The world of options trading can be both thrilling and daunting, with a myriad of strategies and terminology to navigate. One such distinction lies in the concepts of “Buy to Open” and “Buy to Close.” But what do these terms mean, and how can they impact your trading strategies? In this blog post, we will delve into the differences between these two essential concepts, explore their practical applications, and provide guidance on mastering the art of options trading with a focus on “buy to open vs buy to close.”

Short Summary

Buy to Open and Buy to Close are two important strategies in options trading with distinct functions.

Strike price, expiration date, and underlying asset all contribute to the value of an option.

Mastering these strategies requires understanding when each should be used as well as common misconceptions and pitfalls associated with them.

Decoding Buy to Open and Buy to Close

| Feature | Buy to Open | Buy to Close |

| Action | Opens a new options position | Closes an existing options position |

| Effect on Portfolio | Establishes a long call or put position | Exits a long call or put position |

| Order Type | Creates a new contract | Offsets a previously sold contract |

| Risk | Potential for profit or loss | Limits potential loss (on a losing position) or captures profit (on a winning position) |

| Terminology | Used to “enter” the options market | Used to “exit” the options market |

The Essence of Buy to Open

Long Call Options Example

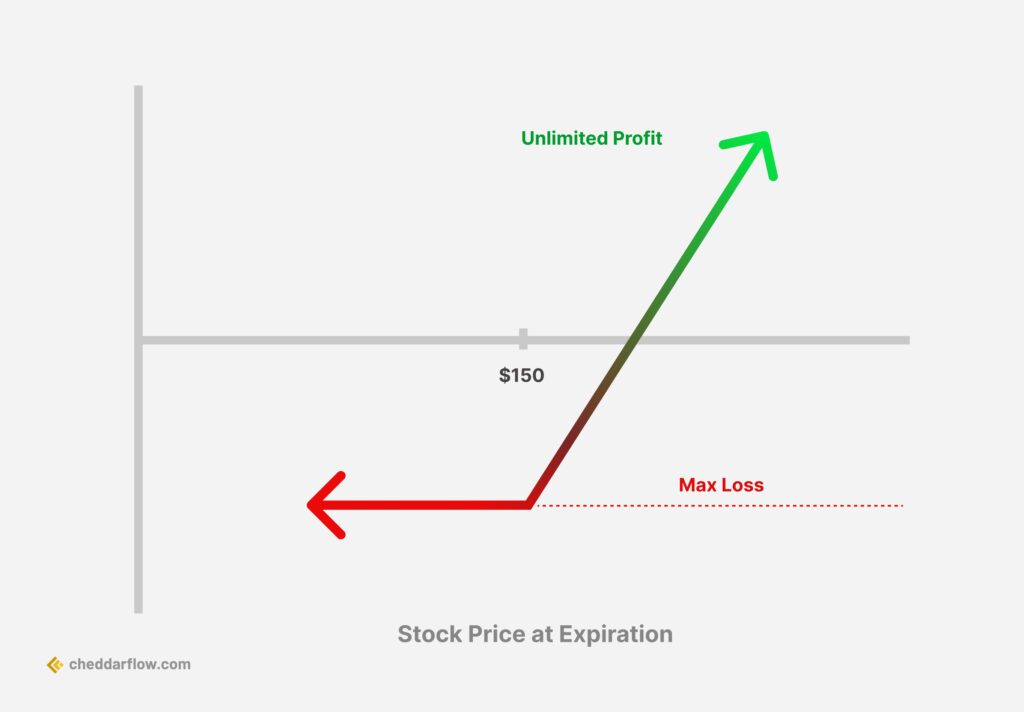

Buy to Open is an order type used by investors who wish to take a long position on an option contract, anticipating the option price to increase over time. Options traders utilize this strategy when they want to acquire a call or put option, essentially betting on the price direction of the underlying asset.

Purchasing to open an options position enables a speculator to take advantage of a potential increase in profits with minimal risk. Such long options positions can yield large returns. However, options are considered wasting assets, as their value decreases as they near their expiration date – a phenomenon known as time decay.

