Peter Lynch, a legendary investor and philanthropist, has left a lasting impact on the world of finance and beyond. With an estimated net worth of around $450 million, his success story is a testament to the power of perseverance, dedication, and strategic thinking. In this blog post, we’ll explore Lynch’s journey, from his humble beginnings to his incredible achievements in the investment world and his philanthropic endeavors. By the end, you’ll have a deeper understanding of the principles that guided Lynch’s investment decisions and the lessons we can learn from his remarkable success.

Key Takeaways

Peter Lynch has achieved a net worth of $450 million through his investments, managerial role at Fidelity Investments, and best-selling books.

His success is attributed to research, patience and long-term investing strategies such as GARP (Growth At a Reasonable Price) an portfolio diversification.

He is also dedicated to mentoring others by sharing insights from his experiences & philanthropic endeavors.

Peter Lynch Net Worth Overview

Peter Lynch’s net worth is estimated to be around $450 million, primarily due to his successful career as an investor and philanthropist. As an American investor and a mutual fund manager, Lynch has made a name for himself by managing the Magellan Fund at Fidelity Investments from 1977-1990. His astute investment decisions and strategies have made him one of the most successful investors in the history of the stock market.

Next, we will examine the various sources of his wealth and the fundamental principles that have shaped his investment philosophy.

Related Article: Uncovering Charlie Munger’s Net Worth: A Look At The Wealth Of Warren Buffett’s Right-Hand Man

Sources of Wealth

Peter Lynch’s wealth comes from a combination of personal investments, his career as a mutual fund manager, and his best-selling books. As the manager of the Magellan Fund at Fidelity Investments, Lynch achieved remarkable success, making it the best performing mutual fund during his tenure. Lynch’s consistent impressive returns for the fund’s investors were a result of his focus on individual companies and their growth potential.

In addition to his career at Fidelity Investments, Lynch has authored several best-selling books, including “One Up on Wall Street” and “Beating the Street”. These books provide valuable insights into his investment strategies and philosophies, which have helped countless investors achieve success in the stock market.

Current Net Worth Estimate

As of 2023, Peter Lynch’s net worth is projected to be around $450 million, though some estimates peg it closer to $352 million. This wealth is the accumulation of his savvy investments, career earnings, and contributions to philanthropy.

Although these figures are only estimates, they are based on reliable sources and provide a good indication of Lynch’s financial success.

Related Article: Uncovering Larry Fink Net Worth: Financial Success Of The Billionaire CEO Of BlackRock

The Making of an Investment Icon

Peter Lynch’s trajectory to becoming an investment icon was set in motion by his working-class upbringing, education at Boston College and Wharton School, and his early career at Fidelity Investments. These experiences underpin his investment philosophy and approach to the stock market, which will be elaborated upon in the subsequent sections.

Early Life and Education

Peter Lynch’s early life experiences, including his first investment in Flying Tiger Airlines, shaped his investment philosophy and approach to the stock market. At just 12 years old, Lynch invested $800 in the airline’s stock for $8 per share, which eventually increased to $80 per share. This early success in investing not only provided him with the funds to finance his education at Boston College and the Wharton School of the University of Pennsylvania, but also sparked his interest in the world of finance and investment.

Lynch’s educational background provided him with a strong foundation in finance and investment principles. Lynch believes that this knowledge, combined with his early investment experiences and the skills he gained at Lynch Leadership Academy, would later serve as the cornerstone of his investment philosophy.

Career Highlights at Fidelity Investments

Peter Lynch’s career at Fidelity Investments began in 1966 when he started as an intern. In 1974, he became the director of research at the company, a role he held until 1977. However, it was his management of the Magellan Fund from 1977 to 1990 that solidified his reputation as a legendary investor.

During his tenure at the Magellan Fund, Lynch focused on individual companies, starting with large American companies and eventually transitioning to international and smaller stocks. His impressive returns at the Magellan Fund contributed significantly to his net worth and established him as one of the most successful investors in history.

Key Principles of Peter Lynch’s Investment Strategy

Peter Lynch’s stock investment strategy is centered around understanding the businesses you invest in, focusing on growth at a reasonable price, and maintaining a diversified portfolio.

