Cathie Wood has taken the world of finance by storm, gaining fame as the visionary founder of ARK Invest and one of the most influential investors of our time. With her unwavering focus on innovative technology and disruptive companies, Wood has defied traditional investing norms and amassed a net worth of around $250 million, leading many to discuss her net worth. Join us as we dive into her investment strategies, her journey to wealth, and her perspectives on Bitcoin, space exploration, and more.

Short Summary

Cathie Wood’s current net worth is estimated to be $250 million, with ARK Invest’s AUM valued at over $13 billion.

Wood invests in innovative and disruptive technology companies for potential exponential growth, notable investments including Tesla, Apple and Coinbase.

Her successful journey began with a degree in finance & economics and has since included various roles at prominent firms as well as predictions of the 2008 housing collapse.

Cathie Wood’s Current Net Worth

As the CEO of ARK Invest, Cathie Wood has built a fortune through her investment management firm. With an estimated net worth of $250 million and ARK Invest’s assets under management (AUM) valued at $13 billion, Wood has become a force to be reckoned with in the financial world. Despite a decrease in her net worth in 2021, Wood remains confident in her investment strategies, believing that returns will exceed 50% within the next five years.

ARK Invest primarily focuses on innovative technology companies that are revolutionizing industries such as artificial intelligence, energy storage, and renewable energy. Cathie Wood’s net worth is a testament to her ability to identify and invest in cutting-edge companies with high growth potential.

The Birth of ARK Invest

In 2014, Cathie Wood founded ARK Invest, an investment management firm that has since grown its AUM to over $13 billion. The company, now situated in St. Petersburg, Florida, started from humble beginnings, with Wood personally financing it for three years before securing external investment. These early challenges did not deter her, and Wood’s determination led to the creation of a powerhouse in the world of finance, concentrating on companies at the forefront of technology.

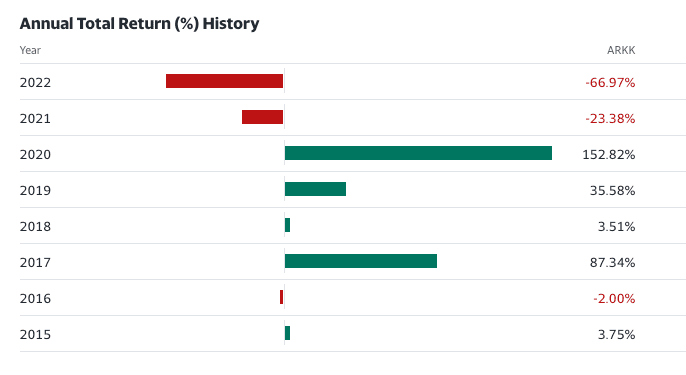

ARK Invest’s flagship fund, the ARK Innovation ETF, has been a resounding success, becoming the largest actively managed ETF with $7.8 billion in assets under management and an astounding 150% return in 2020. The company has since launched several other ETFs, each focusing on different sectors and industries driven by disruptive innovation.

ARK Invest’s ETFs

Cathie Wood’s ARK Invest ETFs target disruptive technology companies that have the potential to revolutionize industries and markets. Notable investments within these ETFs include Tesla, Apple, Square, and Zoom, among others. By focusing on such innovative companies, Wood’s investment strategy aims to capitalize on the immense growth potential offered by these trailblazing firms.

In addition to these well-known tech giants, Wood has also invested in companies like Trimble, an industrial technology organization, Coinbase, a prominent cryptocurrency exchange, and Exact Sciences, a maker of cancer diagnostic tools. These investments showcase Wood’s commitment to identifying and supporting companies at the cutting edge of their respective industries.

Wood’s Investment Strategies and Successes

Cathie Wood’s investment strategies revolve around identifying companies that demonstrate innovative characteristics and have the potential for significant growth. ARK. Invest’s website echoes this philosophy, emphasizing that disruptive technology is the key to higher returns and that focusing on retrospective benchmarks is not relevant for the future.

ARK Invest’s ETFs such as ARKK and ARKG have proved to be fruitful investments in the past five years. They have outperformed the market on a consistent basis. The ARKK fund has seen tremendous growth since 2016, increasing by an incredible 450%. It is bolstered by holdings in major tech companies such as Zoom, Tesla, Shopify, and Coinbase. Similarly, ARKG, which focuses on technologies such as molecular diagnostics and genetics, has seen an impressive growth of approximately 340%.

