Are you eager to start investing but feel limited by high-priced stocks? Enter the world of fractional shares, an innovative investment solution that levels the playing field by allowing you to buy a “slice” of a stock for as little as $5. With Charles Schwab’s cutting-edge Stock Slices program, you can access some of America’s leading companies and build a diversified portfolio without breaking the bank.

In this comprehensive guide, we’ll explore the ins and outs of Charles Schwab’s Stock Slices program, discuss how to invest in fractional shares, and compare Charles Schwab to other online brokerages. Whether you’re a seasoned investor or just starting, fractional share investing can be a game-changer in reaching your financial goals.

Key Takeaways

Invest in fractional shares with Charles Schwab to unlock dollar cost averaging and portfolio diversification for maximum returns.

Open a Schwab Account today, fund it conveniently and easily, then choose & purchase Stock Slices to get started.

Compare fees/account minimums between Charles Schwab & other online brokerages for the best fit, start investing now!

Charles Schwab and Fractional Shares: An Overview

Charles Schwab, a pioneering online brokerage, has made investing more accessible and affordable by offering fractional shares through its Schwab Stock Slices program. This revolutionary approach to investing enables investors to build a diversified portfolio without the need for substantial capital upfront.

Fractional shares grant you the ability to buy a “slice” of a stock, even if the stock price is high, allowing you to invest smaller amounts and still reap the rewards of stock market growth. Before diving into investing, it’s wise to assess your individual circumstances and possibly consult a professional investment advisor.

What are Schwab Stock Slices?

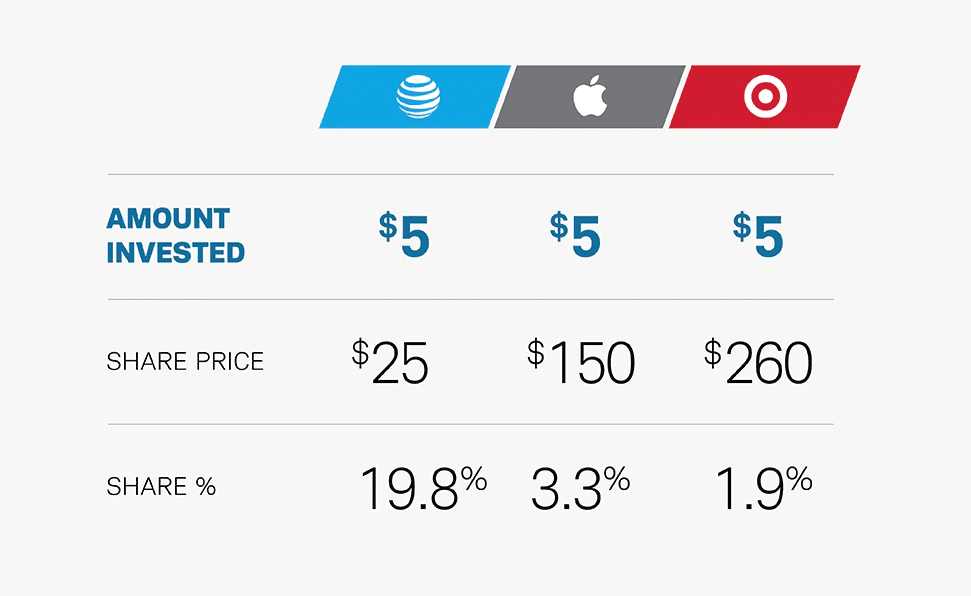

Schwab Stock Slices offer an incredible opportunity for investors to buy a “slice” of a stock for as little as $5, enabling them to invest in expensive stocks with smaller amounts, even after stock splits. This innovative program allows you to purchase fractional shares of up to ten S&P 500 companies for a set dollar cost, giving you the flexibility to invest in specific stocks without having to buy a whole share or exchange-traded funds.

Retail Schwab brokerage account holders, including those with custodial accounts and individual retirement accounts (IRAs), are all eligible for Schwab Stock Slices, offering a wide range of options to suit your investment needs. Additionally, Charles Schwab provides financial advisory services to help you make informed investment decisions and maximize your potential returns.

Related Article: What Does Overweight Stock Mean?

Eligible Stocks for Schwab Stock Slices

With Schwab Stock Slices, you can invest in some of the top U.S. publicly traded companies by purchasing a portion of a company’s stock, as long as the shares available for purchase are those in the S&P 500 Index. This diverse selection of stocks offers you access to a wide range of investment opportunities, allowing you to customize your portfolio based on your preferences and financial goals.

From tech giants like Apple and Amazon to powerhouse corporations such as Microsoft and Google, Schwab Stock Slices allows you to invest in some of the most exciting S&P 500 stocks. The S&P 500 selection process is exclusive to Standard & Poor’s and incorporates criteria such as:

Market capitalization

Industry leadership

Operational performance

Liquidity

Remember, Schwab Stock Slices limits your choices to S&P 500 stocks, excluding non-S&P 500 stocks.

