Options trading can be a daunting world for beginners and seasoned investors alike. But what if there was a simple, powerful strategy for generating consistent income and minimizing risk? Introducing the Wheel Strategy, a systematic approach to options trading that offers precisely that. Get ready to uncover the secrets of this proven strategy and start reaping the rewards.

Key Takeaways

The Wheel Strategy is a powerful options trading method that uses cash-secured put and covered call strategies to generate consistent income.

Risk management involves setting stop loss rules, choosing stable stocks, and being prepared for potential losses.

The Wheel Strategy offers higher returns than credit spreads without margin requirements.

The Wheel Strategy Fundamentals

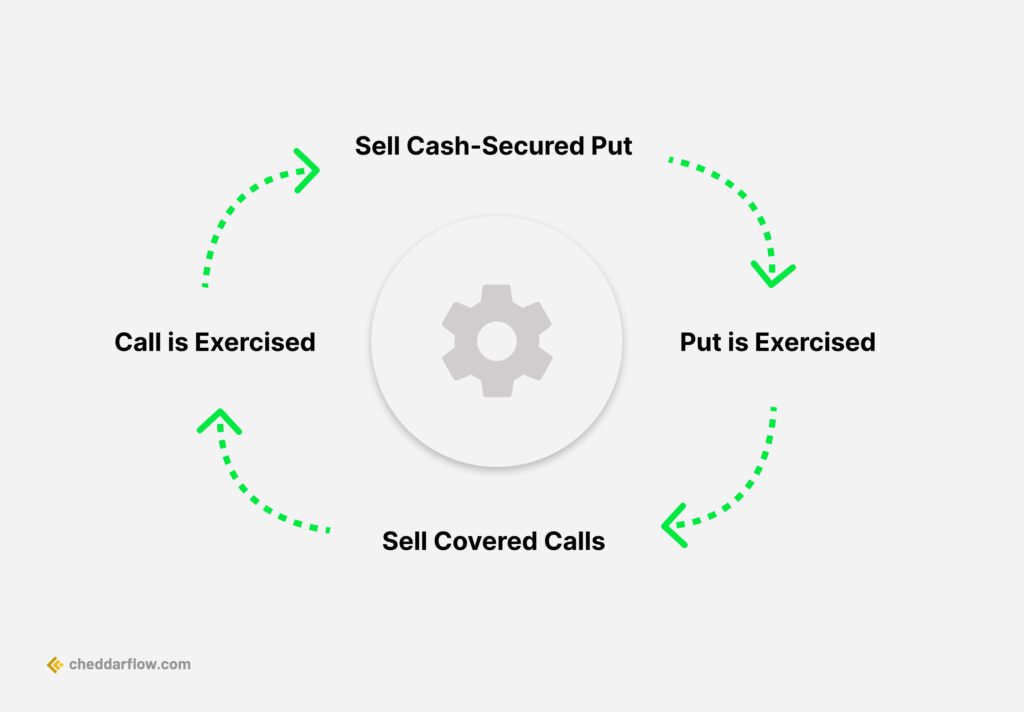

The Wheel Strategy, sometimes referred to as the “triple income strategy,” is a powerful options trading method that generates consistent income by selling cash-secured put options and covered calls in a systematic approach. The main aim of the Wheel Strategy is to consistently generate credit income through the sale of put options, and then start selling covered calls on the assigned stocks. The two primary option selling strategies employed in the Wheel Strategy are cash-secured put and covered call, both of which are based on the current market price of the underlying asset.

Selling options allows investors to:

Earn passive income

Receive premiums from the buyers

Decrease the purchase price of the underlying asset

Increase the sale price of the same asset

Time decay may be advantageous for this strategy, and rising implied volatility may be detrimental to the strategy. For optimal effectiveness of the Wheel Strategy, it is advised to sell put/call options at an anticipated at-the-money expiry strike price. Moreover, writing options with 30-40 days until expiration can exploit time decay and high implied volatility compared to historical volatility.