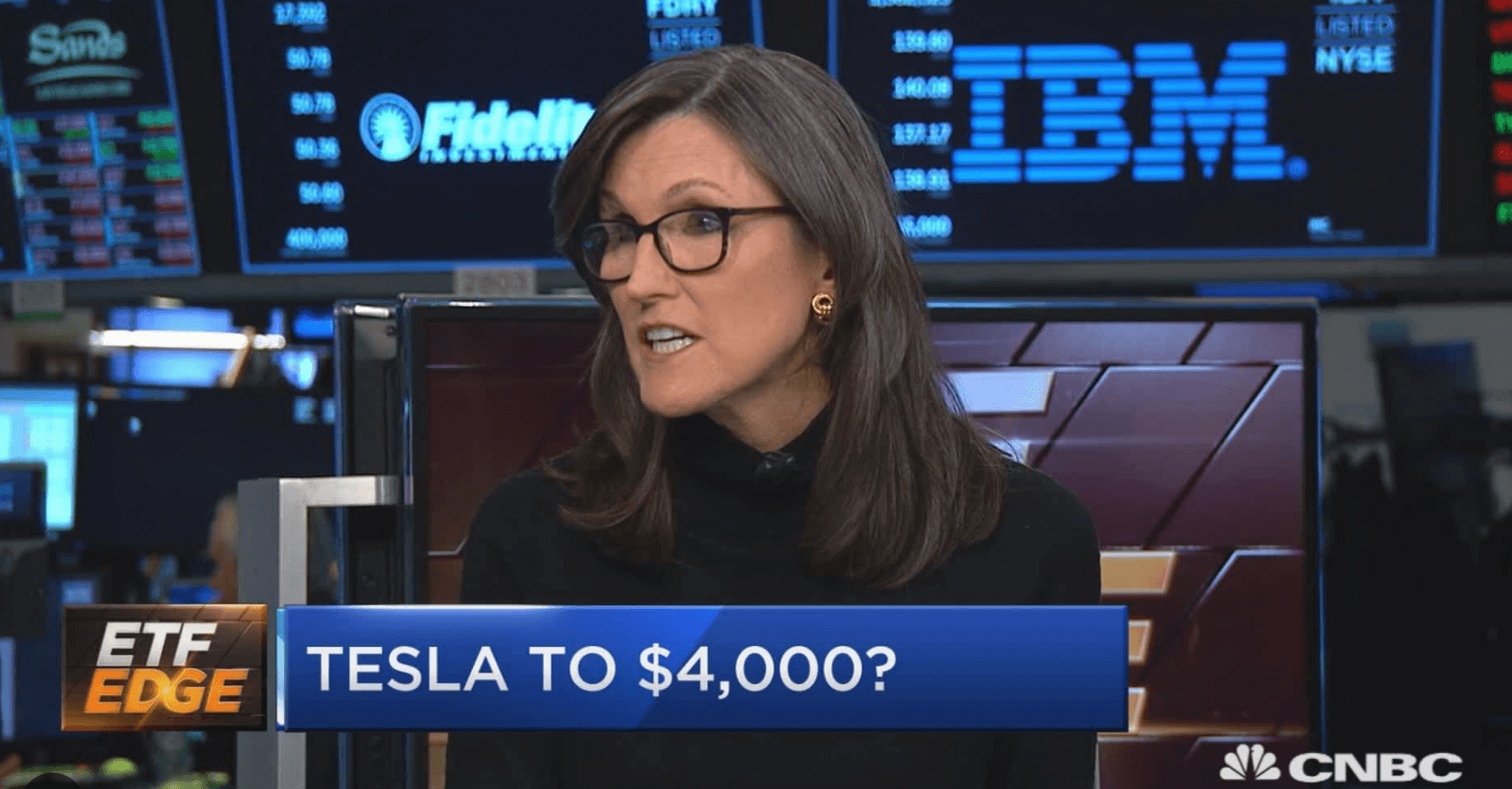

Wood’s successes are not limited to her ETFs’ performance. She has also made bold predictions, such as Tesla’s share price reaching $4000 and Bitcoin hitting $500k. These predictions, though met with skepticism by some, showcase her confidence in the future of disruptive technologies and her ability to identify potentially game-changing investments.

