Gamma is a critical Greek in options trading. Understanding and managing gamma allows options traders to forecast delta changes, implement delta-hedging strategies, and optimize their risk-reward profile in different market conditions. This is a powerful tool that options traders must master to navigate the complex and ever-changing options market.

What is Gamma in Options Trading?

Gamma (Γ) is a measure of the rate of change of an option’s delta. Delta, itself, represents how much an option’s price changes (remove bold + underline and link to the Delta guide) in response to a $1 change in the price of the underlying asset.

Here are some key points to remember about gamma:

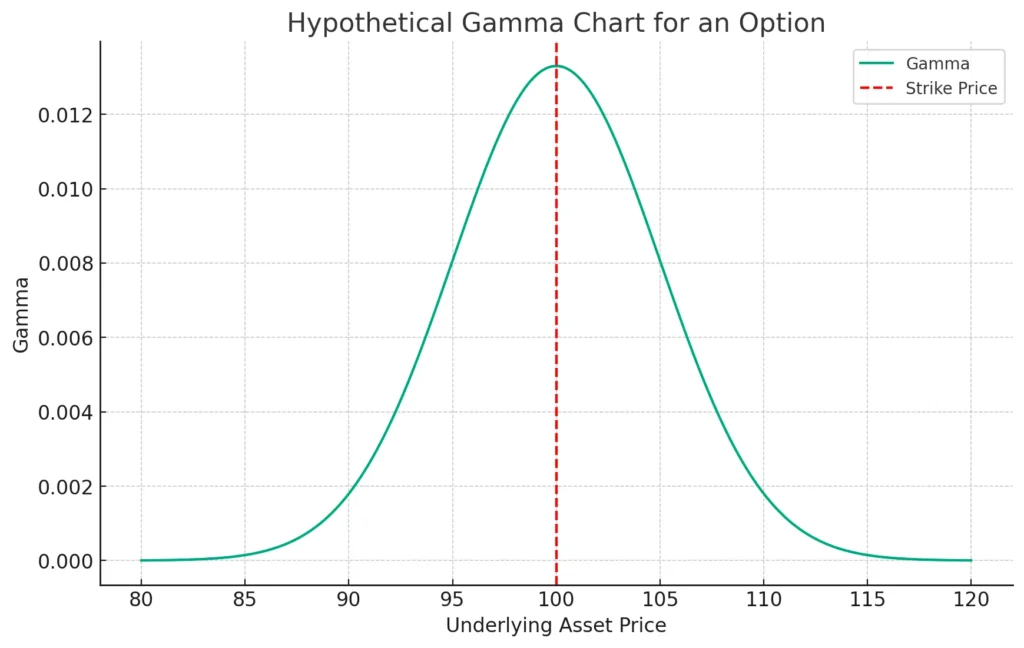

- Gamma is highest when an option is at-the-money (ATM). This means the strike price of the option is close to the current price of the underlying asset. As the option moves in-the-money (ITM) or out-of-the-money (OTM), gamma decreases.

- Gamma is also higher for options closer to expiration. This is because time decay (theta) has less time to erode the option’s value, making it more sensitive to price changes.

- Gamma can be used for hedging strategies. By understanding how gamma affects the delta, traders can adjust their positions to manage their risk exposure.

Now that you know the basics, let’s go in-depth.

What Gamma is Used For

Essentially, it offers valuable insights and influencing various strategies.

Here’s a breakdown of its key functions.

Sensitivity: Unpacking Delta’s Change

Imagine delta as the rate of change in an option’s price relative to the underlying asset’s price. Gamma takes this a step further, measuring how quickly delta itself changes with each small movement in the underlying asset’s price.

Think of it as the “acceleration” of delta.

A high gamma indicates that delta can experience significant shifts even with minor underlying asset price changes. This can amplify your profits or losses, depending on your position.

Hedging: Managing Risk

Gamma’s ability to measure delta’s sensitivity makes it a valuable tool for hedging options positions. By strategically pairing options with opposing gammas, you can offset some of the risks associated with price movements.

This is similar to how counterweights balance each other on a seesaw, creating stability.

For example, a long call option (right to buy) can be hedged by a short put option (right to sell) with a balancing gamma. This helps mitigate the impact of price fluctuations on your overall position.

Strategies: Exploiting Opportunities

Drawing on gamma’s insights, traders can develop sophisticated strategies like delta-neutral approaches. These aim to maintain a delta of zero, regardless of underlying asset price changes. This can be used to reduce risk or capitalize on volatility through other means.

Example of Gamma

Let’s imagine you own a long call option on a stock currently trading at $100 with a strike price of $100 (at-the-money).

