In the fast-paced world of options trading, where diverse strategies abound, put writing stands out as a compelling approach for investors seeking to capitalize on bullish market sentiments. An artful maneuver that grants traders the power to generate income while expressing confidence in an underlying asset’s potential, put writing involves selling put options to eager buyers. By stepping into the shoes of a put writer, one embraces a position that not only yields immediate premiums but also opens the door to prudent opportunities in an upward-trending market.

What is a put option?

A put option is a type of financial derivative that gives the buyer the right, but not the obligation to sell and or sell short the underlying asset at a predetermined price.

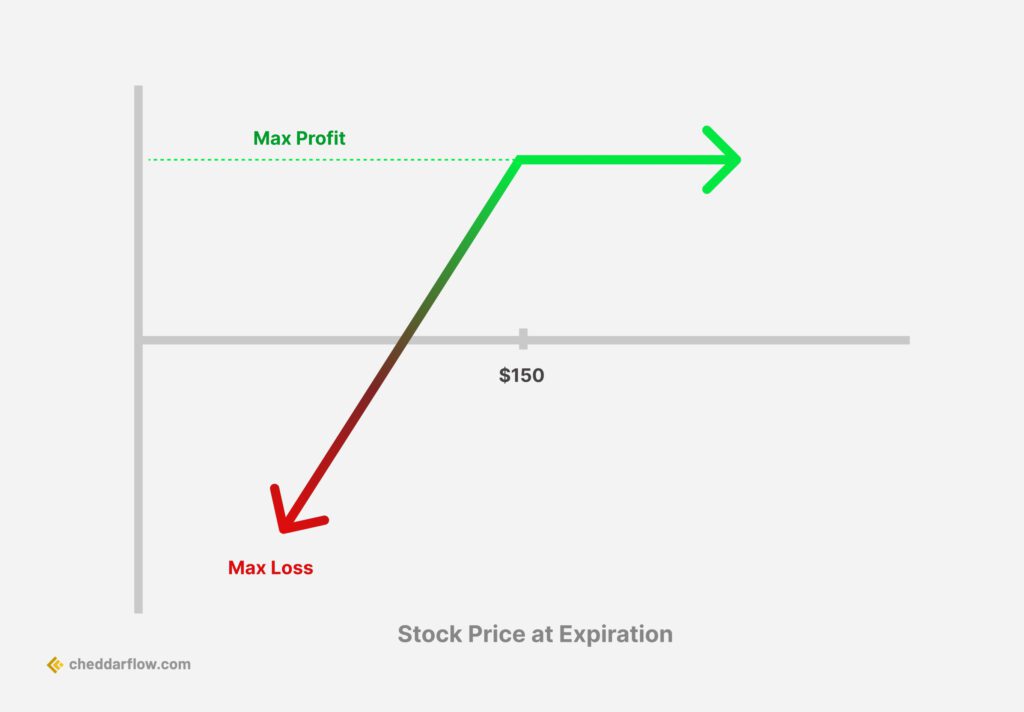

Buying a put allows for an investor who is long shares in a stock to make money in the event of a decrease in share price. Like car insurance, in order for an investor to gain access to this privilege, they must pay what’s known as a premium.

For example, if you own 100 shares of Apple stock and paid $100 per share, if Apple drops to $90 you would lose $10 a share. In order to hedge out your investment in case Apple drops to $90, you would buy the 90 strike put option. This means that if Apple drops in share price to $90, the put option you bought would increase in value, making you money and essentially zeroing out your investment.

Long Put Strategy

When a put option becomes in the money, say the 90 strike Apple put, the buyer of said put has two options they can choose from. They can either sell the put back to the market and take in the increased premium (profit), or they can exercise the put option and sell their Apple stock at $90 a share even if Apple drops to $85. A put option is considered in the money if the share price is $0.01 above the strike price bought. This means that if Apple closes at $89.99 your 90 strike put option is in the money.

Related Article: Put Options Explained

Exploring Put Writing Benefits

Put writing can be an important tool for an investor or trader. For an investor, if they want to acquire a stock at a specific price, they can write a put option in order to do so. They would take in the premium of that put option which would reduce the cost basis of buying the shares.

