For options traders, few phenomena are as feared or misunderstood as implied volatility (IV) crush. This sudden and dramatic drop in an option’s value, often occurring after a major event like an earnings report, can quickly turn a promising trade into a devastating loss. Yet IV crush is not an inevitable pitfall – with the right knowledge and strategies, traders can not only avoid its perils but even capitalize on the unique opportunities it presents. In this article, we’ll dive deep into the mechanics of IV crush, explore real-world examples, and arm you with practical techniques to master this crucial aspect of options trading.

What is an IV crush?

An IV crush is a situation in the options market that describes a rapid decrease in implied volatility (IV). Implied volatility is a metric used in options pricing to estimate the potential for stock price movement.

Options traders use IV to price option contracts.

Impact on Options Prices

“How does IV crush affect options?”

The price of an option is determined by several factors, including the underlying stock price, the strike price of the option, the time to expiration, and implied volatility.

Since IV is a major component of option pricing, a sudden drop in IV can cause the price of the option to decrease significantly. This can be a negative outcome for options traders who were hoping to profit from high volatility.

How do you calculate the implied move?

There are two main ways to calculate the implied move, both relying on information from the options market: ATM Straddle Price & IV.

At-the-Money Straddle Price

This is a simpler method that works well for estimating the expected move for short timeframes, especially around binary events like earnings announcements. Here’s what you do:

- Identify the front-month ATM straddle. A straddle is a strategy involving buying both a call option and a put option with the same strike price and expiration date. At-the-money (ATM) means the strike price is closest to the current stock price.

- Find the combined price of the ATM call and put option in the options chain for the upcoming expiry closest to the event.

- Multiply this combined price by 0.85. This is a rule-of-thumb adjustment factor used to account for factors besides volatility affecting the straddle price.

Formula: Implied Move = (ATM Call Price + ATM Put Price) * 0.85

Implied Volatility

This method is more precise but requires a bit more calculation. Here’s what you’ll need:

- Stock Price (S): Current price of the underlying stock.

- Implied Volatility (IV): This is a volatility measure specific to a particular option contract and reflects the market’s expectation of future price movement. You can find the implied volatility in the options chain for the desired strike price and expiration date.

- Time to Expiration (T): This is expressed in years. You can calculate it by finding the difference between the expiration date of the option and the current date, and then dividing by 365 (or the number of days in a year if you prefer).

Formula: Implied Move = S * IV * √(T)

Both methods provide an estimate of the expected move, not a guaranteed outcome.

The second method is more accurate for longer timeframes but requires selecting a specific option contract (strike price and expiry) which can influence the result.

Real-Life Example: IV Crush

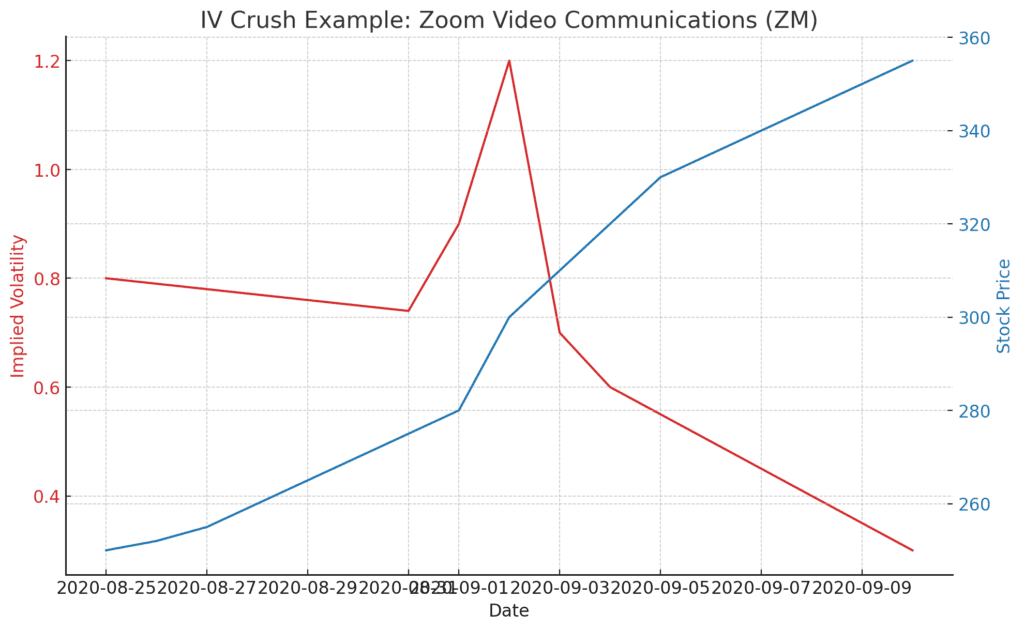

A real-life example of IV (Implied Volatility) crush happened with Zoom Video Communications (Ticker: ZM) around the time of their Q2 earnings report in September 2020.

