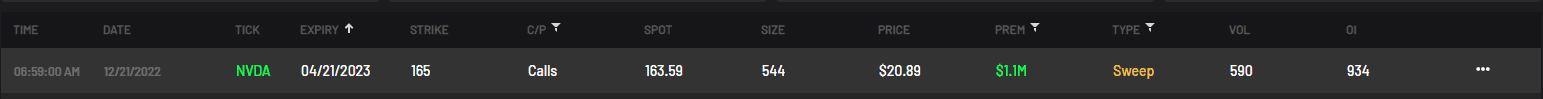

On December 12th, 2022 a trader swept $1.1 million (544 contracts) of the $NVDA 165 strike expiring on April 21st, 2023. Nvidia stock jumped 97% since their purchase, bringing the value of this order to $5.2 million.

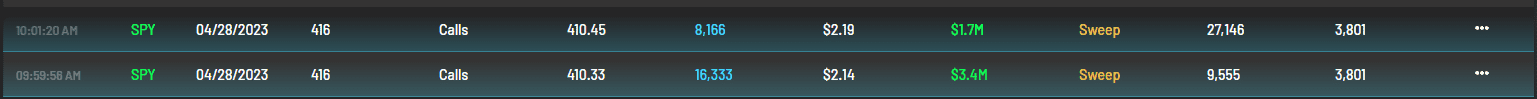

One of the best types of order flow is these blue highlighted “highly unusual” orders. These have an extremely high win rate and are important to pay attention to. A large firm swept the April 28th, 416 calls paying $5.1 million above the ask. These contracts expire in two weeks which means the buyer is expecting a large move in $SPY within that time frame.

Smart Money vs Retail Money

Smart money is that of institution traders, hedge funds, and wealth management funds. They are much more sophisticated traders with access to more information and deep pockets. Retail traders on the other hand are those who trade for themselves and are known for being less sophisticated. They are also know as “dumb money”.

It is no secret that options can control future stock price movements. Unusual options activity can help a retail trader gauge where “smart money” believes the stock price will go. In the call sweep examples above, this would be a prime illustration of unusual options activity by smart money. A retail trader could then perform an analysis to determine if they agree with the direction of that order and follow along.

Tips on Trading With Unusual Call Sweeps

Before entering trades, it is beneficial to have unusual options flow in your toolbox. Being able to successfully pick out and analyze the true intent of the orders are another thing. There are millions of option orders placed each day, which can confuse an amateur trader. A large portion of the options flow can be hedges or complex strategies such as credit spreads. In order to be successful, here are the best tips to look out for in the flow:

1. Look For Large Premiums

Watch for call sweeps over $500K in premium, expiring in less than a month, and preferably above ask. This would show that the buyer has a sense of urgency to get into that trade.

2. Trade Liquid Stocks

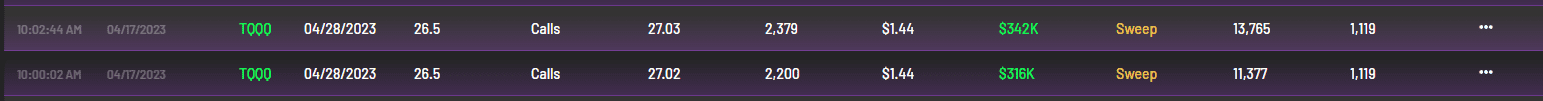

Although it is always best to trade liquid names such as $SPY or $QQQ for the tight bid-ask spread, watch for flow in the less liquid 3x leveraged names such as this $TQQQ order. This trader bought $658K $TQQQ calls expiring in less than 2 weeks.

3. Look For Highly Unusual Trades

Always look for the blue highlighted “highly unusual” sweeps that come in the order flow. These are going to be orders that are above ask with lots of premium, or out-of-the-money sweeps with large premium behind them. They also tend to have a high success rate, meaning the odds of profitability are high.

