Larry Fink, a name synonymous with success in the financial world rose from modest beginnings to become the billionaire CEO of BlackRock, the world’s largest asset management firm. But what does it take to create and lead a financial powerhouse that manages over $5 trillion in assets? Join us as we uncover the fascinating journey of Laurence Douglas Fink, delving into his early life, career milestones, investment strategies, and philanthropic pursuits. Get ready to be inspired by the story of a man who defied the odds and shaped the global financial landscape.

Short Summary

Larry Fink’s net worth of $1 billion is attributed to his equity stake in BlackRock, salary as CEO, and other investments.

His long-term approach to sustainability and responsible investing has had a positive impact on global finance.

He has shifted from skepticism towards cryptocurrencies to optimism about their potential for investment success.

Larry Fink’s Path to Wealth

Laurence Douglass. Fink’s ascent to the top of the finance world is nothing short of remarkable. Born into a middle-class family, Fink, also known as Laurence Douglas Fink, has managed to amass a net worth of approximately $1 billion, primarily attributed to the financial behemoth he co-founded, BlackRock. From his humble beginnings to his role as Chairman and CEO of the world’s largest asset management firm, Fink’s journey is a testament to the power of hard work, determination, and strategic vision.

Starting with his education, followed by a career at First Boston and ultimately co-founding BlackRock, Fink’s life has revolved around finance and investment management. His ability to navigate the complex world of finance and foresee emerging trends has enabled him to achieve unprecedented success, making him one of the most influential figures in the global financial industry.

Early Life and Education

Born and raised in California, Larry Fink grew up in a traditional Jewish family. His father owned a shoe store, while his mother worked as an English professor. Fink’s passion for finance was ignited during his time at the University of California, Los Angeles (UCLA), where he pursued a degree in Political Science. His enthusiasm and drive for success led him to obtain an MBA in Real Estate from the UCLA Anderson School of Management. This foundation in finance and real estate would prove to be instrumental in his later accomplishments.

Upon completing his MBA, Larry embarked on a career in finance, starting with a position as a mortgage-backed securities trader at First Boston. It was here that he gained invaluable experience and honed his skills in the financial industry, setting the stage for his future success.

Career at First Boston

Larry Fink’s tenure at First Boston proved to be a crucial stepping stone in his career. He was responsible for overseeing the first Boston’s bond department and was a part of the management committee. Fink’s background in real estate was instrumental in his success at First Boston, where he managed the company’s bond department and other key positions.

As the managing director, Fink successfully raised the net income of First Boston by more than a billion dollars, with the help of key executives like Ken Wilson. His time at First Boston not only provided him with valuable experience in the financial industry, but also positioned him as a rising star in the world of finance.

Co-founding and Growing BlackRock

In 1988, two years after his departure from First Boston, Larry Fink co-founded BlackRock along with other finance professionals like Keith Anderson. The company received a $5 million loan from Blackstone, with Pete Peterson and Steve Schwarzman receiving approximately 50% stakes in the company. Susan Wagner, one of the co-founders, played a crucial role in the company’s early development.

Under Fink’s leadership, BlackRock quickly became a global powerhouse in asset management. The merger between BlackRock and Merrill Lynch led to a significant increase in the assets under management of BlackRock, reaching approximately $1 trillion. By September 1999, BlackRock had already accumulated $165 billion in assets. This initial success accelerated even greater growth. BlackRock is currently the biggest money management company in the world. It has total assets under management of over $5 trillion.

Fink’s influence has also extended beyond BlackRock. In 2008, the U.S. government entered into an agreement with BlackRock to address the financial crisis that had impacted the nation. The Federal Reserve sought help from BlackRock amid the coronavirus pandemic of 2020. This was to enable them to acquire distressed securities. These engagements highlight the level of trust and respect that Fink and BlackRock have garnered in the global financial community.

Related Article: Discovering Michael Burry Net Worth In 2023

The Billionaire Status: Breaking Down Larry Fink’s Net Worth

Larry Fink’s net worth is a testament to his financial acumen and the impressive growth of BlackRock. As CEO of the world’s largest asset management firm, Fink’s net worth is estimated to be around $1 billion. The majority of his wealth comes from his substantial holdings in BlackRock and his successful investment activities.

To better understand the sources of Fink’s wealth, let’s delve into his equity stake in BlackRock, his salary as the company’s CEO, and his other investments and assets.

Equity Stake in BlackRock

The lion’s share of Larry Fink’s net worth comes from his impressive equity stake in BlackRock. According to the most recent data, Fink holds approximately 484,000 shares of BlackRock. This significant stake in the world’s largest asset management firm is estimated to be worth around $335 million.

This sizable equity position in BlackRock not only reflects the profitability of BlackRock but also reflects the value of BlackRock. Fink’s belief in the company he co-founded also demonstrates his commitment to its continued success and growth.

