Imagine being part of the fastest-growing social media platform’s stock investment journey, tapping into a market that pays over $5 billion to its content creators yearly. Welcome to the world of OnlyFans. In this post, we’ll explore the potential of investing in OnlyFans stock, the company’s business model, and the steps it would need to take to go public. Let’s dive in!

Short Summary

OnlyFans is a privately held company with potential to go public, offering investors reliable subscription-based revenue and growth opportunities.

Investment in OnlyFans involves research and understanding of the platform’s business model as well as associated risks.

Alternative investments include established giants such as Facebook and Playboy, providing diversification while mitigating risk.

OnlyFans and the Stock Market

OnlyFans, a British social media platform, has gained immense popularity by connecting content creators with their fans through subscription-based exclusive content. The platform is owned by Fenix International Limited and its partners, making it a privately held company. This means that unlike public companies, OnlyFans is not currently available for purchase on the stock market.

However, the possibility of going public in the future remains, opening up potential investment opportunities for those interested in the platform’s growth. The platform’s impressive $1.2 billion revenue in 2021 and its valuation of over $1 billion have captured the attention of investors worldwide.

With no definitive answer regarding OnlyFans becoming a publicly traded company, it’s essential to understand the differences between private and public companies and the potential for OnlyFans to go public.

Private vs. Public Companies

Private companies, such as OnlyFans, are not publicly traded on the stock market, meaning their ownership is controlled by a select group of individuals and entities. Public companies, on the other hand, have shares available for purchase by investors on stock exchanges.

The distinction is crucial for investors, as only publicly traded companies provide the opportunity to buy and sell shares on the open market. For now, OnlyFans remains a private company, with the potential for going public in the future.

Potential for Going Public

To become a publicly traded company, OnlyFans would need to undergo an Initial Public Offering (IPO). This process involves offering shares to the public, allowing investors to buy into the company. Although OnlyFans’ CEO, Amrapali “Ami” Gan, has stated that the company is content with remaining privately held and has no plans for an IPO, several Special Purpose Acquisition Companies (SPACs) have approached OnlyFans with IPO proposals.

If OnlyFans decides to go public, it could attract significant investor attention due to its substantial revenue and rapid growth. However, until the company announces plans for an IPO, individual investors cannot buy OnlyFans stock. Instead, they must wait and monitor the company’s progress and potential for going public in the future.

Understanding OnlyFans’ Business Model

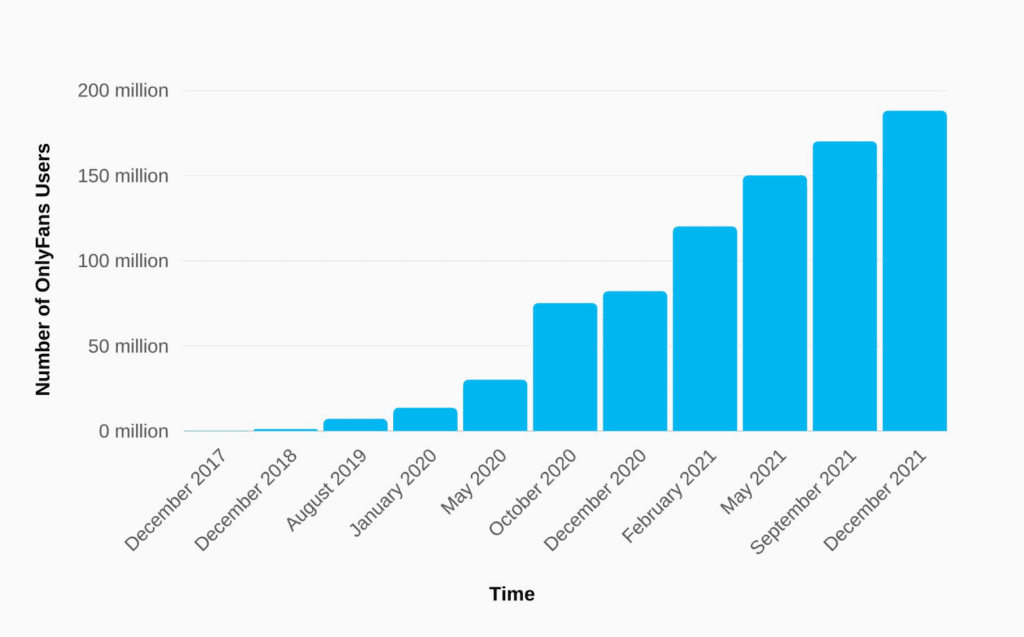

OnlyFans Users Numbers

OnlyFans operates on a subscription-based revenue model, with the platform taking a 20% cut of all earnings generated by content creators. This business model has proven successful, as the platform has reported yearly payments of over $5 billion to more than 1.5 million content creators.

Understanding the intricacies of OnlyFans’ business model is crucial for potential investors, as it directly affects the company’s valuation and potential stock price. The platform primarily generates revenue through subscriptions, with creators setting their subscription fees for access to their exclusive content. Additionally, OnlyFans takes a commission from tips and pay-per-view content, further contributing to its revenue stream.

This consistency in revenue generation can be an attractive proposition for potential investors, especially if OnlyFans decides to go public.

Creator Earnings

Content creators on OnlyFans earn money through subscription fees, tips, and pay-per-view content. The platform takes a 20% commission from all revenue generated, ensuring that creators receive the majority of the income.

With over $5 billion distributed in creator earnings, OnlyFans’ commission structure supports the platform’s growth and profitability. Understanding the creator earnings aspect of OnlyFans’ business model is crucial for potential investors, as it highlights the platform’s ability to generate income for its creators while retaining a portion for operational costs.