For a trader, put writing is a bullish strategy that allows the trader to keep 100% of the premium if the put option closes out of the money on the expiration date. For example, if you believe that Apple will close over $100 a share in one month’s time, then you could sell the one-month 95 strike put and collect 100% of the put premium granted Apple closes above $95.

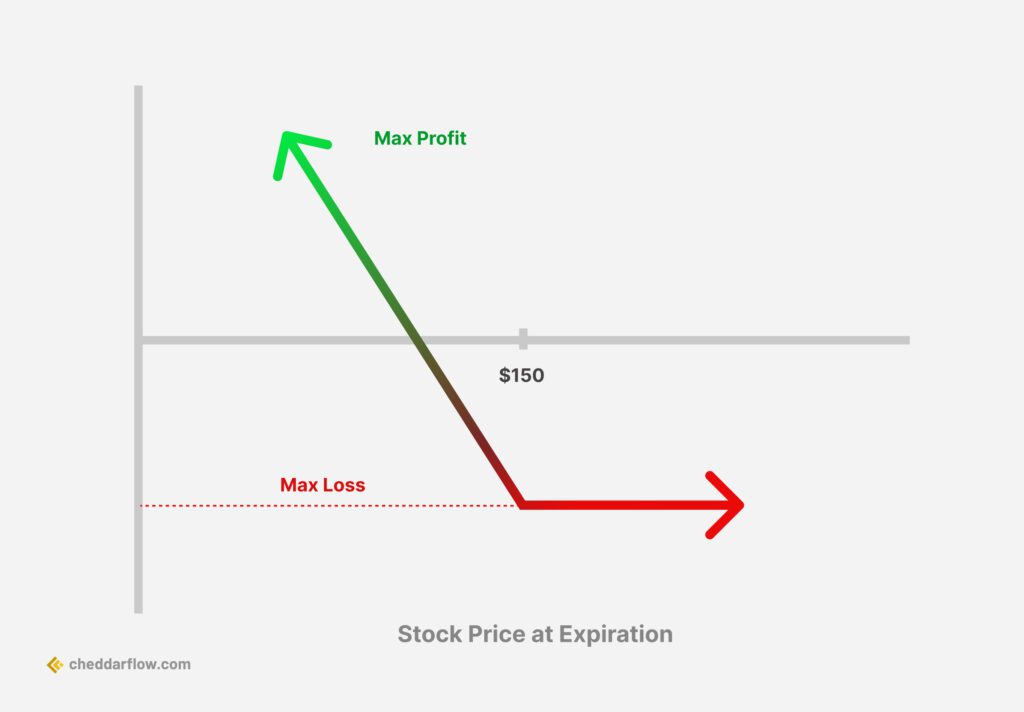

Short Put Strategy

The benefits of put writing allow for an investor to reduce the cost basis of buying shares and generate income. Speculative traders benefit from bullish put writing as they have Theta decay working in their favor as supposed to buying a put. Traders and investors can also get the added benefit of collecting 100% of the premium if the stock price closes above the strike price sold.

Risks of Put Writing

There can be many risks associated with put writing. If the put that you sold expires in the money, then the writer of the put would be forced to buy 100 shares of the stock, even if they don’t want to own it.

Put writing carries nearly unlimited losses. The lowest a stock price can fall to is in theory $0. If you sold a 100 strike put with the underlying at $105, and the stock price falls to $5 a share, you could face a $100 per share loss times 100. That would be a $10,000 loss per put sold.

