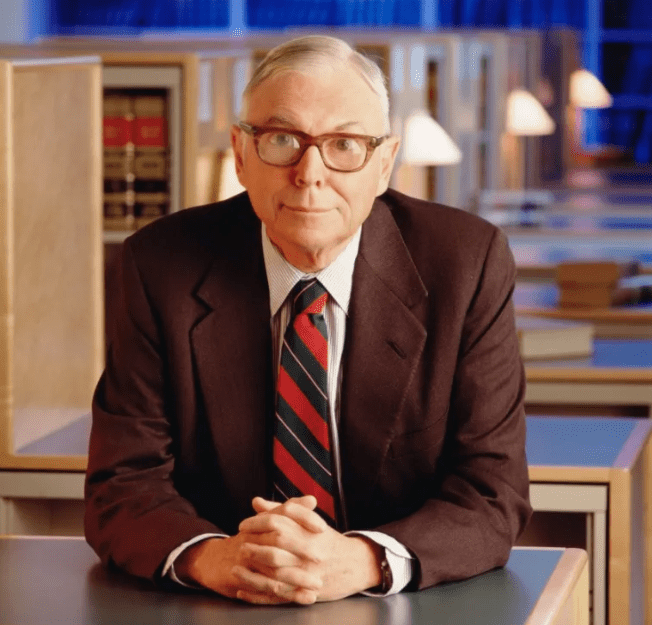

Behind every successful investor is a story of resilience, determination, and wisdom. One such investor is Charlie Munger, who, alongside Warren Buffett, has built an empire through Berkshire Hathaway. Munger’s life and unique investment philosophy offer valuable lessons for investors and philanthropists alike. Let us embark on a journey to understand the man behind the wealth, his principles, and how they have shaped his success.

Short Summary

Charlie Munger’s net worth is estimated to be $2.4 billion, largely due to his successful investment partnership with Warren Buffett and strategic investments in strong companies.

His unique investment philosophy combines value investing principles, mental models from multiple disciplines, and a long-term outlook.

Charlie Munger has provided invaluable wisdom on various topics through books, speeches and interviews which can help aspiring investors gain insight into his success.

Charlie Munger’s Journey to Wealth

Charlie Munger’s journey to wealth, which is a significant part of his life, began with humble beginnings, as he navigated the ups and downs of life, his education, and career. It was his partnership with Warren Buffett that catapulted him to prominence, and his role in Berkshire Hathaway further solidified his standing in the world of finance.

Munger’s net worth, estimated to be around $2.4 billion, is a testament to his sagacity and relentless pursuit of excellence.

Early Life and Education

Born Charles Thomas Munger on January 1, 1924, in Omaha, Nebraska, Charlie’s parents instilled in him a strong work ethic and a passion for learning. He pursued mathematics at the University of Michigan, but his studies were interrupted by World War II. After serving in the Army Air Corps, Munger resumed his education eventually earning a law degree from Harvard Law School; he graduated magna cum laude with a Juris Doctor in 1948.

As a lawyer, he practiced at the law firm Wright & Garrett in California, before founding his own law firm, Munger, Tolles & Olson.

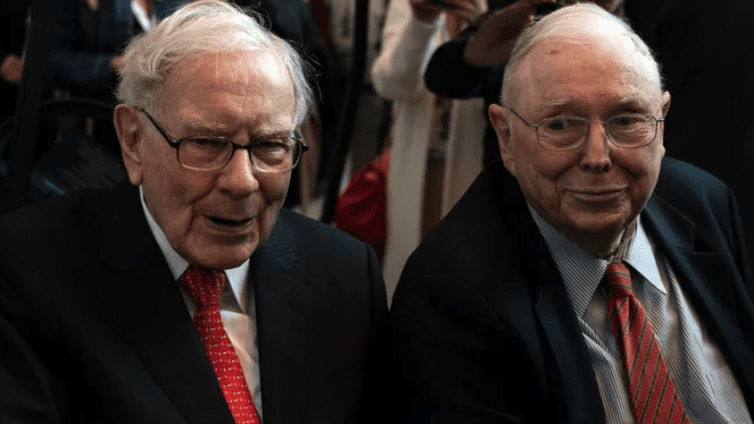

Partnership with Warren Buffett

Munger’s life took a decisive turn when he met Warren Buffett at a dinner party in 1959. They began exchanging ideas in the early 1960s, and their investment partnership would go on to become one of the most successful investing duos in history. Munger played a significant role in transforming Buffett’s investment philosophy by urging him to consider not just the cost, but also the quality and capacity for compounding when making investment decisions. One of Munger’s mantras was “forget what you know about buying fair businesses at wonderful prices; instead, buy wonderful businesses at fair prices.”

