In the realm of income-focused investing, the JPMorgan Equity Premium Income ETF (JEPI) and the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) stand out as two intriguing options. Both ETFs are designed to generate income for investors through a combination of dividend-paying stocks and the sale of covered call options, but they target different segments of the market and employ distinct strategies to achieve their goals. This article delves into the nuances of JEPI and JEPQ, comparing their investment approaches, performance, and suitability for different types of investors.

Differences: JEPI vs JEPQ

| Feature | JEPI | JEPQ |

|---|---|---|

| Benchmark Index | S&P 500 | Nasdaq 100 |

| Number of Holdings | ~400 | 100 |

| Investment Style | Actively managed selection based on fundamental analysis | Data-driven selection based on risk-adjusted expected returns |

| Dividend Yield | Currently 8.48% (SEC yield) | Currently 10.75% (SEC yield) |

| Volatility | Lower (1.83%) | Higher (2.15%) |

| Sector Exposure | More diversified across sectors | Heavily concentrated in Technology (41%) |

| Market Cap Exposure | Includes both large and mid-cap stocks | Only large-cap stocks |

| Expense Ratio | 0.60% | 0.60% |

| Minimum Investment | $100 | $100 |

| Launch Date | February 2020 | May 2022 |

| Performance Since Inception | More consistent, but lower overall returns | Higher returns, but less established |

| Tax Efficiency | Similar | Similar |

Key Differences:

Benchmark Index: JEPI tracks S&P 500 (500 stocks), JEPQ tracks Nasdaq 100 (100 stocks).

Diversification: JEPI is more spread out, JEPQ is heavily concentrated in tech.

Dividend Yield: JEPQ currently edges out JEPI, but JEPI has shown consistent improvement over its longer history.

Performance History: JEPI has longer track record, while JEPQ is still young.

We believe this is the information you’re here for. Though, if you want to go the extra mile, bear with us we’re now going deeper into this.

JEPI: A Closer Look

JEPI, launched in May 2020, aims to provide investors with a steady income stream while also offering the potential for capital appreciation. It primarily invests in U.S. large-cap stocks that exhibit low volatility and value characteristics. The ETF uses a bottom-up fundamental research process, leveraging J.P. Morgan’s proprietary risk-adjusted stock rankings to select its holdings. It does this by investing in a combination of:

U.S. large-cap stocks: These are stocks of companies with a market capitalization of over $10 billion. JEPI typically invests in stocks that exhibit low-volatility and value characteristics.

Selling call options on the S&P 500 Index: JEPI employs a disciplined options overlay strategy, selling out-of-the-money S&P 500 Index call options to generate income. This approach aims to deliver a significant portion of the S&P 500’s returns with less volatility, making JEPI an attractive option for investors seeking income with a conservative risk profile

JEPQ: A Different Approach

JEPQ, introduced in May 2022, also seeks to provide investors with current income and the prospect of capital appreciation. However, it differentiates itself by focusing on the Nasdaq-100 Index, giving investors exposure to major technology and growth companies.

Current income: Achieved through a combination of investing in dividend-paying stocks and employing income-generating strategies like selling call options.

Nasdaq 100 exposure: Tracks the performance of the Nasdaq-100 Index, providing access to major technology and growth companies.

Reduced volatility: Utilizes various techniques, including sector selection and option strategies, to aim for smoother returns compared to the broader market.

Key characteristics:

Invests primarily in stocks from the Nasdaq-100 Index, but also utilizes equity-linked notes (ELNs) and call options for income generation.

Offers a 30-day SEC yield of 5.56% (as of February 16, 2024).

Involves a higher expense ratio of 0.35% compared to passively managed ETFs.

Considered a non-diversified fund due to its concentration in specific securities.

Similarities

| Feature | JEPI | JEPQ |

|---|---|---|

| Type | Exchange-Traded Fund (ETF) | Exchange-Traded Fund (ETF) |

| Objective | Income generation with some capital appreciation | Income generation with some capital appreciation |

| Investment Approach | Uses an options strategy alongside equity investments | Similar options strategy with equity investments |

| Dividend | Aims to provide monthly income | Also aims to provide monthly income |

| Issuer | J.P. Morgan | J.P. Morgan |

| Market Focus | Primarily US equities | Primarily US equities |

| Risk Level | Moderate, due to mix of equities and options | Moderate, similar risk due to strategy |

Both aim to generate income through a mix of equities and options strategies, are issued by J.P. Morgan, and primarily focus on the US equity market.

Target Audience

JEPQ: Tempts younger investors with its focus on the high-flying Nasdaq 100 and potential for capital appreciation, but comes with higher volatility.

JEPI: More suitable for retirees seeking steady income and diversification. Its broader exposure across sectors and lower concentration in tech (15% vs JEPQ’s 43%) provide a smoother ride.

