Think of a company’s financial health as a delicate balance on a scale – on one side, we have the top line, representing revenue and sales, and on the other, we have the bottom line, reflecting net income and profitability. In this comprehensive guide, we will delve deep into the definitions, differences, and strategies for analyzing and improving both topline vs bottomline growth, ultimately revealing the secret to a well-balanced and thriving business.

Short Summary

Understanding top line and bottom line is essential for businesses to grow their profitability and attract investors.

Top Line reflects a company’s total revenue, while Bottom Line represents the net income after accounting for all expenses.

Businesses should strive to achieve balance between top line and bottomline growth in order to ensure sustainable improved profitability over the long term.

Understanding Top Line and Bottom Line

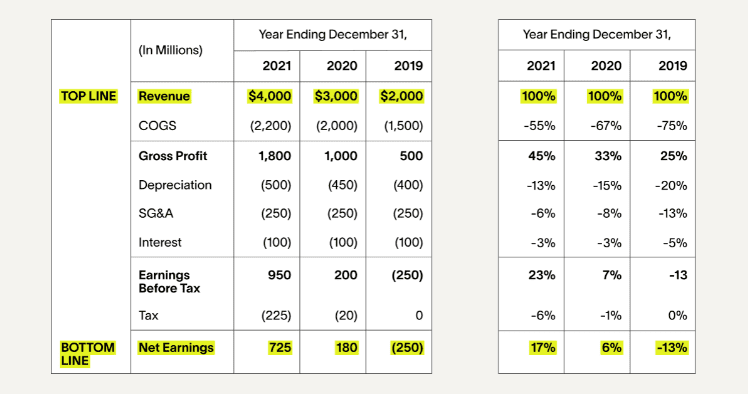

In the realm of business finance, the terms “top line” and “bottom line” are frequently used to assess a company’s financial performance, including the top and bottom lines. The top line represents a company’s total revenue or gross sales, while the bottom line signifies net income or profit after deducting all expenses. Both figures, including the bottom line figures, can be found on a company’s income statement, which serves as a roadmap for understanding a company’s financial health.

Monitoring and evaluating both top line and bottom line growth is crucial for businesses aiming to enhance profitability and attract potential investors. When a company emphasizes top-line growth, it has the potential to generate more funds for marketing, new product lines, and team expansion. On the other hand, focusing on the bottom line ensures that a higher percentage of earned dollars remains as retained income, which can be used for capital allocation, issuing dividends, or financing future operations.

Related Article: Unpacking EBITA Meaning

Top Line: Revenue and Sales

So, what is the top line, and why is it so vital? Top line refers to a company’s total revenue or gross sales generated within a given period. It is a crucial indicator for forecasting future profits and attracting investors, as it demonstrates a company’s ability to generate sales and overall market demand for its products or services.

Top-line growth, on the other hand, is the increase in income generated from sales or core business operations. If a company’s expenses remain constant, an increase in top line can lead to an increase in profit. As a result, businesses with strong top-line growth are often viewed as more financially stable and attractive to potential investors.

Bottom Line: Net Income and Profitability

While the top line showcases a company’s revenue-generating prowess, the bottom line reveals its overall profitability and efficiency by representing the company’s net income or profit after deducting all expenses. Monitoring the bottom line is essential for businesses aiming to improve their financial performance and attract potential investors, as it provides a clear picture of the company’s earnings after accounting for all expenses. Analyzing the company’s income statement is a crucial step in this process.

Bottom-line growth, in turn, is the net income or net profit after considering all expenses, effectively illustrating a company’s profitability and operational efficiency. By analyzing and improving bottom-line growth, organizations can reduce superfluous expenses and enhance operational efficiency, resulting in increased net earnings and overall financial performance.

Analyzing Top Line Growth

Analyzing top line growth involves evaluating sales performance and identifying opportunities for sales growth through marketing campaigns, new products, and pricing strategies. This process is crucial as it allows businesses to refine their sales and marketing strategies, ultimately leading to increased revenue and overall business success.

To measure sales effectiveness, organizations can employ metrics such as conversion rate, close rate, and quota attainment, which provide a comprehensive assessment of the sales team’s performance. By examining these metrics and implementing improvements, businesses can enhance their sales effectiveness and drive top-line growth.

Measuring Sales Effectiveness

Sales effectiveness is evaluated using a variety of metrics such as conversion rate, close rate, and quota attainment, which together provide a comprehensive assessment of the sales team’s performance. By measuring sales effectiveness, businesses can gain valuable insights into their sales and marketing strategies, ultimately leading to increased revenue and stronger top-line growth.