Therefore, it is essential to weigh the potential rewards against the risks associated with Buy to Open before entering a trade.

The Function of Buy to Close

On the other hand, Buy to Close is used when traders wish to close an existing short position in an option trade. A trader would employ a buy-to-close order when they anticipate that the option price will decline over time. By doing so, they can prevent further losses that may be incurred by delaying the closure of their position.

In essence, Buy to Close is a strategy used to offset a short position, terminating the trader’s involvement with the current contract and concluding their position and associated risks. By understanding the function of Buy to Close, traders can better manage their existing positions in the options market.

In Summary

| Buy to Open | Buy to Close |

|---|---|

| Traders who want to purchase a call or put option | Traders who want to sell a call or put option |

| Used for going into a “long” position | Used for “exiting” a short position |

| Buyer seeks potential increase in profits with minimal risk | Seller seeks to profit or prevent losses |

Key Components of Options Trading

Before diving into practical examples of Buy to Open and Buy to Close, it is essential to grasp the fundamental elements of options trading. The key components that influence the value of an option include the underlying asset, strike price, expiration date, and option type. Understanding these components will equip traders with the necessary knowledge to make informed decisions on when to use either Buy to Open or Buy to Close strategies.

Let’s take a closer look at each of these components in the following subsections, providing a comprehensive understanding of the factors that play a critical role in options trading.

Strike Price

The strike price is the predetermined price at which the buyer of the option can purchase or sell the underlying asset. It is determined by the prevailing market conditions when the option is acquired. The strike price is of paramount importance in the evaluation of an option, as it directly influences the level of profit or loss that can be obtained from the option.

Expiration Date

The expiration date is the date on which the option contract terminates, rendering it no longer valid. Typically, the expiration date is the third Friday of the contract month or the month in which the contract expires. The expiration date is of great significance as it denotes the date when the option contract becomes void and can no longer be traded.

Underlying Assets

Underlying assets refer to the financial assets which serve as the basis for a derivative’s price, such as options contracts. These assets can include stocks, bonds, commodities, interest rates, market indexes, and currencies. Examples of underlying assets may encompass stocks like Apple or Microsoft, commodities such as gold or oil, indices like the S&P 500 or Nasdaq, and currencies like the US dollar or Euro.

Practical Examples: Buy to Open vs Buy to Close

Now that we have a solid understanding of the key components of options trading, let’s put this knowledge into practice with some real-life examples. These scenarios will illustrate the practical applications of Buy to Open and Buy to Close, helping traders better comprehend when to employ each strategy and how they can impact their options positions.

Buy to Open Scenario

Consider a trader who believes that the price of Stock Q will increase in the near future. To capitalize on this prediction, the trader decides to buy a call option for Stock Q at a strike price of $120. This gives the trader the right, but not the obligation, to purchase Stock Q shares at $120.

If the stock price indeed rises, the trader can exercise the option and buy the shares at $120, then resell them at a higher price for a profit. Alternatively, the trader can resell the contract (Sell to Close) to a new buyer, capturing the increased value of the option.

Buy to Close Scenario

In contrast, let’s consider a trader who believes that the price of Stock X will decrease in the near future. The trader decides to sell a put option for Stock X at a strike price of $90, granting them the right to sell Stock X shares at $90. If the stock price does indeed decline, the trader can exercise the option and sell the shares at $90, then buy them back at a lower price for a profit.

However, if the trader wishes to exit the position before the option’s expiration date, they can buy back the contract (Buy to Close) from the exchange, capturing the decreased value of the option. This Buy to Close scenario illustrates the potential rewards and risks associated with closing a short position in an options trade.

In Summary

| Buy to Open | Buy to Close |

|---|---|

| You are purchasing a option contract in hopes that it will go up in value. | You are removing yourself from the option contract and ending all obligations. |

Mastering the Art of Options Trading

As we have seen through the examples above, mastering the art of options trading requires a thorough understanding of when to use Buy to Open and Buy to Close strategies. Knowing when to initiate or close a position can be the key to maximizing profits and minimizing losses in the options market.