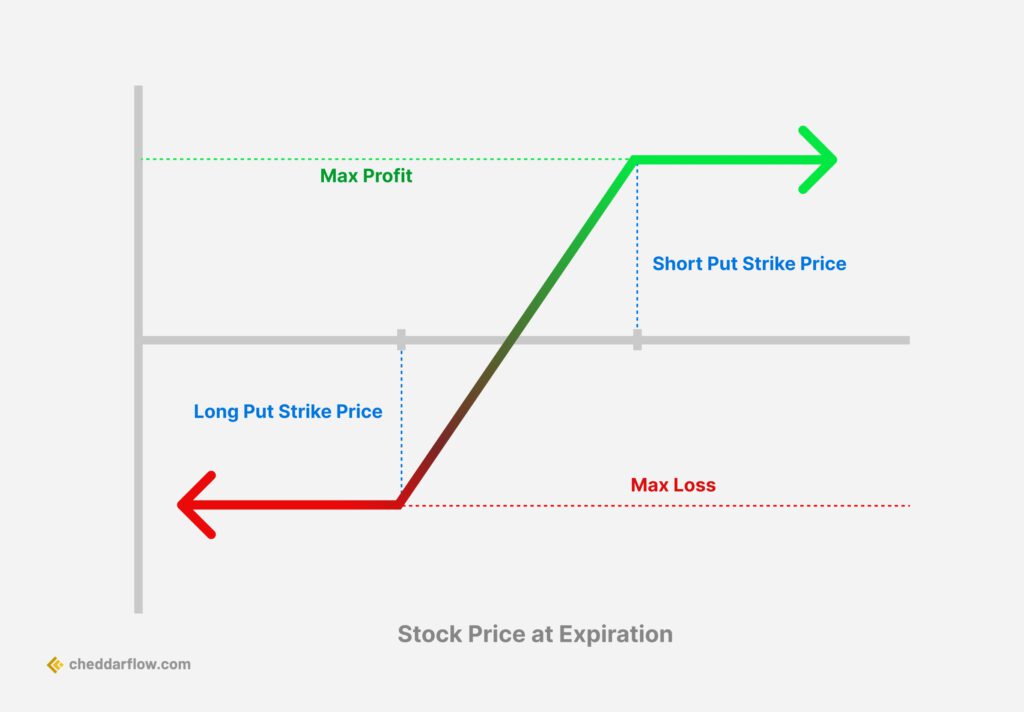

Following proper risk management when writing put options is an absolute necessity. You can mitigate any potential losses by deploying a put credit spread. This involves buying a lower strike put option than the one you sold, which would ultimately cap any losses.

Put Credit Spread Strategy

Overall, many risks are faced by both an investor and trader when writing puts. The main risk is that the stock price falls significantly under the strike price sold and they would be forced to buy shares at a higher price than the market price.

Implementing Put Writing Strategies

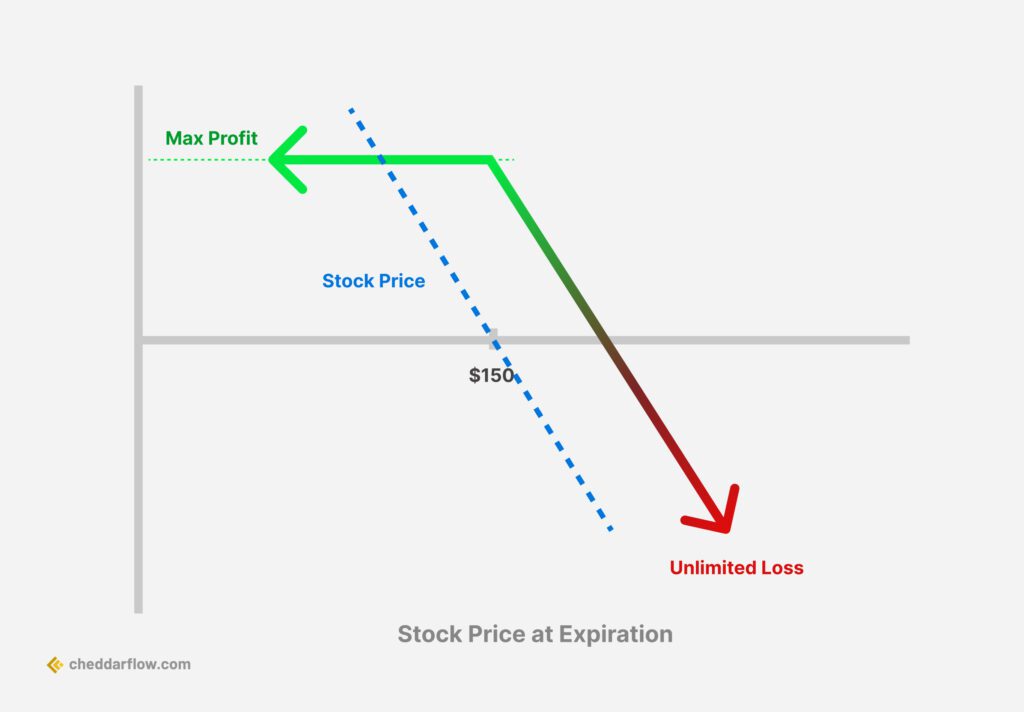

Covered put writing: When you are short 100 shares of stock, you can write puts against your position to take in premium. This also allows you to have a guaranteed exit price, granted the put finishes in the money while mitigating potential losses in the event of the share price rising.

