Picture this: it’s the third Friday of the quarter, and the stock market is buzzing with activity. Trading volume surges, prices fluctuate wildly, and investors scramble to make sense of it all. Welcome to the world of quad witching, a phenomenon that can have a significant impact on the stock market. But what exactly is quad witching, and how can you navigate these turbulent trading days to maximize your profits? In this blog post, we’ll delve into the intricacies of quad witching, explore its effects on the market, and provide you with valuable tips to successfully trade during these critical days.

Short Summary

Quadruple witching is characterized by an increase in trading volume and market volatility due to the simultaneous expiration of derivatives contracts.

Investors should use risk management techniques, such as delta-hedging and setting stop-loss orders, to protect their portfolios on quadruple witching days.

Timing trades around these key dates can help maximize profits while minimizing losses. Careful risk management strategies must be employed due to increased market volatility.

Demystifying Quadruple Witching

At its heart, quadruple witching is the expiry of four kinds of derivatives contracts at the same time. These are stock options, stock index options, stock futures and stock index futures. This phenomenon occurs on the third Friday of March, June, September, and December.

With so many contracts set to expire on the same day, quadruple witching can cause a flurry of trading activity as investors scramble to close out their positions or roll them forward to the next expiration date.

But to truly understand the impact of quadruple witching, we must first delve into the four key components that make up this market event.

Stock Options

Stock options are financial instruments that grant the buyer the right, but not the obligation, to buy or sell an underlying stock at a predetermined price before the option’s expiration date. These contracts typically expire on the third Friday of every month.

In the context of quadruple witching, the expiration of stock options contributes to the overall trading volume and volatility as investors must decide whether to execute, sell, or roll their options contracts forward. For instance, if you hold a call option that gives you the right to buy a certain stock at a fixed price, you can either exercise the option and purchase the stock, sell the option to another investor, or let it expire if the stock price is below the strike price.

Stock Index Options

Stock index options are financial instruments, similar to stock options. These instruments represent a whole stock index, for instance the S&P 500. The key difference lies in the fact that stock index options are settled in cash rather than shares of the underlying stock. These options offer investors the ability to diversify their portfolios, hedge against market fluctuations, and capitalize on arbitrage opportunities.

Stock Futures

Stock futures are trading contracts that require the owner to buy or sell a specific stock at a pre-agreed price on an upcoming date. Such contracts provide investors with an assurance of deciding their investment price ahead of time. These contracts usually reach their maturity date on the third Friday of every third month. During quadruple witching, the expiration of stock futures contracts adds to the overall trading volume as investors must decide whether to roll their contracts forward or let them expire.

In the case of rolling forward a contract, investors sell their expiring contracts and purchase new contracts with a later expiration date. This process allows investors to maintain their position in the underlying stock while extending the life of the contract, further adding to the trading activity and market volatility on quadruple witching days.

Stock Index Futures

Stock index futures are futures contracts that represent an entire stock index and are typically settled in cash rather than shares. They differ from stock futures, which are contracts for delivering stocks at a predetermined price.

By utilizing stock index futures, investors can mitigate the risk of a portfolio of stocks and minimize the impact of bear markets. Much like stock futures, the expiration of stock index futures during quadruple witching contributes to the increased trading volume and market volatility.

The Importance of Quadruple Witching Days

The simultaneous expiration of these four derivatives contracts on quadruple witching days results in a significant increase in trading volume. This heightened trading activity is due to a combination of factors, such as market makers closing out expiring options contracts, investors rolling their contracts forward, and the quarterly index rebalancing, also known as reconstitution.

It is not always the case that quadruple witching leads to increased market volatility. However, it can still happen. In the following sections, we will explore the specific impacts of quadruple witching on trading volume, market volatility, and institutional investors’ strategies.

