Imagine a world where paralysis is reversible, and brain disorders are treatable with cutting-edge technology. That’s the potential of Neuralink, a company developing brain-computer interfaces to unlock human potential. In this blog post, we will guide you through the ins and outs of investing in Neuralink stock, including its current status, financial backers, road to IPO, and alternative investment options.

Key Takeaways

Neuralink is a privately-funded company backed by Elon Musk and other notable investors, with an estimated valuation of $5 billion.

The timeline for Neuralink’s IPO depends on the development of marketable products, FDA approval process and financial milestones.

Investors can prepare for Neuralink’s IPO by researching the company, opening a brokerage account and considering potential risks associated with investing in neural engineering sector ETFs or funds.

Is Neuralink Publicly Traded?

Though investing in Neuralink may seem appealing, one must grasp the fact that it is not yet publicly traded. The company remains private, with no Neuralink stock symbol or public trading options available. This means that regular investors cannot acquire Neuralink stock until it becomes publicly available.

Despite the inability to invest in Neuralink in 2023, keeping abreast with the company’s progress and any impending initial public offering (IPO) developments remains crucial.

Related Article: Stripe Stock 2023: How To Invest In The Pre-IPO Market

Neuralink’s Financial Backers

Neuralink’s primary shareholder is Elon Musk, the company’s CEO and visionary entrepreneur. Other notable private investors supporting Neuralink’s growth include Peter Thiel’s Founders Fund and Google Ventures. Together, these investments have significantly contributed to Neuralink’s estimated valuation of approximately $5 billion as of June 2023.

As a private company, Neuralink has raised over $600 million from these investors to develop its groundbreaking brain-computer interface technology.

The Road to an IPO

Neuralink’s journey toward an IPO is filled with uncertainties, with the need to develop marketable products, secure FDA approval, and hit financial milestones before it can go public. These factors make it difficult to predict a specific IPO date, leaving potential investors wondering when they might have the opportunity to invest in Neuralink.

Related Article: How To Invest In Aldi Stock In 2023

Marketable Products

A key requirement for Neuralink’s IPO will be the development of marketable products that demonstrate the potential and profitability of its technology. Although Neuralink’s products are not yet available to the public, the company’s innovative brain-computer interface technology sets itself apart from competitors and has the potential to revolutionize healthcare and address a wide range of neurological conditions and disabilities.

The global brain computer interfaces market, including the emerging generalized brain interface technology, is expected to reach billions of dollars by 2032, indicating a substantial market opportunity for Neuralink’s products.

FDA Approval

Securing FDA approval for its brain-computer interface technology is another key step for Neuralink. The FDA approval process for medical devices like Neuralink’s technology involves:

Nonclinical testing

Submission of an Investigational Device Exemption (IDE)

Conducting human clinical studies

Filing a premarket approval (PMA) application.

This process can take anywhere from six months to a few years to complete, depending on various factors.

