To further understand the difference between short term and long term options, it’s useful to first understand that an option contract is made up of intrinsic and extrinsic value. The intrinsic value is the amount above the strike price of an option contract for a call option, or the amount below the strike price for a put option. The extrinsic value (also called “time value”) is the portion of the contract that you’re paying for the time you have to reach the strike price.

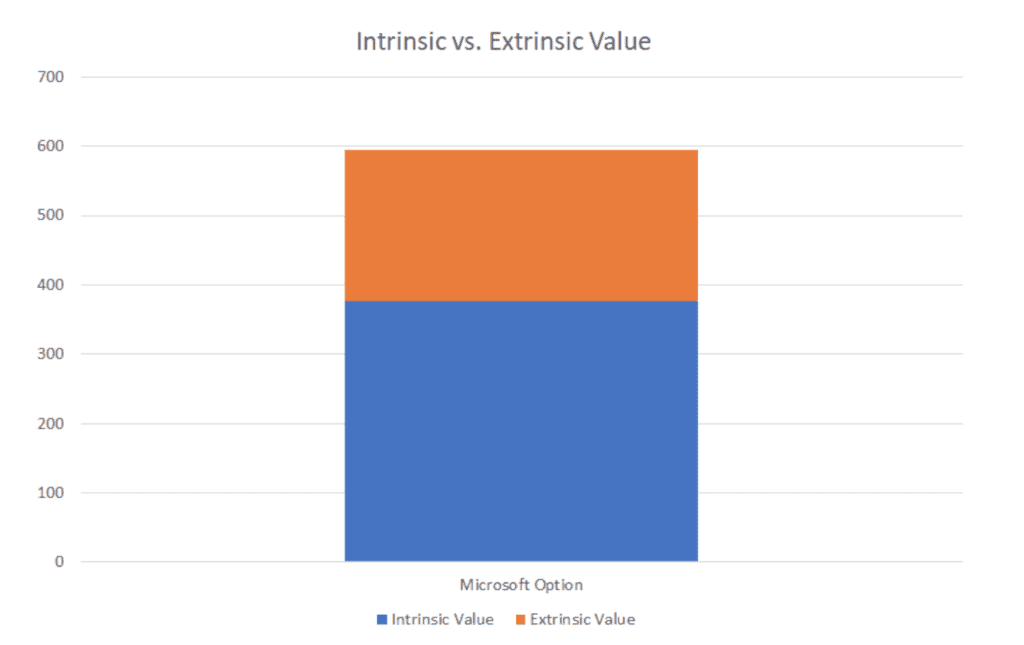

For example, on October 23, a Microsoft call option with a strike price of $220 and November 13 expiry costs $595. As of October 23, Microsoft’s stock price is $216.23. Since the strike price is above the current price then the option is full of extrinsic value.

This information is important for later, as short term options tend to have a lower extrinsic value since there is less time value for the option, versus long term options that have a high time value. It’s also worth knowing that theta decay is the rate at which an option loses its extrinsic value. The closer an option is to the expiry date, the higher the rate. This means that short term options lose their time value at a much higher rate than long term options.

Short Term Options

Everyone has a different idea on the timeframe for short term options but generally they have expiry dates ranging from a few days away, to a few weeks away. People typically play short term options when there is an event that can drastically move the stock price in the near term. Events like an earning call, company conference, competitor news coming out, or larger economic events (stimulus, presidential election, etc). Here are the top advantages and disadvantages of playing short term options.

| Pro’s | Con’s |

|---|---|

| Potential for large increase in option value | Very high risk, options can easily go to $0 |

| Options are usually cheaper because they don’t have much time value left | Very high theta decay, options lose value quickly |

Short term options are very risky. They have a huge potential upside, but that also means they can go to zero very quickly if the stock moves in the wrong direction or doesn’t increase enough in value (for a call option). They are usually cheaper because of the short time horizon but that also means that theta decay is very strong and the options lose value even quicker.

For example, if you bought a November 6 PayPal Call option with a strike price of $187.5, it would cost you $910 at market close on November 2nd. PayPal dropped after earnings and that call option is only worth $35 when the market opened the next day!

On the flip side, if you bought a November 6 Qualcomm Call option with a strike price of $130, it would cost you $335 at market close on November 4th. Qualcomm jumped ~13% after hours because of earnings and that call option is worth over $1,500 the next morning which is about a 5x increase!

Long Term Options

Long term options typically have an expiry date of 6 months or more. People play long term call options in order to get more leverage in a stock, instead of buying 100 shares, which requires more capital. Here are the top advantages and disadvantages of playing long term options.

| Pro’s | Con’s |

|---|---|

| Gain leverage of 100 shares for a lower capital cost | Unlike stocks, long term options have an expiry date and theta decay |

| Low theta decay because options have long expiry dates | More expensive than short term options |

In some ways long term options can be similar to holding the underlying stock. You get leverage of 100 shares and a price increase of the delta value depending on the strike price. Meaning a call option with a 0.7 delta will increase $0.7 for every $1 increase of the underlying stock price. Because long term options have a far expiry date, most of the option value is extrinsic, with a low theta decay initially that starts to increase around 60 days before expiry.

The main downside of long term options is that if the stock doesn’t increase in value (for call options) then your options start losing intrinsic and extrinsic value. When holding a stock you can wait for the stock price to go up as long as needed, but with long term options there’s an expiry date so if the stock trades sideways or goes down, you will be losing money on the option.

For example, if you buy a Microsoft Call option with a $200 strike price and a January 21, 2022 expiry date, it would cost $3,650 on November 4th. If Microsoft reaches $250 by June 11, 2021 then that option would be worth $5,477 which is an increase of $1,827. If you used the option price of $3,650 to buy around 17 shares (at $217 stock price), you would only gain $561 for the same price increase on June 11, 2021.

On the flip side, if Microsoft stays at the same price on June 11, 2021 then the option value would go down to $3,150 because of theta decay. This is a rough decrease of $500 that wouldn’t have happened if you bought shares instead of options. The decrease in value could be much greater if the stock starts to go down since you have leverage of 100 shares.

Final Thoughts

Short term options can be very tempting because of the huge potential but they’re also very risky. Very often option prices are elevated ahead of major events like an earnings call which means that the stock price needs to move a lot in your favor in order to profit because of IV crush (reduction of Implied Volatility after an event). A good way to think about buying short term options is to buy whatever you’re okay with losing. That means a small percentage of your account that you’re willing to gamble in hopes of a huge upside.

Long term options can be a great tool to gain more leverage on a stock if you’re bullish. It offers a lower capital cost for greater exposure. However, with long term options you have an expiry date (compared to buying the underlying stock), and if the stock price remains the same or decreases, you lose intrinsic and extrinsic value on behalf of 100 shares.