Leading up to the earnings announcement, there was a lot of speculation and uncertainty about how the company would perform, given the surge in usage due to global lockdowns.

This speculation drove up the implied volatility of Zoom’s options:

- When Zoom announced their earnings, they exceeded expectations with significant growth in both revenue and profits.

- Despite the positive news, the uncertainty surrounding the earnings was resolved, leading to a decrease in implied volatility.

- This rapid decrease in IV post-earnings announcement is what’s referred to as an “IV crush.”

This meant that even though the stock price surged due to the positive earnings report, the value of the options fell sharply due to the IV crush, catching many options traders by surprise.

This scenario is a classic example where traders betting on the direction of the move (up or down) might still not profit from their positions if they didn’t account for the potential IV crush after the earnings release.

How to Benefit from the IV Crush

Benefiting from the crush involves strategies that take advantage of the decrease in options pricing volatility.

- Understand IV Crush: It happens when the implied volatility of options drops sharply, often after a major event or news related to the underlying stock (like earnings reports). This drop in IV leads to a decrease in option prices.

- Sell Options Before Events: One way to capitalize is by selling options (like puts or calls) before a big event when the IV is high. After the event, the IV usually drops, and you can buy the options back at a lower price, pocketing the difference.

- Vertical Spreads: Implement strategies like credit spreads where you sell an option and buy another option of the same type (calls or puts) but with a different strike price. This can help limit your risk while still taking advantage of the IV crush.

- Choose Expirations Wisely: Shorter-term options are more affected by IV changes. Selling options with a shorter time to expiration can maximize the IV crush effect.

- Monitor and Manage: Keep a close eye on market events and manage your positions actively. Be ready to adjust your strategy based on how the IV is moving.

Overall, profiting from IV crush requires careful planning, understanding the risks involved, and using defined-risk strategies. Successful options trading demands a strong understanding of options mechanics and market dynamics.

Conclusion

IV crush, while intimidating, is a natural and predictable part of the options landscape. By grasping its underlying dynamics, timing your trades judiciously, and employing strategies like selling options, spreads, and LEAPS, you can deftly navigate this notorious hazard. More than mere damage control, a solid understanding of IV crush unlocks lucrative opportunities to profit from the very volatility that once seemed so threatening. As with all facets of trading, the key lies in continuously educating yourself, carefully managing risk, and patiently waiting for the right setups.

Frequently Asked Questions

What is the opposite of IV crush?

The opposite of an IV crush is often referred to as an “IV spike” or “IV expansion.” This occurs when the implied volatility (IV) of a stock’s options increases sharply.

- An IV spike typically happens in anticipation of significant events or when there’s increased uncertainty about the stock’s future price movements.

- Unlike an IV crush, which occurs after the uncertainty is resolved (like after an earnings report), an IV spike builds up as the event approaches or when unexpected news increases the market’s uncertainty.

Is IV crush good?

Whether an IV crush is good or not depends on your position in the market:

- Options Sellers: It’s generally good for options sellers. When IV is high, they can sell options at a higher premium. After the IV crush, the value of the options they sold decreases, making it cheaper for them to buy back the options to close the position or let them expire worthless, securing the premium as profit.

- Options Buyers: It’s typically bad for options buyers. They might buy options at a high premium due to high IV before an event. If the stock’s price movement after the event isn’t significant enough to offset the decrease in option value due to the IV crush, they can incur significant losses.

So, an IV crush is favorable for those who have written options and unfavorable for those holding long options positions, unless the underlying asset moves enough to compensate for the decrease in IV.

Does IV crush always happen after earnings?

IV crush often happens after earnings announcements but it’s not a guaranteed outcome. The reason it’s common is because earnings introduce a lot of uncertainty about a company’s performance. Before the announcement, traders and investors speculate on the results, which increases demand for options and drives up implied volatility (IV).

Once the earnings are released and the uncertainty is resolved, IV tends to drop, hence the term “IV crush.”