The Volume-Weighted Average Price (VWAP) indicator is a cornerstone of modern trading, offering a nuanced view of market dynamics by blending price action with trading volume. Developed in the 1980s by Kyle Krehbiel, VWAP has evolved beyond its initial scope, now serving as a critical tool for traders and investors aiming to discern the true market value of securities. This guide delves into the intricacies of VWAP, from its foundational calculation methods to its strategic application in trading scenarios.

What Is VWAP?

VWAP stands for volume-weighted average price. It’s a technical analysis indicator used to measure the average price of a security over a specific period, taking into account the volume of trades at each price point.

In simpler terms: VWAP tells you the average price at which a stock has actually been traded throughout the day, weighted by the volume of each trade.

VWAP Formula: Typical price = (High price + Low price + Close price) / 3

Later in this guide we’ll explain how to properly calculate it.

What Does VWAP Tell You?

VWAP tells you the average price a security has traded at throughout the day, based on both volume and price. It’s a snapshot of where the money is moving and at what price.

Essentially, it gives traders insight into the market’s trend and the best points for entry or exit.

Use & Importance of VWAP

The importance of VWAP comes from its unique ability to provide valuable insights into a security’s trading activity through three key functions.

Market Sentiment:

VWAP acts as a sentiment indicator, revealing where the majority of trading volume lies – above or below the VWAP line.

When the VWAP is higher than the current price, it signifies more buying pressure, suggesting potential bullish sentiment.

Conversely, a VWAP below the price indicates more selling, hinting at bearish tendencies

Support and Resistance Levels:

The VWAP line often acts as a dynamic support or resistance level. Buyers and sellers may cluster around the VWAP, making it a point of potential price bounce or reversal.

This can be helpful for traders to plan entry and exit points for their positions.

Timing Trade Entries and Exits:

Some traders use VWAP as a timing tool.

Entering a trade when the price dips below the VWAP could signal a buying opportunity, while selling when the price surges above the VWAP might indicate a potential profit-taking point.

However, it’s crucial to remember that VWAP is a lagging indicator and shouldn’t be solely relied upon for predictions.

Differences: VWAP vs Simple Moving Average

VWAP acts like a weighted scale → Giving more importance to trades with higher volume to reveal the “true” average price.

Simple Moving Average just smooths out closing prices → To show you the general trend, ignoring the bustle of individual trades.

Let’s take a look at a table:

| Difference | VWAP | Simple Moving Average |

|---|---|---|

| Calculation | Takes into account both price and volume | Only considers closing prices |

| Interpretation | Represents the “true” average price weighted by volume | Shows the average closing price trend |

| Applications | Identifying support and resistance levels, gauging market sentiment, timing trades | Identifying long-term trends, confirming short-term breakouts, acting as support/resistance |

| Limitations | More sensitive to volume changes, lagging indicator | Ignores volume, prone to false signals in choppy markets |

VWAP and SMA are similar, but achieve their goals fundamentally different ways, leading to distinct interpretations and applications.

How to Calculate VWAP Yourself

There are two main ways to calculate VWAP: manually and using software.

We’ll now go in-depth on both methods.

Manually Calculating

Gather your data: You’ll need data on the price and volume of each trade for the security you’re interested in, over the time period you want to calculate the VWAP for. This data can be obtained from a financial data provider or from your brokerage firm.

Calculate the typical price for each trade: The typical price is the average of the high, low, and close prices for each trade. So, for each trade, you’ll need to do the following:

Typical price = (High price + Low price + Close price) / 3

Multiply the typical price for each trade by the volume of that trade: This will give you the dollar value of each trade.

Sum the dollar values of all the trades: This will give you the total dollar value of all the trades for the time period you’re interested in.

Sum the volume of all the trades: This will give you the total volume of all the trades for the time period you’re interested in.

Divide the total dollar value of all the trades by the total volume of all the trades: This will give you the VWAP.

