Navigating the complex world of business often leads to the crossroads of shareholders vs stakeholders. Understanding their differences and the delicate balance between them is crucial for a company’s long-term success and sustainability. But fear not, as we embark on this journey together, we will unravel the intricacies of these two groups, explore their priorities, and delve into the theories that shape company goals.

Key Takeaways

Shareholders are owners of equity while stakeholders have a broader interest in the success and wellbeing of a company.

Common shareholders possess voting rights and potential for higher returns, whereas preferred shareholders have fixed-income dividends with higher priority claim on assets.

Balancing interests between shareholders & other stakeholders requires companies to identify key stakeholders, embrace stakeholder models & ensure fair treatment for all parties involved.

Defining Shareholders and Stakeholders

Shareholders and stakeholders are distinct groups with different interests in a company. Shareholders own equity, while stakeholders have a broader range of interests.

The success or failure of a company, including its ability to manage the company’s debts, has significant implications for both shareholders, who may receive a guaranteed annual dividend payment, and stakeholders, who focus on the overall company’s success and well-being of the company’s operations as well as the company’s performance.

| Characteristic | Shareholder | Stakeholder |

|---|---|---|

| Definition | An individual or institution that owns shares of stock in a company. | Any person or group that has an interest in or is affected by the operations of a company or organization. |

| Relationship to the company | Owner | Has a vested interest in the company, but does not necessarily own a piece of it. |

| Primary interest | Financial return on investment | Long-term success of the company |

| Rights | Voting rights, right to receive dividends, right to inspect the company’s books and records, right to sue the corporation for the misdeeds of its directors and/or officers | May have rights such as to be consulted on decisions that affect them, to receive information about the company, or to participate in the company’s governance. |

| Examples | Employees, customers, suppliers, government agencies, communities | Investors, employees, customers, suppliers, government agencies, communities, the public |

Shareholders: Owners of Equity

Shareholders are individuals or entities that possess shares in a company. Their primary concern is maximizing financial returns and increasing company profitability. Shareholders provide crucial investment for the company, and their ownership stake is directly tied to the company’s performance.

Some key points about shareholders include:

Shareholders can be individuals or entities

Their main goal is to maximize financial returns and increase company profitability

Their ownership stake is directly tied to the company’s performance

Majority shareholders, for example, own at least 50% of the company’s outstanding shares, wielding considerable influence over the company’s management and decisions.

On the other hand, preferred shareholders enjoy several advantages such as:

Priority in liquidation

Potential voting rights

Preferential tax treatment

These advantages make preferred shares an attractive investment option for those seeking stable income and priority in the event of company liquidation.

Related article: What Is Float In Stocks?

Stakeholders: Broader Interests

Stakeholders are any individuals or groups that have an interest in a company’s performance, including:

Employees

Customers

Suppliers

The community

They maintain a long-term relationship with the company and are concerned with its overall success and well-being, beyond the financial returns prioritized by shareholders. Stakeholders can be classified as internal or external. Internal stakeholders have a direct involvement with the company, such as employees, owners, shareholders, and managers, while external stakeholders, including customers, suppliers, government agencies, and the wider community, are indirectly impacted by the organization’s activities.

Types of Shareholders and Stakeholders

Exploring further into the realm of shareholders and stakeholders uncovers their unique types. Shareholders can be classified as common or preferred, each with unique characteristics and priorities. Stakeholders, on the other hand, can be categorized as internal or external, depending on their relationship with the company.

Common vs. Preferred Shareholders

Common shareholders possess voting rights and the potential for higher returns, albeit with a higher risk. They have the right to vote on certain corporate actions and decisions, giving them power proportional to the amount of shares held. However, common stock is more volatile and carries a greater risk of loss, making it suitable for investors with a higher risk tolerance.