How to Invest in Fractional Shares with Charles Schwab

To start investing in fractional shares with Charles Schwab, you’ll need to complete three simple steps:

Open a Schwab account: Visit their website and fill out the registration form with your personal information. Once your application is verified, you can proceed to the next step.

Fund your account: Deposit funds into your Schwab account. This will provide you with the capital needed to start investing in fractional shares.

Choose and purchase stock slices: Once your account is funded, you can browse through the available stock slices and choose the ones you want to invest in. Purchase the desired stock slices to begin your investment journey.

By following these three steps, you can easily start investing in fractional shares with Charles Schwab.

Funding your Schwab account is a breeze, with options such as wire transfer, account transfer, or mobile check deposit available. With your account funded, you’re ready to select and purchase stock slices, giving you the opportunity to build a diversified portfolio tailored to your investment goals.

Related Article: Understanding Short Covering: Definition, Meaning, And How It Works

Opening a Schwab Account

The process of opening a Schwab account is straightforward and user-friendly. Here are the steps:

Visit the Schwab website.

Click on the “Open an Account” or “Apply Now” button.

Fill out the registration form with your personal information.

Once your application is verified, which usually takes around 1 day, your account will be approved and ready for funding.

Non-US citizens can also open a Charles Schwab account to access US markets directly and take advantage of all the great opportunities by opening an account at international.schwab.com. With a Schwab account, you’ll have access to a wide range of investment options, including the ability to invest in fractional shares through the Schwab Stock Slices program.

Funding Your Account

There are several convenient methods to fund your Schwab account, such as wire transfer, account transfer, or mobile check deposit. These options make it easy to ensure your account is ready for investing, allowing you to take advantage of the opportunities provided by the Stock Slices program.

If you prefer a more automated approach, you can set up automatic funding transfers with Charles Schwab by following these steps:

Navigate to the ‘Trade’ section on the Charles Schwab website.

Select ‘Automatic Investing’.

Choose the account you want to use for automatic investing.

Set up the desired frequency and amount for the automatic transfers.

By setting up automatic funding transfers for mutual funds, you can ensure that your portfolio continues to grow without constant oversight.

Choosing and Purchasing Stock Slices

Once your account is funded, it’s time to choose and purchase stock slices. This process involves selecting up to 30 eligible stocks and specifying the dollar amount you want to invest in each. With a minimum investment of just $5 per slice, you can build a diversified portfolio tailored to your financial goals and risk tolerance.

To confidently review your stock slice selections before investing, follow these steps:

Open an account with Schwab.

Link a bank account.

Select Schwab Stock Slices™.

Browse fractional stocks.

Review the trade.

Place the order.

This step-by-step process ensures you have complete control over your investments and can make informed decisions based on your financial objectives, taking into account your individual circumstances prior to seeking investment advice, as every investment inherently involves risk.

Benefits of Investing in Fractional Shares with Charles Schwab

By choosing to invest in fractional shares with Charles Schwab, you unlock numerous benefits, including dollar cost averaging and portfolio diversification. Dollar cost averaging is an effective strategy that allows investors to benefit from market fluctuations by regularly contributing a set amount each month to an investment account. This helps you to reduce the risk of investing and maximize your potential returns.

Diversification is another key benefit of investing in fractional shares with Charles Schwab. By spreading your investments across multiple stocks, you can reduce your overall risk and protect your portfolio against losses in the event that one particular asset class or sector performs poorly.

Dollar Cost Averaging

Dollar-cost averaging is a flexible investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the price of the asset. This approach can help you:

Increase your investment position when prices are low and reduce it when prices are high, to benefit from market volatility.

Encourage disciplined investing

Potentially reduce the average cost per share over time

Charles Schwab’s Stock Slices program supports dollar cost averaging by allowing you to:

Invest a consistent dollar amount at regular intervals

Manage timing risk

Stick to your long-term investment plan

Maximize your chances of achieving your financial goals

Diversifying Your Portfolio

Diversifying your portfolio is a crucial aspect of successful investing. By spreading your investments across different asset classes, sectors, and industries, you can protect your portfolio against losses and minimize risk. Fractional shares through Charles Schwab help achieve diversification by allowing you to invest smaller amounts in multiple stocks, ensuring a well-balanced portfolio tailored to your financial goals.

With access to a wide range of S&P 500 stocks, Charles Schwab’s Stock Slices program enables you to build a diversified portfolio without having to invest large sums of money. This flexibility allows you to adapt your investments based on your risk tolerance and financial objectives, setting you on the path to success.

Potential Drawbacks of Fractional Share Investing

While fractional share investing has its advantages, you should also be mindful of potential downsides like restricted voting rights and transferability issues. For example, fractional share owners may not have the same voting rights as whole share owners, limiting their influence on company decisions.

Transferring fractional shares between brokerages can also be challenging, as not all firms support fractional share transfers. It’s important to thoroughly research the policies and fees associated with fractional share investing before diving in, ensuring you make an informed decision that aligns with your financial goals.

