Have you ever heard of short selling and wondered how traders eventually close their positions? The answer lies in the concept of shorts covering. In the world of investing, understanding short covering is crucial for anyone looking to navigate the unpredictable terrain of short selling. This comprehensive guide will provide you with the necessary knowledge, real-life examples, and tools to help you make informed decisions about shorts covering opportunities.

Short Summary

Short covering is the process of buying back borrowed securities to close out existing short positions, often in order to capitalize on a security’s declining prices or mitigate potential losses from short selling.

Short squeezes occur when rapid short covering leads to a sharp rise in stock prices, often resulting in significant gains for some and substantial losses for others.

Investors can monitor short interest and utilize tools and resources to identify potential short covering opportunities in order to capitalize on price movements.

Understanding Short Covering

Short covering is a crucial aspect of the investing world, particularly for those involved in short selling. But what exactly is short covering? In the simplest terms, it is the process of buying back borrowed securities to close out existing short positions, often at a higher price than when they were initially sold.

Short covering may occur when the trade has become profitable, the trader alters their outlook on the original thesis, or the trade is significantly underperforming, prompting the investor to cover the short position.

This process is fundamentally linked to short selling, a trading strategy used to capitalize on the declining prices of financial security. Short selling involves borrowing the security from a broker, selling it in the market, and then repurchasing it once the prices have decreased.

Together, short selling and short covering create a dynamic interplay in the market that can have significant impacts on stock prices and market volatility.

Related Article: Understanding Buy to Open Vs Buy to Close

Definition of Short Covering

At its core, short covering involves buying back securities that have been borrowed in order to close a short position, with the intention of either profiting or minimizing losses. Short covering occurs when short sellers buy back the securities they initially sold short, usually at a higher price, in order to close out their short positions.

The Purpose of Short Covering

The main purpose of short covering is to close an open short position, potentially resulting in substantial gains or losses depending on market conditions. When engaging in short selling, investors must be cognizant of the fact that their losses may be unlimited due to the theoretically limitless gain potential of the stock price.

As such, the potential benefits or drawbacks of short covering are contingent on market conditions. If the stock price increases after the short position is closed, the short seller will gain a profit. Conversely, if the stock price decreases, the short seller will experience a loss.

Relationship Between Short Selling and Short Covering

Short selling and short covering are two sides of the same coin, with short selling being the initial action and short covering being the closing action. Short covering is the act of purchasing shares to close out an existing short position, which is the opposite of short selling. In the context of short sales, these two actions play a crucial role in the trading process.

It is fundamentally linked to a short-selling strategy where investors gain from the stock’s decreasing price. In other words, short covering is the process that brings a short-selling trade to its conclusion, either securing profits or cutting losses.

The Mechanics of Short Covering

Understanding the mechanics of short covering is essential for investors looking to capitalize on short selling opportunities. The process involves initiating a short position, closing out a short position, and considering factors that may influence short covering decisions. As market conditions change and new information becomes available, the decision to engage in short covering can be influenced by various factors, including an investor’s risk tolerance, current market conditions, and the potential for a short squeeze.

It is important for investors to be aware of the potential risks and rewards associated with short covering, as well as the tools and resources available for monitoring short interest and identifying short covering opportunities. This knowledge will enable them to make informed decisions about when to close out their short positions and potentially profit from short covering moves in the market.

Initiating a Short Position

A short position is initiated by borrowing shares and selling them, anticipating a price drop. Before initiating a short position, investors must establish a margin account with a brokerage firm and have sufficient cash or stock equity in that margin account as collateral.

This is essential for protecting both the investor and the brokerage firm from the potential downside risk associated with short positions. It is important for investors to understand that short positions possess the potential for unlimited losses if the stock price increases instead of decreasing.

Closing Out a Short Position

Closing a short position involves buying back the borrowed shares and returning them to the lender. To close out a short position, the investor must buy back the same number of shares that were borrowed and sold, and return them to the lender.

This process is essential for both securing profits and minimizing losses in a short-selling trade.

Factors Influencing Short Covering Decisions

When making short covering decisions, an investor’s risk tolerance, the current market conditions, and the potential for a short squeeze are all taken into account. For instance, an investor might decide to close out their short position if the stock has reached their target profit level, if their outlook on the stock has changed, or if the stock’s price has risen significantly, causing substantial losses.

