What is Theta?

Theta, or better known as time decay, is an option greek that measures the rate of decline of an options price due to the passage of time.

Understanding Option Greeks

Being aware of the greeks is an essential part of options trading. Traders must constantly be paying attention to understand the contract they are buying. The greeks are a set of measurements that determine the pricing of said option. There are 4 main greeks known as the first-order derivatives. They are Delta, Theta, Vega, and Rho.

Delta: Measures the rate of change of an options price for every $1 move in the underlining.

Theta: Measures the time decay of an option.

Vega: An option’s sensitivity to implied volatility.

Rho: Measures the expected change in an option’s price per one percentage point change in interest rates.

Theta Decay In Options Trading

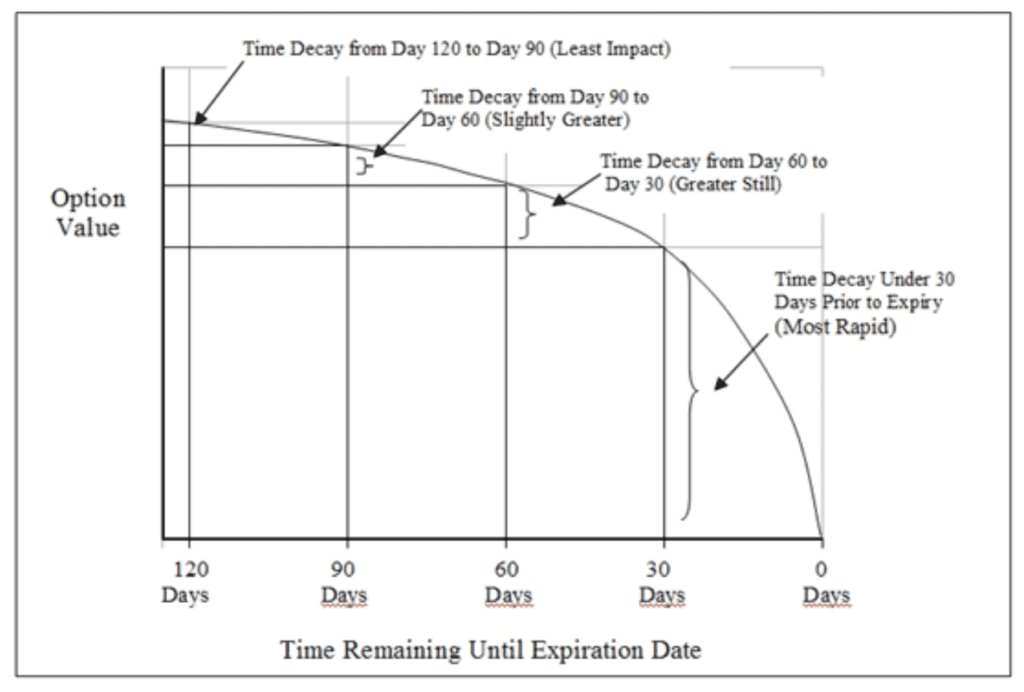

As shown in the chart below known as the Theta curve, option contracts with expirations over 90 days (3 months) experience the least amount of Theta decay. Options quickly begin their decay after the 90 to the 60 days to expiration mark. This is why option sellers like to write contracts with less than 90DTE.

The general rule here amongst buyers is that to experience the least amount of time decay, you would want to purchase option contracts with more than 3 months to expiration or 90 days. When you buy options you have negative Theta and when you sell options you have positive Theta.

In-the-money: Lowest Decay

At-the-money: Highest Decay

Out-the-money: Low Decay

Calculating Theta in Options

As noted previously, Theta measures the time decay of an option for every one calendar day in the year. For the sake of simplicity, we are going to assume that there is no change in the share price or implied volatility, and one calendar day has passed.

Say you buy an option for 1.00 with 7 days to expiration. The theta on that option is -0.17 so you would take the price you paid (1.00) and subtract the Theta (-0.17) and you would get an option price of 0.83 after one calendar day has passed.

Theta Option Strategies

There are many strategies to take advantage of Theta decay as an options seller. The 3 most popular would be an Iron Condor, Calendar Spread, Naked Calls and Puts.