Related Article: What Is Theta In Options Trading

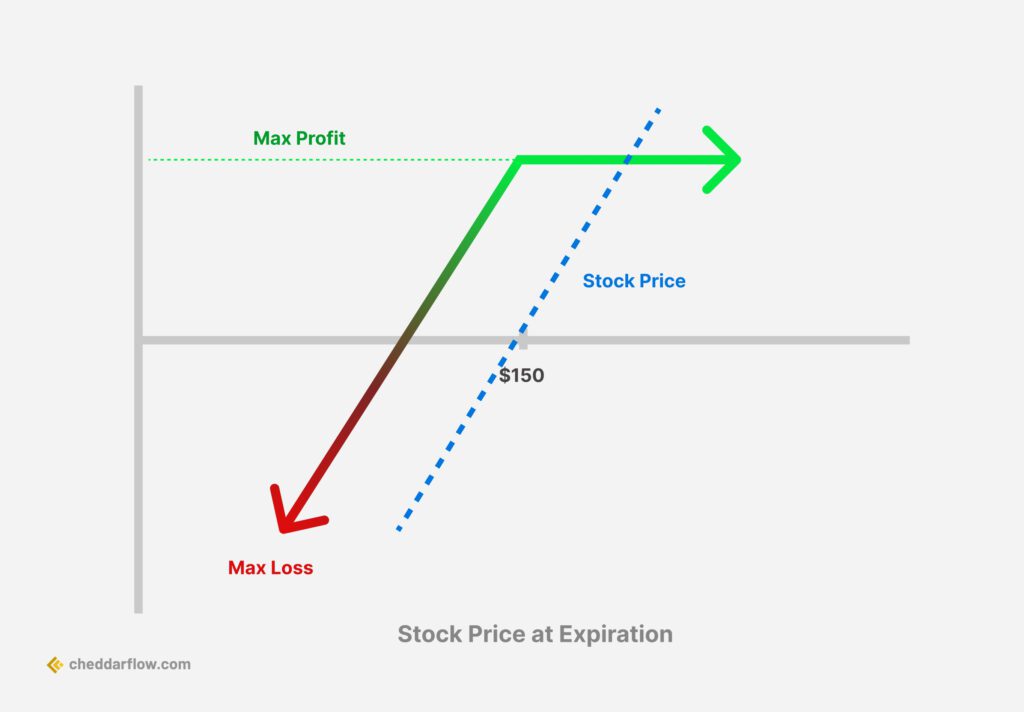

Cash-Secured Put Options

A cash-secured put option involves selling a put option while having sufficient funds to purchase the underlying stock in the event of assignment. The ideal outcome is when the option expires worthless, allowing the seller to keep the premium. The maximum loss from a Wheel Strategy example involving a short $20,000 put option is -$18,000. This amount includes the $2,000 premium received. The ideal settlement price for a cash-secured put occurs when the underlying is equal to the strike price, resulting in the option expiring worthless and the seller retaining the premium.

The underlying asset should be acquired promptly in case the short put option expires in-the-money. Selling cash-secured puts generates income and can lead to stock ownership at a lower cost basis if assigned. The contract expires worthless, and the premium received for selling the put is retained if the underlying security’s price is above the short put option’s strike price at expiration.

Should the stock price be lower than the strike price at expiration, you will be assigned 100 shares per contract at the strike price, and the cost basis of the position will be reduced by the net credit of any put options sold.

Related Article: Put Options Explained

Covered Calls

The covered call strategy entails:

Selling call options on a stock that is already owned

The ideal situation for a short covered call is when the option expires at-the-money, resulting in the seller keeping the premium

The stock price will be sold at the strike price of the call option if it is above this price at expiration

Any additional profits cannot be collected beyond the strike price

The maximum potential loss associated with the covered call strategy is the difference between the price of acquiring the underlying asset and the premium received.

The maximum profit attainable through a covered call strategy with a strike price of 430, cost basis of 414 per share, and premium of 1.08 is $1,708. The potential gain is constrained when selling covered calls and cash-secured puts. The formula for determining the maximum profit in a covered call strategy is (Strike Price of Call – Stock Cost Basis) + (Premium Received from Selling Call).