Covered Put Strategy

Cash-secured put writing: Cash-secured puts allow for an investor or trader to write naked puts while guaranteeing a broker that you have the cash necessary to buy 100 shares of the underlying if the put expires in the money.

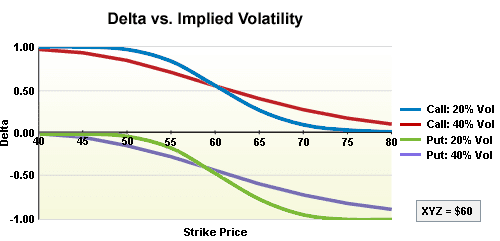

An effective use case of bullish put writing is after a market correction. Implied volatility on the put option is going to be elevated due to the correction in share price. When implied volatility drops, the Delta on a put option will move toward zero. By writing a put option with higher implied volatility, after a market correction, traders can take advantage of the implied volatility returning back to normal levels. When implied volatility and the Delta of the put option move towards zero, the writer of a put option will make money. An added benefit to this is that a trader can still participate in the market upside, as this trade has a bullish view.

Case Studies and Examples

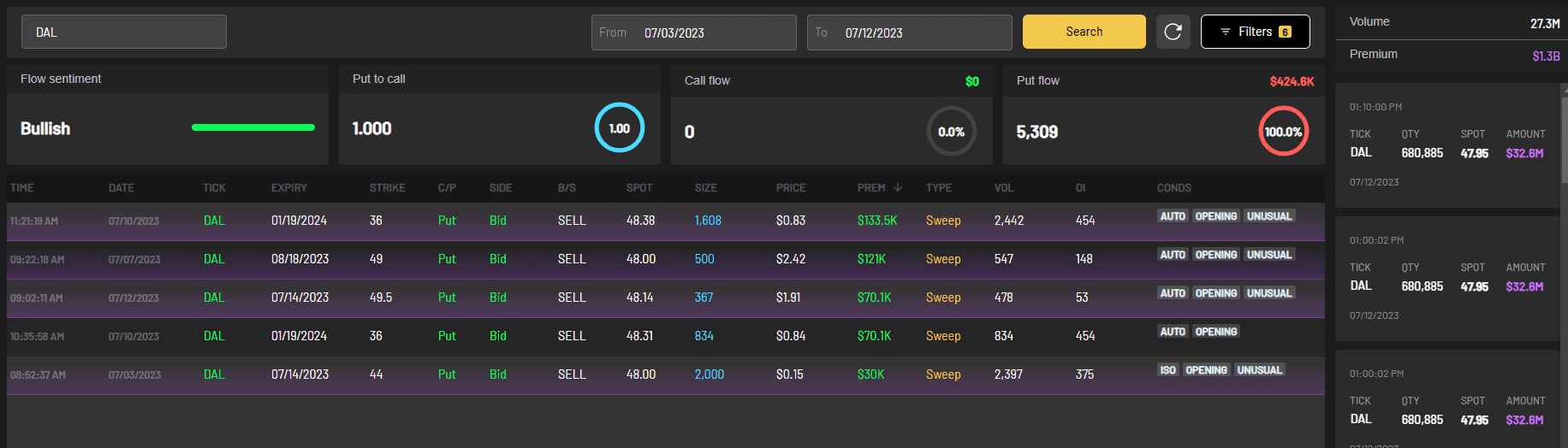

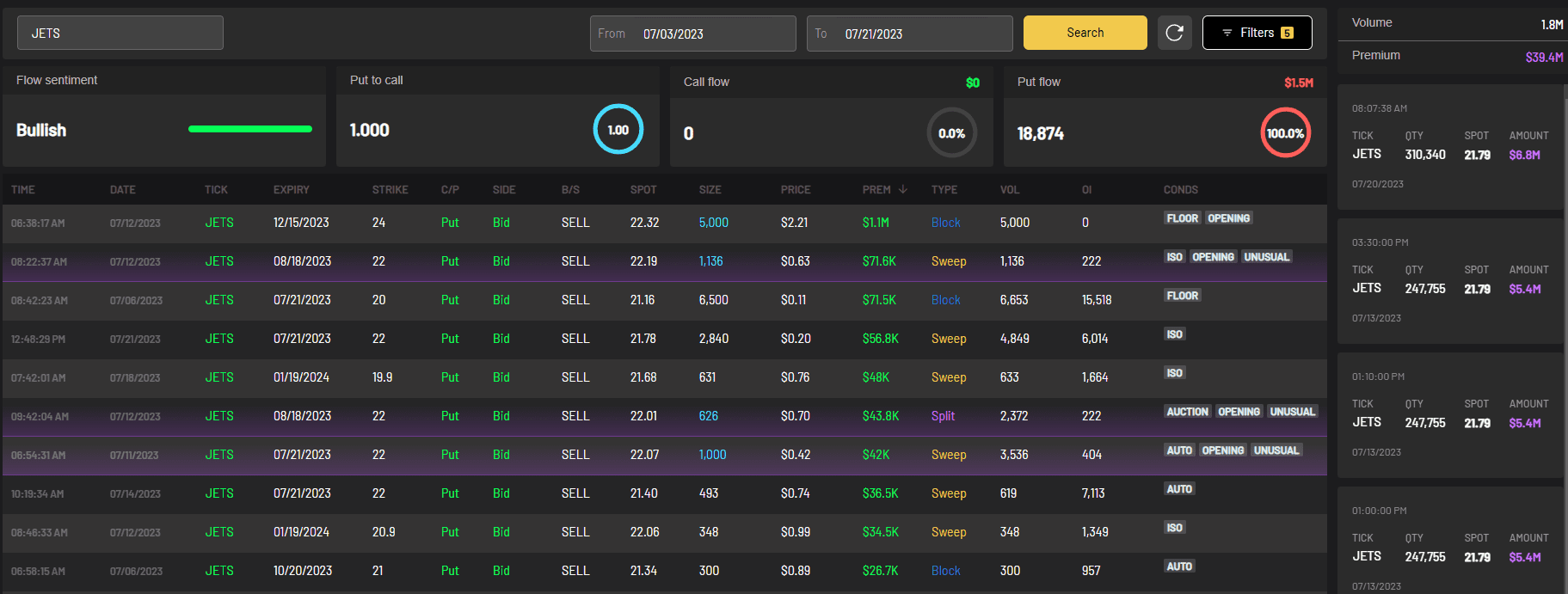

(DAL) Delta Airlines reported its quarterly earnings on July 13th. In the lead-up to the report, some large put writing orders hit the tape. With this, an ETF that tracks airline stocks JETS, also saw large put writing orders.

A trader sold to open 500 DAL 8/18/23 49p for $121K in premium and 5,000 JETS 12/15/23 24p for $1.1M in premium. The order size takes up the volume for the day and is over the open interest which shows these were sold to open orders. With this, $90M in the Dark Pool was reported after hours which can help give conviction for a trade. DAL reported a fantastic quarter which sent the stock price soaring and these puts were now far out of the money, returning a hefty profit for the traders.