Salary as BlackRock CEO

As CEO of BlackRock, Larry Fink’s salary is another significant component of his net worth. In 2022, Larry Fink’s salary as BlackRock CEO was reported to be $36 million. However, in 2023, BlackRock decreased the salary of BlackRock CEO Larry Fink by 30% to $25.2 million, following the advice of key executives like Gary Reeder.

Despite the reduction in his salary, Fink’s overall net worth remains impressive, thanks to his substantial equity stake in BlackRock and other investments.

Other Investments and Assets

In addition to his equity stake in BlackRock and his salary as CEO, Larry Fink’s net worth is also influenced by other investments and assets. For instance, credible sources indicate that Fink has a personal crypto portfolio, although the exact value of this investment remains uncertain.

Fink’s net worth is further bolstered by his real estate holdings. He owns properties in Manhattan, North Salem, New York, and Vail, Colorado, which add to his overall wealth. These diverse investments and assets contribute to Fink’s status as a billionaire.

Investment Strategies and Market Views

Larry Fink’s investment strategies and market views have played a crucial role in shaping BlackRock’s success and growth. His leadership style focuses on a long-term outlook, sustainability, and responsible investing, making BlackRock a leader in ESG investing. Fink’s dedication to corporate governance and social responsibility has established new standards for the industry and has influenced the company and the wider financial landscape.

In addition to his emphasis on long-term and sustainable investing, Fink’s views on cryptocurrencies have evolved over time, further influencing BlackRock’s investment strategies.

Let’s explore. Fink’s approach to ESG investing, his opinion on cryptocurrencies, and the impact of his market views on BlackRock’s investment decisions.

Long-term Approach and ESG Investing

Fink’s emphasis on a long-term approach, sustainability, and responsible investing has positioned BlackRock as a leader in ESG investing. ESG investing involves investing in companies that adhere to certain environmental, social, and governance criteria. BlackRock has become a leader in this field by incorporating sustainability factors into their investment strategies, setting an example for the industry and demonstrating the potential to achieve both financial returns and beneficial outcomes.

Larry Fink has also been an advocate for sustainable businesses, believing that the next 1,000 unicorns will be green energy companies. In his 2020 annual open letter, Fink disclosed to investors that BlackRock would be severing ties with prior investments involving thermal coal and other investments that pose a substantial environmental risk. This focus on ESG investing showcases the importance of ESG investing. Fink’s commitment to creating a more sustainable future in the world of finance.

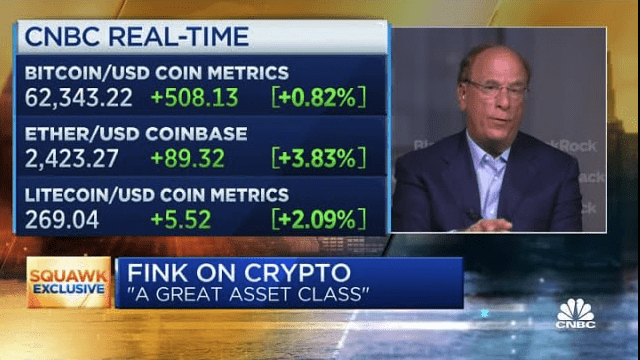

Opinion on Cryptocurrencies

Larry Fink’s opinion on cryptocurrencies has evolved over time, from skepticism to optimism. In 2017, Fink classified Bitcoin as a speculative asset and expressed concerns about its potential to facilitate money laundering. However, as the market evolved and cryptocurrencies gained mainstream acceptance, Fink’s perspective began to change.

Fink is now highly optimistic about what cryptocurrencies can achieve and recognizes the immense opportunities they present, though he does note that the market is largely driven by speculation. This shift in opinion has the potential to influence BlackRock’s investment strategies in the ever-evolving world of digital assets.

Impact on BlackRock’s Investment Strategies

Fink’s market views and investment strategies have had a profound impact on BlackRock’s overall performance and growth. His focus on long-term, sustainable, and responsible investing has made BlackRock a leader in ESG investing, with assets under management exceeding $5 trillion. Fink’s commitment to corporate governance and social responsibility has also influenced the wider financial industry, setting new standards and inspiring future generations to prioritize sustainability and philanthropy.

Fink’s evolving views on cryptocurrencies have the potential to further shape BlackRock’s investment strategies in the digital asset space. As the world’s largest asset management firm, BlackRock’s approach to investing in cryptocurrencies could have significant implications for the broader market, and Fink’s evolving opinion could play a crucial role in shaping the future of digital assets.