Implementing the Wheel Strategy: Step-by-Step Guide

The Wheel Strategy involves the following steps:

| Step | Action | Outcome |

|---|---|---|

| 1 | Sell Cash-Secured Put | Receive premium for selling a put option. |

| 2 | Outcome A: Put Expires Worthless | Keep the premium as profit. |

| 3 | Outcome B: Put is Exercised | Buy the stock at the strike price using the set-aside cash. |

| 4 | Sell Covered Call | Receive premium for selling a covered call. |

| 5 | Outcome A: Call Expires Worthless | Keep the premium as profit. |

| 6 | Outcome B: Call is Exercised | Sell the stock at the agreed-upon strike price. Earn profit if stock appreciates plus the call premium. |

| 7 | Repeat Steps 1-6 | Continue the cycle by selling more cash-secured puts and covered calls. |

Market Conditions Favorable for the Wheel Strategy

Ideal for calm, neutral, or slowly trending markets, the options wheel strategy thrives on time decay and steady stock prices. In calm market conditions, option premiums tend to be small and narrow, making it more difficult to sell options. Designed for income generation across a wide range of market scenarios, the Wheel Strategy offers versatility and consistent income.

It’s vital to deploy the Wheel Strategy only under anticipated calm market conditions. The Wheel Strategy benefits from time decay as it reduces the value of options over time, enabling traders to leverage the decrease in option value and accumulate premiums.

Risk Management and the Wheel Strategy

Managing risk in the Wheel Strategy involves setting stop-loss rules, choosing stable stocks, and being prepared for potential losses. Establishing stop-loss rules when utilizing the Wheel Strategy is essential as they assist in limiting losses should the stock price decrease. Selecting stable stocks when employing the Wheel Strategy is of great importance as it helps to minimize the risk of significant losses resulting from a drop in stock price.

The main risk of the Wheel Strategy lies in potential market downturns, which could lead to assigned stocks losing value. Risk management in the Wheel Strategy necessitates the establishment of stop-loss rules, selection of stable stocks, and preparedness for potential losses.

Setting Stop Loss Rules

In the Wheel Strategy, establishing stop-loss rules aids in curtailing potential losses, particularly during significant downward stock price movements.

To establish stop-loss rules in options trading, follow these steps:

Determine your risk tolerance.

Analyze the options contract.

Set the stop-loss level.

Submit the stop-loss order to your broker.

By following these steps, you can minimize your losses and manage your risk effectively.

The suggested stop-loss level when executing the Wheel Strategy may vary depending on the individual’s risk tolerance and trading objectives. Generally, a stop loss of 10-15% below the stock price when the put was initially sold is a suitable approach. Additionally, it is wise to adjust the stop loss lower when multiple puts have been sold.

Choosing Stable Stocks

Selection of stable, long-term bullish stocks mitigates the risk of drastic price changes and enhances the probability of regular income generation. When selecting stable stocks for the Wheel Strategy, factors such as:

Financial health

Dividend payments

Market capitalization and liquidity

Industry and sector

Historical price stability

Indicators of a long-term bullish stock that is suitable for the Wheel Strategy include steady, albeit gradual, growth, larger companies with stability, and a long-term inclination towards the stock. The volatility of a stock can have several implications for the Wheel Strategy, as increased volatility can lead to greater price fluctuations in the stock, which can generate more substantial profits from selling covered calls but also carries the risk of the stock price declining and the option being exercised, ultimately resulting in the sale of the stock at a lower price.

Capital Requirements and Profit Potential

The Wheel Strategy requires a large amount of capital in the initial stage because cash-secured puts have to be sold. Investing this way has a higher risk associated with it, which must be considered before taking the plunge. It can generate consistent income and potentially high annualized returns. The minimum initial capital requirement for initiating the Wheel Strategy in options trading should be in the range of $5,000 to $10,000.