The Journey to Wealth: Cathie Wood’s Career Path

Before founding ARK Invest, Cathie Wood had already built an impressive career in the world of finance. She began her journey by obtaining a degree in finance and economics and then landed her first job as an assistant economist at Capital Group, under the mentorship of esteemed professor Arthur Laffer.

Wood’s career progressed through roles at various financial firms, including Capital Group, Jennison Associates, AllianceBernstein, and Tupelo Capital Management. During her tenure at Jennison Associates, she faced criticism, particularly during and after the 2008 financial crisis. However, Wood remained resilient and continued to refine her investment strategies.

In 2014, Wood founded ARK Invest, drawing on her wealth of experience across different financial firms and her passion for investing in disruptive technologies. Today, Wood’s net worth and the success of ARK Invest stand as a testament to her vision and determination in the world of finance.

Cathie Wood’s Views on Bitcoin and Cryptocurrency

Cathie Wood has been an outspoken proponent of Bitcoin and other cryptocurrencies. She views Bitcoin as a beneficial investment for safeguarding wealth against inflation and potentially serving as an insurance mechanism. Wood also believes that cryptocurrencies have the potential to disrupt the existing financial system and praises the durability of cryptocurrencies like Bitcoin and Ethereum.

ARK Invest’s involvement in the cryptocurrency space is evident through its investments in crypto projects such as Coinbase and Grayscale Bitcoin Trust, making it one of the notable institutional holders of Bitcoin shares. Wood’s advocacy for cryptocurrencies showcases her commitment to embracing disruptive technologies and staying ahead of the curve in the investment world.