Financial Milestones

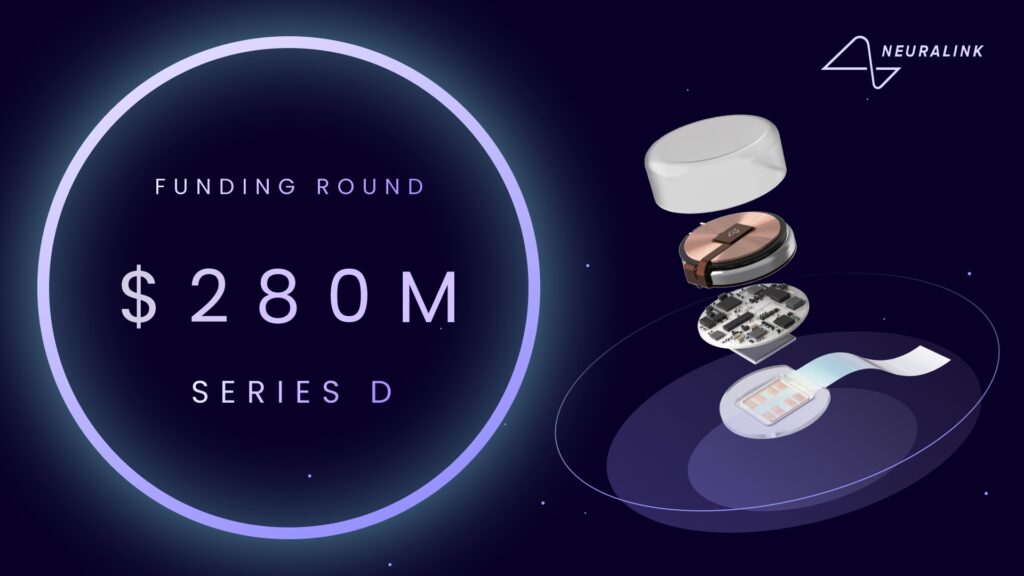

Neuralink must hit financial milestones like revenue growth and profitability before it can go public. The company has already raised $280 million in new funding (in August 2023) from investors to develop its technology, but its current revenue and profitability figures remain undisclosed. With the expected advancements, these milestones may be achieved sooner than anticipated. Once these milestones are reached, the possibility of Neuralink shares being available to the public could become a reality.

Research on other tech startups indicates that, on average, these companies require 6.4 years and five funding rounds before successfully launching an IPO.

Investing in Neuralink Alternatives

Investors keen on the neural engineering sector have alternative biotech companies to consider, like Amgen, Biogen, and AstraZeneca. These companies offer similar technologies and may provide investment opportunities while waiting for Neuralink’s IPO. Additionally, investors can explore firms such as Arch Venture Partners, which are known for backing innovative companies in the sector.

Another option for indirect exposure to Neuralink is investing in Alphabet stock, as Google Ventures, an early investor in Neuralink, is a subsidiary of Alphabet. By investing in Alphabet or other related stocks, investors can potentially benefit from Neuralink’s growth while diversifying their portfolio in the technology sector.

How to Prepare for Neuralink’s IPO

To prepare for Neuralink’s IPO, investors ought to delve into the company’s background, financials, offerings, and executive team. This will provide a comprehensive understanding of Neuralink and its prospects, allowing investors to make informed decisions when the stock becomes available.

In addition to researching Neuralink, investors should set aside funds and open a brokerage account with platforms such as Fidelity, eToro, or SoFi to buy Neuralink stock. These platforms offer hassle-free online trading, low account requirements, and no fees. By having an account and funds prepared, investors will be ready to invest in Neuralink’s stock as soon as it becomes available.

Risks and Rewards of Investing in Neuralink

Both risks and rewards are part of investing in Neuralink. On the one hand, the company’s groundbreaking technology has the potential for significant returns. However, Neuralink also faces regulatory hurdles and market uncertainties.

Some of the potential market risks for Neuralink include:

FDA concerns regarding the device’s battery

Potential security risks associated with malware and Bluetooth connectivity

Allegations of mishandling infectious pathogens

The need to address complex legal and ethical consequences

Investors, including accredited investors, should weigh these risks against the potential rewards when considering an investment in Neuralink.

ETFs and Funds with Exposure to Neural Engineering

To gain a more extensive exposure to the neural engineering sector, investors might look into ETFs such as the Global X Robotics & Artificial Intelligence ETF (BOTZ). This fund invests in companies focused on robotics and AI technologies, which may include companies with neural engineering applications.

Additionally, mutual funds such as FBTAX, FBIOX, and FBDIX have holdings in neural engineering companies, including private companies, providing another avenue for investment in this innovative sector.

Summary

In conclusion, investing in Neuralink stock requires patience, research, and preparation. As a private company, Neuralink’s IPO timeline remains uncertain. However, by staying informed about the company’s progress, exploring alternative investments, and preparing for the potential IPO, investors can position themselves for success in the neural engineering sector. As Neuralink continues to develop its revolutionary brain-computer interface technology, the potential for significant returns and life-changing advancements in healthcare remains an exciting prospect for investors.

Frequently Asked Questions

Can you buy Neuralink stock?

Unfortunately, Neuralink is not publicly traded, so you are not able to buy stock in it. You need to be an accredited investor to invest in the private market.

Will Neuralink have an IPO?

It is unlikely that Neuralink will have an IPO soon since it is a private company and majority-owned by Elon Musk. The company regularly raises private investment from various funds and individuals instead of setting an IPO date. Furthermore, the influx of capital does not necessitate an IPO for funding purposes.

What is Neuralink stock called?

Neuralink does not have a stock symbol or trade in the public stock market as it is not yet a public company.

What is Neuralink’s current stock status?

Neuralink is not currently publicly traded, meaning its stock is unavailable to on the public market.