Options trading can be a lucrative endeavor for seasoned traders and newcomers alike. The world of options offers many opportunities for profit, but it can also be confusing and complex. To truly master the art of options trading, it’s essential to understand the intricacies of selling options contracts and the differences between two key concepts: sell to open vs sell to close. These terms may sound similar, but they represent distinct strategies with unique risk profiles and potential outcomes. Strap in as we dive into the world of sell to open vs sell to close, and uncover the secrets to making informed decisions in the options market.

Key Takeaways

Options trading is a dynamic financial market instrument involving call and put options with predetermined strike prices.

Sell to Open orders involve creating and selling an option contract as part of a short position, while Sell to Close closes existing long positions for potential profits or losses.

Successful options trading involves understanding order types, risk management strategies, timing tactics and probability calculations in order to maximize returns.

Breaking Down Options Trading

Options trading offers a dynamic and flexible avenue for participating in the financial markets. At its core, options trading revolves around options contracts, which are agreements that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) within a set time frame (expiration date). The core elements of options trading include:

The underlying asset

Option’s strike price

Expiration date

Option type

These elements form the foundation of options trading and allow you to trade options effectively.

Understanding the two core concepts in options trading – sell to open and sell to close – is essential for traders. While both involve selling options contracts, sell to open is used to establish a new position, and sell to close is used to terminate an existing position.

Key Components of Options Trading

Understanding the essential components that constitute an options contract is fundamental to mastering options trading. There are two primary types of options: call options and put options. Call options give the buyer the privilege to buy the underlying asset at the option’s strike price, whereas put options provide the right to sell the underlying asset at the option’s strike price. The strike price is the price at which a trader is granted the right to buy or sell the underlying security.

Understanding the influence of intrinsic and extrinsic value on an option’s price is vital in options trading.

Intrinsic value represents the difference between the underlying asset’s price and the strike price.

Extrinsic value (also known as time premium) refers to the option’s value beyond its intrinsic value.

Time premium decreases as expiration approaches and will eventually become zero on the expiration date.

Grasping these concepts enhances your decision-making process in options trading.

Related Article: Unlocking The Power Of Extrinsic Value

Sell to Open: Opening a Short Position

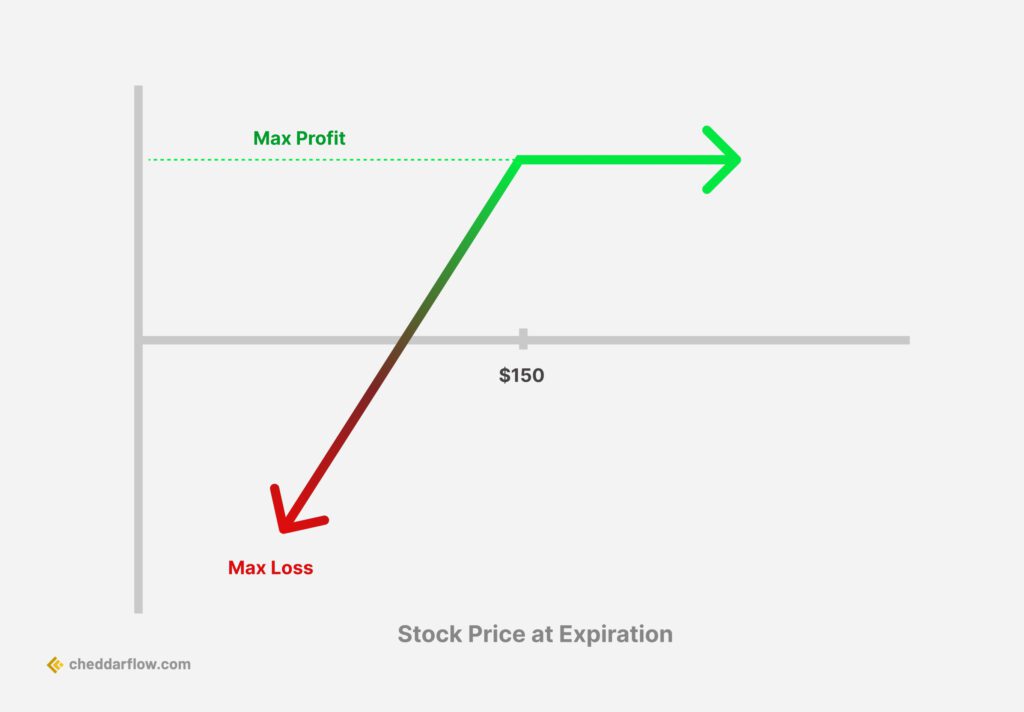

Short Put Example

Sell to open is a trading action that involves:

Selling an options contract to initiate a new position, usually a short position

Creating a new options contract and selling it to another market participant

Expecting the price of the underlying asset to decline, allowing the trader to profit from the decrease in the value of the options contract.

Bear in mind that the act of selling options contracts brings along certain risks. Here are some key points to consider:

When selling a call option, the potential loss is theoretically unlimited, as there is no ceiling on how high the price of the underlying asset can rise.

On the other hand, when selling a put option, the potential loss is limited to the strike price minus the premium received.

Comprehending the risks tied to selling options contracts is important for informed decision-making in the options market.

Selling Calls and Puts

When opening a short position, traders can choose to sell either call or put options. Selling call options involves the obligation to sell the underlying asset at the strike price if the option is exercised, while selling put options requires the obligation to purchase the underlying asset at the strike price if the option is exercised. The decision to sell calls or puts usually depends on the trader’s outlook on the underlying asset’s price direction and their risk tolerance.

There are both benefits and drawbacks to selling call and put options. Selling call options can generate income through the upfront option premium and requires a lower financial commitment than purchasing call options. However, the potential for profit is limited, and the trader is exposed to the risk of unlimited losses should the stock price rise significantly.

Selling put options can generate revenue through premium collection and potentially allows the trader to acquire the underlying asset at a more favorable price. However, there is a risk of downside losses if the price of the underlying asset moves against the trader’s expectations.

Related Article: Master The Short Put Strategy

Receiving Premiums

When selling options contracts to open a position, traders receive a premium, which is the payment from the buyer of the contract. The premium is credited to the trader’s account and represents the initial income generated from the sale of the options contract. It’s important to note that the premium received from selling an options contract can turn into a loss if the price of the underlying asset moves in an unfavorable direction.

The premium received when selling an options contract is influenced by various factors, such as:

Intrinsic value

Time value

Volatility

Interest rates

Dividends

Option strike price

Comprehending these variables and their influence on the received premium aids traders in making informed decisions while selling options contracts to open a position.