The Impact of Short Covering on Stock Prices

Short covering can have a significant impact on stock prices, as it often results in increased demand for shares, leading to a potential increase in the stock’s price. This increase in demand can be further exacerbated by the limited availability of shares to purchase, as short sellers scramble to cover their positions. The effects of short covering on stock prices can be observed in various ways, including the occurrence of short squeezes, increased market volatility, and the emergence of bullish signals.

To better understand these impacts, it is essential to delve into the specific aspects of short covering that can influence stock prices and the market as a whole.

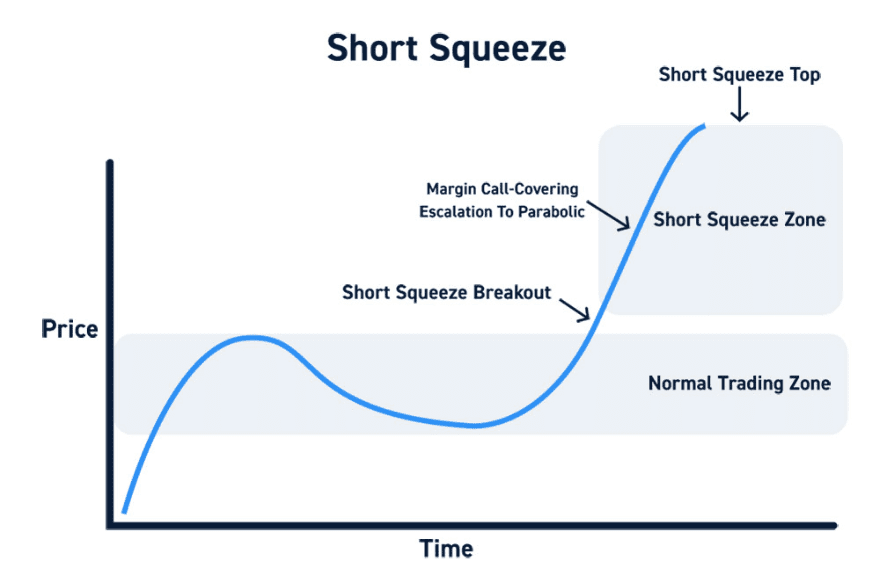

Short Squeezes

Image source: centerpoint

Short squeezes occur when excessive short covering leads to a rapid increase in stock prices. This can happen when a large number of short sellers are forced to buy back shares to cover their positions, driving up the stock price even further.

This rapid increase in demand can cause a feedback loop that sustains the upward trend of the stock, resulting in significant gains for some investors and substantial losses for others, particularly those who were short the stock. The GameStop saga is a prime example of a short squeeze caused by coordinated buying and short covering.

Market Volatility

Short covering can contribute to market volatility due to the sudden demand for shares. As short sellers rush to buy shares to cover their positions, the stock price may experience significant fluctuations, affecting not only the stock in question but also the broader market. This process is often referred to as a stock short.

This increased volatility can create opportunities for investors who are able to identify short covering scenarios and capitalize on the resulting price movements.

Bullish Signals

Short covering can be seen as a bullish signal, as it indicates increased demand for a stock. When short sellers close their positions by buying back shares, it can create upward pressure on the stock’s price, potentially leading to further gains for investors who hold long positions in the stock. Additionally, monitoring a stock’s short interest can provide valuable insight into the sentiment of short sellers in the market.

This increased demand and potential price appreciation may also attract additional investors, further driving up the company’s stock price and reinforcing the bullish signal.

Real-Life Examples of Short Covering

Real-life examples of short covering can help investors better understand the potential risks and rewards associated with this trading strategy. From the infamous GameStop saga to other notable cases, these examples highlight the power of short covering in the market and the importance of being well-informed about the dynamics of short selling and short covering.

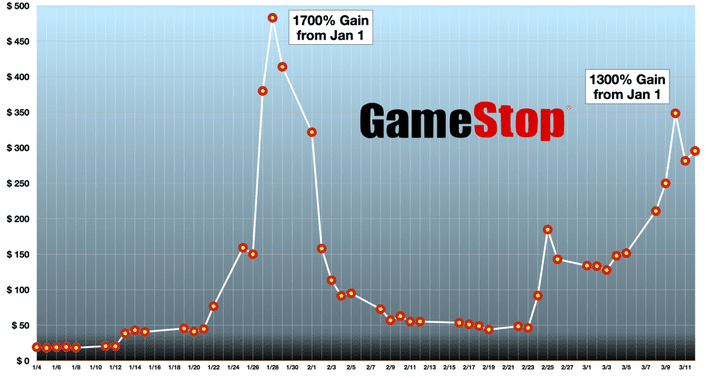

The GameStop Saga

Image source: Forbes

The GameStop saga involved a massive short squeeze caused by coordinated buying and short covering, resulting in significant gains and losses for traders who owned GameStop stock outright. Retail traders identified a high level of short interest in GameStop and collaborated via the Reddit trading group WallStreetBets to organize intense buying of the company’s shares and options.

