Have you ever wondered what is float in stocks and why some stocks experience sudden price fluctuations, while others seem to remain relatively stable? The answer lies in the concept of stock float, a crucial aspect of investing that can significantly impact a stock’s liquidity, volatility, and ownership structure. Understanding what is float in stocks can help investors make informed decisions when trading and investing in the stock market.

In this blog post, we will delve into the definition of what is float in stocks, the differences between high and low float stocks, and the factors that can influence stock float. We will also discuss various trading strategies for low float stocks and the role of institutional investors in stock float. By the end of this post, you will have a solid understanding of what is float in stocks and its importance in the world of investing.

Key Takeaways

Stock float is the number of shares available for public trading, and can provide insight into a company’s liquidity, volatility, and ownership structure.

High float stocks offer increased liquidity and stability while low float stocks present greater risk with potential quick gains.

A comprehensive strategy including research & technical analysis is essential for successful trading of low float stocks. They also carry higher risks which should be taken into account.

Defining Stock Float

Stock float refers to the number of shares available for public trading, excluding those held by insiders or under trading restrictions. Understanding a company’s stock float is beneficial as it sheds light on a company’s liquidity, volatility, and ownership structure, which are all crucial factors when analyzing a stock’s float.

We’ll further explore stock float’s components, its calculation, and the distinction between high and low float stocks in the sections that follow.

Components of Stock Float

Stock float is made up of the shares of a company that are accessible to the public for trading on the open market. It does not encompass shares held by insiders, employees, or major stakeholders, as these are considered closely held shares. The float symbolizes the genuine supply of shares available for trading, which can be classified as:

High: when there is a large number of shares available for trading and high liquidity

Medium: when there is a moderate number of shares available for trading and moderate liquidity

Low: when there is a limited number of shares available for trading and low liquidity. Analyzing stock float data can help investors make informed decisions based on the supply and demand dynamics of a particular stock.

High float stocks are characterized by a large number of shares available for trading, while low float stocks have a smaller number of shares. Medium float stocks lie somewhere in between. Subsequent sections will break down the pros and cons of high and low float stocks and their influence on investment decisions.

Calculating Stock Float

To calculate stock float, one must subtract the number of restricted shares, such as those in employee stock ownership plans or held by insiders, from the company’s total outstanding shares. This calculation provides an indication of the liquidity of a stock, as well as its potential for price fluctuations.

Significant fluctuations in a stock’s valuation can occur when transitioning from a low float to a high float company, such as when a large amount of restricted stock released from an IPO lock-up period becomes available for trading. Grasping the calculation of stock float is pivotal for investors to evaluate the possible risks and rewards linked with a specific stock.

High Float vs. Low Float Stocks

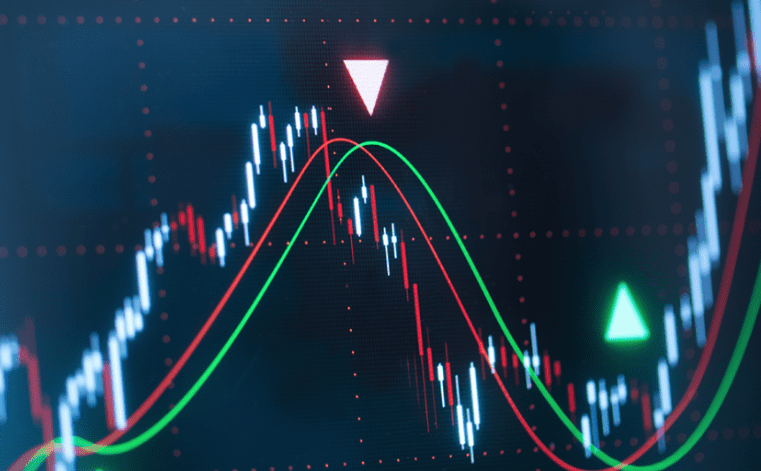

While high float stocks offer more liquidity and stability, low float stocks are characterized by higher volatility and potential for quick gains, but also higher risks. In this context, it’s essential to understand the concept of floating stock when dealing with low float and high float stocks, as well as monitoring stock prices.