We will further explore these principles in the subsequent sections and examine how they steered Lynch to his extraordinary success in the investment world.

“Invest in What You Know”

Peter Lynch’s “invest in what you know” philosophy emphasizes the importance of understanding the companies you invest in and their potential for growth. He believed that individual investors can achieve higher returns than professional fund managers by focusing on industries and companies they are familiar with. This approach encourages investors to conduct thorough research on potential investments, gain insight into the industry and stay updated on news and trends.

Investing in what you know can lead to more informed decisions about capital allocation. This principle, pivotal to Lynch’s success, has also motivated numerous investors to adopt a similar approach and achieve remarkable returns in the stock market.

GARP: Growth At a Reasonable Price

GARP, or Growth At a Reasonable Price, is a key principle of Peter Lynch’s investment strategy, focusing on finding undervalued stocks with strong growth potential. The GARP model is a hybrid approach that combines the growth-investing potential for share-price increases with the discipline of value-investing to avoid overpriced stocks.

To locate stocks with undervalued prices and strong growth potential, GARP investors should consider stocks with robust fundamentals, such as elevated earnings growth, manageable debt, and competent leadership. By focusing on these factors, investors can identify opportunities that offer both growth and value, ultimately leading to higher returns.

Portfolio Diversification

Peter Lynch’s approach to portfolio diversification involved owning over 1,000 stocks, ensuring a balanced and well-rounded investment portfolio. Diversification is a crucial component of successful investing, as it helps to reduce risk by spreading investments across multiple assets, sectors, and industries.

The advantages of diversification include minimizing risk, augmenting returns, and establishing a more balanced portfolio. By investing in a variety of asset classes, sectors, and industries, investors can mitigate the impact of poor performance in any single area and take advantage of various investment opportunities.

This approach was instrumental in Lynch’s success and serves as valuable guidance for investors looking to optimize their returns.

Philanthropic Endeavors and Legacy

Peter Lynch’s philanthropic work and legacy extend beyond his investment success, with a focus on education, medical research, and cultural organizations, such as the Fidelity Charitable Gift Fund.

We will delve into various initiatives and foundations Lynch has supported in the subsequent sections, showcasing his commitment to community contribution and his aspiration to inspire others.

The Lynch Foundation

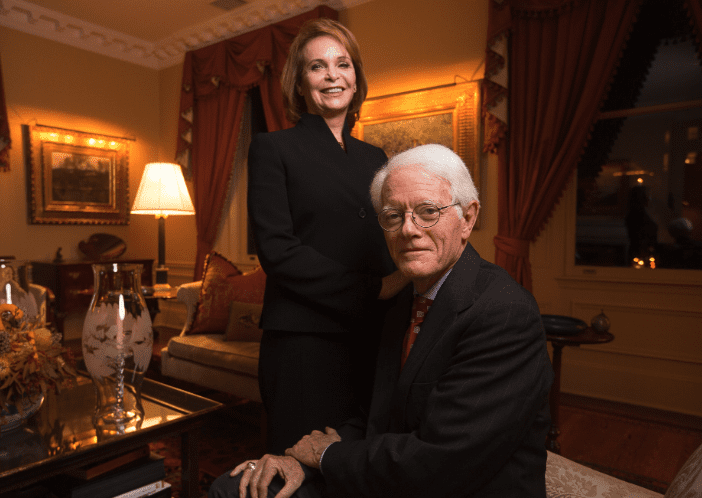

The Lynch Foundation, founded by Peter and his late wife Carolyn Ann Hoff, supports various charitable causes, including education and healthcare initiatives. By providing financial assistance to various organizations, the Lynch Foundation aims to make a lasting impact on the lives of those in need.

Some of the charitable causes supported by the Lynch Foundation include educational initiatives, healthcare programs, and cultural organizations. Through their philanthropic work, Peter and Carolyn Lynch have demonstrated their commitment to giving back to the community and helping to improve the lives of countless individuals.

Mentorship and Education

In addition to his philanthropic endeavors, Peter Lynch continues to mentor young analysts and share his investment wisdom through speaking engagements and educational programs. His commitment to education and mentorship has had a significant impact on the lives and careers of many aspiring investors.