To enhance sales effectiveness, organizations should regularly assess their sales and marketing strategies, making data-driven adjustments as needed. This can involve refining target customer segments, optimizing marketing campaigns, and improving sales training and support, all of which can contribute to increased top-line growth.

Identifying Opportunities for Revenue Expansion

Exploring new markets, customer segments, or product offerings can provide valuable opportunities for revenue expansion. Identifying these opportunities is essential for businesses aiming to grow their top line and overall financial success.

To explore new markets or customer segments, businesses can conduct thorough market research, analyze customer needs and preferences, and test new products or services. Additionally, organizations can implement revenue growth strategies such as offering additional or upgraded services, extending contracts, or increasing marketing efforts to further drive top-line growth.

Analyzing Bottom Line Growth

Focusing on bottom line growth entails managing operating expenses and enhancing operational efficiency to improve profitability. By analyzing bottom-line trends and patterns in expense changes, businesses can gather valuable insights for financial planning and identify areas where cost-cutting measures or operational improvements may be needed.

Automated metrics such as the SaaS magic number and the rule of 40 can be utilized to monitor financial efficiency and determine the effectiveness of a company’s bottom-line growth strategies. By closely tracking these metrics and implementing improvements, businesses can optimize their bottom line and enhance overall financial performance.

Expense Management

Expense management involves controlling, tracking, and processing employee expense reimbursements and corporate credit card expenses, ultimately allowing businesses to reduce costs and find alternative income sources to boost the bottom line.

To reduce costs, businesses can implement strict cost control measures such as identifying ways to lower operating costs, including administrative costs, streamlining processes, and outsourcing certain tasks. By proactively managing expenses and exploring alternative revenue sources, businesses can strengthen their financial performance and improve bottom-line growth.

Enhancing Operational Efficiency

Operational efficiency refers to a company’s ability to produce goods and services with the least amount of resources, ultimately resulting in improved profit margins and overall financial performance. By enhancing operational efficiency, businesses can not only improve their bottom line, but also create a more sustainable and successful business model.

Measures to increase operational efficiency can involve adjusting pricing, reducing expenses, and seeking out new opportunities to increase profitability. Additionally, businesses can monitor metrics such as net revenue retention and LTV:CAC ratio to identify internal processes that may be impeding customer satisfaction and make necessary improvements.

Balancing Top Line and Bottom Line Growth

It is essential for businesses to find a balance between top line and bottom line growth, as neglecting either element can result in inefficiencies and potential opportunities being overlooked. Achieving equilibrium between top line and bottom line growth involves lowering costs, augmenting sales, and optimizing operational efficiency, ultimately leading to long-term success.

Businesses that focus solely on either top line or bottom line growth risk missing out on valuable opportunities for overall financial success. By maintaining a balance between these two crucial aspects, organizations can ensure sustainable growth, improved profitability, and a more resilient business model.

Case Study: Successful Top Line and Bottom Line Growth Strategies

Image source: Ramp

To illustrate the importance of balancing top line and bottom line growth strategies, consider a case study of a company that effectively implemented strategies for both revenue and profitability growth. By targeting the appropriate customers, augmenting revenue through sales to new and existing customers, and optimizing sales, marketing, and customer service strategies, the company achieved significant top-line growth.

Simultaneously, the company focused on adjusting pricing, reducing expenses, and seeking out new opportunities to increase profitability, resulting in impressive bottom-line growth. This case study demonstrates that a balance between top line and bottom line growth strategies is essential for long-term success, as neglecting either aspect can lead to inefficiencies and missed opportunities.

Summary

In conclusion, understanding and balancing top line and bottom line growth is crucial for businesses aiming to achieve long-term success. By carefully analyzing and implementing strategies that cater to both revenue generation and expense management, companies can optimize their financial performance, attract potential investors, and build a resilient business model. Remember, a well-balanced company is a thriving company.

Frequently Asked Questions

What does topline mean in business?

In business, the term ‘top line’ refers to a company’s revenue or total sales figures. It is the first item on an income statement and forms the basis for analyzing the growth of the company.

The bottom line of the income statement is the net income, which is calculated after all operating expenses, depreciation, interest and taxes are taken into account.

Is EBITDA the bottom line?

No, EBITDA is not the bottom line as it does not take into account taxes and other expenses.

The bottom line (net income) is the money left after all expenses and taxes are deducted from all revenues and gains.

What is the difference between top line and bottom line growth?

The main distinction between top line and bottom line growth is that the former is concentrated on increasing sales and generating more revenue, while the latter focuses on reducing costs and increasing profits.