The upcoming Databricks IPO is generating a buzz among investors, and for a good reason. With a potential valuation of $40 billion, this San Francisco-based enterprise software company has been making waves in the data analytics and machine learning market. As we dive into the details of this highly anticipated IPO, let’s explore Databricks’ background, key financials, and competitive landscape to help you make an informed decision on whether to invest in this promising tech company.

Short Summary

Databricks is an enterprise software company with a unified data analytics platform, projected to become a highly-anticipated IPO in 2023 with an estimated valuation of over $40 billion.

Investors can take advantage of pre-IPO investment opportunities and should consider the associated risks before investing.

Databricks has a competitive edge over its competitors, and plans to use proceeds from the IPO for development. Expansion post listing.

Databricks IPO: Key Details and Timeline

Although an exact databricks IPO date has not been set yet, indications such as the selection of a lead underwriter or a confidential filing may suggest that the upcoming databricks stock IPO is within a six to twelve month window. When the IPO date is announced, it is expected that Databricks will list on either the New York Stock Exchange (NYSE) or the Nasdaq exchange.

In terms of the type of Initial Public Offering, it is likely that Databricks will opt for a traditional IPO rather than merging with a Special Purpose Acquisition Company (SPAC). While utilizing a SPAC enables a company to bypass the intricate and costly IPO process, a traditional IPO allows the company to obtain new capital in a more resource-intensive manner.

Databricks’ potential valuation of $40 billion is indeed a significant figure that has piqued the interest of many investors. As the IPO approaches, keeping an eye on any developments and announcements will be crucial for those looking to invest in this upcoming tech giant.

The Company Behind the IPO: Databricks Overview

Founded in 2013 by Ali Ghodsi and a team of experienced engineers from the University of California’s AMPLAB in San Francisco, Databricks has quickly grown into a leading enterprise software company. The company has secured over $850 million in funding, contributing to its impressive private valuation. Fidelity, Microsoft, Amazon, CapitalG, Salesforce Ventures, Tiger Global, Andreesen Horowitz, Blackrock, and New Enterprise Associates are among the prominent investors of the organization. They have heavily invested in the company to ensure its success.

Databricks announced a unified data analytics platform that accelerates data processing and machine learning workflows, and provides tools and optimizations that facilitate collaboration and AI-driven insights. With over 7 thousand organizations worldwide using Databricks for data science and analytics, the company has demonstrated its ability to deliver valuable solutions to clients like Condé Nast, H&M, Regeneron Pharmaceuticals, and Shell. Additionally, more than 40% of Fortune 500 companies have taken advantage of Databricks’ services.

Despite being a private company, Databricks has already gained recognition for its disruptive potential. The company ranked 34th on CNBC’s “Disruptor 50” list in 2021, up from 37th the previous year. This upward trajectory is a testament to the company’s growth and market impact, making it an attractive prospect for investors.

Investing in Databricks: Market Potential and Growth

Databricks, a leader in big-data-analytics and data warehouse market with a 14.99% share, is projected to become a highly anticipated IPO in 2023 or possibly in 2024, potentially making Databricks publicly traded with an estimated valuation of over $40 billion. The potential market for investing in Databricks would be contingent upon the industry and purpose of their products. This growth potential is further supported by investments from notable cloud technology firms like Amazon, Microsoft, Alphabet, and Salesforce.

The potential market for Databricks lies in data analytics, a long-term trend expected to remain strong in the decades to come. With increasing demand for data-driven insights and decision-making across industries, Databricks is well-positioned to capitalize on this trend and continue expanding its market share.

As the Databricks IPO approaches, investors should carefully consider the company’s growth potential and market positioning to make an informed decision. With major tech investors backing the company, Databricks is poised to become a significant player in the data analytics market.

Financials: Databricks Valuation and Revenue

Databricks Valuation

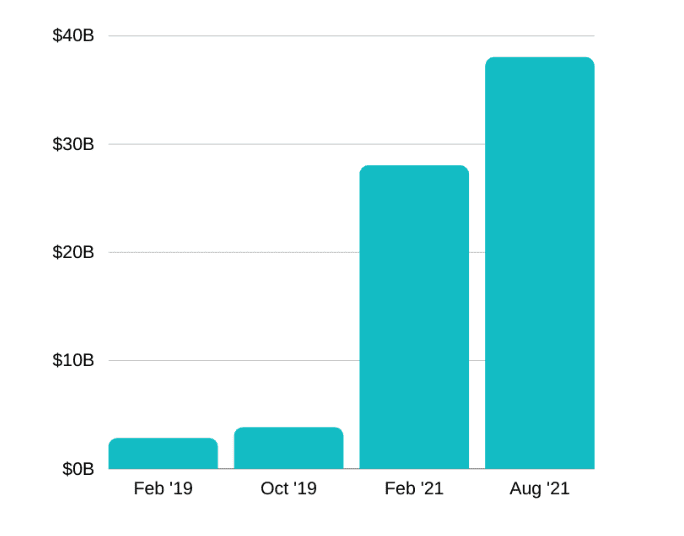

Databricks’ post-money valuation was $38 billion following the Series H funding of $1.6 billion in August 2021, and its revenue was reported to be over $800 million for the end of 2021. However, the company’s valuation has decreased to $33 billion as of October 2022, having been $38 billion in August 2021.

