The past week has been hectic for the stock market. The VIX spiked to almost 29, indicating a lot of put flow, and there was a significant volume on SPY, compared to previous days. The major cause of this frenzy was the Silicon Valley Bank and the whole fiasco surrounding it. Due to this event, there has been a lot of fear in the market, and whenever this happens, the market likes to cool off, as seen in the past.

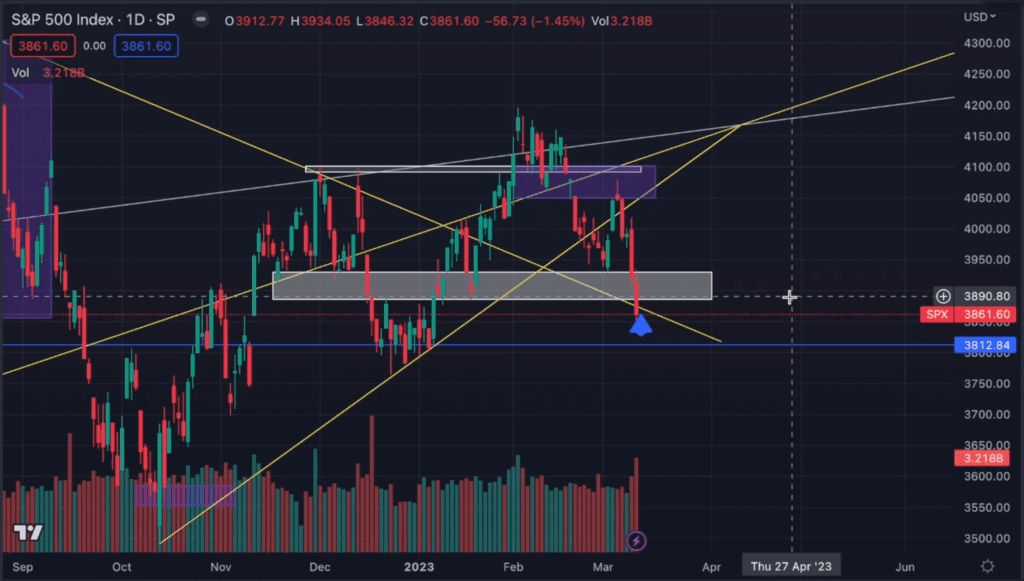

Currently, the SPX chart indicates that the market is within the demand range box and touching a downward trend line that goes to the all-time high level. It is also sitting in the oversold condition. While there is potential for a short-term reversal to the upside, it is important to note that people should not get carried away with price and assume that the market will continue to rise higher.

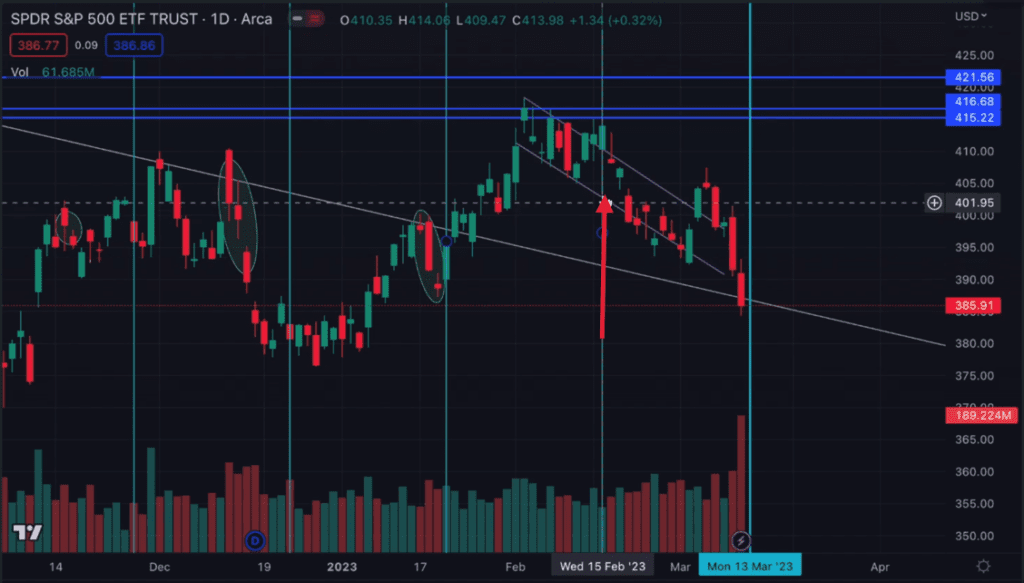

The technicals suggest that the market is due for a bounce, and it is likely to happen on Monday or later in the week. One of the most basic cycles used is the 18-day cycle, which was last referenced on Wednesday, February 15th, where there was a significant reversal off this cycle. This cycle has shown tremendous success in the past and could indicate that there will be a bounce in the market. However, it is crucial to note that while the market may bounce, it is still bearish in the macro sense, and there will be more downside to come.

It is important to be careful with a retest of the range. While it is due for a bounce, going short in the hole at any time is not good risk-reward practice. If there is a bounce around these levels, it is essential to keep in mind that it is a short-term reversal, and people should not assume that the market will continue to rise. As seen in the past, people have gotten carried away with the price, gone long, and assumed that they would make a new high of the move. However, this resulted in a hard rejection and a lot of downside.

There is a ton of fear in the market right now, as seen on TradingView, Twitter, and news articles. However, it is crucial to remember that this fear could indicate some form of reversal. As seen in the past, when there is sudden fear in the market, and there is a sell-off, the market likes to cool off eventually. The technicals were pointing to a short setup last week, and the fundamentals aligned with the technicals, resulting in a major dump. While the market is currently bearish, there may be potential for a short-term reversal to the upside, and it is important to be careful and keep in mind that the market will likely see more downside in the future.

Make sure to catch our full weekly recap video below: