Imagine a world where life-saving medical supplies are delivered to remote locations within minutes, not hours or days. This vision is becoming a reality thanks to Zipline, a drone delivery startup focused on bringing vital medical supplies to the hardest-to-reach places. As an investor, you might be wondering about the potential opportunities in Zipline stock. In this blog post, we’ll explore the ins and outs of this innovative company and its investment landscape.

Short Summary

Zipline is a drone delivery startup with a $4.2 billion valuation and FAA approval for expansion of services within the U.S.

Pre-IPO shares can be accessed through ARK Venture Fund or pre-IPO equity platforms, though accredited investors may have access to private securities offerings not registered with financial authorities.

Investors should conduct extensive research and due diligence in preparation for potential Zipline IPO opportunities.

Understanding Zipline: A Drone Delivery Startup

Founded in 2014 by Keller Rinaudo, William Hetzler, and Keenan Wyrobek, Zipline is a South San Francisco-based logistics company that uses proprietary fixed-wing drones to deliver medical supplies to remote areas. With a team of 979 employees, the company has taken on the ambitious mission of ensuring rapid access to vital medical supplies for all individuals globally.

Zipline’s drones, also known as “Zips,” have successfully completed over 600,000 deliveries, including over eight million life-saving vaccine doses, health and wellness products, and other critical medical supplies. This remarkable achievement has made a significant impact on the medical community, especially in rural areas where access to health centers and hospitals is limited.

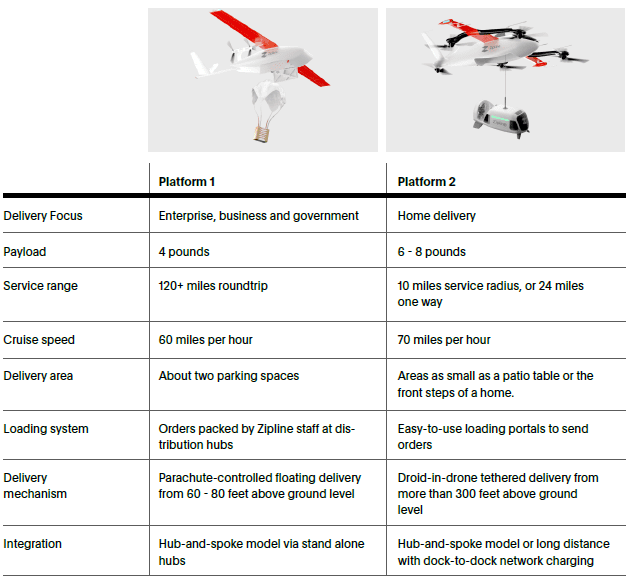

The company offers two delivery platforms:

Platform 1, which uses a launch system and parachute drop

Platform 2 is a flying drone that is equipped with a cable-dropping capability to deliver packages securely.

Both platforms provide efficient delivery of medical supplies via Zipline flights, making Zipline a leading logistics company in the drone delivery space.

