Are you looking for an exciting investment opportunity in a rapidly growing industry? Then look no further than the highly anticipated Instacart IPO! As the online grocery delivery market continues to boom, Instacart has emerged as a leading player, and its potential public debut promises to be a significant event in the stock market. In this comprehensive guide, we’ll take you through everything you need to know about the Instacart IPO, including its current status, potential valuation, business model, financial performance, risks, and how to invest. So let’s dive in and uncover the opportunities that await in the world of grocery delivery!

Short Summary

Instacart is preparing for its IPO, with an uncertain date due to market volatility and internal valuation decreases.

Investors should assess the company’s financial performance and growth prospects before investing in Instacart’s IPO.

Accredited investors can purchase pre-IPO shares from secondary marketplaces or wait until post-IPO trading begins to make informed decisions about investment.

Instacart IPO Overview

Founded by Apoorva Mehta, a former Amazon employee, Instacart is an online grocery delivery service that has experienced rapid growth since its inception in 2012. The company’s valuation skyrocketed during the pandemic as it waived delivery fees and attracted more customers. Currently valued at an estimated $12 billion, Instacart has captured the attention of investors worldwide, eagerly awaiting its initial public offering (IPO).

Though the company filed a draft registration statement with the Securities and Exchange Commission, the exact Instacart IPO date remains uncertain. The delay is attributed to market volatility and internal valuation decreases during the pandemic. Nevertheless, the IPO is highly anticipated, and understanding the company’s business model, financial performance, and growth prospects is crucial for potential investors.

Status of Instacart IPO

As of now, the status of Instacart’s IPO is still undetermined, with no definite date or share price. The company is focusing on growing its Instacart business and expanding its services, possibly considering both direct listings and a traditional initial public offering. The company’s Instacart valuation will play a significant role in determining the best approach.

The uncertainty surrounding the IPO date leaves potential investors in a state of anticipation. While market conditions and the company’s internal valuation continue to fluctuate, it’s essential for investors to stay updated on any news regarding the IPO and be prepared to act when the time comes.

Reasons for Delay

One of the primary reasons for the delay in Instacart’s IPO is the market volatility that has persisted during the pandemic. Investors’ perception of growth prospects during these uncertain times has led to a cautious approach on the part of the company.

Another contributing factor to the delay is the decrease in internal valuation that Instacart has experienced. The company is concentrating on augmenting some of its services for grocery retailers, including targeted advertising, before taking the leap into the public market. These factors combined have led to a cautious approach towards the IPO, with the company waiting for more favorable market conditions before making its debut.

Potential Valuation

Instacart’s potential valuation has seen significant fluctuations in recent times. The most recent figure stands at $12 billion, impacted by stock market fluctuations and the company’s performance. This valuation is a departure from the $39 billion valuation after the funding round in March 2021.

Investors should keep a close eye on Instacart’s valuation as the IPO date approaches. Market conditions and company performance will continue to influence the valuation, which will ultimately impact the attractiveness of the investment opportunity.

| Year | Valuation ($bn) |

|---|---|

| 2016 | $2B |

| 2017 | $3.4B |

| 2018 | $7.6B |

| 2020 | $13.7B |

| 2021 | $39B |

| 2022 | $24B |

| 2023 (EST) | $12B |

Understanding Instacart’s Business Model

To make an informed investment decision, it’s crucial to understand Instacart’s business model. Instacart is based in San Francisco and provides grocery pick-up and delivery services. It is a convenient way for customers to get what they need. The company’s strategy is to facilitate the online grocery ordering process, providing consumers with doorstep delivery of their shopping and aiding smaller grocers to succeed online.

Instacart faces competition from other grocery delivery services, including Amazon Fresh, Walmart Grocery, and Shipt. Despite the competition, Instacart has managed to carve out a significant market share by offering a broad selection of products, an expansive network of stores, and a large customer base.

How Instacart Works

Instacart operates as a grocery delivery and pick-up service that partners with various retailers and employs personal shoppers to fulfill customer orders. The company’s platform offers a convenient solution for consumers’ grocery needs. It provides access to numerous large grocery store chains, and customers can receive same-day delivery in select cities.

Since its establishment in 2012, Instacart has successfully attracted a large customer base and expanded its services to cater to the ever-growing demand for convenient grocery delivery solutions.

Revenue Streams

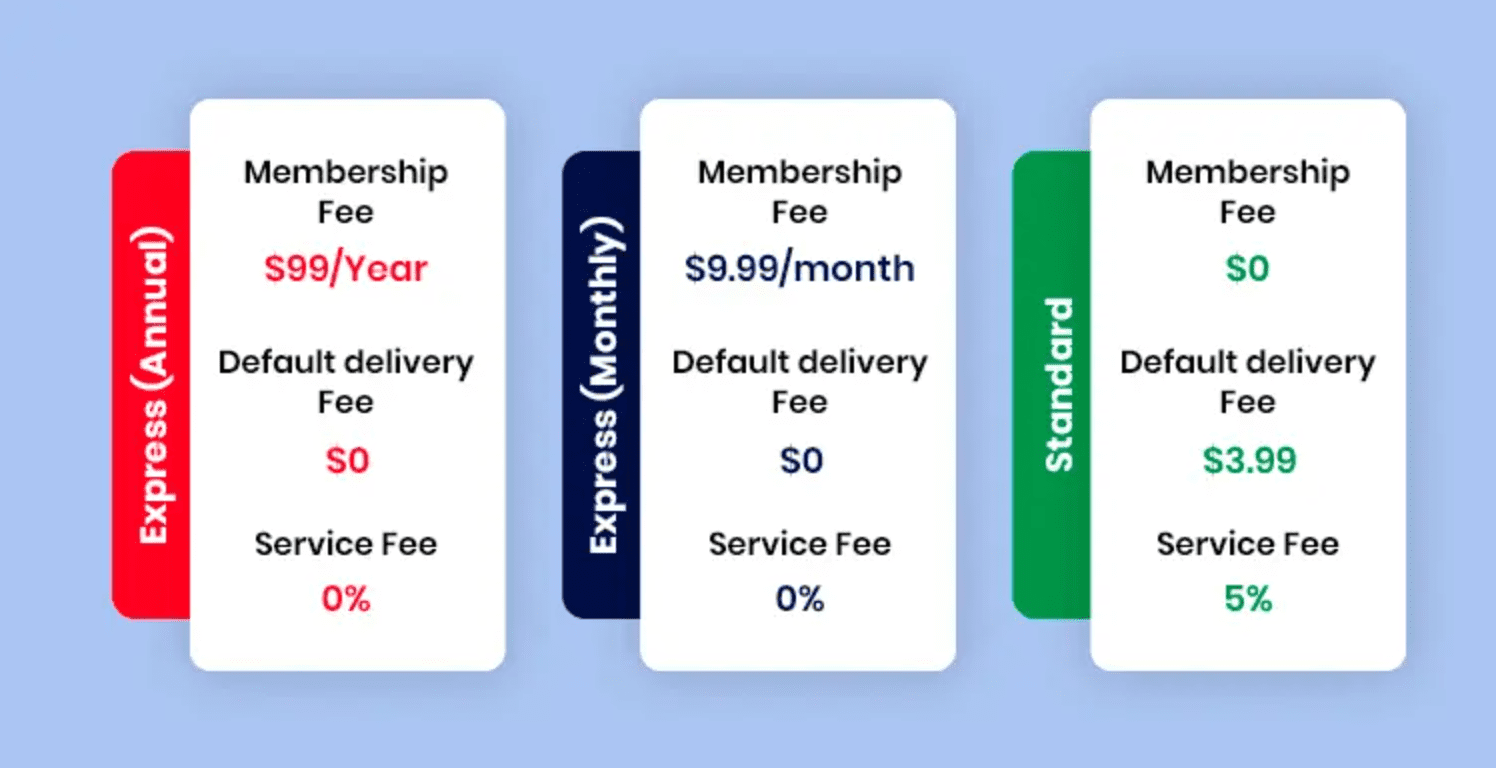

Instacart Subscription Plans: Source

Instacart generates revenue through a variety of avenues, including delivery fees, subscription memberships such as their monthly service, and advertising. Customers pay a delivery fee for each order, while Instacart Express, a membership service, eliminates delivery fees on orders of $35 or more but still requires customers to pay the service fee for the shopper and encourages tipping.

The company is also working on diversifying its income streams by focusing on digital advertising and optimizing its core service to provide food delivery within 15-30 minutes.

Competition Landscape

The grocery delivery market is highly competitive, with numerous companies competing for market share. Besides Amazon Fresh, Walmart Grocery, and Shipt, other contenders in the market include FreshDirect, Blue Apron, and DoorDash.

Despite the fierce competition, Instacart has managed to set itself apart by offering a reliable delivery system, an intuitive application, and partnerships with various retailers. However, as the market continues to evolve, Instacart will need to stay ahead of its competition and adapt to changing consumer preferences to maintain its market position.

Related Article: Investing In Discord IPO

Financial Performance and Growth Prospects

An essential factor to consider before investing in Instacart’s IPO is the company’s financial performance and growth prospects. During the pandemic, Instacart experienced a 500% increase in order volume as customers sought to avoid shopping in public areas. This surge in demand has translated into impressive revenue and market share growth for the company.

However, as the pandemic subsides and normalcy returns, it remains to be seen whether Instacart can maintain its growth trajectory. Understanding the company’s financial performance and growth prospects is crucial for investors to make well-informed decisions.

Financial Reports

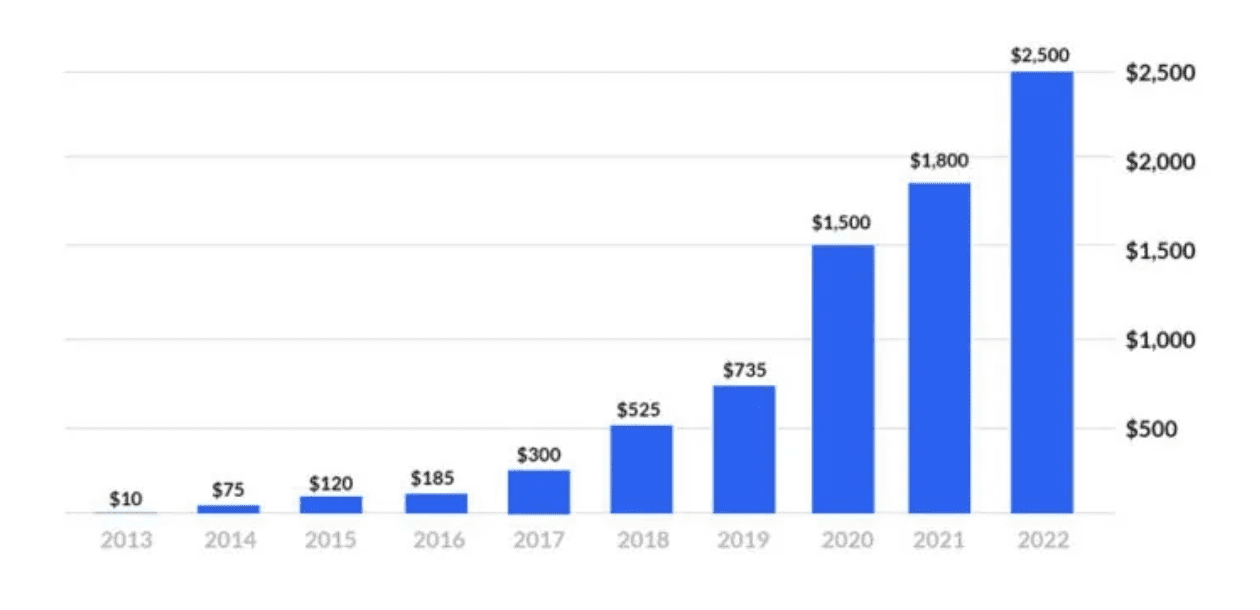

Instacart Revenue: Source

Instacart’s financial reports indicate increasing revenues, with a 39% year-over-year increase, totaling approximately $2.5 billion. However, the company has not disclosed its net income figures, making it challenging to gauge its overall profitability.

Growth Trajectory

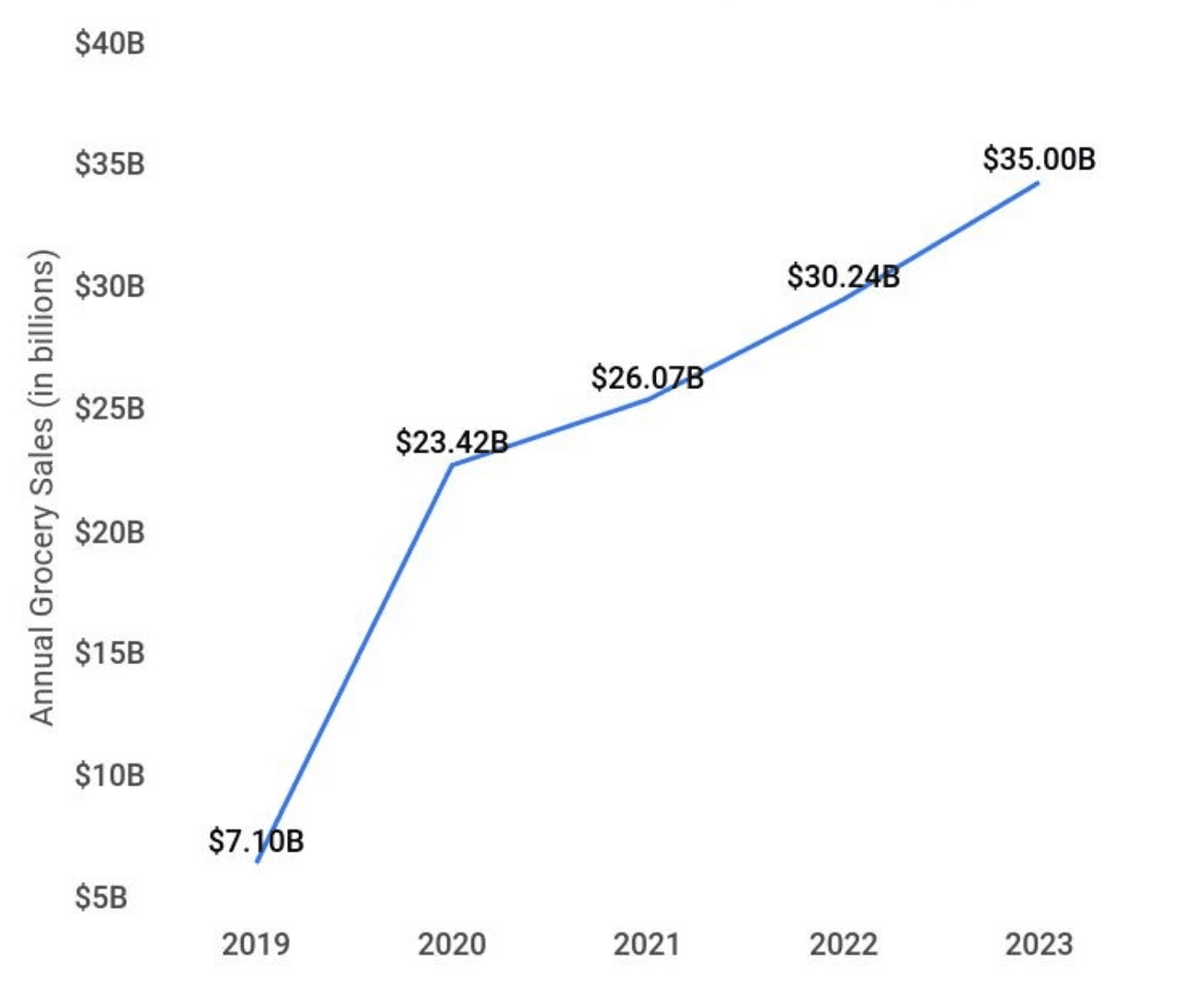

InstaCarts Projected Grocery Sales: Source

Instacart has seen a notable increase in its gross transaction volumes, with a 5-10% rise in Q1 2021 compared to the same period in 2020. Additionally, its revenue has grown to $2.5 billion in 2022, a 39% increase from the preceding year. However, according to Insider Intelligence, Instacart’s share in the grocery delivery intermediary market is anticipated to drop to 68.2% in 2023 from 84.2% in 2020.

While Instacart has experienced impressive growth in recent years, the company’s market share is expected to decrease in the coming years.

Expansion Plans

Instacart is looking to diversify its business by entering new markets and providing shopping technology solutions to other retail businesses. The company confirmed a private funding round on March 2nd, 2021, with a valuation of $39 billion.

These expansion plans showcase Instacart’s ambition to solidify its position in the market and explore new opportunities for growth. As the company continues to innovate and expand its services, investors should closely monitor these developments to assess the potential impact on the company’s value and future growth prospects.

Risks and Challenges Facing Instacart

Investing in the Instacart IPO comes with its fair share of risks and challenges. Market reversals, policy changes, and competition pose significant threats to the company’s financial stability and growth prospects.

Federal Reserve Policy Changes

Changes in Federal Reserve policies could impact the company’s financial stability. The Fed is likely to increase short-term interest rates to a level close to 2%, which could cause a significant increase in financing costs for companies with uncertain prospects for profitability in the future.

Instacart, like other companies, would be affected by these policy changes, potentially impacting its capacity to finance its operations and expand its business.

Competition and Market Share

Image Source: Ridester

Instacart faces competition from other grocery delivery services, which could affect its market share. Competitors such as Amazon Fresh, Walmart Grocery, Shipt, DoorDash, Dumpling, and Fresh Direct are all vying for a slice of the lucrative grocery delivery market.

How to Invest in Instacart IPO

Now that we’ve covered the ins and outs of the Instacart IPO, you may be wondering how to invest in this potential opportunity. There are three possible options for obtaining shares: pre-IPO secondary marketplaces, the initial public offering, and post-IPO investment.

In this section, we’ll guide you through each of these options, providing you with the information you need to make an informed decision on how to invest in Instacart’s IPO.

Pre-IPO Secondary Marketplaces

Accredited investors can explore pre-IPO secondary marketplaces like Equitybee, Linqto, EquityZen, and Forge Global to buy shares of Instacart. These platforms provide access to pre-IPO startups and allow investors to fund employee stock options.

However, investing in pre-IPO shares comes with risks, as the company’s financials are not publicly filed with regulators prior to the IPO. As a result, pre-IPO shares are only offered to accredited investors, and ordinary investors may find it challenging to acquire these shares.

Initial Public Offering (IPO)

Investing in Instacart’s IPO may be challenging for retail investors, as priority is typically given to wealthy clients at top banks. For investors with a capital of less than $250,000, TradeStation is an option to access IPOs with lower demand.

If you’re unable to acquire IPO shares, it’s recommended to wait until the company begins trading post-IPO. This approach allows you to invest in Instacart once it becomes a publicly traded company and its financials are disclosed, providing a clearer picture of its financial stability and growth prospects.

Post-IPO Investment

After the IPO, investors can consider buying Instacart shares on the stock market. By closely monitoring the company’s performance and financial reports, investors can make informed decisions on when to invest in Instacart’s stock and capitalize on potential growth opportunities.

Investors should pay close attention to the company’s financials, such as revenue, and consider seeking investment advice to make informed decisions.

Summary

In conclusion, the Instacart IPO presents an exciting opportunity for investors looking to capitalize on the booming online grocery delivery market. By understanding the company’s business model, financial performance, growth prospects, and potential risks, investors can make well-informed decisions and seize the opportunity when it arises. While the IPO date remains uncertain, staying updated on developments and being prepared to act quickly is essential for investors eager to join the Instacart journey.

Frequently Asked Questions

Did Instacart have an IPO?

Instacart has not had an IPO yet, as its listing was originally planned for 2022 but due to market volatility it has been delayed to 2023.

How much is the Instacart IPO worth?

Instacart is estimated to be worth around $13 billion, with the Instacart stock price determined by dividing the total value by the number of shares issued at IPO.

Who owns instacart?

Instacart was founded in 2012 by entrepreneur Apoorva Mehta, with Maplebear Inc. being its parent company.

Apoorva Mehta is the owner of Instacart.

Is instacart publicly traded?

Instacart is not publicly traded, but Equitybee provides accredited investors access to invest in the company before they IPO.

What is Instacart’s business model?

Instacart’s business model involves partnering with local retailers and employing personal shoppers to pick up and deliver groceries to customers.