Rivian, the innovative electric vehicle (EV) manufacturer, has gained significant attention in recent years for its groundbreaking R1T pickup truck, R1S SUV, and Amazon electric delivery van. With a strong focus on utility vehicles and a commitment to sustainability, Rivian is making its mark on the rapidly growing EV industry. But what does the future hold for Rivian stock? In this blog post, we’ll take a deep dive into the company’s background, financial performance, and what analysts predict for the future of Rivian’s stock price, specifically focusing on the “Rivian stock price prediction 2030”.

As investors, we know that the EV market is booming, and Rivian’s unique approach to creating electric adventure vehicles has the potential to revolutionize the automotive industry. As we explore Rivian’s stock price prediction up to 2030, we’ll consider factors such as financial growth, market positioning, and competition, providing you with the insights you need to make informed investment decisions.

Short Summary

Rivian Automotive is an ambitious EV company with a positive stock price prediction.

Factors such as production capacity, market demand and strategic partnerships influence Rivian’s stock price.

Analysts have a Buy rating for Rivian stocks with long-term potential. Investors should research the company before investing.

Rivian Automotive: Company Overview

Founded by RJ Scaringe, Rivian Automotive has quickly established itself as a major player in the EV market, with its highly anticipated R1T pickup truck and R1S SUV. Rivian’s commitment to innovation and sustainability has captured the interest of investors and consumers alike, making Rivian stock a hot topic in the world of finance.

As Rivian continues to expand its product lineup, the company is poised to capitalize on the growing demand for electric vehicles and focus on sustainability, solidifying its presence in the EV industry. This could lead to a positive Rivian stock price prediction and substantial investment opportunities for those looking to get in on the ground floor of this ambitious company.

Factors Influencing Rivian Stock Price

Rivian’s stock price is influenced by a variety of factors, including production capacity, market demand, and strategic partnerships. For example, supply chain issues and potential economic downturns could negatively impact Rivian’s financial performance, leading to a decline in stock prices. Conversely, positive market trends, competition, and technological advancements could all contribute to a more promising Rivian stock price forecast.

On November 9, 2021, Rivian conducted an upsized initial public offering (IPO) on the Nasdaq stock exchange. It priced 153 million shares at $78 each, amounting to a market valuation of approximately $66.5 billion. This impressive debut showcased the company’s potential and drew the attention of investors worldwide.

However, it’s essential to remember that Rivian’s stock price will also be subject to fluctuations based on market sentiment and the company’s performance. As with any investment, potential investors should be prepared for ups and downs and carefully consider their risk tolerance before investing in Rivian stock.

Rivian’s Financial Performance and Growth

Rivian has shown impressive growth in production and deliveries, which is evidenced by its increasing revenues and strong order backlog. The company has received over 114,000 preorders for its R1-series trucks and SUVs, which could impact the RIVN stock price. Rivian’s annual production goal for 2023 is set at 50,000 vehicles, demonstrating their commitment to meeting market demand.

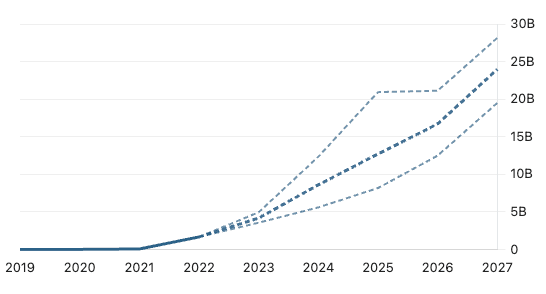

The company’s financial performance and growth trajectory are of great interest to investors and analysts alike. It’s anticipated that Rivian will generate a revenue stream between $12.7 billion to $20.9 billion by 2025, with the potential to deliver 700,000 units by 2030, contributing to a positive stock price prediction. However, it’s worth noting that Rivian has experienced net losses and negative gross profits in recent quarters, as shown by its Q1 2023 adjusted EBITDA of $(1,122) million and gross profit of $(535) million.

| Revenue | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|

| High | 5.0B | 12.3B | 20.9B | 21.1B | 28.2B |

| Avg | 4.2B | 8.6B | 12.7B | 16.7B | 24.0B |

| Low | 3.6B | 5.6B | 8.2B | 12.5B | 19.5B |

Despite these challenges, Rivian’s growth prospects remain promising, and the company is well-positioned to capitalize on the expanding EV market. Investors should keep a close eye on Rivian’s financial performance in the coming years to make informed decisions about the stock’s potential.

