In the world of options trading, understanding the concept of extrinsic value is crucial for maximizing profits and minimizing risks. As a key component of an option’s price, extrinsic value represents the cost of owning the option contract, influenced by factors other than the underlying asset’s price. But what exactly is extrinsic value, and how can traders harness its power to optimize their trading strategies?

This comprehensive guide will walk you through the fundamentals of extrinsic value, including its definition, components, calculation process, and factors influencing it. Moreover, we will explore different options types, pricing models, and practical applications in trading, all with the goal of empowering you to make informed decisions and attain success in options trading.

Key Takeaways

Understanding extrinsic value is essential to understanding its cost and relationship with various factors.

The components of extrinsic value include expiration date, implied volatility, interest rates and dividends.

Strategies for maximizing profits from the options market involve identifying high or low extrinsic values, extending expirations dates, increasing implied volatility etc., while managing risks associated with these factors.

Understanding Extrinsic Value: The Basics

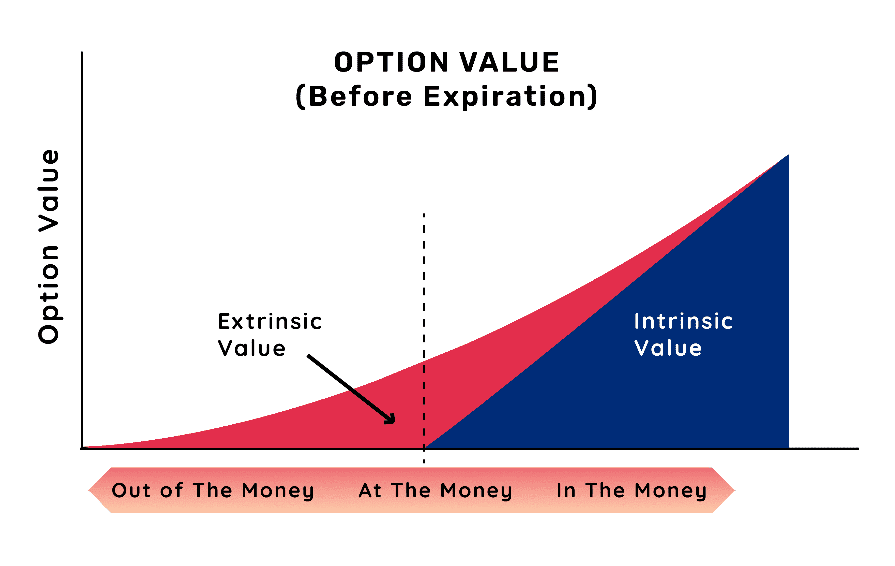

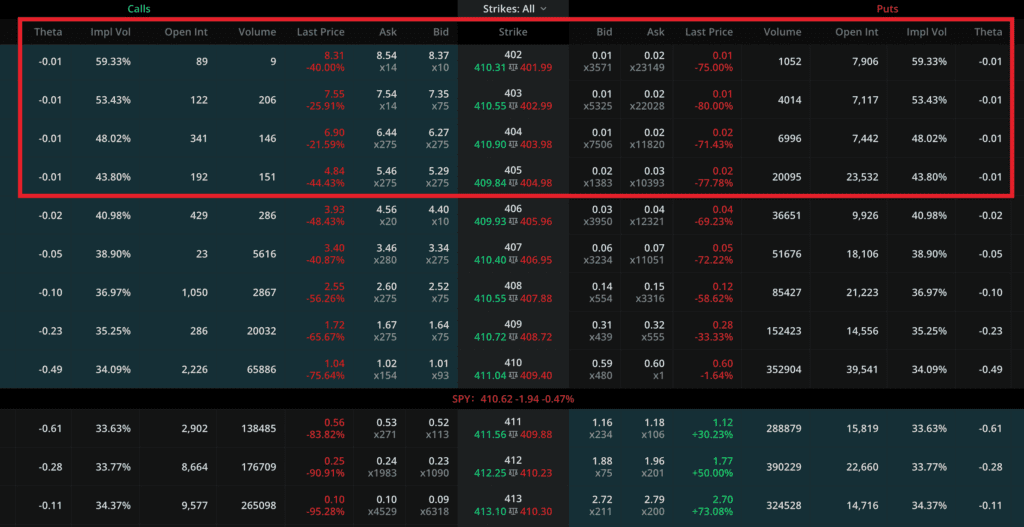

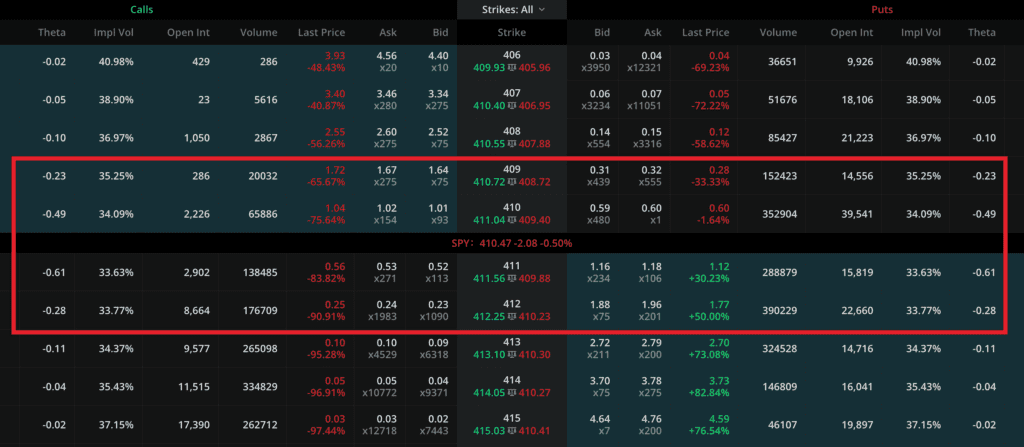

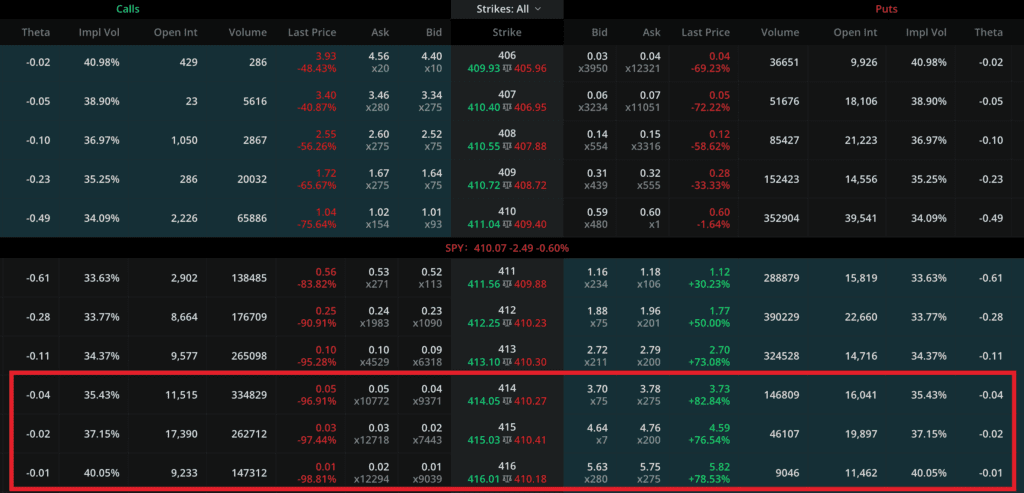

Source: Marketdata.app

Extrinsic value, also known as time value, is the cost of holding an option contract, and is affected by elements other than the price of the underlying asset. This additional component of an option’s price can be attributed to factors such as implied volatility and time decay, which contribute to more extrinsic value in an option. In options trading, the extrinsic value of in-the-money options is the highest, followed by at-the-money options, and out-of-the-money options have the least extrinsic value.

