What is a Call Option?

A call option provides the buyer the right, but not the obligation, to buy a stock at the specified strike price by the expiration date. Call options are a mechanism for traders and investors to make a bullish bet on the stock using a form of leverage.

Each option contract represents 100 shares of the underlying stock and therefore movements in the stock price are magnified by swings in the value of the call contract. If the stock price increases, the buyer of the option can sell the contract for a profit or exercise the contract to purchase the shares at a discount to the current market rate.

How do Call Options Work?

Options have two sides to the trade; the buyer and the seller.

The buyer pays the option premium for the right to purchase the stock at the specified price by the expiration date. The buyer will purchase a call if they are bullish on the stock and believe that it will go up in value within the date of the option contract. As a buyer of a call option you need to get two things right; the direction of the stock (should increase), and the time period (should be within the option contract).

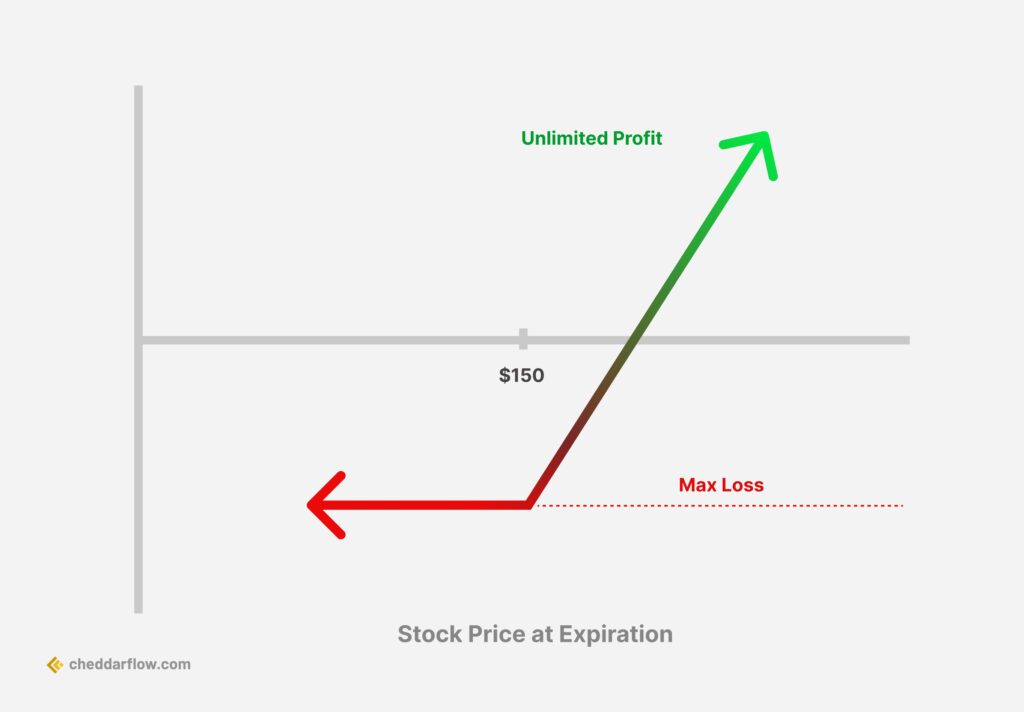

If the underlying stock increases in value, the buyer of the contract can either sell the option contract for a gain or exercise the contract in order to purchase the shares. The below graph illustrates the potential profit from buying a call contract. Initially, the buyer is at a loss since they pay the premium. But as the underlying stock price increases, the value of the options contract increases.

When the stock price increases beyond “T”, the buyer would have reached the break-even point where further increases in the stock price are profitable for the buyer of the option contract.