Rivian Stock Price History and Volatility

Since its IPO in November 2021, Rivian’s stock has experienced high volatility, with significant fluctuations in rivian stock prices due to market sentiment and the company’s performance. Factors that impact Rivian’s stock price include positive production and delivery figures, such as the quarter ending June 30, 2023, which led to a surge of more than 13% and reaching its maximum stock price. However, the withdrawal of its partnership with Mercedes-Benz led to a steady decline in Rivian’s stock, with rivian’s stock price falling from $40 to around $15 by December 2022.

Analysts’ Opinions on Rivian Stock

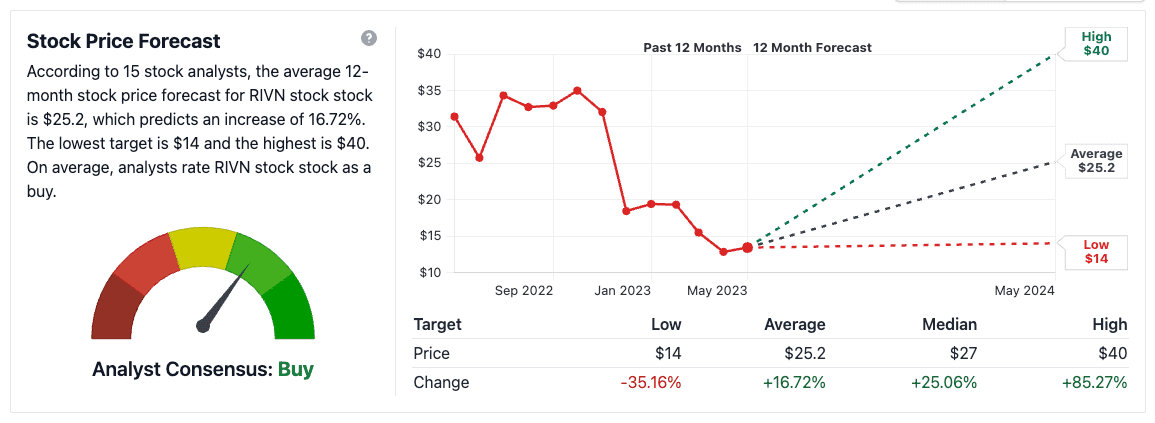

Analysts’ opinions on Rivian stock are varied, with some predicting strong growth and others expressing concerns about the company’s valuation and competitive landscape. The consensus rating of 15 analysts in the last year for Rivian Automotive stock is a Buy, with an average price target of $25.2 over the last three months.

It’s crucial for potential investors to consider these varying opinions when evaluating Rivian stock. While some analysts anticipate substantial growth, others have reservations about the company’s valuation and the competitive environment in the EV market.

As always, conducting thorough research and considering multiple perspectives can help investors make informed decisions about investing in Rivian stock.

Rivian Stock Price Prediction 2030

As we look towards the future, it’s essential to consider the various scenarios that may influence Rivian’s stock price in 2030. In the following sections, we’ll explore both the bullish and bearish outlooks, each with their own set of factors that could impact the company’s growth and stock performance. By examining these factors, we aim to provide a comprehensive stock forecast for Rivian in the coming decade.

Bullish Scenario

In a bullish scenario, Rivian’s stock price in 2030 could range between $85.90 to $95.10, driven by the company’s continued innovation, strategic partnerships, and strong market position in the EV industry. Rivian’s focus on utility vehicles and its strategic partnership with Amazon to develop and manufacture electric delivery vehicles could give it a competitive edge in the market. Considering these factors, Rivian’s stock price prediction for the next decade seems promising, while its stock price prediction 2023 will be an important milestone to watch, as well as the stock price prediction 2025.

However, it’s essential to recognize that this bullish outlook is contingent on Rivian’s ability to overcome challenges such as supply chain issues and increased competition. Investors should remain vigilant in monitoring the company’s progress and consider these factors when evaluating the long-term potential of Rivian stock.

Bearish Scenario

On the other hand, a bearish scenario for Rivian stock in 2030 could see the stock trading at lower levels due to increased competition, supply chain issues, and macroeconomic factors that could negatively impact the company’s growth. For example, if the company sells fewer cars, Rivian’s competitors, such as Tesla and Ford, have a considerably higher production rate, which could pose a challenge for the company.

