Imagine being part of the next frontier of human evolution, not on earth, but in the vast expanses of outer space, among the stars. That’s the dream that Relativity Space, an innovative private company in the aerospace sector, is striving to turn into reality. This pioneering company is redefining rocket manufacturing using 3D printing technology, with the goal of establishing human industrial bases not just on Earth, but even on Mars. Exciting, isn’t it? For investors, the potential of Relativity Space stock is certainly worth keeping an eye on.

Key Takeaways

Relativity Space is revolutionizing aerospace manufacturing with 3D printing technology, aiming to establish a human industrial base on Mars.

The first launch of Relativity Space was met positively by the public, and it has secured $1.6 billion in funding with its post-money valuation standing at $4.2 billion.

Investing pre-IPO presents both risks and rewards. Alternative investment options include private share funds and equity crowdfunding platforms as well as potential partnerships or acquisitions for future growth opportunities in space exploration

Relativity Space: A New Frontier in Aerospace Manufacturing

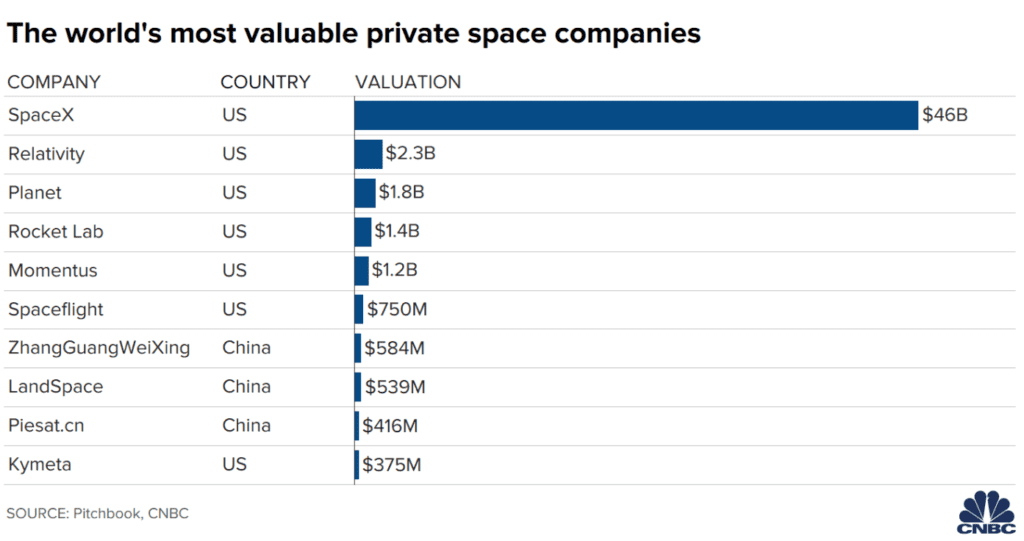

Relativity Space is gaining major attention in the aerospace industry for its distinctive approach to rocket manufacturing, setting it apart from competitors like Rocket Lab. This private company is leveraging 3D printing technology, revolutionizing the way launch vehicles are constructed. The goal? To broaden the horizons of human experience by establishing our industrial base on Mars. With Relativity Space’s aim set high, the company continues to advance its bold mission, with its sights set on the stars. As Relativity Space boasts, their innovative methods are truly transforming the future of space exploration, making it an interesting space stock to watch.

But why the buzz around private companies in the aerospace sector? Well, it’s because Relativity Space is not just any private company. It stands out as one of the few companies using additive manufacturing to cause a significant shift in the aerospace industry. The global aerospace 3D printing market, valued at USD 1.35 billion, is ripe for innovation and Relativity Space is at the forefront.