Sell to Close: Exiting a Long Position

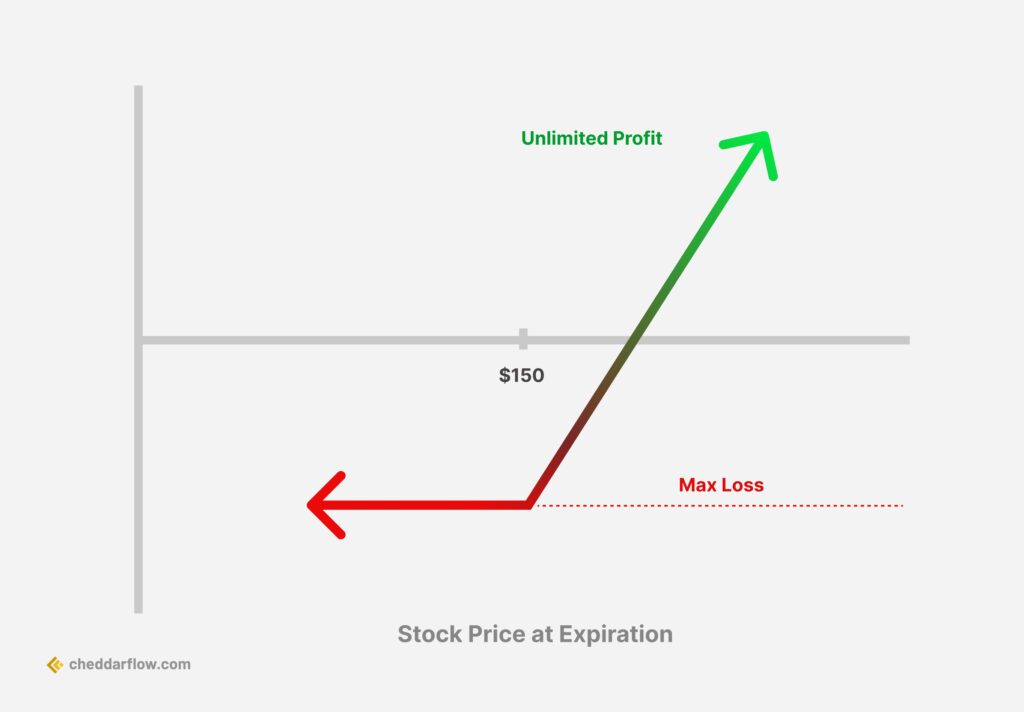

Long Call Example

Sell to close is another critical concept in options trading. It refers to the action of selling an options contract to close an existing long position. This is typically done when a trader believes that the price of the underlying asset will decrease, allowing them to benefit from selling the options contract and potentially realizing a profit.

Discerning when to appropriately use a sell to close order is significant. The decision to sell to close is usually based on a trader’s outlook on the price direction of the underlying asset, their risk tolerance, and their overall trading strategy.

Closing Call and Put Options

Closing call and put options positions using the sell to close order involves selling the options contract that was initially purchased to open the position. This allows the option holder to terminate their position and potentially realize a profit or limit their losses. To execute a sell to close order, the trader would need to enlist the services of an options broker who will facilitate the sale of the options contract on their behalf.

The potential outcomes for traders who use sell to close orders include realizing a profit, no gain, or a loss, depending on the difference between the value of the position when sold and when purchased.

Realizing Profits or Losses

When using the sell to close order, traders can realize profits or losses based on the following factors:

The difference between the initial purchase price of the options contract and the price at which it is sold

The value of the position at the time of selling

The entry price of the position

Any transaction costs associated with the trade

All of these factors are taken into account when determining the profit or loss.

Market conditions can also have a significant impact on the profit or loss potential of a sell to close trade. By carefully monitoring market conditions and making informed decisions, traders can maximize their profits and minimize their losses when using sell to close orders.

Comparing Sell to Open vs Sell to Close

Now that we’ve explored both sell to open and sell to close orders, let’s take a closer look at their key differences. While both involve selling options contracts, sell to open is used to establish a new position, and sell to close is used to terminate an existing position. The primary distinctions between these two orders involve risk management and timing.

Comprehending the distinctions between sell to open and sell to close orders is vital for devising an effective trading strategy. In the following sections, we’ll delve deeper into the nuances of risk management and timing for both types of orders, as well as provide practical examples to help you better understand these concepts in action.

Risk Management

Sell to open and sell to close orders have distinct risk profiles. When selling to open, traders expose themselves to potentially unlimited losses due to the obligation to fulfill the terms of the options contract if the price of the underlying asset moves unfavorably. In contrast, when selling to close, the potential losses are limited to the initial capital invested in the options contract.

Various risk management strategies can be utilized by traders during the execution of sell to open and sell to close orders. For example, when selling to open, traders can place stop-loss orders to exit a position if the price moves in the opposite direction, thus limiting potential losses.

Timing and Market Conditions

Timing and market conditions play a significant role in the decision to use sell to open or sell to close orders. For sell to open orders, traders typically aim to capitalize on a bearish or range-bound market, as these orders are used when expecting the underlying asset’s price to decrease or remain stagnant. On the other hand, sell to close orders are often used in favorable market conditions, such as when the price of a stock is increasing or there is heightened demand, allowing traders to benefit from the current market value and potentially realize a gain.

The best timing strategies for both sell to open and sell to close orders will be dictated by individual trading objectives and risk acceptance.

Practical Examples of Sell to Open and Sell to Close

To further illustrate the concepts of sell to open and sell to close, let’s take a look at some real-world examples of using these orders in options trading. These examples will help you understand how these concepts apply to actual trading situations and enable you to make more informed decisions in your own options trading journey.