Distinguishing extrinsic value from intrinsic value and exploring its components is a vital step in understanding it. In the following sections, we will delve deeper into these aspects, shedding light on the intricate relationship between extrinsic value and various factors that influence it.

Extrinsic Value vs. Intrinsic Value

The intrinsic value of an option is the gap between the market price and the strike price, whereas the extrinsic value refers to the additional worth of the option beyond its intrinsic value. To put it simply, intrinsic value represents the immediate profit that could be realized if the option were exercised, whereas extrinsic value accounts for the additional premium paid for the option, taking into account factors affecting extrinsic value such as time until expiration and market volatility.

Extrinsic value is significantly impacted by elements such as time until expiration, the level of implied volatility, interest rates, and dividends. These factors play a significant role in determining the overall value of an option, and understanding their impact is crucial for making informed trading decisions.

The following section offers a detailed examination of the components of extrinsic value.

Components of Extrinsic Value

Extrinsic value is comprised of various elements, including:

Expiration date

Implied volatility

Interest rates

Dividends

The remaining duration of an option contract, also known as time until expiration, is one of the primary factors influencing extrinsic value. Implied volatility, on the other hand, is a metric used to quantify the anticipated volatility of the underlying asset over the duration of the option contract, and plays an essential role in determining extrinsic value.

Interest rates and dividends are other key components that can impact the extrinsic value of an option contract. Specifically, interest rates refer to the cost of borrowing money, while dividends refer to the amount of money paid out to shareholders of a company. With a clear understanding of the components of extrinsic value, we can now explore the process of calculating extrinsic value and how it is influenced by various factors.