4. Combine With Dark Pool Orders

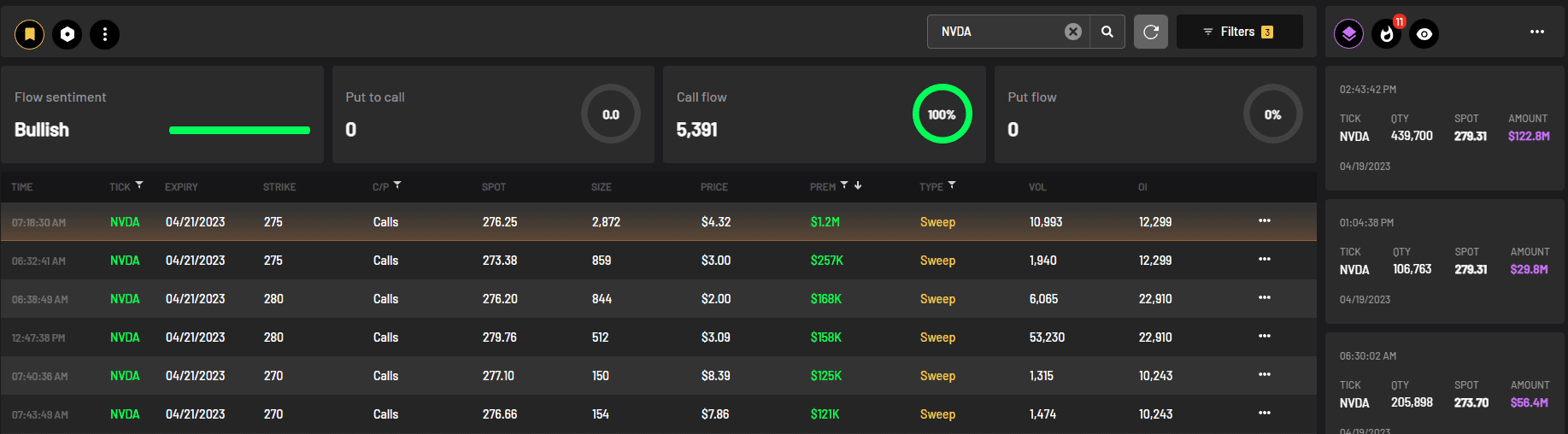

Combining order flow along with dark pool prints can help give conviction to a trade. Let’s take a look at another $NVDA example. On April 19th, 2023 this call sweep buyer came in and bought $1.2 million paying above the ask of $NVDA 275c expiring 4/21. You can also see that there was $150 million worth of shares traded in the dark pool the same day. This is a great setup to watch because the buyer is sweeping above ask calls and presumably buying $120 million worth of shares.

Benefits and Risks of Call Sweeps

One benefit of using a call sweep is that if you are anticipating a large move in the stock and need to get into a trade very quickly, call sweeps are the best way to go about getting an order filled completely.

Limit orders in options trading is the maximum amount that a buyer is willing to pay for a single option contract. One risk of a call sweep is that by not placing a limit order and waiting for more liquidity to arrive, the trader is at risk of not getting filled at the absolute best prices and losing to slippage.

Another risk of using a call sweep is that it makes it challenging to hide big money orders. Algorithms could potentially spot this order in the book and try to front-run it with its own order, further losing the initial edge that the call sweep buyer had.

How to See Options Sweep Orders

As you can see from the examples above, these call sweep orders have returned a hefty profit for the traders buying them. Paying attention to these unusual call sweep orders in the options flow is an extremely beneficial tool to have as retail traders. This is why it is crucial to follow the “smart money.” Cheddar Flow is a modern options order flow platform that does the heavy lifting for you and helps you uncover institutional activity. You will be able to track call sweeps and dark pool prints in real-time.

Frequently Asked Questions

Is a call sweep bullish or bearish?

A call sweep is generally a bullish trade.

What is the difference between a call sweep and a call block?

A call sweep will fill an entire order size, regardless of price. A call block is a single order that is privately negotiated away from the public market.

What does it mean when calls sweep above ask?

When call sweeps are above ask, that signals the trader is expecting a large move in the underlining and they are willing to pay above the best offer to get their order filled.

Why should I be paying attention to these type of trades?

Big institution traders and deep pocket investors aka “smart money” control most of the market so it’s important to track what they are doing on a regular basis.