There are several concepts that are very important to understand when trading options. These include bid-ask spreads, the greeks, and Implied Volatility (IV). This article will explain implied volatility and the concept of IV crush.

Implied volatility is represented as a percentage and it indicates the volatility or estimated fluctuation in the underlying stock price over the option contract. IV is very important because it directly impacts the premium of an option contract. A higher IV indicates a larger expected fluctuation in the underlying stock price which results in a higher premium. A lower IV means a lower probability of a significant change in the stock price and therefore a lower premium on the option contract.

What is IV Crush?

Implied volatility crush refers to the drastic decrease in the premium of an option contract due to a drastic drop in the IV. This often happens when an option contract has a high IV due to a highly uncertain event like an earnings call. Since there is a high degree of uncertainty, the high IV will result in a high premium. However, after the uncertain event happens, the IV drastically drops which causes a significant drop in the premium of an options contract.

This means that even if the underlying price of the stock hasn’t changed, there will still be a decrease in the price of an options contract because the IV decreased. IV Crush can be beneficial or detrimental depending on if you are buying or selling options.

Buying Options

As an option buyer, high IV means you are paying an elevated premium in hopes of a drastic change in the stock price. If you are buying a call option, you’re hoping for a large increase in the stock price (and therefore the option contract). If you are buying a put option, you are hoping for a significant decrease in the price of the stock.

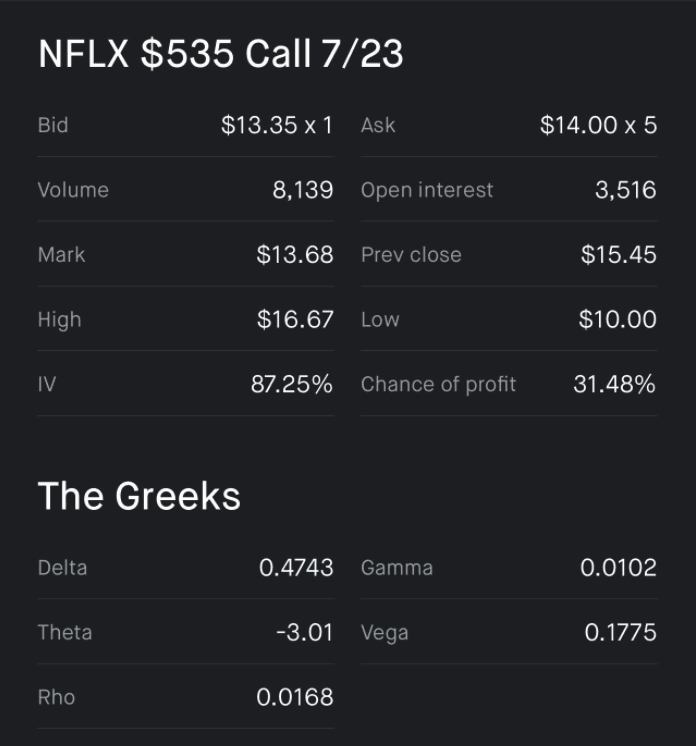

For example, if you bought the Netflix $535 7/23 Call option on July 19, you would pay a premium of $1,370. Netflix was scheduled to report earnings after hours that same day, therefore the IV for this options contract was elevated at 87.25%.

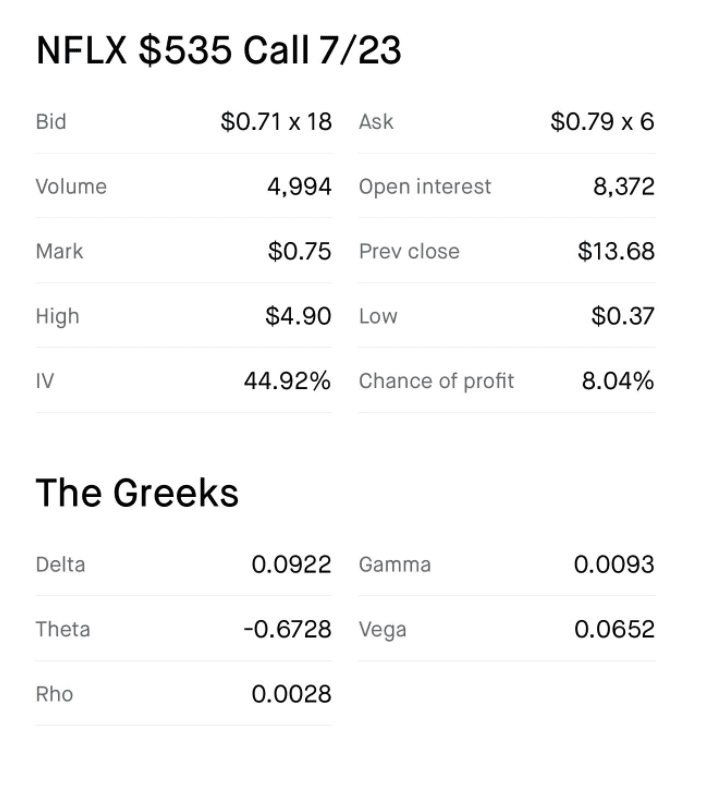

Netflix dropped after hours and the next day the stock was down ~3%. Furthermore, the IV for that option contract had decreased to 44.92%.

The decrease in the stock price along with implied volatility crush, resulted in a decrease of the price of the option contract to $75. Even if the underlying stock price remained flat after the earnings call, the IV crush would have had a major negative impact on the option price.

Selling Options

Selling options involves collecting premium. The premium earned is directly affected by the IV percentage. As an option seller, high IV options represent an opportunity to collect a higher premium. People often sell options ahead of uncertain events like an earnings call in order to collect a high premium.

In the Netflix example, you can consider the other side of the trade which involves the person selling that call option. They collected the premium of $1,370 and since the resulting option price decreased to $75, they earned a net profit of $1,295 (assuming they bought back the option contract).

Final Thoughts

Here are some main ideas to know when generally thinking about implied volatility:

- Implied Volatility is a measure of uncertainty around the stock price over the option contract.

- IV crush is the drastic drop in IV that results in a drop in the option price.

- Buying options with a high IV will be more expensive due to the elevated premium.

- Selling options with a high IV represents an opportunity to collect high premiums.