Calculating Extrinsic Value: The Process

Calculating extrinsic value involves determining the difference between an option’s market price and its intrinsic value. This can be achieved by taking into account the various components of extrinsic value, such as time until expiration, implied volatility, and interest rates and dividends. Comprehending the factors that impact extrinsic value enables traders to make informed decisions, leading to more profitable trading outcomes.

To further illustrate the calculation of extrinsic value, let us examine the formula for determining extrinsic value and a step-by-step example of calculating extrinsic value for a specific option contract.

Formula for Determining Extrinsic Value

The formula for determining extrinsic value is dependent on the option’s moneyness and the difference between the strike price and stock price. In essence, the formula for computing extrinsic value entails subtracting the intrinsic value from the option price or premium. This allows traders to identify the portion of the option’s price that can be attributed to factors other than the intrinsic value of the option, such as time until expiration and implied volatility.

Applying the extrinsic value calculation formula helps traders understand the extrinsic value of various option types., including in-the-money, at-the-money, and out-of-the-money options. This information can then be used to make informed decisions when trading options, ultimately leading to more profitable trades.

Step-by-Step Calculation Example

To demonstrate the calculation of extrinsic value, let us consider a call option with an option’s strike price of $50, a market price or premium of $4, and an underlying stock price of $52. In this case, the intrinsic value of the option is $2, as the difference between the stock price and the strike price is $2.

To calculate the extrinsic value, we simply subtract the intrinsic value of $2 from the market price or premium of $4, resulting in an extrinsic value of $2. This means that $2 of the option’s price can be attributed to factors other than its intrinsic value, such as time until expiration and implied volatility.

Factors Influencing Extrinsic Value

As previously discussed, the extrinsic value of an option is significantly influenced by factors such as time until expiration, implied volatility, interest rates, and dividends. These factors play a significant role in shaping the overall value of an option, and understanding their impact is crucial for making informed trading decisions. In the following sections, we will delve deeper into each of these factors and their influence on extrinsic value.

Time Until Expiration

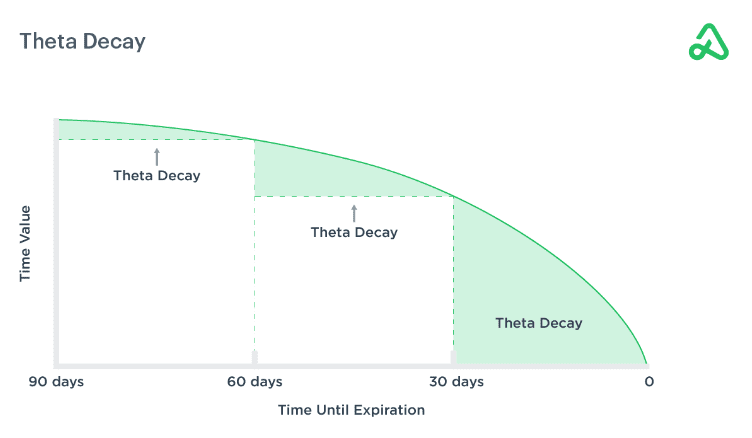

Source: Optionsalpha

Time until expiration has a significant impact on extrinsic value, with longer expiration periods commanding higher premiums. This can be attributed to the fact that options with more time until expiration have a greater chance of becoming in-the-money, and therefore, more valuable. As the expiration date of an option approaches, its extrinsic value typically decreases due to the diminishing likelihood of the option becoming in-the-money.

Related Article: What Is Theta In Options Trading

Implied Volatility

Implied volatility affects extrinsic value in the following ways:

Higher volatility increases the potential for larger price movements of the underlying asset.

Options with higher implied volatility are considered more valuable due to the greater probability of significant price changes.

Higher implied volatility leads to higher extrinsic value.

Interest Rates and Dividends

Interest rates and dividends can also impact extrinsic value, with higher interest rates and lower dividends generally leading to higher extrinsic values. However, certain factors may contribute to a lower extrinsic value. Higher interest rates can increase the cost of carry for options, while lower dividends can reduce the attractiveness of owning the underlying asset, both of which can result in higher extrinsic values for options.

Extrinsic Value Across Different Options Types

Extrinsic value varies across different options types, including in-the-money, at-the-money, and out-of-the-money options. Each of these options types has unique characteristics that affect their extrinsic value, and understanding these differences is crucial for making informed trading decisions. In the following sections, we will explore the extrinsic value of these different options types and how they can impact your trading strategies.

In-the-Money Options

In-the-money options have both intrinsic and extrinsic values, with the latter decreasing as the option moves further in-the-money. This is because the intrinsic value of the option increases as it moves further in-the-money, leaving less room for extrinsic value to contribute to the overall option price. As a result, in-the-money options typically have lower extrinsic values compared to at-the-money or out-of-the-money options.

