The Triple Top pattern stands as a sentinel at the peak of market trends, signaling a potential shift from bullish exuberance to bearish caution. This revered chart pattern, characterized by its three consecutive peaks at approximately the same price level, is more than just a visual marker; it embodies the tug-of-war between buyers’ optimism and sellers’ pragmatism.

As traders and analysts scrutinize the charts for this pattern, the Triple Top serves as a harbinger of change, suggesting that the prevailing uptrend may be running out of steam. Understanding and trading this pattern requires a blend of technical acumen and market intuition, making it a critical tool in the arsenal of those seeking to navigate the complex waters of financial markets with precision and insight.

What Is the Triple Top?

A triple top is a bearish reversal chart pattern that indicates a potential downturn in the price of an asset. It is formed by three consecutive highs that reach approximately the same price level, each followed by a pullback. The neckline is a horizontal line connecting the two lowest lows of the pullbacks.

Key Points

- Three consecutive highs: The price reaches approximately the same high point three times.

- Pullbacks: After each high, the price pulls back but fails to break below the neckline.

- Neckline: A horizontal line connecting the two lowest lows of the pullbacks.

- Breakout: The price breaks below the neckline, confirming the bearish reversal.

How It Works: Triple Top Pattern

The triple top formation is a simple and recognizable pattern characterized by three peaks that occur at roughly the same level.

This pattern emerges when prices are initially in a distinct upward trend.

It Tells Us 3 Things

- Waning buying pressure: The repeated failure to break above the resistance level suggests diminishing enthusiasm from buyers, who are unwilling to pay higher prices.

- Potential trend reversal: The breakdown below the swing low signals a possible shift from an uptrend to a downtrend.

- Selling pressure building: The breakdown may trigger selling from traders who were waiting for confirmation of a reversal, further pushing the price down.

The triple top pattern closely resembles the head and shoulders formation, with the key difference being that the central peak aligns closely in height with its neighboring peaks, instead of towering above them.

It also bears similarity to the double top pattern, where the price hits a resistance level twice, forming two high points before declining.

Related Article: Inverse Head and Shoulders Pattern.

Trading the Triple Top Pattern

Trading a Triple Top pattern is about spotting a specific chart formation and acting on the expected market movement that follows.

Here’s our take.

- Identification: A Triple Top has three peaks at roughly the same price level, separated by two troughs. It signals that the price is struggling to break through a resistance level, indicating potential bearish reversal.

- Confirmation: The pattern is confirmed when the price falls below the support level of the troughs. This is your signal that the bears (sellers) are taking control from the bulls (buyers).

- Entry Point: After confirmation, consider entering a short position (selling), expecting the price to drop further. The ideal entry is just after the price breaks below the support level.

- Stop-Loss: Place a stop-loss order just above the highest peak of the Triple Top. This limits potential losses if the market moves against your expectations.

- Profit Target: The profit target can be estimated by measuring the height of the pattern (from the support line to the tops) and projecting this distance downward from the breakout point.

- Risk Management: Only invest what you can afford to lose, and consider the risk-to-reward ratio of the trade to make sure it aligns with your trading strategy.