Related Article: The Latest On Flexport Stock: Valuation, IPO, And How To Invest

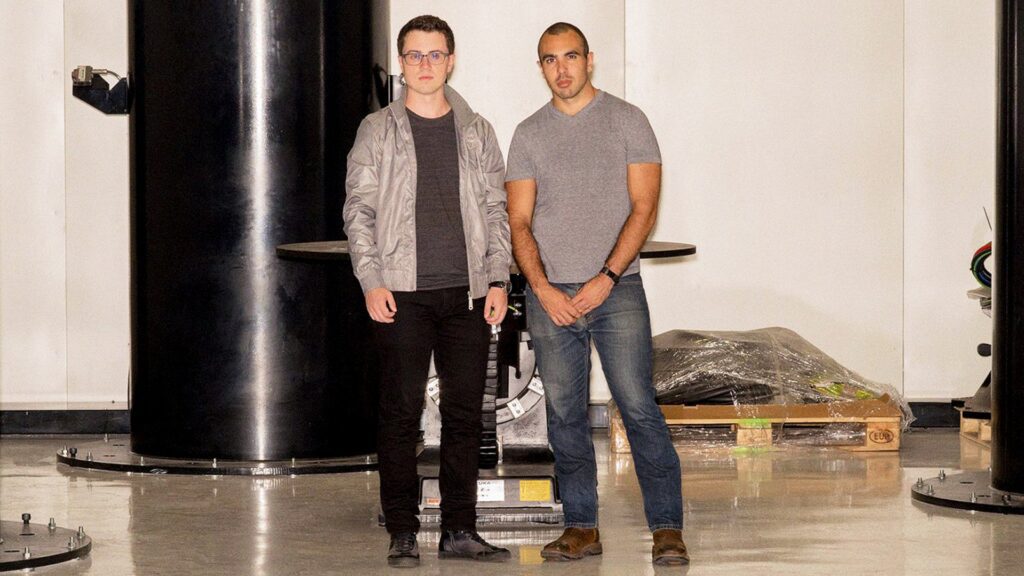

The Founders and Their Vision

At the helm of Relativity Space are its founders, Tim Ellis and Jordan Noone. With a background in aerospace engineering, Noone brings to the table a wealth of knowledge and experience. Ellis, on the other hand, is a visionary leader driving the company’s ambitious mission.

So, what is the grand vision driving these innovative leaders? It’s a future where humanity’s industrial base extends beyond Earth to Mars, offering new value propositions. By utilizing 3D printing technology in rocket production, Relativity Space is truly setting itself apart from its competitors with its vertically integrated technology platform. Unsurprisingly, the company has managed to pique the interest of notable investors like Mark Cuban and Social Capital.

3D Printing Revolutionizing Rocket Manufacturing

The pivotal element for Relativity Space is its use of 3D printing technology. It’s the secret sauce that’s helping the company transform the way rockets are built. This approach has led to the creation of the Terran 1, the world’s first fully 3D-printed rocket capable of carrying diverse payloads. The impact of 3D printing on rocket manufacturing extends beyond just cost efficiency and speed. It’s opening up new possibilities in space infrastructure development.

3D printing technology is altering the aerospace industry’s standards through customization and the application of advanced materials, while also addressing vehicle complexity. Besides, the technology’s ability to create lightweight structures with optimized internal geometries is a major plus.

The First Launch: A Milestone Achievement

Any aerospace company’s pivotal moment is marked by its first rocket launch. For Relativity Space, it was a demonstration of the viability of their 3D printed rockets as a launch vehicle. The company’s initial launch took place on March 22, 2023, marking a significant milestone in its journey. The cargo of this historic launch? An early 3D-printed part, serving as a demonstration weight.

The success of this launch was a testament to the company’s innovative approach to rocket manufacturing and launch services. Relativity Space is not solely about constructing rockets; it aims to transform the aerospace industry through the application of additive manufacturing or 3D printing.

Live Streaming and Public Reception

In our interconnected era, what is a significant event without live streaming? The inaugural launch of Relativity Space was streamed live, capturing the interest of space enthusiasts and investors alike. The platform of choice for this event was YouTube, ensuring free access to all who wished to witness this historic event.

And how did the public react to this groundbreaking achievement? The response was overwhelmingly positive. Many hailed the successful launch as a significant milestone in the aerospace industry, recognizing Relativity Space’s innovative approach to rocket manufacturing.

Financial Aspects: Investors, Valuation, and Funding Rounds

The financial stability and growth potential of a company significantly influence its ability to attract investors. In the case of Relativity Space, the company has been successful in drawing the attention of notable investors like Social Capital, Y Combinator, and Mark Cuban. Such support reflects the company’s potential and the investors’ confidence in its innovative method for aerospace manufacturing.

Venture capital firms have also expressed strong interest in Relativity Space. The company has received investments from renowned firms like Fidelity, General Catalyst, and Tiger Global Management, to name a few. With $1.6 billion secured in funding, Relativity Space showcases the potential to be a major player in the aerospace industry. As a result, many investors are now considering whether to buy Relativity Space stock and are curious about the relativity space stock symbol.

Funding History and Valuation Growth

Relativity Space’s funding history paints a promising picture. With over $650 million raised in its latest confirmed funding round, the company’s financial backing is robust. The Series E funding in June 2021, led by Fidelity, raised $650 million, indicating a strong vote of confidence in the company’s vision and potential.

The company’s value has also significantly increased over time. Following the June 2021 equity round, the company’s post-money valuation stood at a whopping $4.2 billion. Such a stellar valuation is indicative of the high growth prospects that Relativity Space offers, making it a potentially worthwhile investment for those with an eye on the future of space exploration.

| Date | Funding Round | Valuation |

|---|---|---|

| March 2016 | Series Seed | $5.49 million |

| November 2020 | Series D | $2.3 billion |

| June 2021 | Series E | $4.2 billion |

| November 2023 | Series F | Not disclosed |

IPO Possibilities: When and How?

Every investor’s pressing question is the likelihood of a Relativity Space IPO. After all, an IPO would open up the opportunity for a wider range of investors to have a stake in this innovative venture. However, the exact timeline for an IPO is currently unknown, with no anticipated date within the next three years.

Several factors could sway the decision towards an IPO. Market conditions, the company’s financial health, and the success of its mission to Mars could all play a role. Regardless of the timing, the prospect of a Relativity Space IPO is certainly something for investors to keep an eye on.

Challenges and Opportunities Pre-IPO

Investing in a company before it becomes publicly traded carries a unique set of risks and opportunities. On one hand, it offers the potential for high returns if the company performs well post-IPO. On the other hand, investing pre-IPO comes with risks such as lack of liquidity, difficulty in valuation, and limited control and influence over decisions like issuing preferred stock.

Hence, potential investors must rigorously examine and assess the risks and benefits before investing in Relativity Space pre-IPO. Despite the challenges, the opportunities that Relativity Space presents are certainly worth considering for those with an appetite for high-risk, high-reward investments.

Related Article: Investing In Neuralink Stock: A Complete Guide For 2023

Partnerships and Acquisitions: What Lies Ahead?

Relativity Space’s future extends beyond its own growth and expansion. Partnerships and acquisitions could play a significant role in accelerating the company’s plans for Mars colonization. Some potential collaborations include:

Partnering with other space sector players to share resources and expertise

Collaborating with investment companies to access additional capital for development

Forming strategic alliances with other aerospace companies to expand operations and reach

These partnerships and acquisitions could help Relativity Space expedite the development of its technologies and achieve its goals for Mars colonization.

Potential partnerships could even extend to collaboration with SpaceX, another major player in the field of space exploration. Such a partnership could facilitate the transport of Relativity Space’s equipment to Mars and construct the necessary launch capability infrastructure.

Summary

Relativity Space is indeed carving a niche in the aerospace industry with its innovative approach to rocket manufacturing. Be it the pioneering use of 3D printing, the ambitious mission of establishing an industrial base on Mars, or the potential for an IPO, the company presents a compelling proposition for investors, employees, and space enthusiasts alike. As we look to the stars, it’s companies like Relativity Space that are leading the charge in shaping the future of human space exploration.

Frequently Asked Questions

Is Relativity Space traded publicly?

Relativity Space is not a publicly traded company and one needs to be an accredited investor in order to buy its pre-IPO shares.

What is Relativity Space worth?

Relativity Space has raised $1.6 billion in funding and announced Series E of $650 million at a $4.2 billion valuation in June 2021, valuing the space startup at over $4 billion.

Who are the owners of Relativity Space?

Relativity Space was founded in 2015 by CEO Tim Ellis and CTO Jordan Noone, who have since grown the team to over 1,000 strong with experts from across aerospace, manufacturing, propulsion, software, and technology. They are currently working on additive manufacturing (3D printing) technologies for private spaceflight.

What is the funding to date for Relativity Space?

Relativity Space has raised $1.6B in funding to date, with their latest round raising $650M on June 8, 2021.

Does NASA have stock?

No, NASA does not have stock available for public investment. However, the agency partners with numerous companies that are publicly traded.