This shift in mindset led Berkshire Hathaway to invest in robust companies like Coca-Cola, American Express, and See’s Candies, making Berkshire Hathaway stock a valuable asset for investors.

Role in Berkshire Hathaway

Munger joined Berkshire Hathaway in the mid-1970s, and quickly rose the ranks, assuming the role of Vice Chairman of the Board of Directors and second-in-command to Warren Buffett in 1978. As Vice Chairman, Munger plays a crucial role in the company’s growth and success, contributing to the rise in Berkshire Hathaway Class A and Class B stocks.

Munger’s leadership and guidance have been instrumental in the success of Berkshire Hathaway.

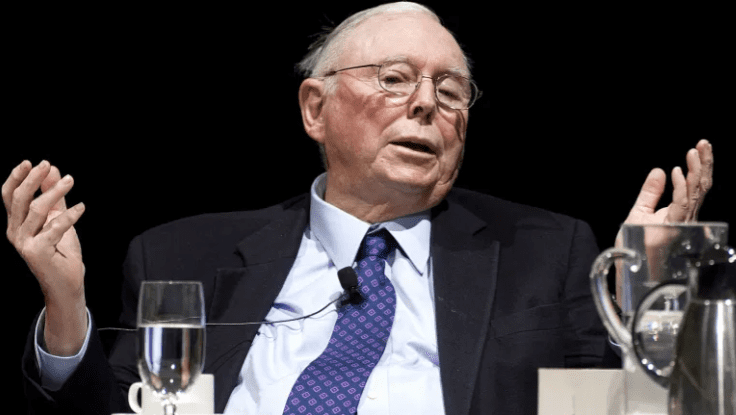

The Munger Investment Philosophy

At the core of Charlie Munger’s remarkable success lies a unique investment philosophy that distinguishes him from other investors. This philosophy, which encompasses value investing principles, mental models, and a focus on long-term horizons, has not only enabled Munger to accumulate significant wealth, but also inspired countless investors seeking to emulate his success.

Value Investing Principles

Value investing, the foundation of Munger’s investment philosophy, involves purchasing securities priced lower than their intrinsic value while considering a margin of safety. Munger emphasizes the importance of investing in undervalued assets, strong companies with competitive advantages, and incorporating a margin of safety in his investment decisions.

By adhering to these principles, Munger has consistently identified and capitalized on opportunities that others have overlooked.

Mental Models and Decision-Making

Mental models and interdisciplinary principles play a significant role in Munger’s decision-making process, leading to better investment choices. Munger’s concept of mental models involves understanding fundamental principles from various disciplines, such as economics, history, and psychology, to enable more rational decision-making.

This multidisciplinary approach to problem-solving has allowed Munger to contemplate diverse viewpoints and make informed decisions in the complex world of investing.

Long-Term Horizons

Munger’s long-term investment horizon is a critical component of his success, as it allows for compounding and growth over time. Munger advocates for the retention of investments for extended periods of time in order to facilitate growth and compounding over the long term. By adhering to this long-term investment strategy, Munger has been able to take advantage of the compounding and growth of his investments, thereby contributing to his wealth accumulation over the years.

Major Investments and Holdings

Throughout his investing career, Charlie Munger has made numerous major investments and held significant positions in various companies. These investments and holdings have played an essential role in contributing to Munger’s net worth and solidifying his reputation in the investing world.

Some of Munger’s most successful investments include:

See’s Candies

Geico

Bank of America

Wells Fargo

Alibaba

Daily Journal Corporation

These investments have not only yielded substantial returns for Munger, but also demonstrated his ability to identify and capitalize on undervalued assets and strong companies with competitive advantages.

Current holdings of Charlie Munger (Q2 – 2023)

| Ticker | Company | Shares | Value | Weighting |

|---|---|---|---|---|

| WFC | Wells Fargo & CO | 1,591,800 | $67,938.02 | 41.54% |

| BAC | Bank of America Corp | 2,300,000 | $65,987.00 | 40.35% |

| BABA | Alibaba Group Holding Ltd | 300,000 | $25,005.00 | 15.29% |

| USB | U.S. Bancorp | 140,000 | $4,625.60 | 2.83% |

Source: GuruFocus

Philanthropy and Giving Back

Beyond his impressive wealth and investment success, Charlie Munger is also known for his philanthropic efforts, primarily focused on the area of education. Munger has had an incredible impact on numerous universities and colleges. These include the University of Michigan and the University of California. His contributions to these schools have been invaluable.