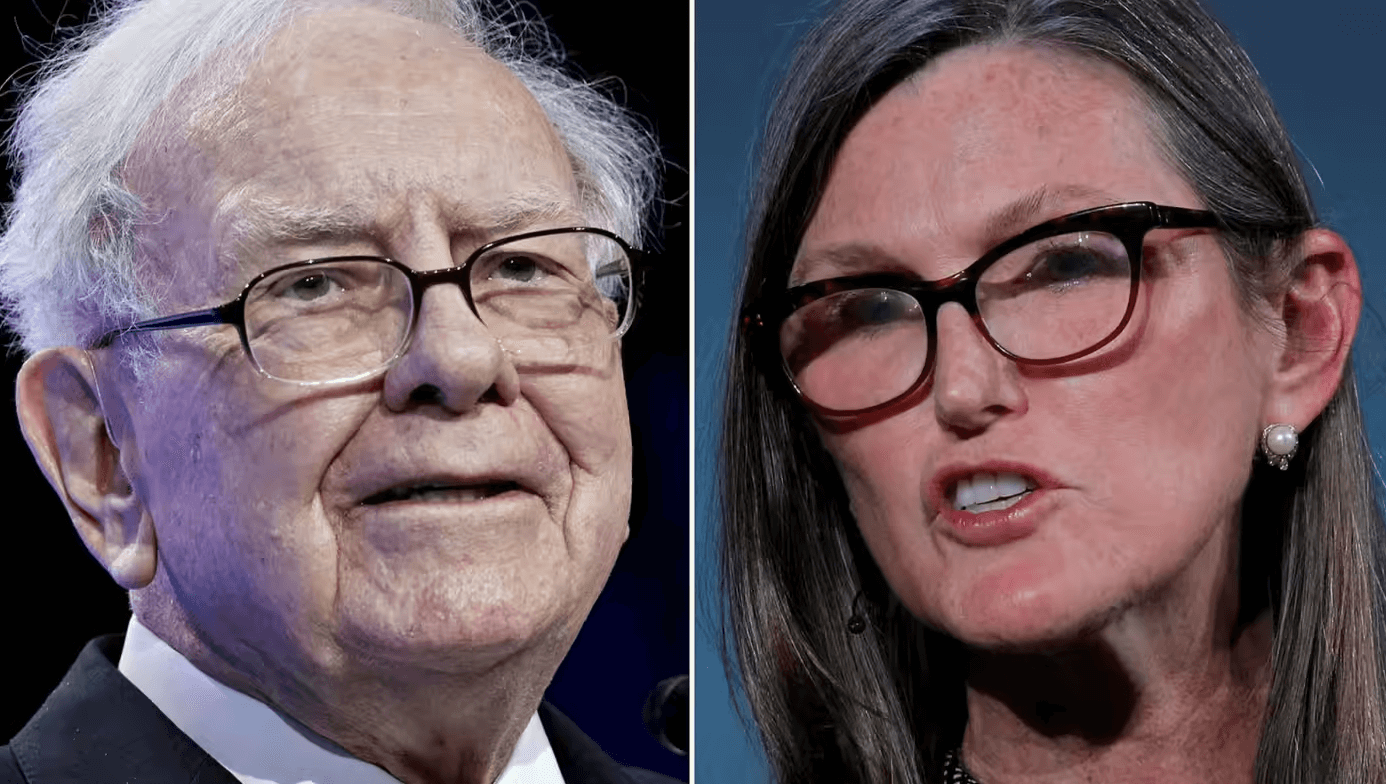

Diverging from Traditional Investing: How Wood Differs from Buffett

Cathie Wood’s investment philosophy contrasts sharply with that of legendary investor Warren Buffett. While Buffett is known for his value investing approach, focusing on companies with consistent performance and strong financials, Wood targets companies with high potential growth and disruptive technologies.

This divergence in investment strategies highlights the different perspectives that these two influential investors bring to the table. Buffett’s approach values consistency and stability, while Wood’s strategy emphasizes the importance of innovation and the potential for exponential growth.

Wood’s Interest in Space Exploration and Related Technologies

Cathie Wood’s investment interests extend beyond Earth, as she has demonstrated significant enthusiasm for space exploration and its related technologies. Wood has invested in startups like SpaceX, Blue Origin, and Virgin Galactic, as well as cutting-edge technologies such as Electro-Aerodynamics and 3D printing.

Through the ARK Space Exploration & Innovation ETF, Wood further showcases her commitment to this burgeoning industry. By investing in companies connected to space exploration and related technologies, Wood positions herself and her investors to potentially benefit from the immense growth potential that this industry offers.

Challenges and Controversies: Wood’s Predictions and Market Response

Cathie Wood’s success has not come without its fair share of challenges and controversies. In 2006, Wood predicted the 2008 housing collapse, but she noticed it too early, leading her to abstain from risk with her portfolio, which ultimately resulted in poorer performance. Wood counterbalanced this loss by altering her strategy and investing in high-risk assets.

Wood has also made bold predictions about Tesla’s share price and Bitcoin, which have been met with mixed market responses. Some critics argue that her predictions are overly optimistic or even unrealistic, while others see them as evidence of her visionary investment approach.

Despite these challenges and controversies, Wood has remained steadfast in her investment philosophy and strategies, continuing to identify and invest in disruptive technologies and high-growth companies. Her successes with ARK Invest and her bold predictions reflect her unwavering belief in the potential of these innovative firms to transform the world.

Summary

Throughout this blog post, we have explored Cathie Wood’s journey to wealth, her investment strategies, and her notable successes. From her early career in finance to the founding of ARK Invest, Wood has demonstrated a keen eye for identifying disruptive technologies and the potential for exponential growth. Her investments in companies like Tesla, Apple, Square, and Zoom, as well as her advocacy for Bitcoin and space exploration, showcase her commitment to supporting game-changing innovations.

Cathie Wood’s story serves as an inspiration to investors and entrepreneurs alike. By embracing disruptive technologies and staying ahead of the curve, she has built a net worth of around $250 million and changed the face of the investment world. As we continue to witness the rise of innovative companies and industries, there is no doubt that Cathie Wood will remain at the forefront, shaping the future of finance.

Frequently Asked Questions

How did Cathie Wood become rich?

Cathie Wood achieved her wealth through her impressive ability to predict stock market trends and by taking calculated risks as an investor. After starting her own firm, Ark Invest, she successfully invested in Tesla shares and other select companies, resulting in a sizable return on investment that has made her millions.

How much does Cathie Wood make?

Cathie Wood is a respected and successful investor with an estimated net worth of $250 million as of 2023. This impressive figure is the result of her income from ARK Invest, her company’s remarkable growth, and her investments in various stocks such as Tesla and Roku.

How much Tesla does Cathie Wood own?

Cathie Wood currently owns 4 million Tesla shares, worth over $400 million and representing 11.52% of her firm’s stock portfolio. This first purchase was made in Q4 2016.