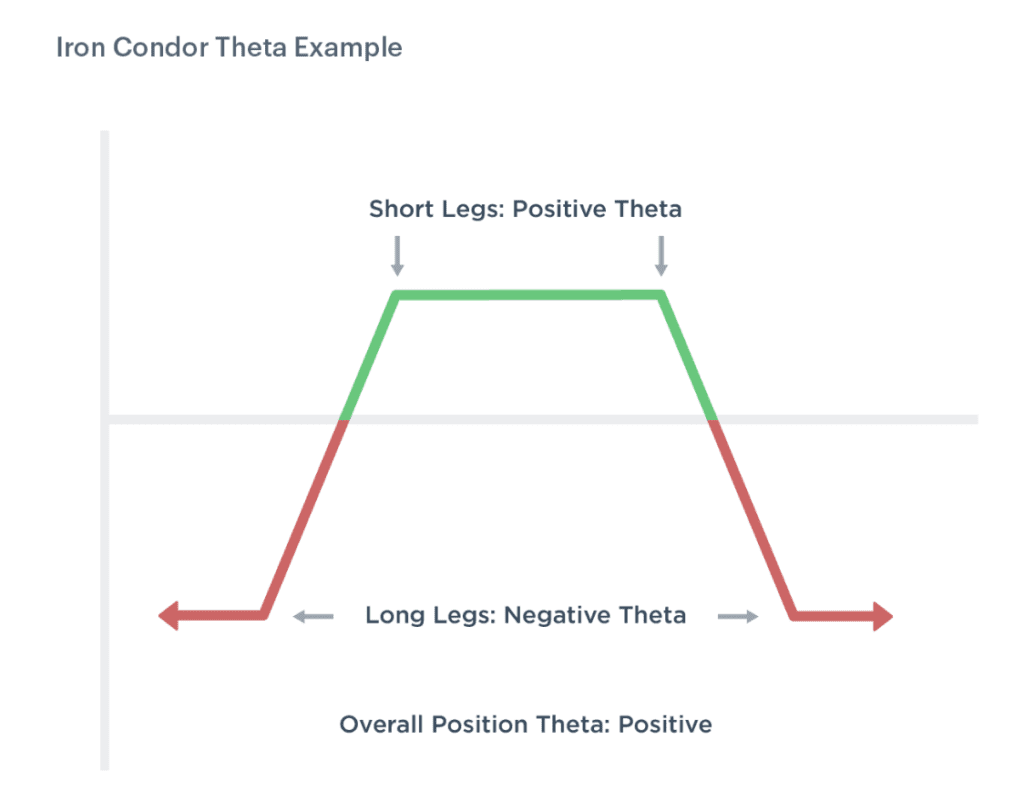

Iron Condor Strategy

This strategy is best deployed when Implied Volatility is high. Iron Condors have a neutral outlook and a defined risk. The trade is structured by combing a bullish put spread (buy a put and sell a higher strike put) and a bearish call spread (buy a call and sell a lower strike call). The goal is to allow the short strikes to expire worthless so that you can keep the premium.