In one notable instance, Munger donated $200 million to UC Santa Barbara with the stipulation that the university construct a dormitory according to his exact and peculiar design. This was not his first donation to UCSB as he had previously donated $65 million to the school to build housing for visiting physicists. This example showcases Munger’s commitment to giving back and improving the educational environment for future generations.

Another one of his significant contributions is the construction of the Munger Research Center at the Huntington Library. Munger has a very well-known love for books and literature, and this center houses some of the world’s most extensive collections of rare books and manuscripts.

In addition to his support for education, Munger has also donated to healthcare, environmental conservation, and other causes. His philanthropy is an inspiration to many. He is a role model for how to use wealth to make a positive impact on the world.

Estimating Charlie Munger’s Net Worth

Estimating Charlie Munger’s net worth can be a challenging task, as his wealth is derived from various sources, including his investor partnership, shareholdings in successful companies, and his role as Vice Chairman of Berkshire Hathaway. Current estimates place Munger’s net worth at around $2.4 billion, according to Forbes.

It is essential to recognize that Munger’s net worth is not only a reflection of his financial success, but also a testament to his wisdom, experience, and unique investment philosophy. By understanding the factors that have contributed to his wealth, we can gain valuable insights into the principles and strategies that have driven his success.

Related Article: Uncovering Larry Fink Net Worth

Learning from Charlie Munger

For those seeking to learn from Charlie Munger’s wisdom and insights, there are numerous resources available, including books, speeches, and interviews. By studying these materials, one can gain a deeper understanding of Munger’s unique investment philosophy, mental models, and interdisciplinary approach to decision-making.

Recommended Books

Books such as “Poor Charlie’s Almanack,” “Seeking Wisdom: From Darwin to Munger” and “Damn Right” provide valuable insights into Munger’s life and investment philosophy. In particular, “Poor Charlie’s Almanack” offers a comprehensive collection of Munger’s thoughts and ideas, making it a must-read for anyone interested in his approach to investing and decision-making.

“Seeking Wisdom From Darwin to Munger” is particularly notable, as it delves into the concept of mental models and explores how understanding fundamental principles from various disciplines, such as psychology, biology, and mathematics, can enable more rational decision-making.

Related Article: The Best Book On Day Trading In 2023: Top 10 For Beginners To Experts

Speeches and Interviews

Throughout his career, Munger has delivered numerous speeches and interviews that offer timeless wisdom on various topics, such as avoiding mistakes, patience and investing, learning, mental models, and changing one’s mind. Noteworthy speeches include ‘A Lesson on Elementary, Worldly Wisdom’, ‘The Psychology of Human Misjudgment’, and his commencement speech at Harvard in 1986.

Summary

In conclusion, Charlie Munger’s life and investment philosophy serve as a testament to the power of resilience, determination, and wisdom. His unique approach to investing, philanthropic efforts, and willingness to share his insights and experiences have made him an inspiration for countless individuals. By studying Munger’s principles and strategies, we can not only gain valuable knowledge, but also strive to emulate his success in our own lives.

Frequently Asked Questions

Why is Charlie Munger’s net worth so much lower than Warren Buffett?

Charlie Munger’s net worth is substantially lower than Warren Buffett’s due to Munger’s large charitable contributions over the years, compared to Buffett who has chosen to give away the majority of his wealth upon his passing.

Munger has donated millions of dollars to various causes, including education, healthcare, and the arts. Buffett, on the other hand, has pledged to give away 99% of his wealth to philanthropic causes.

What companies does Charlie Munger own?

Charlie Munger’s portfolio as of June 30, 2023 includes Wells Fargo & Co (41.54%), Bank of America Corp (40.35%), Alibaba Group Holding Ltd (15.29%) and U.S. Bancorp (2.83%), not including options.

Who is richer Warren Buffet or Charlie Munger?

Charlie Munger’s net worth is estimated to be around $2.3 billion, while Warren Buffett’s is significantly higher at about $107.6 billion, making Buffett the much richer of the two.

What does Charlie Munger invest in?

Charlie Munger invests mainly in Bank of America, Wells Fargo, Alibaba, US Bancorp, Berkshire Hathaway, Costco, and the Daily Journal Corporation.

Additionally, he has some money invested in Himalaya Capital Management, an investment fund run by Li Lu.

How many companies does Charlie Munger own?

Charlie Munger owns a total of 4 companies as of 30 Jun 2023.