On the other side of the spectrum, preferred shareholders have the following advantages:

Assured a fixed dividend with a lower risk

Receive dividends calculated by multiplying the dividend rate and the par value of the preferred shares, resulting in an annual dividend distribution per share

Have a higher priority in terms of claim on assets in the event of liquidation

With their fixed-income dividends and higher priority in terms of claim on assets in the event of liquidation, preferred stock is considered to be less risky and a more stable investment option.

Internal vs. External Stakeholders

Internal stakeholders are individuals or groups who have a direct relationship with the company, such as employees, shareholders, and managers. Their interests are directly tied to the company’s performance, and they play an active role in shaping the company’s future.

External stakeholders, on the other hand, are indirectly affected by the company’s actions and include:

Customers

Suppliers

Government agencies

Creditors

Labor unions

Community groups

They may not have the same financial interest in the company as shareholders, but their well-being and satisfaction can significantly impact the company’s long-term success and reputation.

The Relationship Between Shareholders and Stakeholders

While shareholders are a subset of stakeholders, balancing their interests with those of other stakeholders is key to achieving long-term success and sustainability for the company.

Companies must navigate the delicate balance between pursuing financial returns and addressing the broader interests of all stakeholders, not just shareholders.

Shareholders as Stakeholders

In the intricate web of business relationships, shareholders are also stakeholders with an interest in the company’s performance and success. They provide crucial capital to the company through their investments, and their ownership stake is directly tied to the company’s performance. By recognizing shareholders as stakeholders, businesses can ensure that their decisions and actions consider the impact on shareholder value, promoting transparency and accountability.

Nonetheless, it’s worth noting that despite shareholders being stakeholders, their main interest lies in financial returns and company profitability. This differentiates them from other stakeholders who prioritize the overall success and well-being of all parties involved.

Balancing Interests

Striking a balance between the interests of shareholders and other stakeholders can be a challenging feat. Shareholders generally seek to maximize profits, stock price, and dividend payouts, while stakeholders may be concerned with a broader range of issues, including social and environmental impact, employee welfare, and community relations. These diverging priorities can lead to conflicts over resource allocation, decision-making, and corporate governance.

To address these conflicts and maintain a harmonious balance, companies can employ strategies such as:

Identifying which stakeholders will generate long-term value for shareholders and prioritizing their requirements

Embracing the stakeholder model to ethically reconcile the interests of owners, stockholders, and stakeholders

Guaranteeing equitable treatment of all shareholders, including minority and foreign shareholders

Priorities and Timeframes: Shareholders vs Stakeholders

When it comes to company performance, shareholders and stakeholders hold divergent priorities and timeframes. Shareholders generally focus on achieving short-term gains, while stakeholders are more concerned with the long-term effects and sustainability of the organization.

Grasping this distinction allows companies to reconcile conflicting interests and secure long-term success.

Financial Returns vs. Overall Success

Shareholders focus on financial returns, as their primary concern is maximizing their return on investment. This often leads to a focus on short-term gains and profits, potentially at the expense of long-term sustainability and the interests of other stakeholders.

In contrast, stakeholders prioritize:

Overall success and the well-being of all parties involved

Long-term impact and sustainability of the company

A broader range of factors beyond financial returns, such as social and environmental impact, employee welfare, and community development.

Short-term Gains vs. Long-term Impact

Shareholders often seek short-term profits and a rapid increase in the company’s value, which can be reflected in stock prices. However, this focus on short-term gains can have detrimental effects on the company’s performance and stability, as it can lead to decisions that prioritize immediate benefits without considering long-term implications.

On the other hand, stakeholders are more concerned with the long-term impact and sustainability of the company. With a stakeholders focus, they prioritize:

the achievement of overall success

the maintenance of the well-being of all parties involved

ensuring that the company’s actions align with long-term goals and values.

