Exploring the potential of the Turo IPO? Get key insights into its timing, financial landscape, and industry impact. This article zeroes in on what investors need to know about Turo as it approaches its IPO, unpacking the implications of becoming a shareholder in the evolving car-sharing economy.

Key Takeaways

Turo, a leading peer-to-peer car-share company, plans to go public with an IPO date tentatively set for mid to late 2024, after initially filing with the SEC in August 2021 and facing delays due to economic conditions.

The company’s platform has experienced substantial growth, with a notable increase in customer numbers and bookings, and it competes effectively with traditional car rental services through its asset-light model and user-friendly platform.

While Turo’s revenues and market valuation have increased significantly, the company has yet to achieve profitability, a factor investors must consider when assessing the company’s financial health and future prospects in the IPO.

Exploring the Turo IPO Timeline

Turo initiated its journey to going public by filing its first Form S-1 with the SEC in August 2021. This document, which became publicly viewable in January 2022, signaled the company’s intent to launch an IPO. However, the volatile economic conditions of 2022 brought this process to a sudden halt.

Regardless of early setbacks, Turo revitalized its IPO plans by amending its S-1 filing in July 2023. Industry insiders now anticipate that Turo could conduct its IPO roadshow in December 2023, leading to a potential mid to late 2024 IPO date. This progression indicates the adaptability of Turo’s business model and its ability to navigate through economic turbulence.

Unveiling Turo’s Market Position

Turo has significantly influenced the peer-to-peer (P2P) car-sharing market, a segment that was valued at $1.6 billion in 2021 and is projected to reach $7.2 billion by 2030. The company’s substantial customer growth, which saw a 59% increase from April 2021 to April 2022, signals strong momentum.

Turo’s platform is a bustling marketplace with over 160,000 active hosts and more than 320,000 active vehicle listings as of December 2022. The user base has grown to over 3 million active users who booked in excess of 19.1 million days’ worth of rentals by the same period. Turo’s asset-light business model and focus on providing a curated, managed marketplace sets it apart from traditional rental companies.

Even with competition from traditional car rental companies like Zipcar and Enterprise CarShare, Turo has shaken up the conventional car rental market, enhancing customer satisfaction through its innovative approach. The company’s commitment to customer service, coupled with its flexible and diverse vehicle offerings, has collectively supported Turo’s growth and strong market position.

Decoding Turo’s Financial Health

Turo’s financial trajectory reveals a blend of remarkable revenue growth coupled with profitability concerns. The company saw its revenue soar from $469 million in 2021 to $746.6 million in 2022, with U.S. sales in April 2022 being 419% higher than in April 2019. This substantial revenue growth demonstrates the company’s impressive revenue growth and its ability to leverage its unique business model to generate financial gains.

Despite the encouraging financial indicators, concerns about Turo’s profitability persist. While the company has raised over $500 million in funding, it has not yet managed to turn a profit. This raises questions about its ability to achieve profitable status, particularly in peak rental markets. This factor is crucial for potential investors to consider when examining Turo’s financial health.

Revenue Analysis and Context

2019-2020: The revenue for Turo in 2019 and 2020 shows a modest growth from $141.69 million to $149.91 million, respectively. This period was likely impacted by the global COVID-19 pandemic, which had varying effects on businesses worldwide, including those in the sharing economy

2021: A significant jump in revenue is observed in 2021, with Turo reporting $469 million. This increase could be attributed to a rebound in travel and mobility as restrictions began to ease in many parts of the world, alongside an increased acceptance of the sharing economy.

2022: Continuing the upward trajectory, Turo’s revenue further increased to $746.6 million in 2022. This growth indicates a strong recovery and possibly an expansion in Turo’s market presence and user base

Understanding Turo’s Business Model

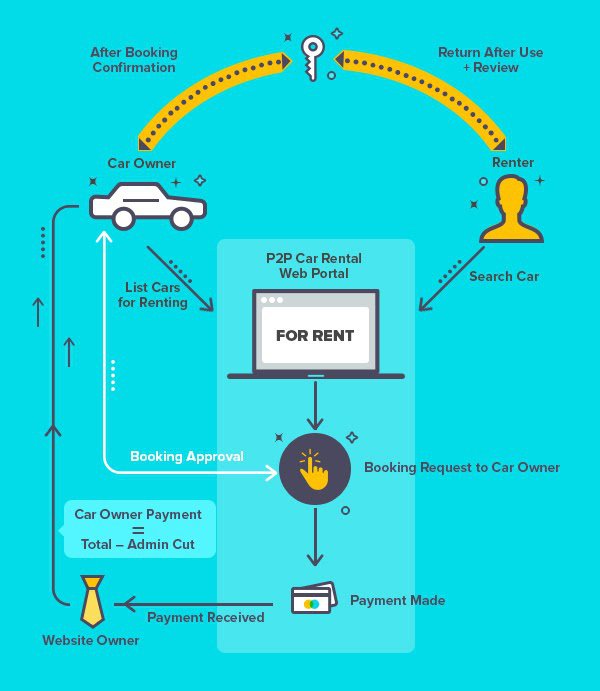

Turo’s unique business model is central to its success. The company operates as a peer-to-peer car-sharing network that connects car owners with renters, offering a variety of vehicles, including luxury and exotic models. Turo generates revenue through a variety of fees charged to both parties for each completed booking. This model showcases the company’s ability to innovate and disrupt traditional business practices in the car rental industry.

Turo’s platform is designed to enhance the value proposition for its users. The growth in Turo’s host community enhances the platform’s value due to network effects, while comprehensive customer support addresses users’ concerns. Turo’s advanced features, such as Turo Go, which allows keyless entry through the app, and contractual protection for damages and thefts, offer added convenience and peace of mind to users.

Car owners have the freedom to list a variety of vehicles, set their own rules, and decide on availability, while renters enjoy flexible options, including location, rental dates, and cancellations 24 hours prior to the start. Turo’s revenue is mainly derived from the commissions charged to both renters and hosts, typically retaining about 25% of each booking fee. This robust business model has collectively supported Turo’s growth and sets the stage for its promising future.

The Appeal to Car Owners

Turo’s platform offers an attractive opportunity for connecting car owners and renters. By renting out their vehicles on Turo when not in use, car owners can:

Earn extra income

Provide discounts for longer trips or advanced bookings, thereby increasing the potential for profits

Share their special car experiences with renters, especially if they own unique or less commonly available vehicles

Turo supports hosts with a range of management tools, such as account verification, pricing suggestions, availability calendars, and handling of post-trip payments. The company also offers performance analytics, business management tools, financing partnerships, and multi-car insurance options for car rental businesses looking to expand on Turo. Car owners can choose from five levels of vehicle protection plans that offer various degrees of reimbursement and earnings from 60% to 90% of the trip price, providing peace of mind.

Anticipating Share Details

As Turo prepares for its IPO, potential investors are eager to comprehend the specifics of its share offerings. The Turo stock price range will be determined in an amended S-1 filing forthcoming to the IPO, and it was speculated between $9.50 to $11.00 per share based on private transactions. Investors will be informed of the final IPO price the evening before the IPO, and any deviations from the anticipated range will require reconfirmation.

Retail investors interested in Turo stock will need to have an active brokerage account to participate in the IPO. There might be restrictions on selling shares immediately after the stock opens for trading, potentially for a duration of up to a month.

The Turo Directed Share Program allocates up to 5% of IPO shares to eligible hosts, providing an opportunity for hosts to participate in the company’s growth.

Assessing Turo’s Valuation Growth

The growth in Turo’s valuation over the years mirrors its successful business strategy and solid financial performance. From a valuation of approximately $1.3 billion in 2019, Turo’s worth has grown to around $2.7 billion as of the most recent updates. This significant growth trajectory paints a promising picture of Turo’s future profitability.

In 2022, Turo’s revenues spiked by 59%, amounting to $746.6 million, up from $469 million in the preceding year, with an impressive growth in active vehicle listings. These financial milestones indicate the company’s impressive revenue growth and strong market position, making it a potentially promising investment for those looking to buy Turo stock.

Turo’s Path to Profitability

Although Turo’s financial performance demonstrates strength and growth, the route to profitability is still unclear. The company possesses strengths such as a strong financial position and streamlined processes, which have collectively supported Turo’s growth, but it has not yet achieved profitability. However, the positive market sentiment point indicates potential for future success.

There is no public financial data to conclusively determine Turo’s profitability, though speculation suggests the private company is not yet profitable. This paints a complex picture of Turo’s financial health, which potential investors should consider carefully.

The Competitive Edge

In a competitive marketplace, Turo confronts intense competition from an array of car-sharing and rental companies, including:

Getaround

Uber Rentals

Zipcar

Lyft Rentals

The Hertz Corporation

Each of these competitors, including Gig Car Share, brings unique strengths to the table. For instance, Getaround shares a similar business model with Turo, and Uber Rentals boasts a substantial user base and capital.

Despite these challenges, Turo has successfully carved out a competitive edge for itself. The company distinguishes itself through:

A selection of unique and diverse vehicles not typically offered by traditional rental companies

Turo’s app-based booking system and flexible pick-up and drop-off options, which enhance customer convenience

Turo Go’s technology, which allows cars to be unlocked via a smartphone app, offering added convenience.

Turo’s commitment to customer service, as evidenced by its various protection plans and 24/7 customer support and roadside assistance, signals its commitment to customer satisfaction and retention. These factors contribute to Turo’s strong competitive position in the car-sharing industry.

Investment Strategies for Turo Stock

For retail investors eyeing Turo stock, maintaining an active brokerage account is necessary to partake in Turo’s IPO under favorable market conditions. This strategy enables investors to buy Turo stock directly once it goes public.

Another investment strategy to consider is investing in publicly-traded companies that have stakes in Turo, such as:

Google Ventures

Mercedes Benz

American Express Ventures

IAC

This approach provides indirect exposure to Turo and allows investors to diversify their portfolio.

Sustainability and Innovation at Turo

Turo stands out in the car-sharing industry due to its dedication to sustainability and innovation. The company has achieved Carbon Neutral Certification by SCS Global Services, demonstrating a balance between its carbon footprint and greenhouse gas reduction projects. Turo addresses all Scopes 1, 2, and 3 emissions, including direct and indirect emission from operations as well as those from the vehicles shared on its platform.

Turo has shown significant support for electric and hybrid vehicles. Some of the company’s initiatives include:

A 139% increase in the use of the ‘electric’ filter for bookings in summer 2023

A Greenhouse Gas Reduction Management Plan

EV financing partnerships, which contributed to around 14% of its Gross Booking Value in 2022

Beyond its platform, Turo invests in projects like the Kootznoowoo Forestry Project, which protects forest habitats and supports local education. Turo’s CEO emphasizes the objective of optimizing the use of the world’s 1.5 billion cars to minimize the environmental impact of personal transportation. This commitment to sustainability and innovation further enhances Turo’s appeal and sets it apart in the car-sharing industry.

Summary

To conclude, Turo’s unique business model, strong market position, and commitment to sustainability and innovation make it a compelling prospect in the peer-to-peer car-sharing industry. While the company has demonstrated impressive revenue growth, its path to profitability remains uncertain. As Turo plans to go public, potential investors should consider these factors and carefully evaluate Turo’s financial health, market position, and competitive landscape. As Turo continues to disrupt the traditional car rental market, it may just be the investment opportunity you’ve been waiting for.

Frequently Asked Questions

Is Turo going to go public?

Yes, Turo has filed for an IPO in 2022 and is committed to becoming profitable.

How do I buy Turo stock?

As of now, Turo is still a private company, so you cannot buy its stock through a brokerage account. However, you can consider investing in companies like IAC Inc, which holds a stake in Turo.

What is Turo’s business model?

Turo operates as a peer-to-peer car-sharing network, connecting car owners with renters and generating revenue through various fees charged to both parties. This allows Turo to facilitate car rentals between individuals, earning revenue from fees.

What is Turo’s current valuation?

Turo’s current valuation stands at around $2.7 billion.

Is Turo profitable?

No, Turo has not achieved profitability as of now.