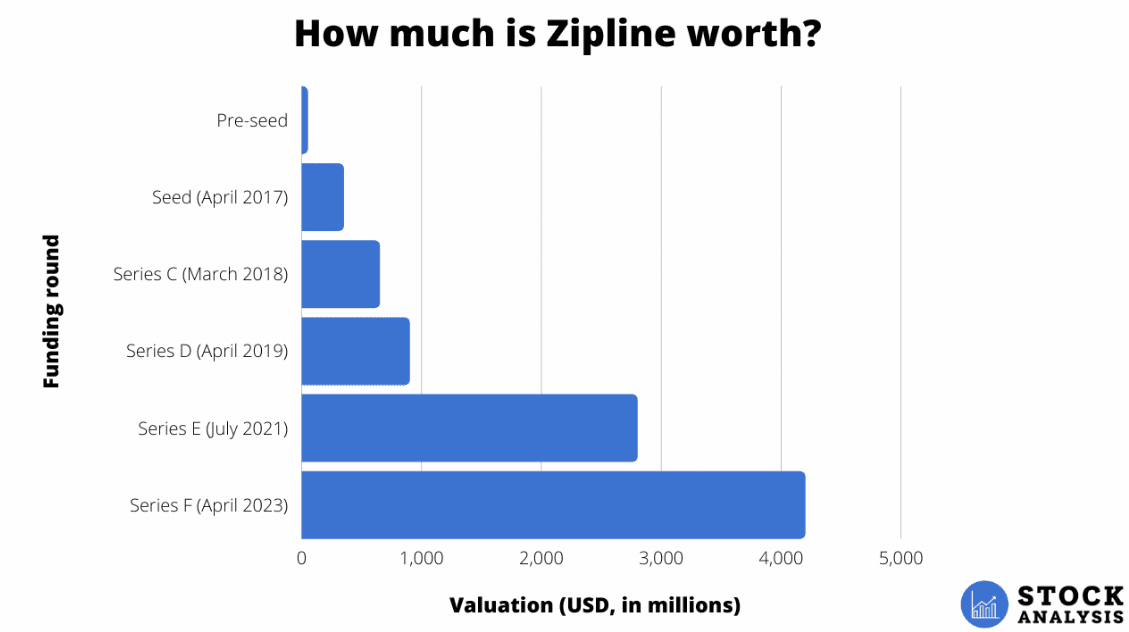

Zipline’s Funding History and Valuation

Zipline has attracted significant attention from venture capital firms, securing more than $900 million in funding to date. This financial backing has led to a valuation of $4.2 billion following its Series F funding round, making Zipline a major player in the drone delivery industry. Sequoia Capital, Andreessen Horowitz, Baillie Gifford, Fidelity, GV, Goldman Sachs, Katalyst Ventures, Oakhouse Partners, Reinvent Capital, Rivas Capital, SV Angel, Subtraction Capital, Temasek, The Rise Fund, Toyota Tsusho Corp, Visionnaire Ventures, and Jerry Yang are notable venture capital investors in Zipline.

One of the most recent milestones for Zipline was obtaining Federal Aviation Administration (FAA) approval for its drone delivery services. This clearance allows the company to expand its operations within the United States, further enhancing its growth potential.

Federal Aviation Administration Approval

The FAA is responsible for regulating and overseeing civil aviation within the United States, ensuring the safety of all operations. Gaining FAA approval is a significant accomplishment for Zipline, as it enables the company to broaden its operations and likely augment its income.

With the green light from the FAA, Zipline can now focus on expanding its delivery services within the U.S., reaching more remote areas and medical facilities in need of instant access to critical medical supplies and medical equipment. This expansion not only benefits the communities served by Zipline but also presents an attractive opportunity for potential investors.

The Potential of Zipline Stock

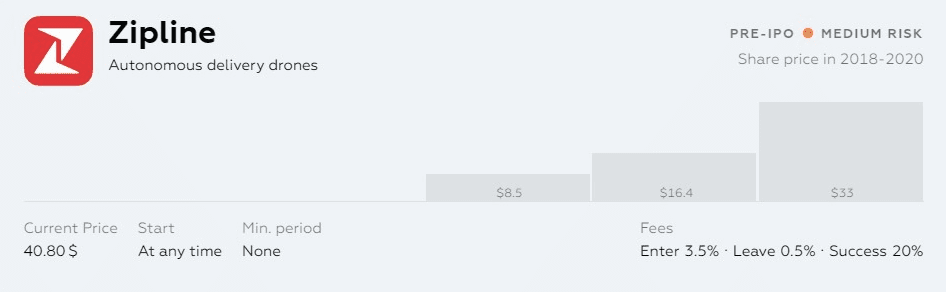

Stock Analysis: Source

As a private company, Zipline’s stock is not yet publicly traded, but it offers pre-IPO shares for interested investors who want to buy Zipline stock. The potential for growth in the drone delivery market, combined with Zipline’s impressive track record and mission-driven focus, makes investing in Zipline stock an intriguing opportunity.

However, investing in pre-IPO shares carries a degree of risk, as the company’s future performance and stock price are not guaranteed. Investors should carefully consider their own risk tolerance and investment objectives before deciding to invest in Zipline stock.

Related Article: Investing In OnlyFans Stock: Everything You Need To Know!

How to Invest in Pre-IPO Shares of Zipline

The minimum investment required to access Zipline stock through the ARK Venture Fund via Titan Invest is $500, while a $10,000 investment minimum is necessary for direct access to Zipline stock through pre-IPO equity platforms.

Accredited Investors

Accredited investors are individuals or entities that meet specific financial criteria, such as a net worth of over $1 million or an income of over $200,000, allowing them to invest in private securities offerings not registered with financial authorities. Only accredited investors who meet all eligibility requirements may purchase shares of Zipline.

TradeStation is a popular broker among accredited investors, as it has an extensive history of accessing IPOs and secondary offerings.

Non-Accredited Investors

Unfortunately, non-accredited investors are unable to invest directly in Zipline pre-IPO shares. However, they can gain exposure to Zipline stock by investing in the Fundrise Innovation Fund or the ARK Venture Fund via Titan Invest, which holds shares in Zipline, Airbnb, SpaceX, ByteDance, Plaid, Kraken, and Databricks.

While non-accredited investors may not have the same direct access to Zipline pre-IPO shares as accredited investors, these alternative investment opportunities offer a way to gain exposure to the company’s potential growth, albeit indirectly.

Related Article: Invest In Instacart IPO: Everything You Need To Know

Key Players in Zipline’s Success

The success of Zipline can be attributed to several key contributors, including founder Keller Rinaudo, investors Katalyst Ventures, Baillie Gifford, GV, Temasek, Bright Success Capital, and Goldman Sachs, chief technology officer, and executive Alfred Lin, who led a Series A investment into the startup.

These key players have provided the financial backing, strategic guidance, and industry expertise needed for Zipline to flourish in the competitive drone delivery market. Their continued involvement and support are crucial to Zipline’s ongoing success and growth.

