In the ever-fluctuating world of financial markets, traders and investors constantly seek reliable tools to navigate the complex landscape of price movements. Among the myriad of technical analysis patterns, the double top stands out as a compelling formation that can signal a potential shift in market sentiment. This article delves into the intricacies of the double top pattern, exploring its characteristics, implications, and practical applications in trading strategies.

What is the Double Top pattern?

A double top is an extremely bearish technical reversal chart pattern that forms in the price movement of an asset, such as a stock, bond, or commodity. It signifies a potential shift in momentum from an uptrend to a downtrend.

What it looks like

A double top pattern resembles the letter “M” when visualized on a price chart.

- Two Highs (Peaks): The pattern consists of two relatively equal price highs, signifying potential resistance levels where the price struggled to break through.

- Neckline: A horizontal support level drawn at the lowest point between the two highs. This line represents a price area where buying pressure might have previously halted a decline.

- Trough (Valley): The dip in price between the two highs.

What it indicates

A double top pattern indicates a potential reversal from an uptrend to a downtrend. It suggests that the bullish momentum is weakening and sellers are gaining control.

- Loss of Buying Pressure: The price reaching similar highs twice suggests buyers are hesitant to push the price higher. They might be encountering resistance or seeing less favorable conditions.

- Profit Taking: Existing investors who bought earlier might be taking profits at these highs, leading to selling pressure.

- Shifting Sentiment: The double top pattern can indicate a change in market sentiment. Investors might be becoming more cautious or bearish on the asset’s future prospects.

How to spot the Double Top pattern

Spotting a double top pattern involves careful observation of a price chart:

- Upward Trend: Look for the pattern to form after a preceding uptrend. This strengthens the reversal signal as it suggests a potential exhaustion of buying pressure.

- First Peak: Identify the first distinct peak in price. This represents the initial attempt to break through a resistance level.

- Trough: Look for a price decline following the first peak. This trough indicates a pause in the uptrend and potential selling pressure.

- Second Peak: Identify the second price peak that’s roughly equal to the first peak. This signifies another attempt to overcome resistance, but with failing momentum.

- Neckline: Draw a horizontal line at the lowest point between the two peaks. This line represents a support level where buyers might have previously stepped in.

Confirmation: The double top isn’t confirmed until the price decisively breaks below the neckline. This breakdown suggests a potential shift in control from buyers to sellers and a continuation of the downtrend.

Real Example of a Double Top

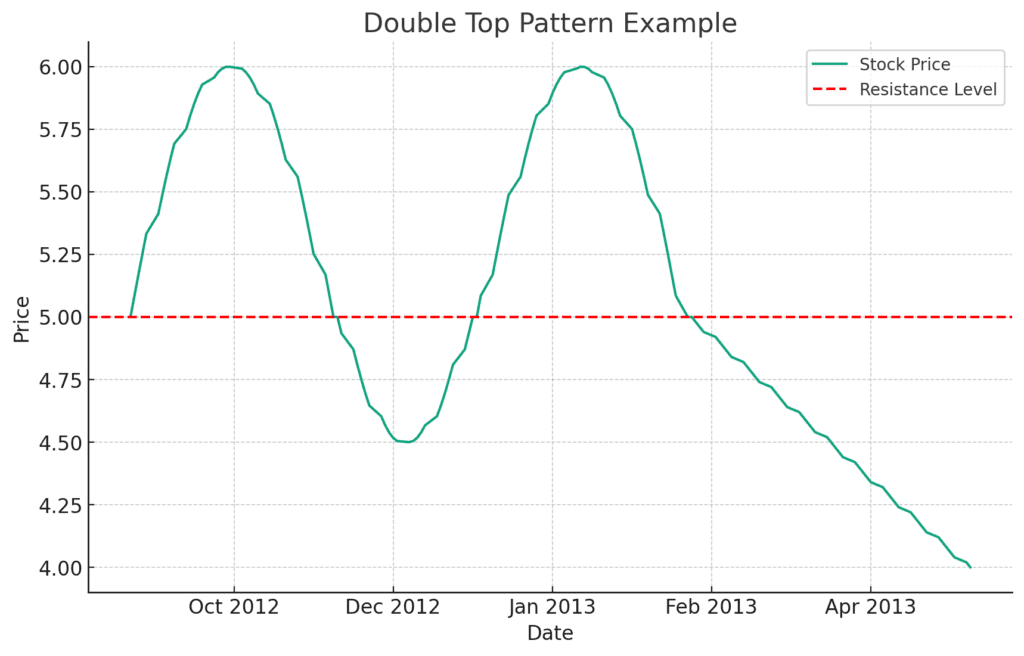

A classic example of a double top in the stock market occurred with Apple Inc. (AAPL) around the end of 2012 and the beginning of 2013.