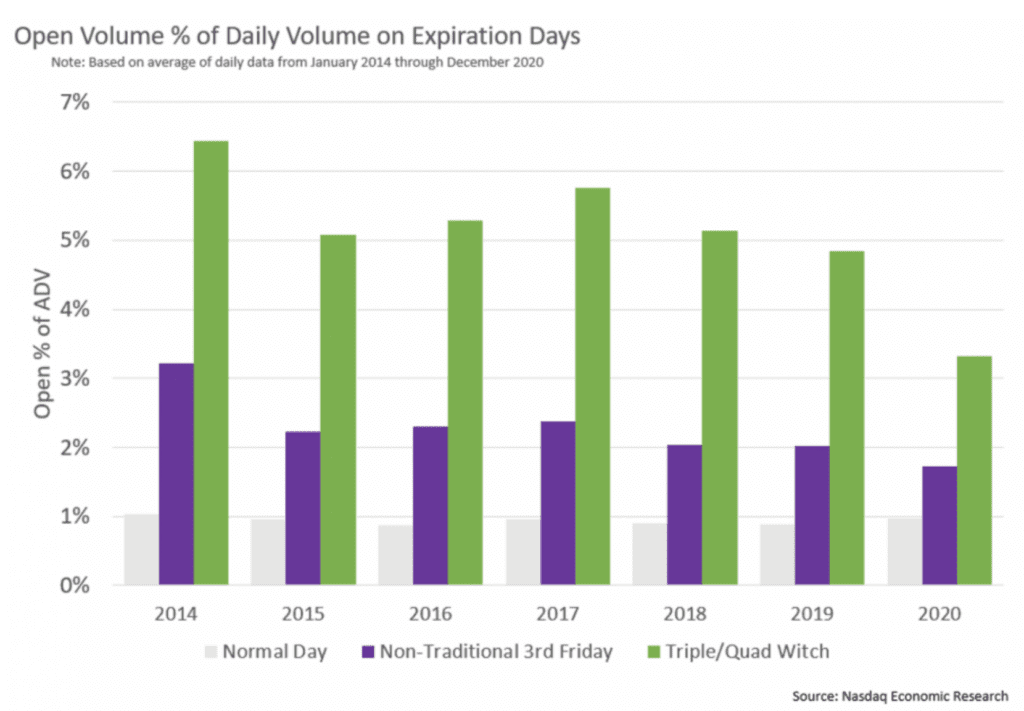

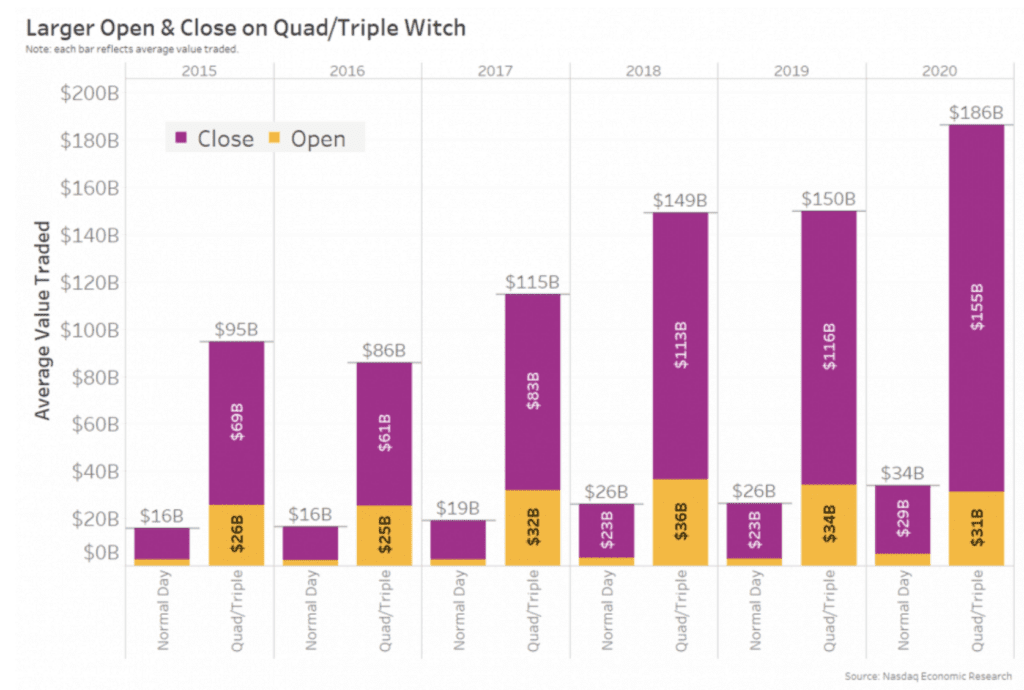

Trading Volume Surge

The surge in trading volume on quadruple witching days is primarily driven by the closing out of matched hedge positions and the rolling of contracts forward. As investors must either close out their positions or roll them forward, the market experiences a significant increase in trading activity.

Market Volatility

Market volatility during quadruple witching can increase due to the simultaneous expiration of the four derivatives contracts. However, this increased volatility is not always consistent and can vary from one quadruple witching day to another. It is important for investors to be aware of the potential risks associated with heightened market volatility and adjust their strategies accordingly.