Personal Life: Family, Philanthropy, and Influence

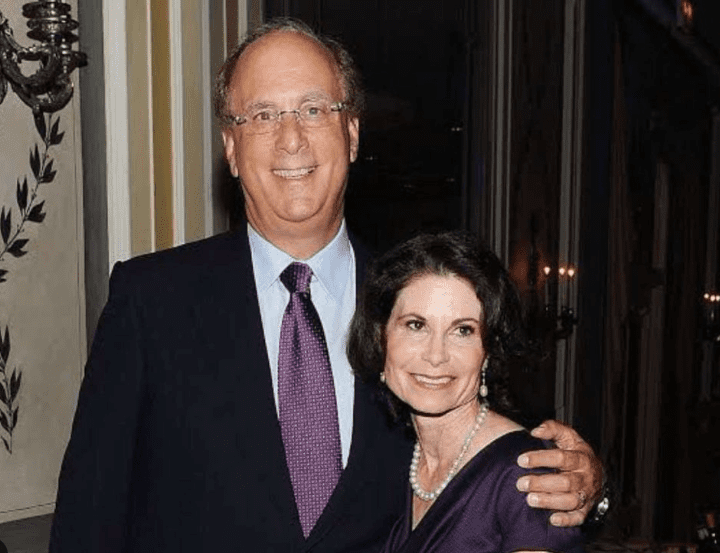

Beyond his professional accomplishments, Larry Fink is also known for his personal life, philanthropic activities, and influence on the global financial industry. Married to his wife Lori since 1974, Fink has three children and owns properties in Manhattan, North Salem, New York, and Vail, Colorado.

Fink’s philanthropic endeavors are equally impressive, encompassing a wide range of charitable initiatives and support for causes that align with his values. His dedication to giving back and promoting sustainability has had a lasting impact on the communities he serves and the finance industry as a whole.

Wife and Children

Larry Fink’s marriage to Lori Fink, his high school sweetheart, has stood the test of time, with the couple celebrating their union since 1974. Together, they have three children, including their eldest son Joshua Fink, who was formerly the CEO of Enso Capital, a now-defunct hedge fund.

Philanthropic Activities

Larry Fink is renowned for his philanthropic ventures. He has also dedicated a significant amount of time and effort into helping others. His philanthropic activities cover a broad scope of charitable initiatives, including donations, social impact projects, and backing of causes that are in line with his values.

Fink’s philanthropic engagements include supporting the Boys and Girls Club of New York, the Robin Hood Foundation, and the New York City Police Foundation, among others. He is an active member of several boards. He serves on the board of trustees of New York University and co-chairs the NYU Langone Medical Center board of trustees. Additionally, he is a trustee of the Boys and Girls Club of New York.

Fink’s dedication to philanthropy has had a beneficial effect on the communities he assists, supplying resources and aid to those in need while also contributing to the funding of research and development in fields like healthcare and education.

Influence on Global Finance

Larry Fink’s influence on global finance extends beyond his role as CEO of BlackRock. He has been instrumental in advocating for corporate governance, social responsibility, and long-term value creation in the global financial industry. Fink’s commitment to these principles has not only shaped BlackRock’s investment strategies, but also set an example for future generations to prioritize sustainability and philanthropy.

In addition, Fink’s evolving perspective on cryptocurrencies and his leadership in ESG investing have the potential to further shape the financial industry in the years to come. As a pioneer in responsible investing and an influential figure in global finance, Larry Fink’s impact on the industry is immeasurable and will continue to resonate for years to come.

Summary

Larry Fink’s journey from humble beginnings to becoming the billionaire CEO of BlackRock is a testament to the power of determination, vision, and strategic thinking. His unwavering commitment to long-term, sustainable, and responsible investing has not only shaped BlackRock’s success but also set new standards for the global financial industry. Fink’s personal life, philanthropic pursuits, and influence on global finance serve as an inspiration to future generations, reminding us that with hard work, dedication, and a commitment to making a positive impact, the sky is truly the limit.

Frequently Asked Questions

How much does Larry Fink own of BlackRock?

As of April 2023, Laurence D. Fink, CEO and co-founder of BlackRock, owns over 484,000 shares of the company, making him the largest individual shareholder with a stock value of $334 million.

Who are the 7 owners of BlackRock?

BlackRock was founded in 1988 by Larry Fink, Robert S. Kapito, Susan Wagner, Barbara Novick, Ben Golub, Hugh Frater, Ralph Schlosstein, and Keith Anderson. They provided institutional clients with asset management services from a risk management perspective.

What is Larry Fink’s net worth?

Larry Fink’s net worth is estimated to be around $1 billion, thanks to his successful leadership at BlackRock and his substantial holdings in the company.

He has been the CEO of BlackRock since 1988 and has been credited with transforming the company into the world’s largest asset manager. He has also been a major investor in the company, owning more than $350 million worth of BlackRock stock.

What was Larry Fink’s career before co-founding BlackRock?

Before co-founding BlackRock, Larry Fink had worked at First Boston, where he managed the bond department and was part of the management committee.