Related article: Short Term Vs. Long Term Options

Theories Shaping Company Goals: Shareholder Theory vs. Stakeholder Theory

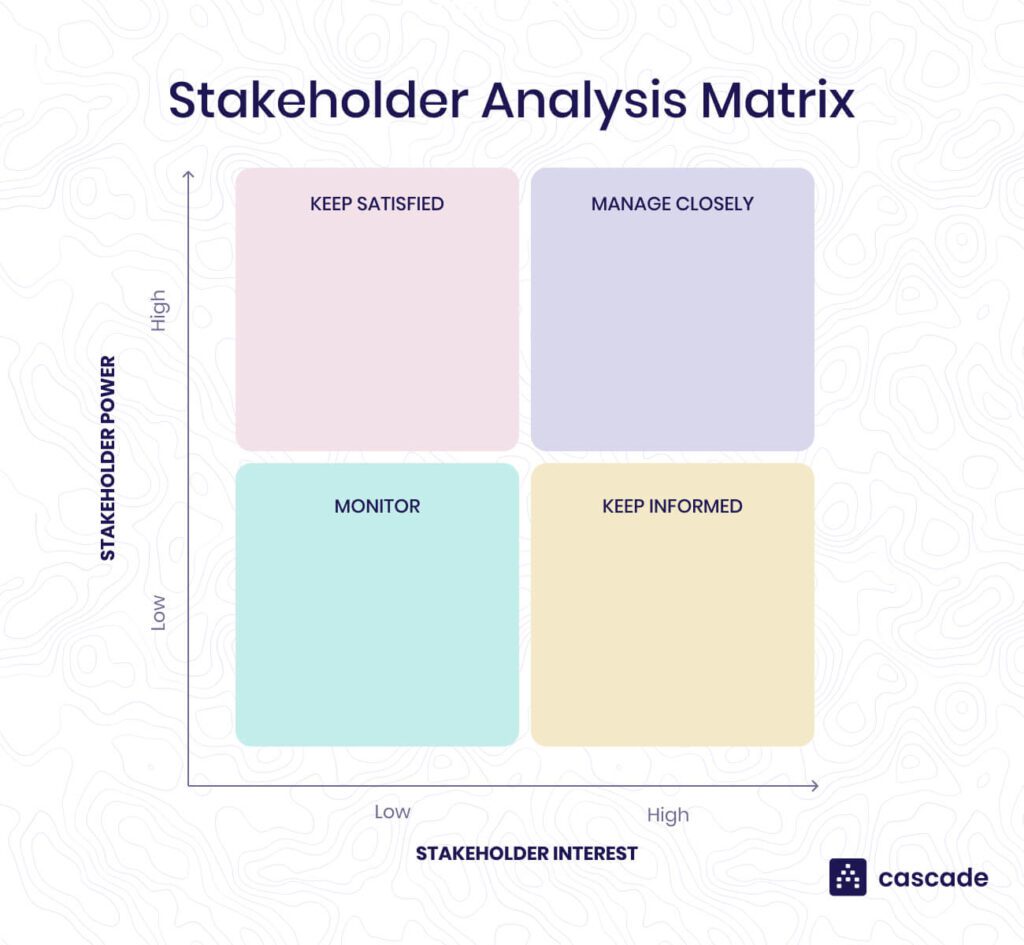

Source: cascade.app

Shareholder theory and stakeholder theory present two contrasting frameworks for determining company objectives and priorities. Shareholder theory, proposed by Milton Friedman, argues that a company’s primary goal is to maximize profits for shareholders within legal boundaries.

Stakeholder theory was first introduced by Dr. In contrast to other theories, it aims to ensure that all the stakeholders’ interests are taken into account. R. Edward Freeman, emphasizes creating value for all stakeholders, not just shareholders, to achieve long-term success and sustainability.

Shareholder Theory: Profit-Driven

Shareholder theory asserts that the primary aim of a corporation is to maximize profits for its shareholders. This theory suggests that managers should prioritize the interests of shareholders over other stakeholders and focus on increasing shareholder value. Shareholder theory has been advocated by notable economists and management experts, including Milton Friedman.