Example of a manual calculation:

| Time | High | Low | Close | Volume | Typical Price | Trade Value |

|---|---|---|---|---|---|---|

| 9:00 AM | $10.00 | $9.80 | $9.90 | 100 | $9.90 | $990.00 |

| 9:05 AM | $10.10 | $9.95 | $10.00 | 200 | $10.01 | $2002.00 |

| 9:10 AM | $10.05 | $9.90 | $9.95 | 300 | $9.97 | $2991.00 |

Total dollar value of all trades: $5983.00

Total volume of all trades: 600

VWAP: $5983.00 / 600 = $9.97

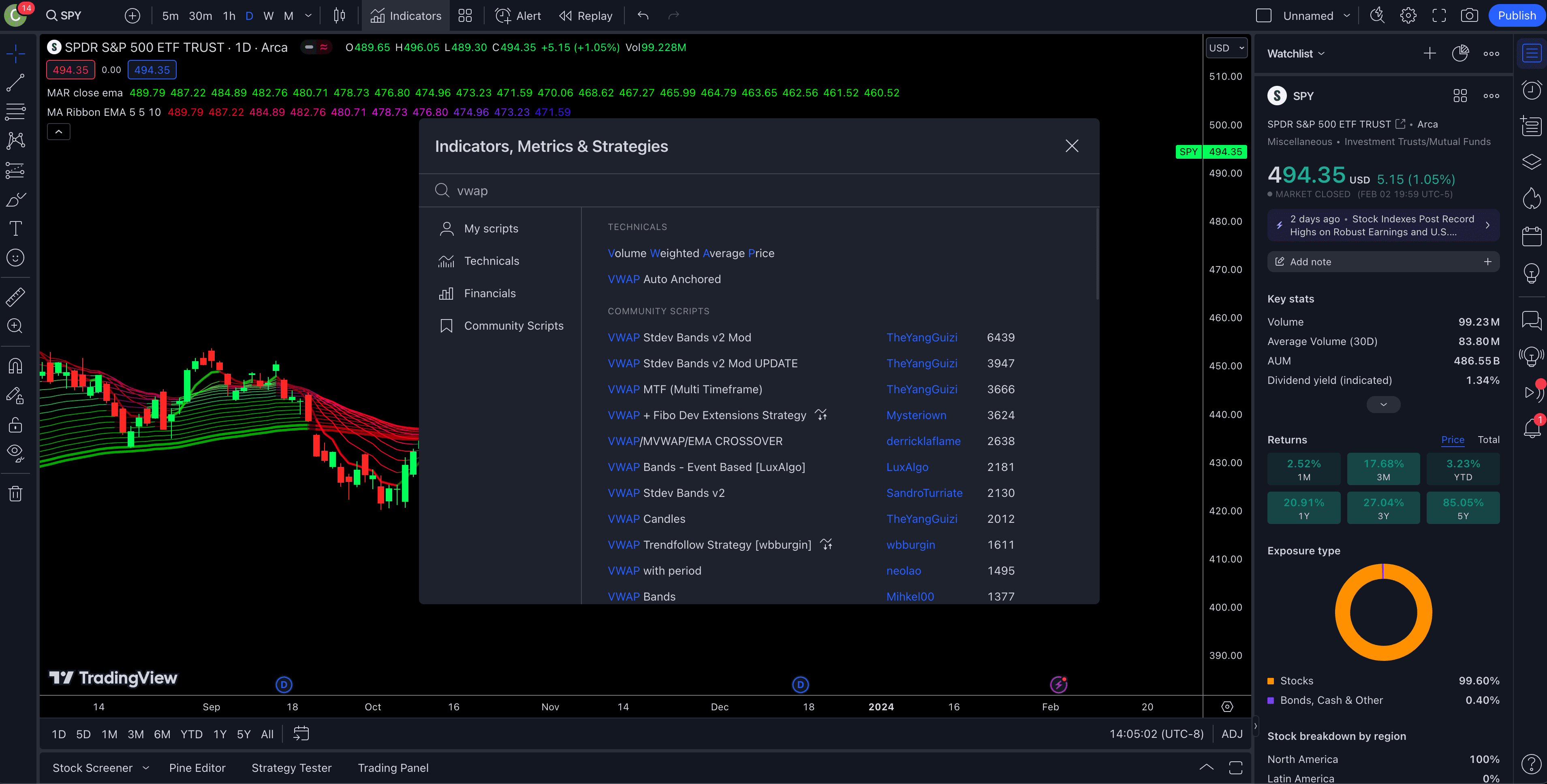

Using Software

Most financial software programs will have a built-in function for calculating VWAP. This can save you a lot of time and effort, especially if you’re calculating VWAP for a large number of securities or for a long time period. Two of the top-rated tools are NinjaTrader and TradingView.

Examples: VWAP in Real Life

1. Stock Repurchases

Companies sometimes buy back their own shares to boost their value or reward shareholders.

They might agree to spend a fixed amount, like $175 million as Guess did. But how many shares do they get for that money?

Enter VWAP — The final number of shares repurchased is calculated based on the average price the stock traded at during the buyback period (often using VWAP). This ensures a fair deal for both the company and shareholders.

2. Mergers and Acquisitions

When two companies decide to tie the knot, they need to figure out how much one company’s stock is worth compared to the other’s.

VWAP can be used to set the exchange ratio – how many shares of one company you get for each share of the other.

For instance, Public Storage’s offer to Life Storage valued the latter at a 19% premium to the 20-day VWAP of both stocks. This means Life Storage shareholders were getting a pretty sweet deal!

3. VWAP in action

Imagine a graph with a stock price line and a VWAP line. When the price line consistently sits above the VWAP, it suggests strong buying pressure and potential for future growth.

If the price dips below the VWAP, it could indicate selling pressure or a potential buying opportunity for bargain hunters.

VWAP is just one tool in the M&A toolbox. It’s crucial to consider other factors like company financials, future prospects, and overall market conditions before making investment decisions.

VWAP: Pros & Cons

1. Pros (Benefits)

More accurate average price: Takes volume into account, giving more weight to trades with higher impact, unlike a simple moving average.

Gauges market sentiment: Helps identify buying and selling pressure by comparing the price to the VWAP. Above VWAP suggests bullishness, below suggests bearishness.