Comparing Zipline to Competitors

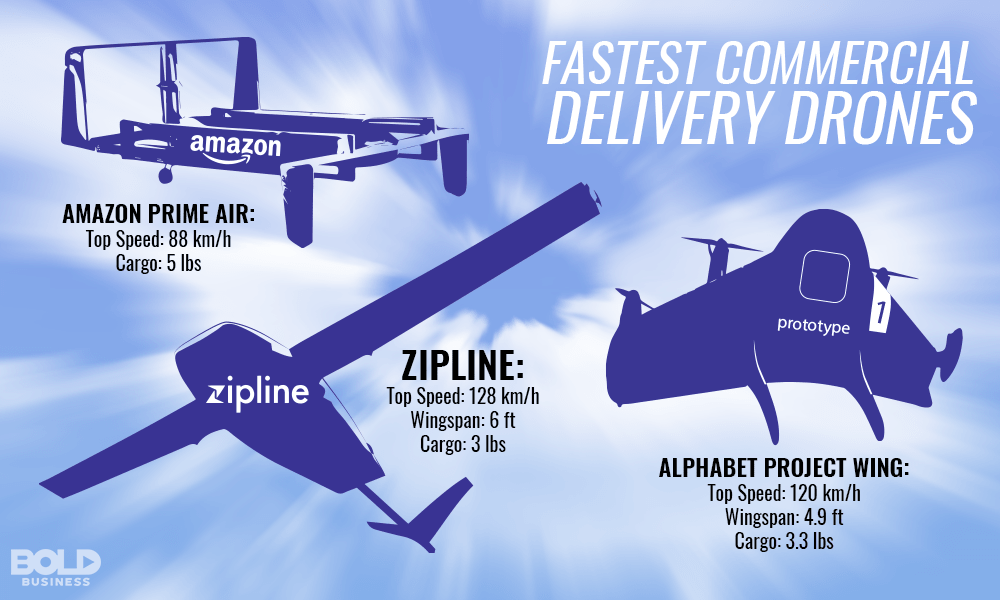

In the competitive world of drone delivery, startup Zipline stands out among other companies such as Amazon Prime Air, Flirtey, and Alphabet Project Wing. Like Zipline, these competitors offer services such as on-demand delivery, scheduled delivery, and emergency delivery using their respective zipline drones.

However, Zipline is raising $330 million in a latest Series F funding round, surpassing its competitors, and boasts a presence in more than 20 countries, giving it a larger market share. Moreover, it has proven to be the fastest among its competitors, with a top speed of 128 km/h. This strong financial and global position places Zipline in a favorable spot to continue leading the drone delivery market and expanding its operations.

Challenges and Opportunities for Zipline

As Zipline continues to grow, it faces challenges related to safety, noise, security, regulations, and technical restrictions such as battery life and payload capacity. These hurdles must be overcome to ensure the company can maintain and expand its operations while adhering to regulatory requirements.

Despite these challenges, Zipline’s innovative approach to drone delivery presents numerous opportunities for growth. As the company continues to refine its technology and develop new solutions, it has the potential to further revolutionize the delivery of medical supplies and other critical goods to remote areas around the world.

Preparing for a Zipline IPO

While there is no definitive timeline for a Zipline IPO, investors should be vigilant for any reports regarding the exploration of a potential IPO with investment banks or a confidential S-1 filing with the SEC. The projected IPO date and stock symbol for Zipline are not yet available.

When preparing for a potential Zipline IPO, investors should conduct thorough due diligence and familiarize themselves with the company’s financial performance, business model, and competitive landscape. This information will be crucial in making informed investment decisions once Zipline goes public.

Related Article: Invest In Databricks IPO: Latest Stock Price & Equity Owners (2023)

Summary

In conclusion, Zipline represents an exciting investment opportunity for those interested in the drone delivery and logistics industry. As the company continues to grow and expand its operations, it faces challenges and opportunities that will shape its future trajectory.

With key players providing support and guidance, a strong market position relative to competitors, and innovative solutions for delivering medical supplies to remote areas, Zipline is poised for continued success.

Frequently Asked Questions

Is Zipline a publicly traded company?

No, Zipline International is not a publicly traded company.

Who owns Zipline Drone company?

Keller Rinaudo Cliffton is the founder and CEO of Zipline Drone company.

How much is Zipline worth?

Zipline is currently valued at $4.2 billion, an increase of 55% from its $2.7 billion valuation in 2021.

Who has invested in Zipline?

Zipline has raised over $900 million from a number of venture capital firms, including Baillie Gifford, Katalyst Ventures, Temasek Holdings, Andreessen Horowitz, GV, Visionnaire Ventures, Lerer Hippeau, Sequoia Capital, SV Angel, Tuesday Capital, Sway Ventures, and Slow Ventures.

It also received funding from Alphabet’s venture arm GV, Pactolus Ventures, Intercorp, Emerging Capital Partners, and Reinvent Capital in 2021.

What is Zipline’s mission?

Zipline’s mission is to provide rapid access to vital medical supplies for everyone around the world.