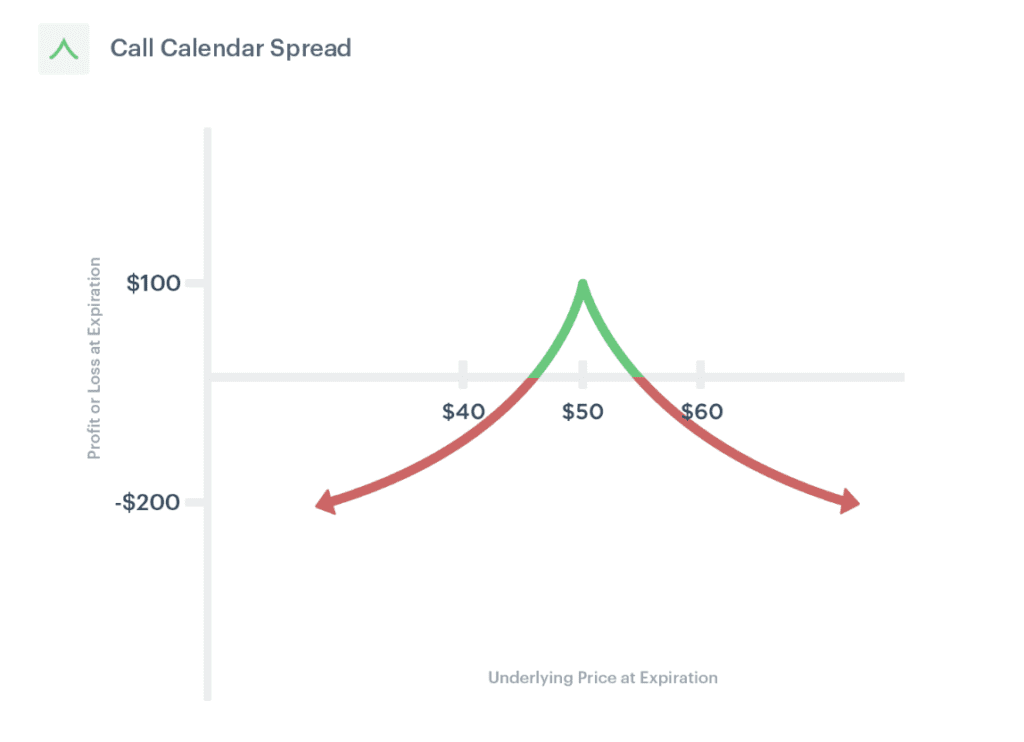

Calendar Spread

A calendar spread or otherwise known as a time spread is also a neutral strategy with defined risk. The trade can be structured on the call side or the put side. You would sell a short-term option while simultaneously buying a further dated option with the same strike price. To realize maximum profit, you would want the stock to make very little movement.

Naked Calls and Puts

Writing naked calls (bearish) and puts (bullish) is a strategy used when the seller does not own the underlining. The goal is for the option to remain out of the money at expiration and allow Theta to decay the options price. Naked calls carry unlimited risk because the stock can move infinitely higher while puts carry a max loss if the stock moves to $0.