Identifies support and resistance: VWAP often acts as a dynamic support or resistance level, where buyers and sellers may cluster, offering potential entry and exit points.

Timing trade entries and exits: Can be used to identify potential buying opportunities when the price dips below the VWAP or selling opportunities when it rises above.

2. Cons (Limitations)

Lagging indicator: Reflects past data, making it less reliable for predicting future price movements.

Sensitive to volatility: Can be more volatile than other indicators, especially in highly volatile markets, potentially leading to misleading signals.

Volume dependence: Relies heavily on volume data, which may be inaccurate or unavailable in certain situations.

Not standalone tool: Should be used in conjunction with other technical and fundamental analysis for better decision-making.

Frequently Asked Questions

What is the significance of VWAP?

VWAP serves as a benchmark for traders and investors, helping them determine the market’s direction and make decisions about entry and exit points. It is particularly useful for identifying whether a stock is trading at a higher or lower price relative to its average, which can indicate buying or selling pressure.

Can VWAP be used for long-term investing?

While VWAP is primarily an intraday indicator due to its reset at the start of each trading day, it can also offer insights for long-term investors. For instance, long-term investors might use VWAP to assess the average price over a day or look for patterns over multiple days to inform their decisions about entry or exit points.

What are the limitations of VWAP?

VWAP has several limitations. It is a lagging indicator, meaning it is based on past data and may not accurately predict future market movements. Additionally, its effectiveness diminishes later in the trading day as the cumulative calculation includes all data from the session start, increasing the lag. VWAP is also less useful over multiple days since it resets daily.

How can VWAP be used in trading strategies?

Traders often use VWAP to identify potential support and resistance levels. A common strategy involves buying when the price is below the VWAP (indicating the asset may be undervalued) and selling when the price is above the VWAP (suggesting it may be overvalued). VWAP can also help in confirming trends and in the execution of large trades by institutional investors to minimize market impact.