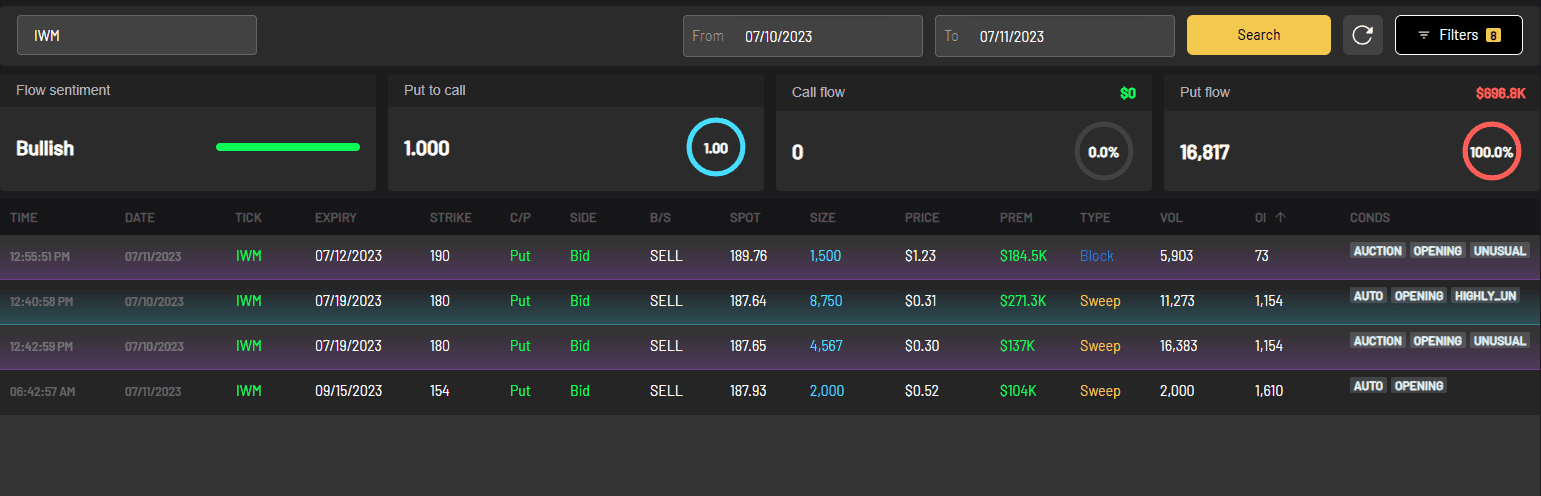

Just a day before the July 12th, 2023 CPI release, a few unusual IWM put writing orders hit the tape.

With one day till expiration and the CPI report, a trader wrote 1,500 IWM 7/12/23 190p for $184K in premium. Two similar orders also hit the tape with 9 days until expiration. 13,317 IWM 7/19/23 180p for $408K in premium was collected. CPI came in “cooler” than expected and the broad market ripped higher. This allowed for the puts that were written to finish out of the money, which the seller collected 100% of the premium.

So, as we can clearly see from the examples above, watching these unusual put writing orders can be extremely beneficial for an investor or trader. Make sure you always pay attention to the highlighted blue “highly unusual” orders.

Some additional things to look at for when trying to identifying put writing inside options flow (STO – Sell To Open):

The contracts should be new and opened. Cheddar Flow identifies these automatically for you by highlighting the contract size in blue

The implied volatility (IV) should be going down as time goes on

The trade should be on the bid side or below

As the spot price of the underlying stock price goes down, so should the price of the contract

Conclusion

Put writing can be an incredibly useful tool for both traders and investors with many ways to structure the trade. If you are short stock, put writing can help to mitigate losses. Traders can take a bullish viewpoint on a stock with put writing. Investors can use put writing for enhanced stock acquisition and premium generation. Make sure to always use proper risk management.

If you want to further explore put writing, Cheddar Flow is the best place to do so. Always consult with a financial advisor before making investment decisions.

Frequently Asked Questions

Is put writing bullish or bearish?

Put writing is considered a bullish strategy. When an investor writes (or sells) a put option, they are essentially taking on the obligation to buy the underlying asset at a specific price (the strike price) if the option buyer decides to exercise their right before the option’s expiration date.

What is the difference between call writing and put writing?

Call writing involves selling call options against an owned asset and is used in neutral to slightly bullish market conditions. Put writing involves selling put options with cash set aside for potential asset purchase and is utilized in bullish to neutral market conditions. Both strategies allow investors to generate income from the options premiums, but they have different risk profiles and profit potential based on the market outlook and the position of the underlying asset.

Who is the writer of a put option?

The writer of a put option is the individual or entity who sells (or writes) the put option to another party, known as the option buyer. When the writer sells the put option, they are entering into a contractual obligation with the buyer.