At-the-Money Options

At-the-money options have the highest extrinsic value, as they are most sensitive to changes in the underlying asset’s price. Since at-the-money options have a strike price equal to the current price of the underlying asset, they are more likely to experience significant price changes as the underlying asset’s price fluctuates. This heightened sensitivity to price movements results in higher extrinsic values for at-the-money options compared to in-the-money or out-of-the-money options.

Out-of-the-Money Options

Out-of-the-money options have the following characteristics:

They only have extrinsic value, which decreases as the option moves further out-of-the-money.

Since out-of-the-money options have no intrinsic value, their entire price can be attributed to extrinsic value.

As the option moves further out-of-the-money, the probability of it becoming in-the-money decreases, leading to a decline in extrinsic value.

Related Article: What OTM Means?

Pricing Models for Extrinsic Value

Pricing models for extrinsic value include the Black-Scholes Model and the Binomial Model, which help determine the fair value of an option contract. Both of these models take into account factors such as time until expiration, implied volatility, and interest rates and dividends, allowing traders to accurately price options and make more informed trading decisions. In the following sections, we will explore the Black-Scholes Model and the Binomial Model in more detail.

Black-Scholes Model

The Black-Scholes Model is a widely used method for pricing options, taking into account factors such as time until expiration, implied volatility, and interest rates. The model was developed by Fischer Black, Myron Scholes, and Robert Merton in 1973 and has since become a cornerstone of modern financial theory. By incorporating these factors into the model, the Black-Scholes Model allows traders to accurately price options and make more informed trading decisions

Binomial Model

The Binomial Model is another popular method for pricing options, using a tree-like structure to model potential price movements of the underlying asset. Developed by John Cox, Stephen Ross, and Mark Rubinstein in 1979, the Binomial Model is based on a discrete-time model of the underlying asset’s price movements. This makes it particularly useful for pricing American-style options, which can be exercised at any time before expiration.

The Binomial Model is renowned for its simplicity and flexibility, making it easy to understand and implement. However, it may not be as accurate as the Black-Scholes Model for certain types of options or in specific market conditions.

Practical Applications of Extrinsic Value in Trading

Practical applications of extrinsic value in trading involve strategies for maximizing extrinsic value and managing risks associated with it. By understanding the factors that influence extrinsic value and how they interact, traders can make more informed decisions when buying or selling options, ultimately leading to more profitable trades. In the following sections, we will explore strategies for maximizing extrinsic value and managing risks associated with extrinsic value.

Strategies for Maximizing Extrinsic Value

Strategies for maximizing extrinsic value include selling options with high extrinsic value or buying options with low extrinsic value. By identifying options with high or low extrinsic value, traders can capitalize on the discrepancies between the option’s market price and its intrinsic value, potentially leading to more profitable trades. Additionally, traders can also employ strategies such as extending expiration dates, increasing implied volatility, and purchasing higher premium options to maximize extrinsic value.

Managing Risks Associated with Extrinsic Value

Managing risks associated with extrinsic value involves understanding the factors that influence it and adjusting trading strategies accordingly. By considering factors such as:

Time until expiration

Implied volatility

Interest rates

Dividends

Related Article: Implied Volatility Crush

Summary

In conclusion, understanding extrinsic value and its various components is crucial for success in options trading. By grasping the fundamentals of extrinsic value, the factors that influence it, and the strategies for maximizing it, traders can make more informed decisions when buying or selling options. Moreover, by employing pricing models such as the Black-Scholes Model and the Binomial Model, traders can accurately price options and identify undervalued or overvalued options in the market.

Armed with this knowledge, traders are better equipped to navigate the complex world of options trading and harness the power of extrinsic value to maximize their profits and minimize their risks. The journey to mastering extrinsic value is an ongoing process, but with dedication and perseverance, traders can unlock the potential of this vital component in the world of options trading.

Frequently Asked Questions

What do you mean by extrinsic value?

Extrinsic value is the difference between the market price of an option (the premium) and its intrinsic value, which reflects the factors outside the price of the underlying asset. This value changes over time based on the time to expiration and the volatility of the underlying asset.

What is extrinsic and intrinsic value?

Intrinsic value reflects the actual value of the strike price compared to the current market price, while extrinsic value consists of the time until expiration, implied volatility, dividends and interest rate risks.

What is an example of extrinsic value options?

An example of extrinsic value options is a call option with a $50 strike expiring in one month, which has no intrinsic value since it’s not In-the-Money (ITM), but still has extrinsic value due to the time until expiration.

What is the difference between the Black-Scholes Model and the Binomial Model?

The Black-Scholes Model is a continuous-time model used to price options, whereas the Binomial Model is a discrete-time model that utilizes a tree-like structure to simulate possible price movements of the underlying asset.