One notable example of Lynch’s dedication to education is the Boston College Lynch School of Education and Human Development, named after him and his wife. This institution serves as a testament to their commitment to education and their desire to help others reach their full potential.

Peter Lynch’s Books and Publications

Peter Lynch has authored several best-selling books, offering insights into his investment strategies and philosophies.

Next, we will delve into two of his most impactful books, “One Up on Wall Street” and “Beating the Street,” both of which have guided numerous investors to stock market success.

“One Up on Wall Street”

“One Up on Wall Street” is a popular book by Peter Lynch that provides guidance on how individual investors can outperform professional fund managers. The book covers topics such as investment techniques related to stock classifications and portfolio design, among others.

The main takeaway from “One Up on Wall Street” is the notion that individual investors can achieve higher returns by focusing on industries and companies they are familiar with and conducting thorough research.

By offering practical examples and easy-to-understand explanations, “One Up on Wall Street” has become a must-read for both novice and experienced investors alike. Its insights into Lynch’s investment philosophies and techniques have helped countless readers improve their investment strategies and achieve success in the stock market.

“Beating the Street”

“Beating the Street” is another influential book by Peter Lynch, offering practical advice on stock picking and long-term investing strategies. In the book, Lynch outlines how to devise a mutual fund strategy, his step-by-step strategies for selecting stocks, and provides advice for investing.

Readers can learn valuable lessons from Lynch’s investing process, such as assessing the company’s fundamentals, investigating the industry, and seeking out undervalued stocks. By following the guidance and strategies presented in “Beating the Street,” investors can increase their chances of achieving long-term success in the stock market.

Lessons Learned from Peter Lynch’s Success

Key lessons from Peter Lynch’s success include the importance of thorough research, patience, and a long-term approach to investing.

Next, we will delve into these lessons and examine their pivotal role in Lynch’s extraordinary success.

The Importance of Research

Peter Lynch’s success demonstrates the value of conducting extensive research on potential investments and understanding the businesses behind the stocks. By gaining an in-depth knowledge of the companies and industries they invest in, investors can make informed decisions and identify potential opportunities and risks.

One notable example of Lynch’s emphasis on research is his coined term “ten bagger,” which refers to stocks that have the potential to generate a return of ten times the purchase price. By conducting thorough research and understanding the growth potential of the companies he invested in, Lynch was able to identify numerous “ten bagger” opportunities throughout his career.

Patience and Long-Term Investing

Embracing patience and a long-term perspective on investing can lead to significant returns, as evidenced by Peter Lynch’s impressive track record. By carefully selecting companies whose assets are undervalued by the market, and adhering to a buy-and-hold strategy as long as the companies continue to perform well, investors can achieve lasting returns.

Lynch also maintained that if the stock of a reputable company decreased in price, it presented an ideal opportunity to purchase additional shares. This approach highlights the importance of not reacting impulsively to short-term market fluctuations and keeping a long-term perspective when making investment decisions.

Summary

In conclusion, Peter Lynch’s journey to becoming a legendary investor and philanthropist offers valuable lessons and insights for anyone looking to achieve success in the world of finance. By understanding his investment philosophy, such as investing in what you know, focusing on growth at a reasonable price, and maintaining a diversified portfolio, investors can learn from Lynch’s extraordinary success. Additionally, his philanthropic endeavors and mentorship efforts serve as an inspiration for us all to give back to our communities and help others reach their full potential.

Frequently Asked Questions

How did Peter Lynch make his money?

Peter Lynch made a lot of his money as the manager of Fidelity’s Magellan Fund from 1977 to 1990, during which he managed to achieve an astonishing 29% return per year and increase assets under management from around $18 million to $14 billion.

What happened to Peter Lynch?

Peter Lynch retired from his famous role as manager of the Magellan Fund at Fidelity Management & Research when he was 46, now serving as its vice chairman.

How much money did Peter Lynch manage?

Under his management from 1977 to 1990, Peter Lynch successfully increased the Fidelity Magellan Fund’s assets under management from around $18 million to more than $14 billion.

What is Peter Lynch’s estimated net worth in 2023?

Based on current estimates, Peter Lynch’s net worth in 2023 is estimated to be around $450 million.