The option has a delta of 0.5 and a gamma of 0.1.

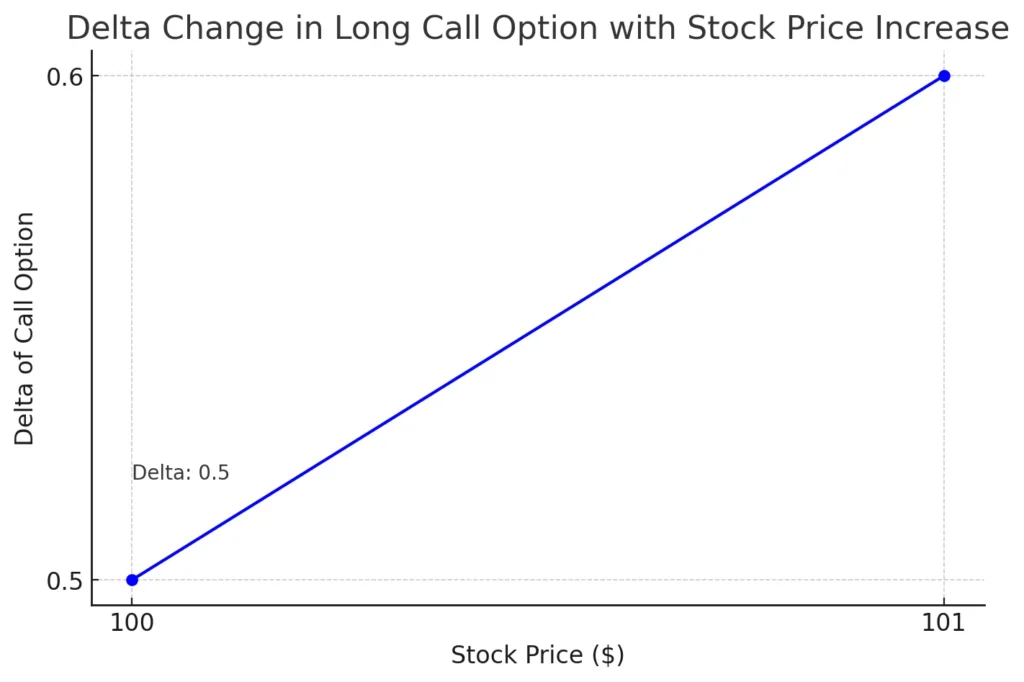

Scenario 1: Price Rise

- The stock price increases by $1 to $101.

- The delta of your call option increases by 0.1 (gamma * price change), resulting in a new delta of 0.6.

- This means the value of your option becomes more sensitive to further price increases.

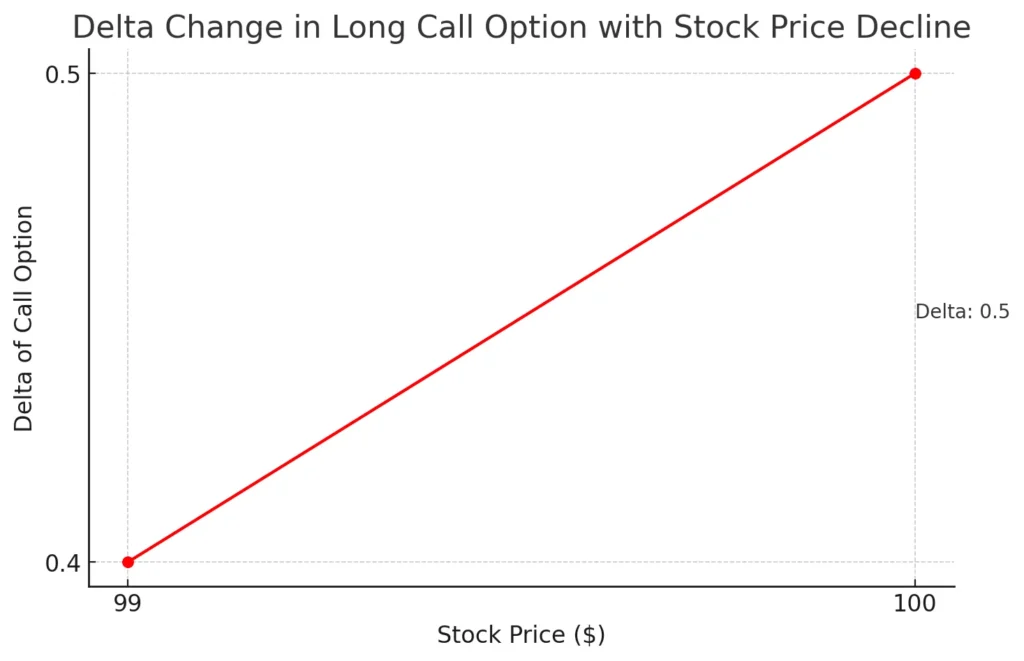

Scenario 2: Price Decline

- The stock price decreases by $1 to $99.