Vanna and Charm Flows

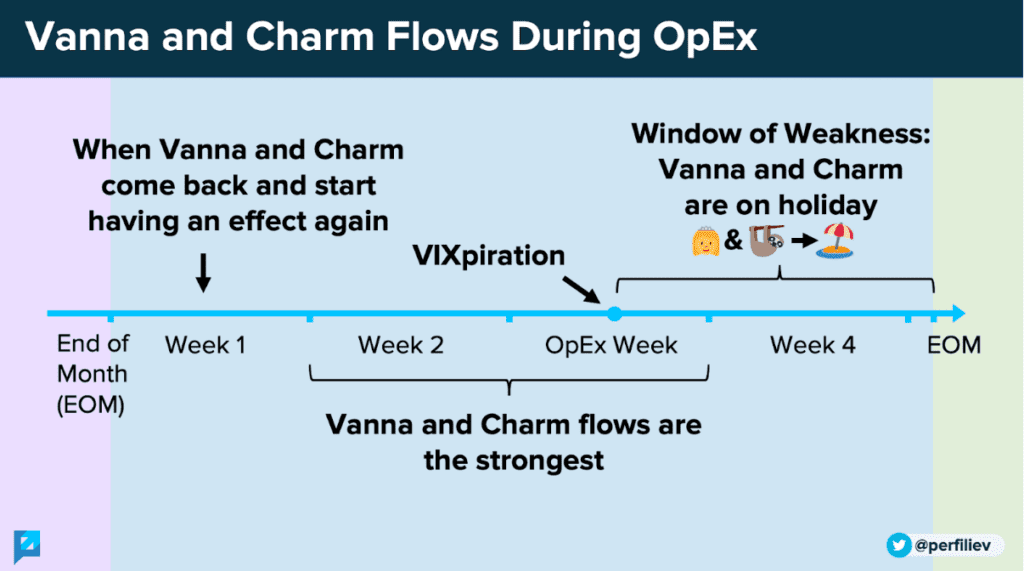

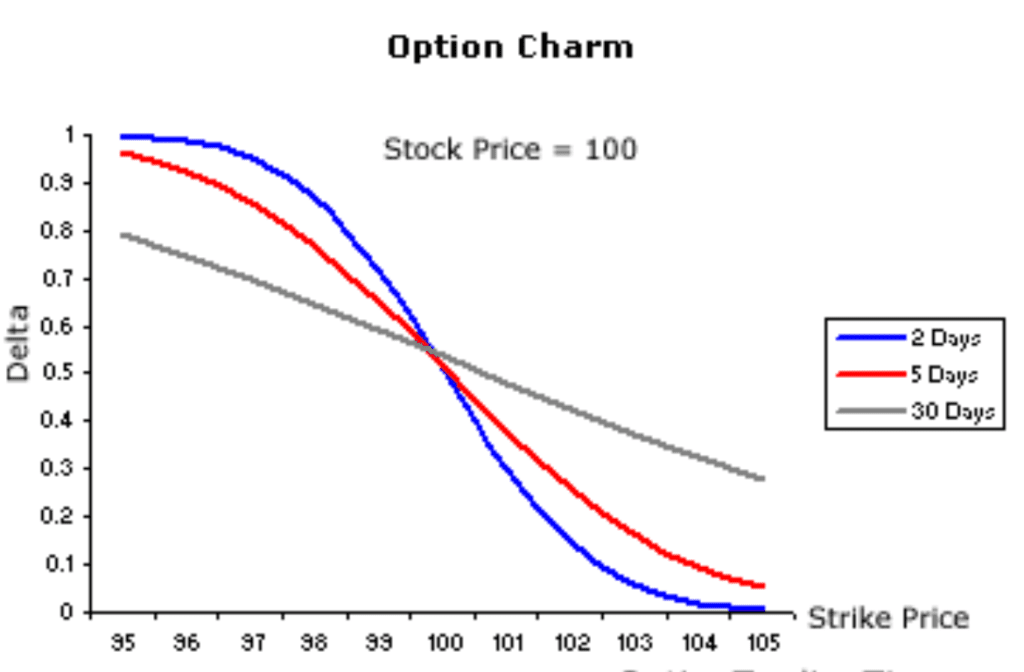

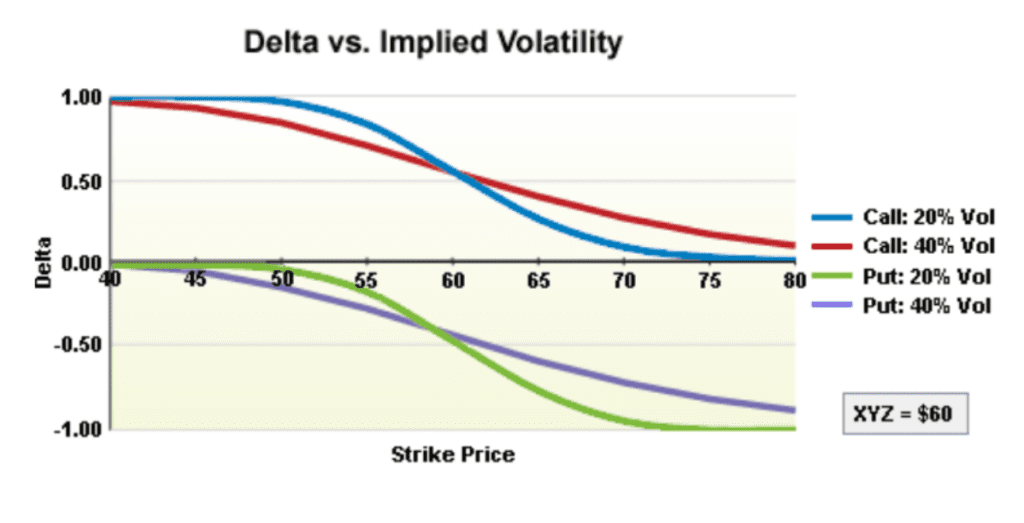

Along with the first-order greeks mentioned previously, there are second-order greeks that affect options prices. Vanna and Charm are two of the more important ones. Vanna measures the change in Delta for every change in implied volatility. Charm, which is the second-order greek of Theta, measures the rate of Delta change for the passage of time (Theta).

Market makers must constantly re-hedge their books to remain delta neutral at all times. Changes in the option greeks like implied volatility or time decay cause dealers to either buy or sell their hedges. As we move closer to monthly options expiration, these dealer hedging flows become stronger. This is why we usually see a slow grind higher in the index on the week of OpEx.

These flows are strongest during OpEx week because as time passes, implied volatility drops, and put options become further out of the money, Delta moves towards 0. When Delta moves towards 0 this causes dealers to buy back the shares and or futures sold, driving the index higher and muting volatility.

As a general rule, the chart below illustrates when these dealer hedging flows have the least and greatest impact. Along with this, 0DTE options can further exacerbate dealer hedging flows, which will ultimately intensify index moves.

Frequently Asked Questions

Q. What is Theta and why is it important in options trading?

Theta, often referred to as ‘time decay’, is a way of measuring how quickly the value of an option declines over time. This concept is significant in options trading, as it determines the price and potential returns from a trade.

Q. What factors affect Theta decay?

The rate of Theta decay is determined by a few elements, such as the time to expiry, strike price, volatility of the underlying asset and the current interest rate. All these components work in tandem to affect the final outcome. Options that expire further away in the future have less theta decay, whereas options with a higher strike price or lower volatility tend to decay faster.

Q. How can traders manage Theta risk?

Traders need to be aware of Theta risk and monitor their positions to prevent losses due to time decay. If a trader has a long option position with significant time decay, they may need to adjust or hedge the position accordingly. By doing this, they can minimize the potential of losing value because of Theta risk.

Conclusion

When buying and or writing options, Theta is extremely important to pay attention to. When you buy options, Theta is working against you. When you write options, Theta is your friend. There are many different trading strategies to profit and or mitigate Theta decay. As an option trader, it’s crucial to understand and know how to calculate Theta in order to make more informed investment decisions.

Option charts provided by OptionAlpha and OptionTradingTips