Here’s what happened:

- During this period, Apple’s stock price peaked twice in close succession, at levels just over $700 (pre-split), before experiencing a significant decline.

- This pattern resembled the shape of the letter “M”, which is characteristic of a double top.

- This scenario highlighted investor sentiment reaching a peak twice, with a notable pullback after each peak, suggesting a reversal from a previous uptrend.

How to Trade a Double Top

Trading a double top pattern involves recognizing the potential reversal signal and taking calculated steps to profit from a potential downtrend.

1. Identify it

Upward Trend: Look for the double top to form after a clear uptrend. This strengthens the bearish reversal signal.

Two Peaks and Neckline: Identify the two price highs and draw the neckline, the horizontal support level between them.

2. Entry point

Breakdown Confirmation: Wait for the price to decisively close below the neckline. This confirms the bearish breakout and potential downtrend.

Sell Order: Once confirmation is established, you can initiate a short sell order, essentially borrowing the asset to sell it at a higher price hoping to repurchase it later at a lower price to return it and pocket the difference.

3. Stop-Loss

Place a stop-loss order above the highest of the two peaks in the double top pattern. This limits your potential loss if the price movement doesn’t follow the expected downtrend.

4. Take profit

One common approach is to set a take-profit target based on the height of the double top pattern.

- Measure the vertical distance between the neckline and the highest peak.

- Then, project that distance down from the neckline to estimate a potential downside target price.

Comparison, Double: Top vs Bottom

| Double Top | Double Bottom | |

|---|---|---|

| Shape | M-shaped | W-shaped |

| Trend Signal | Bearish reversal (downtrend) | Bullish reversal (uptrend) |

| Confirmation Point | Price falls below neckline | Price rises above neckline |

1. Shape

- Double Top: Resembles an ‘M’ shape, with two sequential high price points and a valley in between.

- Double Bottom: Resembles a ‘W’ shape, with two sequential low price points and a peak in between.

2. Trend Signal

- Double Top: Indicates a potential bearish reversal, suggesting a shift from an uptrend to a downtrend.

- Double Bottom: Indicates a potential bullish reversal, suggesting a shift from a downtrend to an uptrend.

3. Confirmation Point

- Double Top: Confirmed when the price falls below the neckline (horizontal support level between the two peaks).

- Double Bottom: Confirmed when the price rises above the neckline (horizontal resistance level between the two troughs).

Both double tops and bottoms are more reliable when formed after a significant trend in the opposite direction (uptrend for double top, downtrend for double bottom).

Conclusion

It is crucial to approach the double top pattern with caution and discipline, as misinterpretation or premature entry can lead to suboptimal results. Traders must remain vigilant in confirming the pattern’s validity through volume analysis, neckline breaks, and other supporting indicators. Furthermore, the double top should not be viewed in isolation but rather as part of a comprehensive trading plan that accounts for market context, risk management, and individual trading style.

Frequently Asked Questions

Is double top pattern bullish?

No, a double top pattern is not bullish. It is a bearish reversal pattern, indicating a potential shift from an uptrend to a downtrend.

While double tops can be useful technical indicators, it’s important to remember that they are not foolproof.

What are the rules for a double top?

By rules, we assume that you’re referring to the conditions of a double top:

- Formation: It looks like the letter “M”. The pattern is formed when the price peaks, retraces, rises back to the same level (or nearly) as the first peak, and then declines again.

- Peaks: The two peaks should be at a similar price level, showing strong resistance at this price point.

- Valley: The low point between the two peaks is called the neckline or support level. The decline from the second peak needs to break this level to confirm the pattern.

- Confirmation: The pattern is confirmed when the price falls below the neckline after the formation of the second peak.

- Volume: Ideally, volume is higher on the rise towards the first peak and lower during the formation of the second peak, indicating waning buying interest.

- Target Price: After confirmation, the price target is often predicted by the height of the formation subtracted from the neckline.

Remember, while it’s a useful tool, it’s not foolproof. Market conditions, news, and other factors can influence outcomes.

What are the rules for a double top?

After a double top forms in a stock, there are two main possibilities: bearish breakdown (most likely) or failed breakdown.

- Bearish Breakdown (Most Likely): This is the scenario the double top pattern anticipates. In this case, the price will fall below the neckline, the horizontal support level between the two peaks of the double top. This breakdown signifies a potential shift in control from buyers to sellers and a continuation of the downtrend.

- Failed Breakdown (Less Likely): In some instances, the price might dip below the neckline but then reverse course and climb back up. This is called a false breakout and suggests the double top pattern might not be valid.

Double tops are not perfect indicators, and past performance doesn’t guarantee future results