The reported revenue for Databricks in 2022 is estimated to be $1 billion, although no further details regarding the margins have been disclosed. While it is not explicitly stated whether Databricks is profitable, the company’s impressive revenue and decreasing valuation are important factors for potential investors to consider.

Major Players: Who Owns Databricks?

Ownership of Databricks is divided between its founders, financial institutions, and tech giants like Microsoft, Google, and Amazon. The company’s chief executive officer and co-founder, Ali Ghodsi, is a key figure in the organization.

Various financial institutions also hold an ownership stake in Databricks. This diverse ownership structure, which includes major tech companies and financial institutions, further underlines the company’s growth potential and market impact.

How to Invest in Databricks Pre-IPO

As the Databricks IPO date is yet to be announced, investing in Databricks pre-IPO can be a challenging endeavor. However, pre-placement of Databricks shares can be done before the IPO through platforms such as Freedom24.

While other platforms like eToro have not announced their availability yet, it is important for prospective investors to keep abreast of any updates regarding pre-IPO investment opportunities and stock price fluctuations.

Risks and Rewards: Is Databricks Stock a Good Investment?

Investing in IPOs is generally considered riskier than investing in known public market stocks. However, IPOs can also offer higher returns, with the Motley Fool often suggesting investments in high-growth, disruptive business models. To better estimate the potential risks and rewards of investing in Databricks stock, you can turn to reliable trade publications like Forbes, WSJ, Crunchbase, or TechCrunch for insights and guidance.

While the potential returns from investing in disruptive business models can be significant, it is essential for investors to carefully weigh the risks associated with investing in IPOs. A thorough understanding of the company’s financials, market position, and competitive landscape is crucial to making an informed decision on whether to invest in Databricks stock.

Databricks vs. Competitors: Competitive Landscape

Databricks is a strong competitor in the data analytics space. It offers a unique solution compared to platforms like Domino Data Lab, Alteryx, and Snowflake, as well as Amazon Web Services, Google, and Microsoft. However, what sets Databricks apart from its competitors is its unified analytics platform built on Apache Spark, enabling users to quickly and efficiently analyze data, develop models, and deploy applications.

In terms of performance, scalability, and ease of use, Databricks has demonstrated superiority when compared to its competitors. The company’s ability to handle large amounts of data quickly and effectively, coupled with its user-friendly interface, has made it a popular choice among data teams and data scientists worldwide.

Future Outlook: Databricks Post-IPO Plans

With the proceeds from a potential IPO, Databricks plans to use the funds to hire additional staff, broaden their product offerings, and further develop their Lakehouse software with additional security and governance features. In 2020, Databricks acquired Redash, an Israeli company that provides data visualization and dashboard building tools for analysts and data scientists. This acquisition demonstrates the company’s commitment to expanding its product portfolio and staying ahead of the competition.

Databricks’ future outlook post-IPO, however, remains uncertain. As with any investment, it is crucial for potential investors to keep a close eye on the company’s growth trajectory, financial performance, and market positioning to make an informed decision on whether to invest in Databricks stock.

Summary

In conclusion, the upcoming Databricks IPO presents a compelling investment opportunity for those interested in the rapidly growing data analytics market. As a leading enterprise software company with a strong market position and backed by major tech giants like Microsoft, Google, and Amazon, Databricks has the potential to deliver significant returns for investors.

Frequently Asked Questions

How much is Databricks stock valuation?

Databricks’ stock valuation is currently at $38 billion, following its most recent fundraising round in August 2021. The company’s valuation increased to $10 billion compared to its Series G round earlier that year.

What is the ticker symbol for Databricks?

Databricks does not currently have a publicly traded ticker symbol since it is a private company.

Is Databricks doing well?

Based on the growth of revenue and the recent round of funding, it is clear that Databricks is doing well. The company has seen steady revenue growth and recently received a massive injection of capital at a large valuation, suggesting that investors remain bullish about its prospects.

This is a positive sign for the company and its future prospects. It is likely that Databricks will continue to grow and expand its operations in the coming years.

Is Databricks going IPO?

It appears that Databricks is likely to go public in the near future, with current speculation suggesting a potential IPO could be underway as early as 2023 or potentially delayed until 2024.

While not yet officially confirmed, all signs point to an upcoming Databricks IPO.