Ever heard of a company revolutionizing global trade while skyrocketing in valuation? Meet Flexport, a digital freight forwarder and customs brokerage platform that has caught the attention of investors around the world. In this blog post, we’ll dive into Flexport’s impressive growth, its path to an IPO, and potential investment opportunities in Flexport stock.

Key Takeaways

Flexport is a San Francisco-based global supply chain company with advanced capabilities and impressive growth.

Accredited investors can buy or sell Flexport stock, while retail investors should consider related investments in the industry and associated risks before investing.

Tracking performance through news updates from reputable sources helps potential investors weigh the rewards and risks of investing in Flexport.

Understanding Flexport’s Business

Imagine a world where global trade is streamlined, connecting all parties involved in a seamless, efficient process. This is the vision of Flexport, a San Francisco-based company founded by Ryan Petersen. As a digital freight forwarder and customs brokerage platform, Flexport connects over 10,000 clients and suppliers worldwide, enabling them to participate in the global economy.

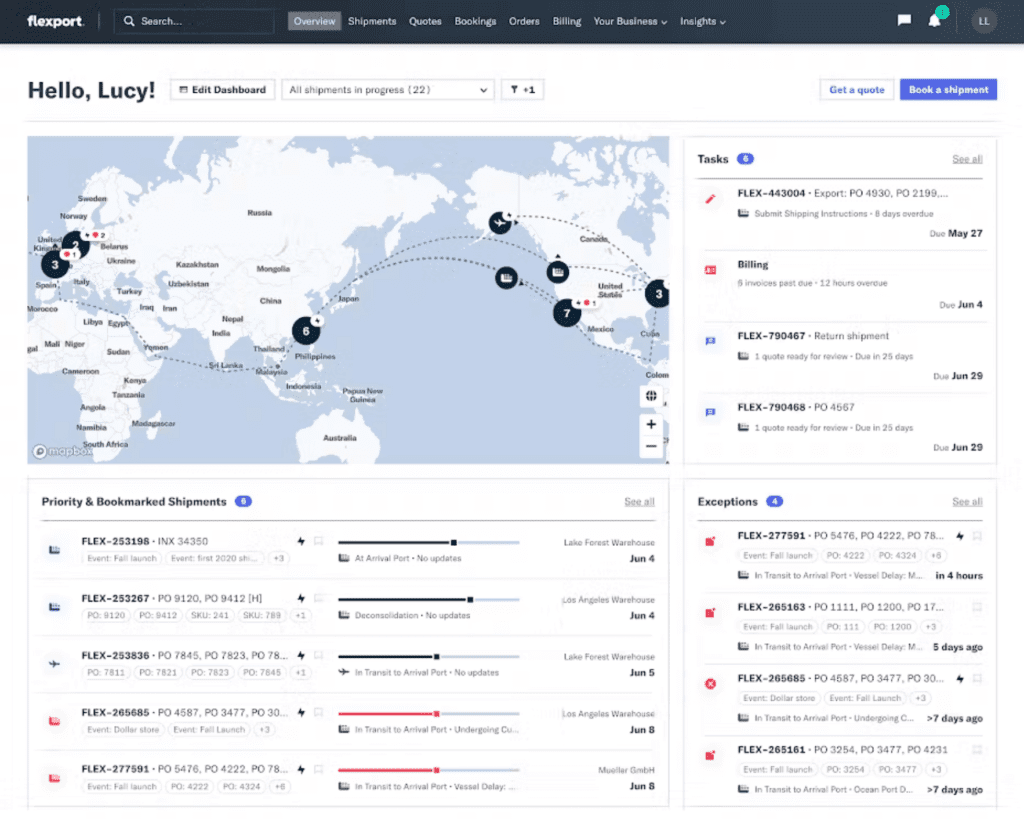

Customers enjoy a range of advanced capabilities on Flexport’s platform, including:

Real-time cargo tracking

Alerts

Quotes

Inventory visibility

The company’s mission is to facilitate international trade and global supply chains. As a private company, Flexport does not have a stock symbol, but its investors include notable names such as Founders Fund and DST Global.

One of the key strategies for Flexport’s growth is the development of a truck brokerage operation to facilitate more efficient transportation of goods throughout North America. This will enable the company to provide a factory-to-door distribution service. To further these ambitions, Flexport recently acquired the technology of Convoy, a trucking startup that had shut down.

Flexport’s unique approach to global trade fosters innovation and growth by bringing together buyers, sellers, and logistics providers of all sizes. Although Flexport is a private company, its rapid growth and unique position in the market have captured the attention of investors worldwide.

Related Article: Investing In Neuralink Stock: A Complete Guide For 2023

Flexport’s Impressive Growth

Flexport’s rapid growth is one standout aspect of the company. A look into Flexport valuation history reveals an impressive increase from $82.06 million in 2014 to $8 billion in 2022. This growth can be attributed to a variety of factors. The digitization of supply chains, a dependable global logistics network, expedited financing options, and freight software all contribute to Flexport’s success. Additionally, the company’s expansion into new markets and ongoing enhancement and innovation have played a significant role in its impressive growth.

This rapid growth has captured the attention of many potential investors, making Flexport one of the most exciting companies to watch in the global supply chain industry.