Example of a Sell to Open Trade

Consider a trader who anticipates that the price of XYZ stock will increase in the near future. To capitalize on this belief, the trader executes a sell to open trade by selling a put option on XYZ stock with a strike price of $50 and an expiration date one month away. By selling the put option, the trader receives a premium of $2 per share, or $200 for the options contract, which represents 100 shares of XYZ stock

In this scenario, if the price of XYZ stock remains above the strike price of $50 before the expiration date, the put option will expire worthless, and the trader will keep the premium received from selling the contract as profit. This is because the buyer of the put option would not exercise their right to sell the stock at $50 when they could sell it at a higher price in the market

However, if the price of XYZ stock falls below the strike price of $50 before the expiration date, the trader, as the seller of the put option, is obligated to buy the stock at the strike price of $50 per share. This could result in a loss if the market price of the stock is lower than the strike price. The loss would be the difference between the strike price and the market price, minus the premium received

It’s important to note that the majority of options contracts are closed out before expiration, meaning the trader could potentially buy back the option to close out their position before the option is exercised

Example of a Sell to Close Trade

In another scenario, a trader believes that the price of ABC stock will increase in the short term. To take advantage of this belief, the trader purchases a call option on ABC stock with a strike price of $100 and an expiration date two months away. The trader pays a premium of $3 per share, or $300 for the options contract, which represents 100 shares of ABC stock at the current market price.

Over the course of the next month, the price of ABC stock rises to $110. The trader decides to execute a sell to close order, selling the call option they initially bought for a premium of $12 per share, or $1,200 for the contract. In this example, the trader realizes a profit of $900 ($1,200 – $300) from executing the sell to close order. This illustrates how traders can benefit from correctly anticipating the price direction of an underlying asset and using sell to close orders to realize their gains.

Tips for Successful Options Trading

Having delved deep into the sell to open and sell to close concepts, we can now conclude with some beneficial tips and strategies for successful options trading. By mastering the nuances of these orders and employing effective risk management and timing strategies, you can increase your chances of success in the exciting world of options trading.

Understanding Probabilities

In options trading, probability calculation is fundamental for making educated decisions and optimizing potential profits. Understanding the probability of an option being in the money or out of the money at expiration can help traders assess the potential profitability of their options positions.

A variety of tools and methods can be used to calculate probabilities in options trading, such as the Black-Scholes model or options delta calculations. By incorporating probability calculations into your trading strategy, you can better manage risk and make more informed decisions when buying or selling options contracts.

Managing Time Decay and Volatility

Two critical elements that can influence the value of options contracts are time decay and volatility. Time decay refers to the decrease in the value of an option as the expiration date approaches, while volatility measures the amount of price fluctuation of an underlying asset within a given period. Both factors can impact the potential profitability of options trades.

To manage time decay and volatility, traders can employ strategies such as purchasing options with longer expiration dates, selling options with shorter expiration dates, and implementing hedging strategies.

Related Article: What Is Theta In Options Trading

Summary

In conclusion, understanding the differences between sell to open and sell to close orders is crucial for success in options trading. By mastering these concepts and employing effective risk management and timing strategies, you can make more informed decisions and capitalize on the opportunities offered by the options market. Remember that options trading carries inherent risks and rewards, and it’s essential to continuously hone your skills and knowledge to stay ahead in this dynamic financial arena. With diligent practice and a deep understanding of sell to open and sell to close orders, you can pave the way to a successful options trading journey.

Frequently Asked Questions

What is the difference between sell to open and sell short?

Selling to open refers to closing a long position and opening a short position, whereas selling short refers to borrowing a security and selling it.

What does sell to open mean?

Sell to open is an options trade order that involves initiating a short option position by writing or selling an option contract. It allows the option seller to receive the premium paid by the buyer on the opposite side of the transaction, thus opening an options contract.

What does sell to close mean?

Sell to close is a term used in derivatives trading which refers to the sale of a previously bought option to close an existing long position. This order can result in a profit or a loss, depending on the value of the position at the time it is closed compared to the value when it was initially opened.

What does buy to close mean?

Buy to close refers to the terminology used by traders, particularly option traders, to exit an existing short position. It involves purchasing an existing options contract to offset and exit the existing contract, thus closing out the trade.

How can I manage time decay and volatility in options trading?

To manage time decay and volatility in options trading, consider purchasing options with longer expiration dates, selling options with shorter expiration dates, and utilizing hedging strategies.