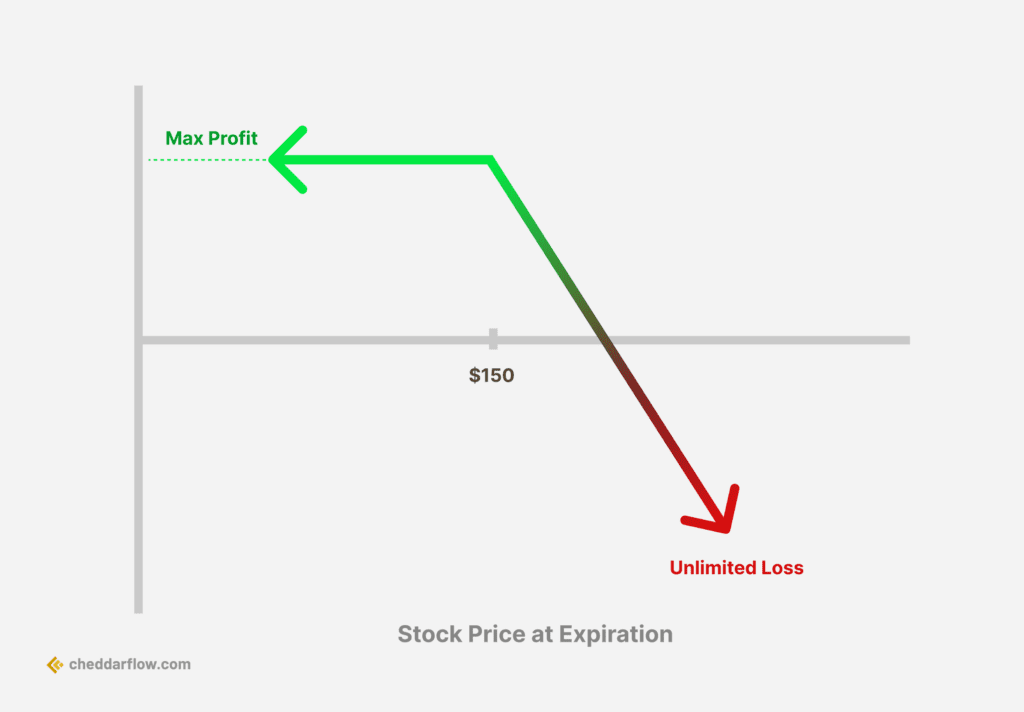

The seller of a call option earns the option premium in exchange for the obligation to sell their shares at the specified strike price if the option buyer decides to execute the contract. Most brokerages require the seller to have 100 shares of the underlying stock for each option contract sold since they agree to sell their shares if the buyer decides to exercise the contract. This is often referred to as a covered call.

If the seller didn’t own 100 shares of the underlying stock price they would be selling an uncovered call which exposes them to unlimited downside since the stock price can increase without a threshold. By selling a call option, the seller is accepting a capped upside in the form of the option premium.

Different Call Options Explained

Long call (bullish) – a long call is a bullish bet that the buyer of a call option is making. They are paying the premium of the options contract in hopes of seeing the underlying stock price increase by the expiry date. In the above chart, we saw that the buyer pays the premium upfront when buying the call option.

If the underlying stock price increases above a threshold, the buyer will break-even. If the underlying stock increases beyond the break-even point, the buyer can decide to sell the option contract for a gain. At any point the buyer can also exercise the option contract in order to purchase 100 shares of the underlying stock at a discount to the market rate. However, it’s more common to sell the option contract for a gain or let it expire worthless if the break-even price is not reached.

Short call (Bearish) – a short call is the position taken by the seller of the call option. They are making a bearish bet that the underlying stock price will not increase in value by the expiration date. In this case they will keep the option premium in exchange for the risk they took.

As demonstrated, the premium of the option contract is initially the loss of the buyer but the profit for the seller. As the underlying stock price increases in value, the value of the long call bet increases while the value of the short call decreases.

Understanding the Difference Between Calls and Puts

Call options are contracts that give the buyer the right, but not the obligation to buy the stock at the specified price by the expiry date. The buyer of a call option is making a bullish bet.

Put options are contracts that give the buyer the right, but not the obligation to sell the stock at the specified price by the expiry date. The buyer of a put option is making a bearish bet.

A similarity between calls and puts is that they involve the buyer paying a premium to the seller. Both types of option contracts represent 100 shares of the underlying stock. In both cases the downside of the buyer is limited to the premium, while the upside is far greater.