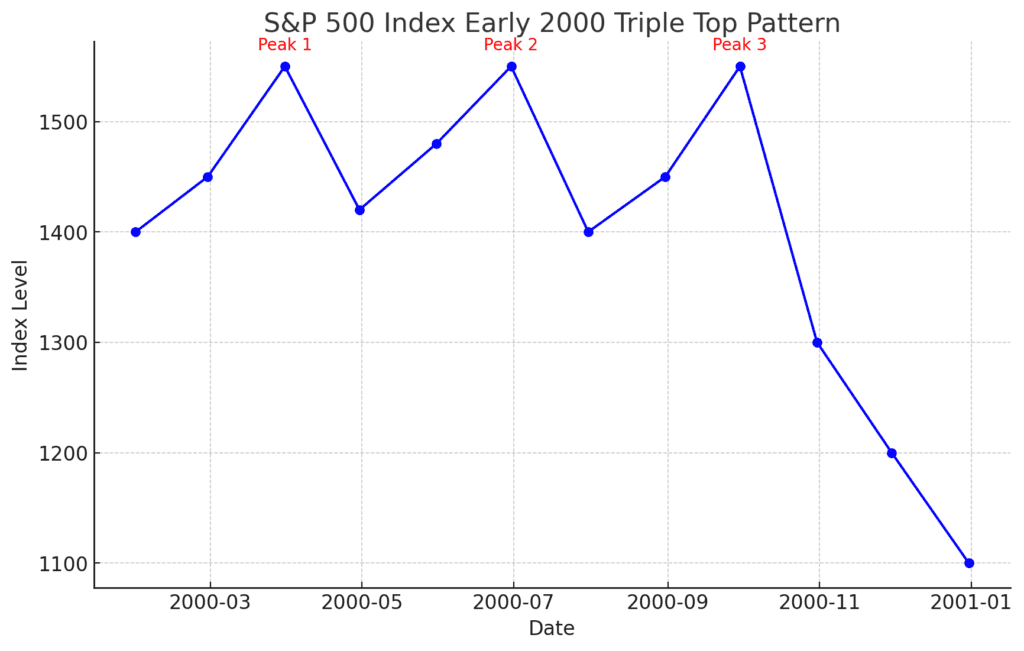

Real-Life Example of The Pattern

Let’s take a look at a real historical example involving the S&P 500 Index from the early 2000:

- Formation: During the dot-com bubble, the S&P 500 Index peaked around three times within a close range. The first peak occurred in March 2000, the second in September 2000, and the third in December 2000, all hovering around the 1550 level.

- Support Level: Between these peaks, the index fell back to support levels near 1350, forming the troughs of the Triple Top pattern.

- Confirmation: The pattern was confirmed when the S&P 500 broke below the 1350 support level in early 2001, signaling a bearish reversal.

- Market Reaction: Following the confirmation, the index entered a bearish market, marking the end of the dot-com bubble. The S&P 500 continued to decline sharply throughout 2001 and into 2002.

A Triple Top pattern signaled a significant market reversal, transitioning from a bullish to a bearish trend, highlighting the importance of pattern recognition in trading and investment strategies.

Frequently Asked Questions

Are Triple Tops Rare?

Triple Tops are relatively rare in the financial markets because they require a specific set of conditions to form: the asset’s price must hit and retreat from a resistance level three times, with similar peaks and troughs in between.

Their rarity is also due to the time it takes for such a pattern to develop, often spanning several months. Despite their infrequency, when they do occur, they’re considered significant indicators of potential trend reversals.

Is A Triple Top Bullish or Bearish?

A Triple Top is considered a bearish reversal pattern. It indicates that the price has tried and failed to break through a resistance level three times, suggesting that the upward momentum is weakening and a downtrend may soon follow.

How Reliable Is A Triple Top?

The reliability of a Triple Top pattern can vary. While it’s seen as a strong indicator of a potential reversal from bullish to bearish trends, its effectiveness depends on several factors.

- Volume: Higher trading volume on the decline from the third peak can confirm bearish sentiment, adding to the pattern’s reliability.

- Market Context: The pattern’s reliability increases when it aligns with other bearish indicators or market conditions.

- Confirmation: The pattern is considered more reliable once the price breaks below the support level formed by the troughs.

Despite these factors, no pattern is foolproof.

Is A Triple Top Stronger Than A Double Top?

Whether a Triple Top is stronger or more reliable than a Double Top as a reversal signal can depend on the context, but many traders consider a Triple Top to be a stronger indication of an upcoming reversal.

This is because the price has tested the resistance level three times without breaking through, suggesting a significant level of selling pressure and buyer exhaustion.

The repeated failure to surpass the resistance level reinforces the bearish outlook.

Conclusion

A Triple Top is a predictive tool used to signal a potential shift in an asset’s price direction. This pattern unfolds as the price reaches a high, pulls back, approaches the same high twice more with pullbacks in between, and finally embarks on a downward trajectory.

The pattern is deemed fully formed when the price dips below the support level, indicating a change to a bearish trend.