The subsequent subsections will elaborate on the advantages of high float stocks and the possible risks and rewards of low float stocks, offering insights into their unique investment profiles.

Benefits of High Float Stocks

High float stocks are preferred by institutional investors due to their ease of buying and selling, as well as their generally lower volatility. The large number of shares available for trading increases liquidity, making it easier for investors to enter and exit positions in a high float stock.

Moreover, high float stocks tend to be more stable than low float stocks. This stability is attractive to institutional investors, who often have large amounts of capital to invest and prefer stocks that are less prone to sudden price swings. In contrast, low float stocks may present greater risks and rewards, as we will discuss in the next subsection.

Risks and Rewards of Low Float Stocks

Low float stocks can offer opportunities for short-term traders to make significant profits due to their heightened volatility. However, they also come with higher risks, as these stocks can be subject to price manipulation and sudden price swings. This makes low float stocks potentially risky for inexperienced or risk-averse investors.

Safe trading of low float stocks requires comprehensive research, application of technical analysis, and staying abreast of market news and trends. In the next section, we will discuss various strategies for trading low float stocks, providing valuable insights to help investors navigate this high-risk, high-reward segment of the market.

Factors Influencing Stock Float

Stock float can be influenced by factors such as insider ownership, share buybacks, and changes in the number of a company’s outstanding shares. One way to manage the stock float is through an employee stock ownership plan, which can affect the number of outstanding shares.

The upcoming subsection delves into how these elements can affect stock float and their consequent implications for investors.

How Stock Float Can Change

Changes in stock float can occur due to various factors, such as new share issuance, share buybacks, or changes in insider ownership. For example, when a company issues new shares to raise capital or repurchases existing shares, the stock float can be affected.

These changes in stock float can have implications for investors, as they can impact the liquidity and volatility of a stock. Comprehending the dynamics of stock float change and its influencing factors is crucial for investors to make well-informed decisions and effectively manage their investment risks.

Trading Strategies for Low Float Stocks

To successfully trade low float stocks, investors need a well-defined strategy that takes into account the unique characteristics of these stocks. The upcoming subsections will underscore the importance of comprehensive research, application of technical analysis, and staying updated with market news and trends in the context of low float stock trading.

Conducting Thorough Research

Intensive research into a company’s fundamentals and financials is key to pinpointing the appropriate low float stocks for trading. This includes:

Examining financial statements such as the balance sheet, income statement, and cash flow statement

Reviewing a company’s past performance

Considering external factors, such as market trends and news, that could impact the stock price.

Utilizing a stock screener can help investors identify low float stocks that meet their criteria. By filtering stocks based on specific financial ratios, technical indicators, and other relevant data, investors can narrow down their options and focus on stocks that align with their investment goals and risk tolerance.

Related Article: A Comprehensive Guide To Topline Vs Bottomline

Utilizing Technical Analysis

Technical analysis, which involves examining historical price movements and trading volumes, can help traders time their entry and exit points in low float stock trading. By studying chart patterns and historical data, traders can gain insight into potential trading opportunities and make more informed decisions.

Some common technical analysis tools and techniques include moving averages, support and resistance levels, and volume analysis.

Related Article: What Is A Bear Trap?

Staying Informed on Market News and Trends

For traders dealing with low float stocks, staying updated with market news and trends is crucial as it can reveal potential profit opportunities and assist in mitigating associated risks. Monitoring industry news, earnings reports, and other market events can help traders stay ahead of potential catalysts that could influence the stock’s price.