The unexpected buying pressure resulted in a short squeeze as several hedge funds were forced to quickly cover their extensive short positions at a significant loss. They had bet against the video game retailer, which was to their detriment.

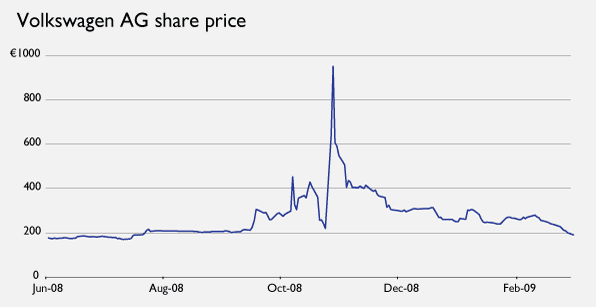

Other Notable Short Covering Cases

Other notable cases of short covering include the Volkswagen AG short squeeze in 2008, when a group of hedge funds attempted to influence the stock price, leading to a substantial surge in the stock price and losses for the short sellers.

More recently, in 2021, AMC Entertainment Holdings experienced a short squeeze when a group of retail investors attempted to drive up the stock price, resulting in a significant surge in the stock price and causing losses for the short sellers.

These examples underscore the potential risks and rewards associated with short selling and short covering, as well as the need for investors to stay informed about market dynamics.

Monitoring Short Interest and Identifying Short Covering Opportunities

In order to capitalize on potential short covering opportunities, it is essential for investors to monitor short interest and utilize various tools and resources to identify these opportunities. By staying informed about market trends, headline catalysts, and short interest figures, investors can better anticipate potential short squeezes and profit from the resulting price movements.

Tools and Resources

Several tools and resources are available for monitoring short interest, including websites like Yahoo Finance, Finviz, and Morningstar, as well as software like FloatChecker and ApeWisdom. These platforms provide investors with up-to-date information on short interest figures, allowing them to make informed decisions about potential short covering scenarios.

Tips for Identifying Short Covering Opportunities

When looking to identify short covering opportunities, consider the following key takeaways short covering:

Search for headline catalysts that may impact stock prices

Monitor short interest and short interest ratios

Analyze market trends

Summary

In summary, short covering is a critical aspect of the investing world, particularly for those involved in short selling. Understanding the mechanics of short covering, its impact on stock prices, and the tools and resources available for monitoring short interest is essential for investors looking to capitalize on short selling opportunities.

As we’ve seen through real-life examples like the GameStop saga, short covering can have a significant impact on stock prices and market volatility. By staying informed and utilizing the available tools and resources, investors can better anticipate potential short squeezes, manage their short positions, and profit from the resulting price movements. So stay informed, stay vigilant, and happy short covering!

Frequently Asked Questions

What does it mean when shorts are covering?

Short covering is the process of buying back shares of stock to close out an open short sale position. When traders or investors have taken a short position and are expecting the price of a security to increase, they may choose to cover their position by buying back the quantity of shares they had initially sold short.

This is done to limit potential losses if the price of the security rises. It is also done to lock in profits if the price of the security has already decreased.

Is short covering bullish or bearish?

Short covering is generally seen as a bullish indicator, as it implies that short sellers believe the market has reached its bottom and are closing their positions.

However, in some cases short covering can signal bearishness if the seller expects the stock to drop further. Ultimately, it all depends on the context of the situation.

What is shorts covering vs closing?

Short covering and closing are two related yet distinct actions taken when an investor is shorting a security. Short covering is the process of buying back the shares sold to close out the short position, whereas closing is the act of returning those shares to their lender.

In other words, short covering is the means by which an investor will close their position in order to prevent any further financial obligations.

Do shorts eventually have to cover?

Ultimately, it’s up to the lender whether they will require shorts to be covered. While many people are able to hold their short for a long time, the lender can force them to cover if they want their stock back.

As such, it is important to be aware that shorts must eventually be covered if the lender requests it.