One way to navigate the increased market volatility during quadruple witching days is to avoid trading options or stocks on these days entirely. By steering clear of the market during the most volatile periods, investors can minimize their risk exposure and potentially avoid significant losses.

Institutional Investors’ Strategies

Institutional investors, such as large banks, hedge funds, and pension funds, play a crucial role in the market dynamics during quadruple witching days. While these investors may adjust their portfolios or hedge their positions during this time, they generally do not alter their long-term positions.

As a result, the overall impact of quadruple witching on price movements is usually negligible, despite the increased trading volume and market volatility.

Key Dates for Quadruple Witching

Quadruple witching occurs on the third Friday of March, June, September, and December, when the four derivatives contracts – stock options, stock index options, stock futures, and stock index futures – all expire simultaneously.

Market Effects of Quad Witching

During quadruple witching days, the market can experience highly unpredictable price action and abnormal market volatility. This can be particularly pronounced during the last hour of the New York trading session, often referred to as the “witching hour”.

Price Movements

Price movements during quadruple witching can be significant if large positions are taken or unwound. However, as institutional investors typically do not change their long-term positions on these days, the impact of quadruple witching on price movements is generally negligible.

Investors should be aware of the potential for sudden and sharp price fluctuations and adjust their strategies accordingly to minimize risk and take advantage of potential opportunities.

Market Whipsaws

Market whipsaws, or abrupt and pronounced price fluctuations, can occur during quadruple witching due to arbitrageurs taking advantage of temporary price discrepancies. As these investors buy and sell securities in different markets to capitalize on the price differences, they can cause sudden and drastic price movements in the stock market.

Hedging and Arbitrage Opportunities

The heightened trading volume and market volatility during quadruple witching days can present hedging and arbitrage opportunities for investors. By employing various strategies such as arbitrage, straddles, portfolio hedging, and trend-following, traders can potentially capitalize on the increased market activity.

Hedging Techniques

Hedging techniques, such as delta-hedging, can be used during quadruple witching days to minimize risk. Delta-hedging involves offsetting the risk of a position by taking an opposite position in a related security.

Arbitrage Strategies

Arbitrage strategies can be employed during quadruple witching days to capitalize on temporary price discrepancies. As prices fluctuate rapidly, arbitrageurs can buy and sell securities in different markets to take advantage of these price differences and generate profits. However, it is important to note that the potential for losses is just as likely as the potential for gains, and investors should exercise caution and employ risk management strategies when engaging in arbitrage during quadruple witching days.

One such arbitrage strategy involves purchasing an undervalued stock in one market and selling it in another market where it is overvalued. This can result in a risk-free profit for the investor, as they are essentially buying low and selling high. However, due to the rapid price movements and increased market volatility during quadruple witching days, it is crucial for investors to be vigilant and adapt their strategies accordingly to minimize risk and maximize profit potential.

Quadruple Witching vs. Triple Witching

In the past, the term “triple witching” was used when only three types of contracts – index options, index futures, and single stock options – expired simultaneously. However, with the addition of stock futures as the fourth derivatives contract, triple witching became obsolete and the term “quadruple witching” was coined to describe the simultaneous expiration of all four types of contracts.

While both triple and quadruple witching days are characterized by increased trading volume and market volatility, it is important to understand that triple witching no longer exists and has been replaced by quadruple witching.

Tips for Navigating Quadruple Witching Days

Successfully trading during quadruple witching days requires careful planning and strategic decision-making. By employing risk management techniques and timing trades appropriately, investors can navigate the heightened market activity and potentially capitalize on the opportunities it presents.

Risk Management

Risk management is crucial during quadruple witching days, as the increased market volatility can lead to significant losses if not properly managed. Investors should conduct thorough research on the market and stocks they are interested in, and devise a comprehensive risk management strategy that includes setting stop-loss orders, limiting exposure, and having a plan for reacting to market volatility.

By employing delta-hedging and other risk management techniques, investors can minimize their risk exposure and protect their portfolios during quadruple witching days.

Timing Trades

Timing trades around quadruple witching days can help maximize profits and minimize losses. One strategy is to trade during the last hour of the day, which is usually characterized by significant volume and order flow. By timing trades to take advantage of increased market activity and volatility, investors can potentially generate higher returns.