The main difference between a call option and a put option is that they bet on opposite outcomes. A call option is purchased to bet on the stock price increasing, while a put option is purchased to bet on the stock decreasing.

It’s worth restating that a call option can also be used to make a bearish bet if a trader takes the side of the seller (short call) but the potential gain is limited to earning the option premium.

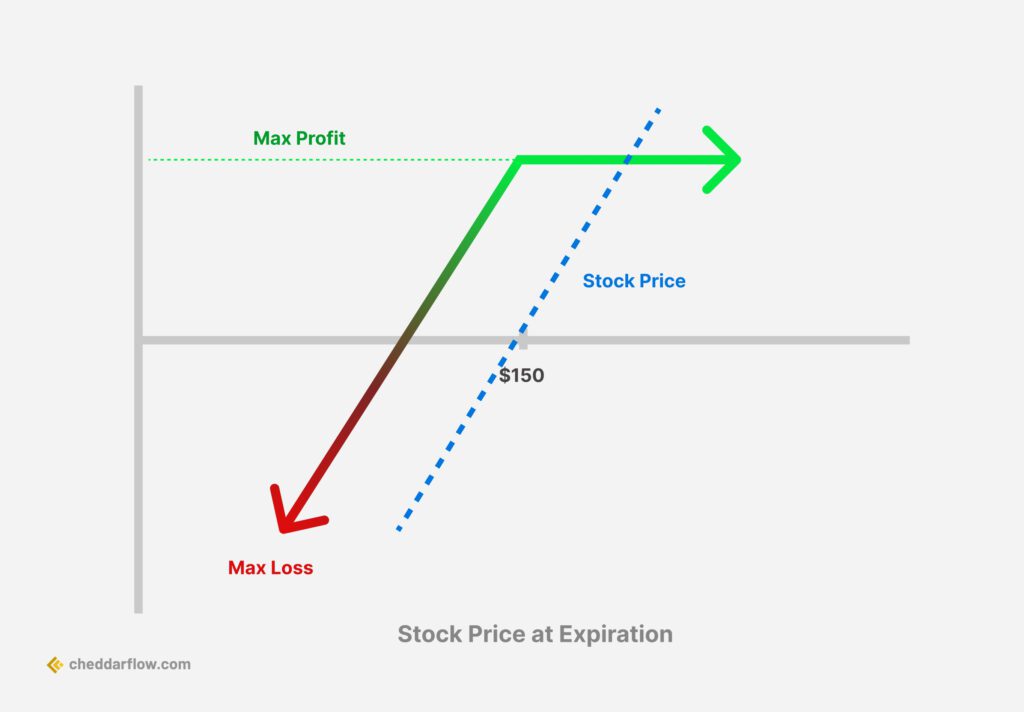

Using the Covered Calls Strategy to Generate Income

Traders and investors can use the covered calls strategy as a way to generate income. A covered call is when a trader sells a call option (short call) on a stock they own. This is called a “covered call” because the seller has 100 shares of the underlying stock for each option contract they sell, in other words, the call option is “covered” if the buyer decides to exercise the contract.

In exchange for selling a call option, the seller earns the option premium which is used as a way to generate income. The covered call strategy is often used by those that own a large number of shares of a given stock. The seller earns the premium for the obligation to sell their shares at the specified strike price by a certain date.

Selling a covered call allows traders and investors to hold the stock while agreeing to sell their shares if the stock price moves up and the buyer decides to exercise the contract. In this case the seller of the option contract would be missing out on additional gains they would have made by simply holding the shares.

Conclusion

This article explained call options, a common and complex option contract. To recap:

- A call option offers the buyer the right, but not the obligation to buy the underlying stock at the specified strike price by a certain date.

- The buyer of the call option is making a bullish bet on the underlying stock price.

- The buyer of the call option is said to be taking a long call position, the seller of the call option is taking a short call position.

- The buyer of a call option is making a bullish bet, the buyer of a put option is making a bearish bet on the underlying stock price.

- Selling call options can be used to generate income by earning the premium on the option contract.