Limited Voting Rights

Voting rights in stock investing grant shareholders the opportunity to participate in corporate decision-making by voting on vital matters such as electing board members, approving mergers or acquisitions, and making changes to the company’s bylaws. Shareholders typically have one vote per share owned, although some companies may have a dual-class structure that allows certain shareholders to have multiple votes per share.

However, fractional share investors may not have the same voting rights as whole share investors. This limitation means that those who invest in fractional shares may have less influence over company decisions, potentially impacting their overall investment experience.

Transferability Issues

Transferring fractional shares between brokerages can be a complex process, as not all firms support fractional share transfers. Each brokerage has its own internal methods for handling fractional shares, which means they cannot be transferred using ACATs or other transfer methods.

Charles Schwab, for instance, does not currently support the transfer of fractional shares to other brokerages. If you plan to transfer your investments between brokerages, it’s important to research the policies and fees associated with fractional share transfers to avoid any surprises or complications.

Comparing Charles Schwab to Other Online Brokerages

Upon comparing Charles Schwab with other online brokerages, you’ll notice variations in stock selection, fees, and account minimums. While Charles Schwab offers a wide range of S&P 500 stocks for fractional share investing, other brokerages may have more limited options. Additionally, fees and account minimums can vary between brokerages, making it essential to conduct thorough research before choosing a brokerage that aligns with your investment goals.

In terms of fees and account minimums, Charles Schwab offers competitive pricing and no account minimums for its Stock Slices program. This affordability, combined with their extensive stock selection and innovative fractional share investing program, makes Charles Schwab a strong contender in the world of online brokerages.

Stock Selection

Charles Schwab’s Stock Slices program allows investors to purchase fractional shares of S&P 500 stocks, providing access to a diverse range of investment opportunities. Other brokerages, such as:

Fidelity

Robinhood

Interactive Brokers

SoFi Active Investing

Webull

offer a larger selection of stocks for fractional share investing. However, the wide range of S&P 500 stocks available through Charles Schwab’s Stock Slices program ensures that you still have ample options to diversify your portfolio and achieve your financial goals.

Take into account the stock selection provided by various brokerages to guarantee access to investment options that match your financial goals and preferences. Comparing Charles Schwab’s stock selection to that of other online brokerages can help you make an informed decision about which brokerage is the best fit for your investment needs.

Fees and Account Minimums

Given the considerable variation in fees and account minimums among online brokerages, comparing these aspects becomes imperative before selecting a brokerage that aligns with your financial circumstances and investment objectives. Charles Schwab’s fee structure is highly competitive, offering $0 for trading stocks or ETFs and just $0.65 per option for trading options contracts. Additionally, they have no minimum deposit for non-margin brokerage accounts, making it easy to get started with investing.

Comparing Charles Schwab’s fees and account minimums to those of other online brokerages, such as E*Trade, Fidelity, and Vanguard, can help you determine which brokerage is the best fit for your investment needs. By conducting thorough research and comparing fees and account minimums, you can make an informed decision and select the brokerage that offers the best value for your investment goals.

Summary

Throughout this guide, we’ve explored the exciting world of fractional share investing with Charles Schwab’s Stock Slices program, delved into the benefits and drawbacks of investing in fractional shares, and compared Charles Schwab to other online brokerages. With the ability to invest in fractional shares of some of America’s leading companies, Charles Schwab offers an innovative and accessible solution for investors looking to diversify their portfolios and achieve their financial goals.

As you embark on your investment journey, consider the unique opportunities presented by fractional share investing with Charles Schwab. By taking advantage of the Stock Slices program and its numerous benefits, you can confidently navigate the world of investing and build a diversified portfolio that aligns with your financial objectives.

Frequently Asked Questions

Which broker is best for fractional shares?

For buying fractional shares in November 2023, Robinhood, TD Ameritrade, E-Trade and Merrill Edge are the best brokers according to NerdWallet. Invest with confidence in these top fractional share brokers.

What is the difference between Fidelity and Charles Schwab fractional shares?

Fidelity offers a more comprehensive selection of fractional shares compared to Charles Schwab, allowing access to over 7,000 stocks and ETFs, with a much lower minimum trade of $1 compared to Schwab’s $5.

Do all brokerages offer fractional shares?

No, not all brokerages offer fractional shares, but they are becoming increasingly popular and more widely available. Many online trading platforms allow for fractional investing with minimal trade barriers, giving investors the ability to buy stock in much smaller quantities than previously possible.

Is Schwab Stock Slices worth it?

Investing in Schwab stock slices can be a great option if you’re looking to diversify your portfolio and don’t mind the associated fees. Make sure to consider your goals, risk tolerance, and other fractional investing brokers before making the choice.

Are fractional shares a good idea?

Buying fractional shares enables you to take advantage of stock gains, qualify for long-term capital gains and receive dividends quickly, with increased diversification for the same amount of capital. Therefore, fractional investing is definitely a great idea. cdfe34