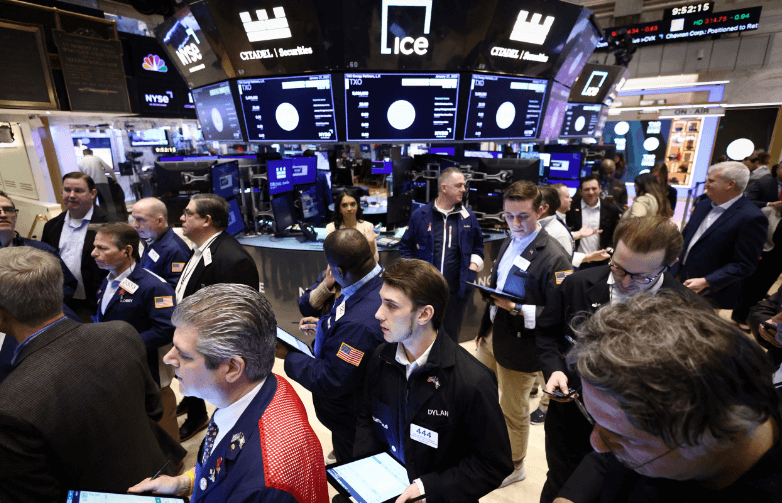

The Role of Institutional Investors in Stock Float

Institutional investors, such as mutual funds, pension funds, and hedge funds, play a significant role in stock float, as they often prefer high float stocks due to their liquidity and stability. Their preferences can impact the overall market dynamics, as the demand for high float stocks can drive up their prices and reduce the likelihood of price manipulation.

On the other hand, low float stocks may be more susceptible to price manipulation and sudden price swings, as there may be less demand from institutional investors. This can make low float stocks a potentially risky investment option for inexperienced or risk-averse investors, as discussed in the previous sections.

Potential Pitfalls of Low Float Stocks

As we have seen, low float stocks can be susceptible to price manipulation and sudden price swings, making them a potentially risky investment option for inexperienced or risk-averse investors. In addition to these risks, low float stocks may also experience limited liquidity, making it difficult for investors to buy or sell shares.

Moreover, low float stocks may have the following potential pitfalls:

Limited liquidity, which can result in higher volatility and wider bid-ask spreads

Increased susceptibility to price manipulation

Difficulty in obtaining reliable information about the company due to lack of analyst coverage

Considering these potential pitfalls, investors need to thoughtfully evaluate their investment goals and risk tolerance before venturing into the realm of low float stocks.

Summary

In conclusion, understanding stock float is crucial for investors looking to navigate the complex world of investing. High float stocks offer more liquidity and stability, making them a preferred choice for institutional investors, while low float stocks are characterized by higher volatility and potential for quick gains, but also higher risks.

By conducting thorough research, utilizing technical analysis, and staying informed on market news and trends, investors can make more informed decisions when trading and investing in stocks with varying float levels. As the world of investing continues to evolve, a solid understanding of stock float can help investors stay ahead of the curve and capitalize on profit-making opportunities.

Frequently Asked Questions

What is a good float for a stock?

A good float for a stock is generally between 10% and 25%, according to most traders.

What does float tell you?

Float provides insight into the number of shares available for trading in the stock market, excluding restricted and closely held shares held by insiders. By understanding the float, investors can get an idea of the stock’s liquidity and how much is held by company insiders.

Is it good for a stock to have a high float?

High-float stocks typically have higher liquidity and lower volatility, making them a better choice for long-term investing strategies. They often have low bid-ask spreads, and if the float suddenly increases, it could signal a lack of confidence from company insiders or institutional investors.

What are some potential pitfalls of investing in low float stocks?

Investing in low float stocks can be risky due to potential price manipulation, limited liquidity, and sudden price swings, making them unsuitable for inexperienced or risk-averse investors.

What strategies should I employ when trading low float stocks?

When trading low float stocks, it is essential to conduct comprehensive research, apply technical analysis and stay up-to-date on the latest market news and trends. Additionally, use stop losses and practice prudent risk management.