By the Numbers

We have used the 2021 figures up until the end of Quarter 1 for this report, while the 2022 statistics are estimated projections from OnlyFans.

Net revenue

| 2020 | $375 million |

| 2021 | $1.2 billion |

| 2022 | $2.5 billion |

Free cash flow

| 2020 | $150 million |

| 2021 | $620 million |

| 2022 | $1.2 billion |

Valuation

| 2018 | $34.8 million |

| 2019 | $582 million |

| 2020 | $2.25 billion |

| 2021 | $9.3 billion |

| 2022 | $18 billion |

Creator metrics

| Creators who earn $1 million annually | 300 |

| Creators who earn $50,000 annually | 16,000 |

The Path to an OnlyFans IPO

The road to an OnlyFans IPO would involve several key steps, such as filing an S-1 form with the Securities and Exchange Commission (SEC), marketing the company to potential investors, and gauging investor interest. While the company has not yet filed for an IPO, understanding the IPO process is essential for potential investors who may be interested in buying OnlyFans stock should the company decide to go public.

Navigating the IPO process can be complex, with several factors to consider, such as regulatory requirements, investor interest, and market conditions.

IPO Filing Process

To file for an IPO, a company must first secure the services of an investment bank, prepare a registration statement, undergo due diligence, and complete regulatory filings. This process can take anywhere from six months to a year or more to complete.

In addition to these steps, the company must also determine its IPO pricing, stabilize its stock price, and transition to public trading.

Marketing and Investor Interest

A crucial aspect of a successful IPO is marketing the company to potential investors and generating interest in the stock. By promoting the unique investment proposition and showcasing the company’s growth potential, a well-executed marketing strategy can help attract investors and boost demand for the stock.

This is especially true for a platform like OnlyFans, which has a niche market and may face potential objections from investors due to the explicit content posted on the platform.

Investing in OnlyFans: Pros and Cons

Investing in OnlyFans presents both advantages and disadvantages. On the one hand, the platform’s rapid growth and increasing popularity offer potential growth opportunities for investors. Additionally, the subscription-based revenue model has proven successful, generating consistent income for both the platform and its creators.

On the other hand, potential risks associated with investing in OnlyFans include regulatory challenges and negative public perception due to explicit content posted on the platform. Furthermore, the company runs on a subscription based model and doesnt have any plans to advertise on its platform. This may lead to revenue losses if income from subscription falls.

Potential Growth Opportunities

OnlyFans’ increasing popularity, status as a major alternative to traditional social media, and the potential for an IPO present growth opportunities for potential investors. With notable users such as Cardi B and Tyga achieving considerable success on the platform in 2021, the platform’s appeal to a wide range of content creators and audiences is evident.

Moreover, OnlyFans’ subscription-based revenue model aligns with Warren Buffett’s concept of “float,” which refers to a consistent flow of cash customers pay to a company, making it an attractive investment option.

As the platform continues to grow and expand its user base, the potential for increased revenue and a successful IPO make OnlyFans an investment worth considering for those willing to take on the risks associated with its niche market.

Risks and Challenges

Potential risks and challenges of investing in OnlyFans include regulatory issues, competition from other platforms, and user fatigue. As the platform’s content often involves explicit material, it may face potential objections from investors based on moral and religious grounds. Additionally, as OnlyFans is not yet publicly traded, there may be limited information available on its specific risks and financials.

Alternative Investment Options

For investors interested in the social media and adult content industries but hesitant to invest in OnlyFans, alternative investment options are available. These options include established social media giants like SnapChat and Meta Platforms, Inc., as well as adult content companies like Playboy and Pornhub.

Social Media Platforms

Investing in established social media platforms like SnapChat (SNAP) and Meta Platforms, Inc. (META) can offer a more stable and diversified investment option than OnlyFans. These platforms have demonstrated impressive growth, with Snapchat experiencing a 22% year-on-year growth rate and Meta generating $114.98 billion in advertising revenue in 2022.

Adult Content Companies

Adult content companies like Playboy (PLBY) and New Frontier Media Inc. (NOOF) also provide alternative investment options for those interested in the adult entertainment industry. These companies have established brands and a history of generating revenue through content production and subscription-based models, similar to OnlyFans.

Summary

As the fastest-growing social media platform, OnlyFans presents a unique investment opportunity for those interested in its potential growth and niche market. While the company is currently privately held, the possibility of an IPO in the future could open up new investment opportunities.

By understanding the platform’s business model, potential growth opportunities, and associated risks, investors can make informed decisions about whether investing in OnlyFans is a suitable option for their portfolio. Furthermore, exploring alternative investment options such as established social media platforms and adult content companies can provide a diversified investment strategy for those interested in these rapidly growing markets.

Frequently Asked Questions

Is OnlyFans on the stock market?

Unfortunately, OnlyFans is not available on the stock market as it is a privately held company. Its parent company Fenix International Limited is owned by Leonid Radvinsky, an adult entertainment entrepreneur.

Therefore, it is not possible to buy OnlyFans stock at this time.

How do I buy shares in OnlyFans?

To purchase shares in OnlyFans, you’ll need to contact the company’s founder, Leonid Radvinsky, as the company is privately held.

Who is the CEO of OnlyFans?

Amrapali Gan is the current CEO of the platform. At 37 years old, he is highly focused on getting the company know for more then adult content.

Who has invested in OnlyFans?

OnlyFans has received funding from one investor, AvoInvest. Leo Radvinsky led the OnlyFans Acq-Fin round in May of 2023.