Performance and Risk Comparison

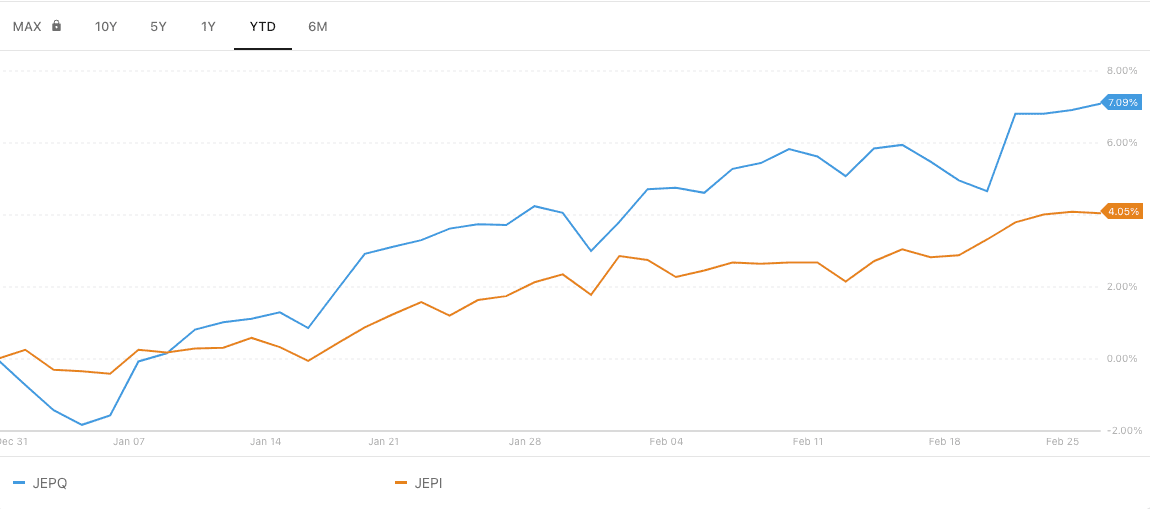

Image from PortfoliosLab

When comparing the performance and risk profiles of JEPI and JEPQ, several key differences emerge. JEPI has a longer track record and has demonstrated consistent performance with a focus on lower-volatility stocks. This has resulted in a more stable investment option, particularly appealing to retirees or those seeking steady income with lower risk.

On the other hand, JEPQ, with its emphasis on the tech-heavy Nasdaq-100, has shown higher volatility but also the potential for greater returns, especially in bull markets where tech stocks often outperform.

During the year-to-date timeframe, JEPQ has delivered a return of 7.10%, outpacing JEPI’s return of 4.05%. The accompanying chart illustrates the growth trajectory of a $10,000 investment in each fund, factoring in adjustments for stock splits and dividends.

What’s right for you: JEPI or JEPQ?

Overall, both offer appealing income streams, but the choice depends on your risk tolerance and investment goals.

Here’s our take:

For retirees: JEPI’s diversification and consistent performance make it a safer bet.

For younger investors: JEPQ’s potential for growth is alluring, but be prepared for the ups and downs.

Consider carefully before diving in! This is not financial advice. Please consult your advisor before making any investment decisions.

Conclusion

Choosing between JEPI and JEPQ depends largely on an investor’s risk tolerance, investment goals, and preference for market exposure. JEPI offers a more diversified and conservative approach, suitable for those seeking steady income with lower volatility.

JEPQ, meanwhile, caters to investors willing to accept higher risk for the potential of greater returns, particularly those bullish on the tech sector. Regardless of the choice, both ETFs provide a novel way to generate income while participating in the equity markets, albeit with distinct strategies and risk/return profiles

Frequently Asked Questions

Is JEPQ good for long-term?

In all honesty, nobody can really tell that. JEPQ, like any investment, has its own set of risks and opportunities that can influence its suitability for long-term investment.

It’s crucial to consider factors like the underlying assets, management team, performance history, and how it aligns with your investment goals and risk tolerance.

How does JEPQ pay such a high dividend?

JEPQ might offer high dividends due to investments in high-yield assets or using strategies like leveraging, which can increase returns but also add risk.

It’s best knowing the fund’s strategy and the risks involved to see if it matches your investment goals.

Which is safer: JEPI or JEPQ?

Generally, a fund focused on more conservative assets like high-quality bonds or stable dividend-paying stocks might be considered safer.

If JEPI leans towards such conservative investments and JEPQ takes on higher risk for potentially higher returns, JEPI could be deemed safer.

‘Safer’ is relative to your risk tolerance and investment goals.

Always compare their portfolios, performance under different market conditions, and how they align with your risk appetite.

What is inside JEPI and JEPQ ETFs?

JEPI aims for income generation and capital appreciation with lower volatility compared to the broader market. It primarily invests in high-dividend-yielding U.S. stocks and employs an options strategy, selling index call options to generate income.

JEPQ focuses on providing income through a similar options strategy but targets Nasdaq-listed stocks, which often include technology and growth-oriented companies.

Both use options strategies to enhance income, but their underlying equity holdings differ, with JEPI focusing on a broader range of sectors and JEPQ possibly having a tech/growth tilt due to its Nasdaq focus.