Additionally, external factors like the COVID-19 pandemic have previously affected Rivian’s stock price, as evidenced by the drop to a low stock price of $18 by the end of 2022. Investors should be aware of these potential challenges and remain cautious when considering the long-term prospects of Rivian stock.

Long-term Investment Potential of Rivian Stock

Revenue Forecast

Given its innovative products, market position, and growth prospects, Rivian’s stock is considered to have long-term investment potential. The company’s unique focus on utility vehicles, strategic partnership with Amazon, and commitment to sustainability set it apart in the EV market, making it an attractive option for those seeking long-term gains.

Comparing Rivian with Competitors

When comparing Rivian with competitors like Tesla and Lucid Motors, it’s essential to consider the company’s unique focus on utility vehicles and its strategic partnership with Amazon. This focus differentiates Rivian from many of its competitors, who primarily concentrate on passenger cars. Additionally, this partnership with Amazon allows Rivian to tap into the growing market for electric delivery vehicles, giving the company a competitive edge in the EV industry.

These factors, combined with Rivian’s commitment to innovation and sustainability, position the company well in the rapidly expanding EV market. How to Invest in Rivian Stock

Related Article: A Comprehensive Analysis Of Starbucks Competitors In 2023

Investing in Rivian stock

If you’re considering investing in Rivian stock, it’s essential to research the company’s financial performance, growth prospects, and market position. Take the time to examine factors such as risk tolerance and investment goals before making a decision.

To purchase shares of Rivian, you can:

Register with a reputable exchange broker, such as eToro or Webull.

Rivian is a publicly traded company on the NASDAQ stock exchange. Its symbol is RIVN.

Conduct thorough research and consider various factors to make informed investment decisions.

Capitalize on the potential growth of Rivian stock.

Summary

In conclusion, Rivian’s stock price prediction up to 2030 presents both potential rewards and risks for investors. The company’s focus on utility vehicles, strategic partnership with Amazon, and commitment to innovation and sustainability set it apart from competitors in the rapidly growing EV market. However, investors should be prepared for volatility and potential challenges, such as increased competition and supply chain issues, when considering an investment in Rivian stock.

By conducting thorough research, considering analyst opinions, and comparing Rivian to its competitors, investors can make informed decisions about the long-term potential of Rivian stock. As the EV market continues to expand, Rivian’s unique approach to creating electric adventure vehicles could prove to be a game-changer in the automotive industry.

Frequently Asked Questions

What will Rivian stock be worth in 2025?

Market analysts predict that Rivian stock will reach around $45 in 2025 due to positive projections for the company.

What will Rivian price be in 2040?

Rivian’s stock price is projected to experience steady growth, reaching an impressive peak in 2040. Therefore, its price in 2040 can be expected to be higher than what it is today.

What products does Rivian currently offer?

Rivian offers two electric vehicles: the R1T pickup truck and the R1S SUV, designed for utility and adventure.

Both vehicles are equipped with four electric motors, providing up to 750 horsepower and 826 lb-ft of torque. This allows for a 0-60 mph time of 3 seconds and a range of up to 400 miles.

What factors influence Rivian’s stock price?

Rivian’s stock price is influenced by factors like production capacity, market demand, strategic partnerships, and macroeconomic conditions.

How has Rivian’s financial performance and growth been in recent years?

Rivian has experienced significant financial growth in recent years, with production and deliveries steadily increasing, revenues growing, and a strong order backlog.

Data and charts provided by Stockanalysis. Disclaimer: Cheddar Flow is not a registered investment advisor nor is licensed as such with any federal or state regulatory agency. Cheddar Flow does not manage client assets in any way. Information provided and opinions expressed on this website do not constitute investment advise. The ideas expressed on this site and related services are solely the opinions of Cheddar Flow and are for educational purposes only. We advise everyone to know the risks involved with trading stocks and options. We encourage every visitor to the website to do his/her own research and to consult with his/her own financial advisor(s) prior to engaging in any investing activities, and to make sure he/she knows all the potential risks involved. Any investment decision that results in losses or gains made based on any information on this site or related services is not the responsibility of Cheddar Flow. Cheddar Flow is solely a data-provider and not a stock picks alert service.