- The delta of your call option decreases by 0.1 (gamma * price change), resulting in a new delta of 0.4.

- This means the value of your option becomes less sensitive to further price declines.

How Traders Use Gamma (The Right Way)

Traders use gamma in several ways, primarily for hedging and speculating based on the underlying asset’s price movements and volatility.

Here’s a breakdown.

Hedging Delta

- Delta-neutral hedging: This strategy aims to maintain a zero net delta position, meaning any gains or losses from price changes in the underlying asset are offset by changes in the option’s value. Gamma plays a crucial role here. By understanding how gamma influences delta’s rate of change, traders can adjust their portfolio actively to keep delta close to zero, minimizing directional exposure.

- Gamma scalping: This involves exploiting short-term fluctuations in gamma to generate profits. Traders adjust their delta-neutral positions by buying or selling small amounts of options based on gamma changes, aiming to benefit from the temporary gains before rolling over their positions before expiration.

Speculating on Volatility

- Exploiting high gamma: Options with high gamma values are more sensitive to price changes in the underlying asset. This presents an opportunity for amplified gains but also magnified losses. Traders who believe the underlying asset’s price will experience significant movements (volatility) may utilize high-gamma options to potentially earn larger profits, though with increased risk.

- Gamma squeezes: These occur when large buying pressure drives up the price of an option, causing its gamma to increase further, attracting even more buying, creating a self-fulfilling price surge. However, such squeezes can be volatile and susceptible to sudden reversals, making them risky speculation tools.

3 Methods: How To Manage Gamma Risk

Gamma, while providing valuable information, can also expose your options positions to significant risks.

Luckily, several strategies can help you manage and lower the risk:

1. Adjusting Positions

- Reduce exposure: If your overall gamma is high, consider selling some of your options or rolling them into options with lower gammas (e.g., out-of-the-money options). This reduces your potential profit but also limits potential losses.

- Increase neutrality: For directional bets, use a combination of options (e.g., spreads) to achieve a closer-to-zero gamma position. While reducing potential returns, this minimizes gains or losses from small price movements.

Traders often consider gamma in conjunction with other Greeks like delta and theta to make informed decisions.

2. Hedging with Other Assets:

- Delta-neutral hedging: Pair your options with underlying assets or other options with opposite gammas. This aims to offset the delta changes, stabilizing your overall position regardless of price fluctuations.

- Stock vs. options hedging: Hedge delta moves using the underlying asset itself. Buying the stock for long calls and selling it for short puts can neutralize delta but carries its own risks and capital requirements.

3. Monitoring and Adapting

- Regular monitoring: Keep track of your position’s gamma and delta as the underlying asset’s price moves. Early detection of increasing gamma allows for proactive adjustments.

- Stop-loss orders: Set stop-loss orders to automatically exit positions exceeding your risk tolerance, particularly when gamma is high.

Gamma hedging requires constant monitoring and adjustments, making it a more advanced technique compared to basic delta-neutral hedging.

Conclusion

Gamma is one of the “Greeks” used in options trading. It represents the rate of change of an option’s delta with respect to the underlying asset’s price. By understanding gamma’s characteristics, such as its peak at-the-money and its acceleration closer to expiry, traders can develop strategies to exploit volatility, hedge portfolios, and optimize their risk-reward profile

Frequently Asked Questions

What is “Gamma Exposure”?

Gamma exposure (GEX) is a concept in options trading that measures the rate of change of an option’s delta.

In simpler terms: It tells you how quickly the sensitivity of an option’s price to changes in the underlying asset’s price (delta) changes itself.

What is a “Gamma Wall”?

A gamma wall in trading refers to a concentration of gamma exposure, which is the rate of change of an option’s delta, at a specific price level for a particular underlying asset.

It’s essentially a barrier created by a large number of options contracts that can significantly impact the price movement of the underlying asset.

What is the “Gamma Blast” in Trading?

In trading, the term “Gamma Blast” refers to a situation where there’s a rapid increase in the value of gamma in options trading, leading to significant market movements. Gamma measures the rate of change in an option’s delta for a one-point move in the underlying asset’s price.

When gamma is high, small changes in the stock price can cause large changes in delta, leading to more significant adjustments in option positions by market makers. This can result in increased volatility and potentially large price movements in the underlying asset.