Summary

Quadruple witching days present a unique set of challenges and opportunities for investors. By understanding the intricacies of stock options, stock index options, stock futures, and stock index futures, and the impact of their simultaneous expiration on the market, investors can better navigate the increased trading volume and market volatility associated with these days.

Frequently Asked Questions

What happens on quadruple witching day?

On quadruple witching day, options and futures contracts for individual stocks, stock indices, and single stock futures all expire at the same time. This leads to heightened market volatility as traders rush to close or adjust their positions before the expiration deadline. Additionally, increased trading activity can lead to higher volumes in the markets.

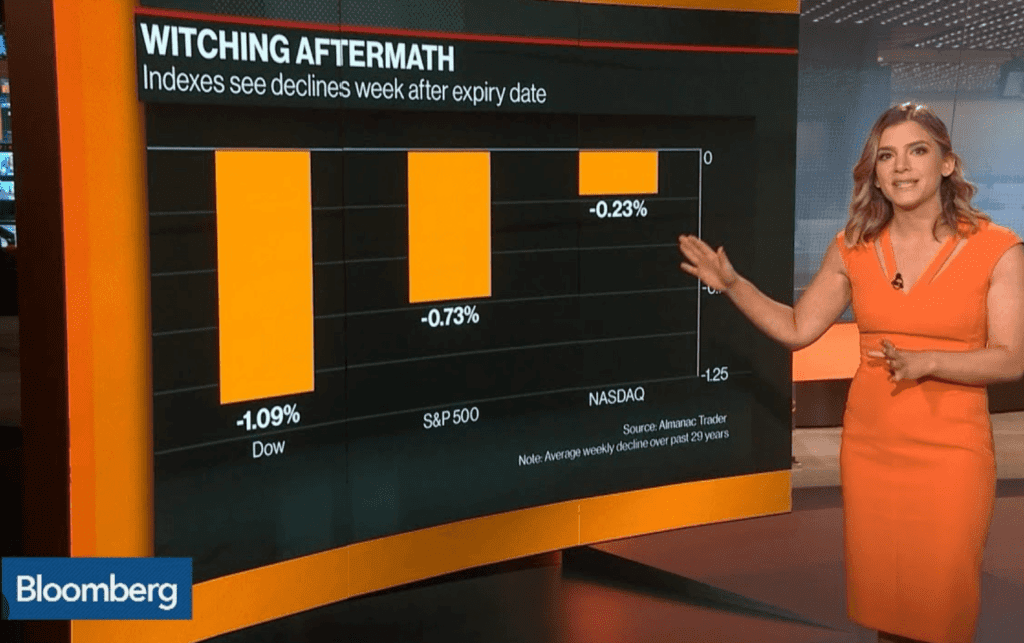

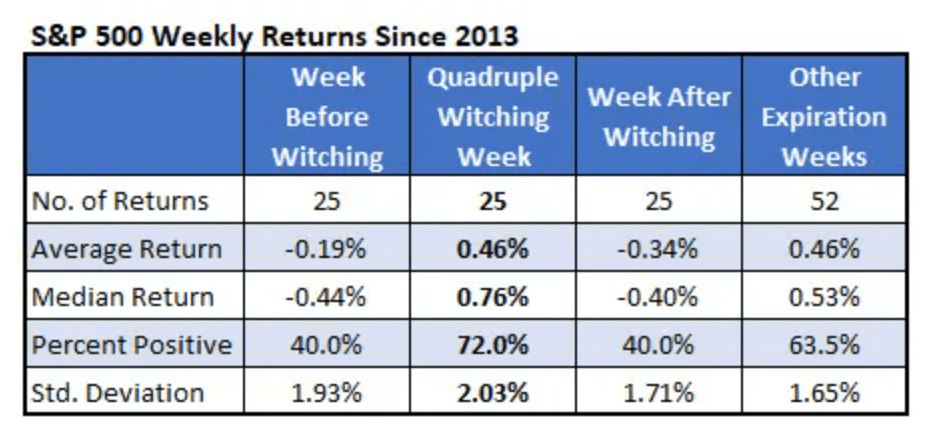

Is quad witching bullish or bearish?

Considering the findings, it can be concluded that Quad Witching Day is generally bearish in nature.

However, the entire week of Quad Witching sees bullish activity. Thus, Quad Witching as a whole is a mixed indicator for the market.

How long does quad witching last?

Quadruple witching is an event that occurs on four days during the calendar year when the contracts on four different kinds of financial assets expire. It takes place on the third Friday of March, June, September and December, lasting for a period of four days each time.