In the following subsections, we will delve deeper into the specific scenarios in which Buy to Open and Buy to Close should be employed, providing further guidance on how to effectively navigate the options market and optimize your trading strategies.

When to Use Buy to Open

A trader should consider using Buy to Open when they are bullish on the underlying asset and anticipate a price increase. For instance, if a trader believes that the price of Stock Y will rise, they can buy a call option for Stock Y, granting them the right to purchase the shares at a predetermined price.

If the stock price does indeed rise, the trader can either exercise the option to buy the shares and resell them at a higher price or resell the contract (Sell to Close) to another individual, capturing the increased value of the option.

When to Employ Buy to Close

Conversely, a trader should consider using Buy to Close when they are bearish on the underlying asset and anticipate a price decrease. For example, if a trader believes that the price of Stock Z will fall, they can sell a put option for Stock Z, granting them the right to sell the shares at a predetermined price.

If the stock price does indeed decline, the trader can either exercise the option to sell the shares and buy them back at a lower price or buy back the contract (Buy to Close) from the exchange, capturing the decreased value of the option.

Common Misconceptions and Pitfalls

In the world of options trading, traders may sometimes fall prey to common misconceptions and pitfalls that can hinder their success. By recognizing and avoiding these potential obstacles, traders can enhance their decision-making process and ultimately improve their performance in the options market.

In this section, we will explore two common pitfalls that traders may encounter: misunderstanding order types and overlooking market factors. By understanding these issues, traders can avoid costly mistakes and better position themselves for success in the options market.

Misunderstanding Order Types

One of the most common pitfalls in options trading is misunderstanding order types, which can lead to costly mistakes. As we have discussed earlier, it is crucial to understand the difference between Buy to Open, Buy to Close, Sell to Open, and Sell to Close, as each order type serves a unique purpose in the options trading process.

Overlooking Market Factors

Another common pitfall in options trading is overlooking market factors that can influence the value of an option. Factors such as volatility, liquidity, and time decay can significantly impact the performance of an options trade, making it essential for traders to consider these factors when making trading decisions.

Summary

In conclusion, understanding the difference between Buy to Open and Buy to Close is an essential aspect of mastering the art of options trading. By familiarizing oneself with these order types, the key components of options trading, and the practical applications of each strategy, traders can make more informed decisions and better position themselves for success in the options market.

As we have explored, avoiding common misconceptions and pitfalls can further enhance a trader’s performance and help them navigate the complex world of options trading with confidence. So go forth, armed with this knowledge, and conquer the options market!

Frequently Asked Questions

What does buy to open mean?

Buying to open means purchasing a derivative such as a call or put option in order to open a new position. This contrasts with selling to open, which involves opening a position by selling a derivative rather than buying it.

Buying to open allows investors to benefit from the potential increase in the price of an asset.

What does buy to close mean?

Put simply, buy to close refers to the process of closing an existing short position by buying options contracts. This is the opposite of buy to open, which is when a trader opens a new position by purchasing options contracts. Buy to close can be used to close out put and call positions.

In short, buy to close refers to an order used to exit an existing short position by buying options contracts. This allows traders to close out their existing positions and offset any risks associated with them.

When should you buy to close an option?

It is recommended to buy to close an option once it has reached 50% of its maximum gain, in order to lock in profits and exit the open position.

What happens when you buy to open a put option?

When you buy to open a put option, you are purchasing the right to sell a particular stock or other asset at a predetermined price within a specified time frame. This gives you the potential to make a profit if the asset’s value falls below the strike price before the option’s expiration date.

By buying to open a put option, you gain the right to sell a particular stock or other asset at a predetermined price within a specified time frame. If the asset’s value drops below the strike price by the option’s expiration date, you can potentially generate a profit from this purchase.

What is buy to open vs buy to close?

Buy to open and buy to close are terms used by options traders to indicate the nature of an order. Buy to open indicates that a new long (call or put options) position has been opened, while a buy to close indicates that an existing short (call or put options) position has been closed (covered).