The initial capital of the Wheel Strategy has a direct effect on the potential profit, as it determines the number of shares that can be purchased and the size of the positions taken. A larger initial capital allows for larger positions and, consequently, the potential for higher profits. The Wheel Strategy is capital-intensive and requires the capital to buy 100 shares of the underlying asset.

Maximizing Returns with the Wheel Strategy

To maximize returns in the Wheel Strategy, one should choose optimal strike prices, time the implied volatility, and leverage theta decay. Understanding the correlation between historical volatility and implied volatility proves beneficial when selling options. Informed decisions can be made by assessing whether the implied volatility is high or low compared to its historical average. For profit optimization, a reliable approach is to sell options when the implied volatility exceeds its historical average.

When determining strike prices, you may want to aim for a delta value near 0.25 and consult Robinhood’s “Chance of Profit” column. Given all other factors remain constant, an increase in implied volatility will result in higher option prices, and a decrease in implied volatility will result in lower option prices.

Implied Volatility Crush can lead to a decrease in the value of options, despite the direction of the price movement.

Wheel Strategy Examples and Comparisons

The Wheel Strategy stands as a potent tool for income generation in options trading. Here’s an example of how it works:

Sell a cash-secured put option on Apple stock with a strike price of $100.

If Apple’s stock price stays above $100 when the option expires, the put option becomes worthless, and you get to keep the premium you received.

If the stock price falls below $100, you will be obligated to buy 100 shares of Apple stock at the $100 strike price, effectively lowering your cost basis for the stock.

You can then sell covered calls on the assigned stock to generate additional income.

Compared to other strategies like outright stock purchases or credit spreads, the Wheel Strategy offers several advantages:

It provides a steadier income stream.

It has the potential for increased annualized returns.

It generates income through the sale of options, rather than relying on capital appreciation.

It does not require margin, unlike credit spreads.

It can potentially provide a higher level of income compared to credit spreads.

Alternative Strategies for Different Market Conditions

Despite the Wheel Strategy’s effectiveness in consistently generating income in options trading, alternative strategies can be utilized to adapt to different market conditions. The Option Collar strategy involves the purchase of the underlying asset while simultaneously buying a protective out-of-the-money put option and selling an out-of-the-money covered call. This strategy curtails both possible losses and gains, thus granting a measure of protection to the investor.

The Risk-Reversal strategy serves as another alternative. Here, an investor sells an out-of-the-money put option and uses the received premium to finance an out-of-the-money call option purchase. This strategy can be used to express a directional view on the underlying asset and manage risk. By grasping various strategies and their uses, investors can tailor their approach to options trading based on current market conditions and their risk tolerance.

Summary

In conclusion, the Wheel Strategy is a powerful and systematic method for generating consistent income in options trading. By combining the sale of cash-secured put options and covered calls, investors can capitalize on market volatility and generate income from option premiums. With proper risk management and an understanding of market conditions, the Wheel Strategy can be an effective addition to any investor’s toolkit. So, take the wheel and drive your investment portfolio towards a steady stream of income.

Frequently Asked Questions

What is an example of a wheel strategy?

An example of a wheel strategy is selling a cash-secured put with a strike price lower than the current stock price in order to collect money. The more distant the expiration, the higher the intrinsic value of the option and the more money will be earned.

Does wheel strategy work?

The Wheel Strategy is a great option with relatively low risk and higher profitability than other popular strategies. It also offers an improved version of the traditional Buy & Hold approach, making it a worthwhile choice for those looking to make investments.

What is the best stock to run the wheel strategy?

For the best results with the wheel strategy, Apple, Microsoft and Verizon offer the most reliable and consistent returns.

What is the wheel strategy for passive income?

The Wheel Strategy is a long-term trading methodology which involves the systematic sale of covered calls and cash-secured puts to generate passive income. By combining these two strategies, investors can not only increase their portfolio value but also earn additional monthly income.

What is the main goal of the Wheel Strategy?

The main goal of the Wheel Strategy is to generate ongoing income through the sale of put options and covered calls on assigned stocks.