The advantages of shareholder theory include the focus on maximizing shareholder value and returns on investment, providing clear goals and objectives for the company, and encouraging efficient allocation of resources. However, the theory’s disadvantages include ignoring the interests of other stakeholders such as employees, consumers, and the local community, potentially leading to short-term decision-making and neglect of long-term sustainability, and possibly prioritizing profit over ethical considerations and social responsibility.

Stakeholder Theory: Value Creation for All

Stakeholder theory recognizes that businesses must deliver value to the majority of their stakeholders in order to be deemed successful. This includes:

Shareholders

Employees

Customers

Suppliers

Communities

Other affected groups

The theory underscores the interdependence of all stakeholders and the necessity for businesses to create value for all in order to ensure long-term success.

Introduced by Dr. R. Edward Freeman, stakeholder theory takes a more holistic approach to business management and decision-making, balancing financial returns with social responsibility, and addressing the needs and satisfaction of all stakeholders to attain long-term sustainable success.

Managing Shareholders and Stakeholders in Business Decisions

Effectively managing shareholders and stakeholders is a prerequisite for informed business decision-making and achieving a balance between financial returns and social responsibility. Employing effective stakeholder management techniques and balancing the pursuit of financial returns with a commitment to social responsibility can help companies navigate the complex landscape of shareholder and stakeholder interests.

Stakeholder Management Techniques

Stakeholder management techniques involve:

Identifying, analyzing, and addressing stakeholder expectations to ensure project success and support

Reviewing stakeholders and their influence on operations

Distinguishing those directly and indirectly impacted by the project

Examining the expectations and interests of all stakeholders in detail to identify additional stakeholders

Effective communication is also crucial for managing stakeholder expectations. Companies can ensure clear and regular communication by:

Maintaining an encouraging and optimistic tone

Attentively listening to stakeholder comments and concerns

Being truthful and transparent in their communication with stakeholders to address any worries or queries they may have

By following these practices, companies can effectively manage stakeholder expectations.

Balancing Financial Returns with Social Responsibility

In their commitment to social responsibility, companies need to strike a balance with the pursuit of financial returns, taking into account the interests of all stakeholders, not solely the shareholders. This balance is essential for long-term success, as focusing solely on shareholder interests can lead to a decline in reputation, decreased employee morale, and potential legal and regulatory issues.

By taking into account the perspectives of both shareholders and stakeholders, companies can make more informed decisions in line with their long-term goals and values. This approach promotes:

Sustainable business practices

Improved firm performance

Increased customer loyalty

Employee satisfaction

Community support

Summary

In conclusion, understanding the differences between shareholders and stakeholders is vital for businesses to navigate the intricate world of corporate governance and decision-making. By recognizing the unique priorities and timeframes of these groups, companies can effectively balance financial returns with social responsibility, ensuring long-term success and sustainability. So, embrace the challenge of balancing the interests of these diverse groups, and your company will undoubtedly thrive in the ever-evolving business landscape.

Frequently Asked Questions

Are shareholders primary stakeholders?

Shareholders are often seen as primary stakeholders, whose expectations of financial returns outweigh the needs of any other stakeholders. They provide risk capital to businesses, and their investments directly impact a company’s financial status. As such, shareholders are primary stakeholders.

What is the difference between a stakeholder and a shareholder?

The primary distinction between a stakeholder and shareholder is that stakeholders have a vested interest in a company, even if they don’t own stock, whereas shareholders own part of the public company through stock. All shareholders are stakeholders, but not all stakeholders are shareholders.

What are some examples of internal stakeholders?

Internal stakeholders include employees, shareholders, and managers, all of whom have an interest in the success of the organization.

What is shareholder theory, and who proposed it?

Shareholder theory, proposed by Milton Friedman, holds that companies should prioritize maximizing profits for shareholders within legal boundaries.

What is the main focus of stakeholder theory?

Stakeholder theory focuses on creating value and long-term sustainability for all stakeholders, not just shareholders.