Flexport’s valuation over the years:

| Date | Funding Round | Valuation |

|---|---|---|

| August 2015 | Series A | $102.54 million |

| September 2016 | Series B-1 | $380.57 million |

| September 2016 | Series B-2 | $320.11 million |

| September 2017 | Series C | $953.3 million |

| February 2019 | Series D | $3.2 billion |

| February 2022 | Series E | $8 billion |

Flexport’s revenue over the years:

Data sources: Research Contrary, Sacra

The Path to Flexport’s IPO

While Flexport has experienced tremendous growth, the company has not yet gone public. There is no definitive date set for Flexport’s initial public offering (IPO), but the goal remains actively pursued. There are various factors to consider when a company decides to go public. These include:

The need for capital

Growth opportunities

Liquidity for shareholders

Enhanced visibility and credibility

Acquisition currency

Exit strategy for early investors

Regulatory requirements

While investing in any company comes with inherent risks and rewards, potential investors should carefully weigh these factors before deciding to invest in Flexport, keeping in mind that investing involves risk.

Investors can monitor Flexport’s performance by keeping abreast of company news and updates, scrutinizing its financials, and observing the company’s competitors. By staying updated on Flexport’s progress, potential investors can make informed decisions about the company’s future IPO and the potential risks and rewards associated with investing in the company.

Related Article: Investing In NFL Stock: How To Get In The Game

Investing in Flexport Stock: Accredited Investors

Accredited investors who meet all applicable eligibility requirements have the opportunity to buy Flexport stock or sell Flexport stock, despite its private status. Flexport’s stock price can be determined by dividing the company’s valuation by the number of shares outstanding.

Accredited investors, including some notable investors, can invest in Flexport preferred stock. To do so, they must create an account on a platform such as Equitybee. Equitybee’s platform offers shares in several top-tier companies.

Investing in Flexport Stock: Retail Investors

As Flexport is not publicly traded at this time, direct investment in the company’s stock is out of reach for retail investors. However, retail investors can still explore related investment opportunities in the logistics and supply chain industry.

One such option is to invest in companies like Shopify or other logistics and supply chain companies, as well as exploring the secondary market. While Shopify’s operations are only partially dependent on Flexport’s success, as it primarily functions as an eCommerce platform, it still represents a related opportunity for retail investors who are interested in the industry.

Investing in any company, be it public or private, carries risks. Potential investors should carefully consider these risks and rewards before deciding to invest in any company, including private companies like those related to Flexport’s industry.

Key Players in Flexport’s Success

The success of Flexport is thanks to the collective efforts of:

Founder Ryan Petersen

The management team

Board members

High-profile investors such as SoftBank, Founders Fund, and DST Global

Petersen, who also serves as the company’s chief executive officer, has been instrumental in driving Flexport’s growth and innovation.

Additionally, the key players in Flexport’s management team include:

Ryan Petersen, the CEO and Founder

Sanne Manders, the President, Flexport Ocean and Air

Stuart Leung, the Chief Financial Officer

Together, these key players have helped shape Flexport into the innovative, industry-leading company it is today.

Flexport’s Competitive Landscape

Flexport competes with numerous other companies in the logistics industry, including Haven, FourKites, and Echo Global Logistics. However, Flexport’s cutting-edge technology and customer-centric approach give it a unique edge in the industry.

Flexport’s innovative technology is comparable to its competitors in the logistics and freight forwarding industry, but its digital-first approach and advanced solutions, such as real-time visibility, streamlined processes, and efficient supply chain management, set it apart.

Moreover, Flexport’s customer-centric approach is distinct from that of other logistics companies, with an emphasis on the customer experience and a customer-obsessed mindset. This progressive approach, powered by technology, data analytics, and a customer-centric attitude, sets Flexport apart from traditional logistics companies.

Risks and Rewards of Investing in Flexport

Investing in Flexport, like any investment, carries potential risks and rewards. Some of the risks include market volatility, the unpredictability of its IPO, and the company’s ability to achieve its goals and compete in the market.

However, the potential rewards are also considerable. Flexport’s strong growth and unique position in the market could lead to a substantial appreciation in the value of an investment, as well as potential dividends or returns.

Before deciding to invest in Flexport or any other company, it is important for potential investors to carefully consider the risks and rewards associated with the investment, as well as their own risk tolerance and investment objectives.

Tracking Flexport’s Performance

Even though Flexport’s stock price isn’t publicly available, investors can keep track of the company’s performance by staying updated with news, following industry trends, and monitoring the performance of related companies. Key industry trends impacting logistics companies such as Flexport include the incorporation of new technologies, growth of autonomous vehicles, utilization of 3D printing, adoption of cloud-based logistics solutions, and emphasis on supply chain visibility. Monitoring these trends can provide insight into the company’s position in the market.

Reliable news updates regarding Flexport’s performance can be accessed from reputable sources such as:

Bloomberg

The Information

CNBC

FreightWaves

Summary

In conclusion, Flexport is an innovative company revolutionizing global trade with its unique approach and rapidly growing valuation. While the company’s IPO remains uncertain, potential investors can explore opportunities to invest in Flexport’s stock or related companies.

Frequently Asked Questions

Is Flexport a publicly traded stock?

Flexport is not a publicly traded stock and does not trade on Nasdaq or NYSE since it is still a private company. To invest in the pre-IPO shares, you must be an accredited investor.

Is Flexport going to IPO?

It does not appear that Flexport is currently pursuing an IPO at this time.

What is Flexport’s current valuation?

Flexport’s most recent valuation was estimated at $8 billion for 2022.

What are some alternative investment opportunities for retail investors interested in Flexport’s industry?

Retail investors interested in Flexport’s industry can explore investing in Shopify or other logistics and supply chain companies as alternative investment opportunities.