Over the past weekend, Credit Suisse had a bail out, which some are calling a liquidity injection, leading to concern among central banks about the current state of the world economy. There are several events taking place this week as well, including FOMC and VIX expiration on Wednesday.

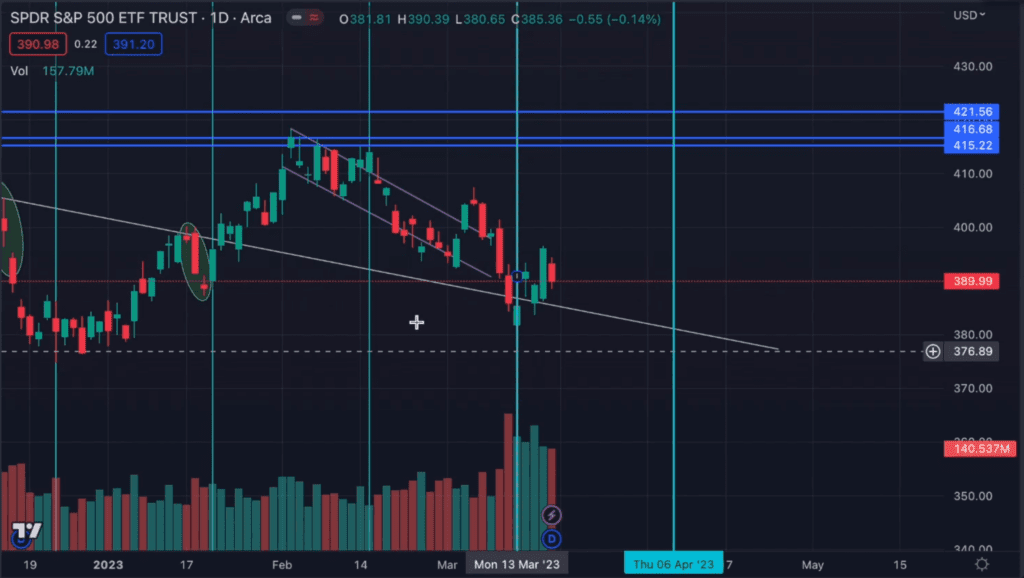

One thing to note is that the 18-day cycle has remained strong, as evidenced by its accuracy in marking the lows of this bear market. However, we have typically seen about a three-day move upward or downward depending on momentum going into that date, and we have already passed that three-day move.

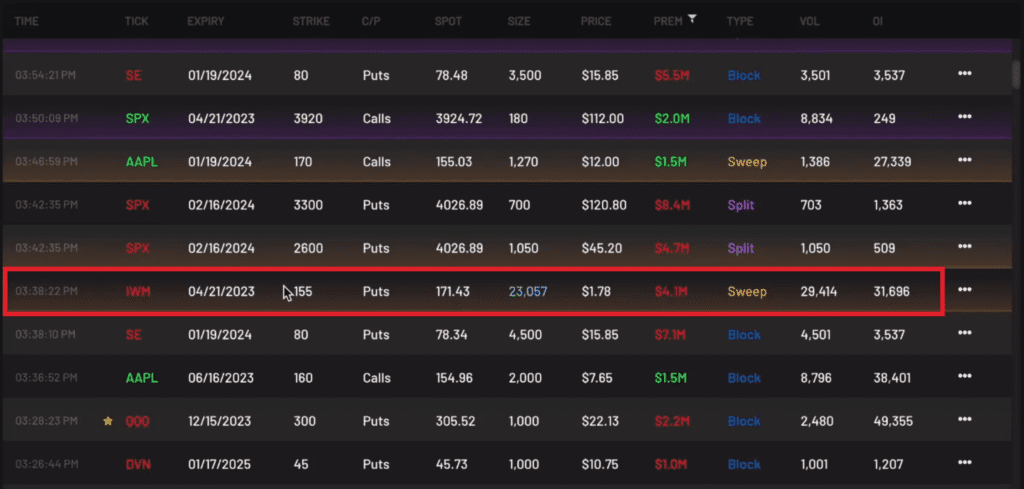

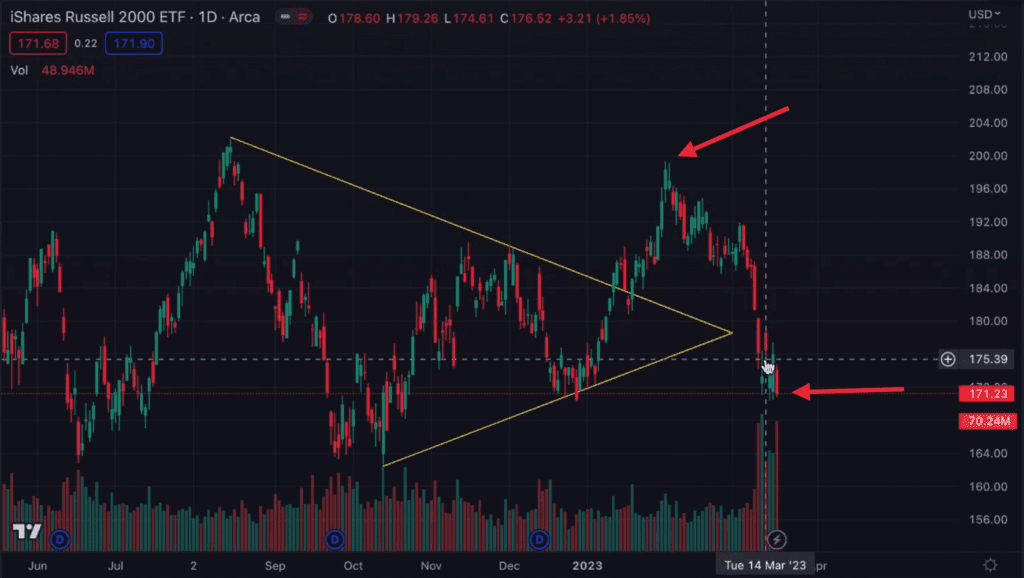

Last week, there was a lot of put flow, especially on IWM, with $4.1 million in premium for the 155 strike, 4/21/2023 expiration. Many of them look to be super far out of the money. The Russell has been one of the weakest of the major indexes, with a fake breakout in January that was unable to hold up and continued down.

This is something to watch closely as it could lead to new lows being met, which would mean going below 162 on a technical basis. Last time we saw a similar pattern of a fake breakout, it was the start of the bear market.

Interestingly, there was a note from the central banks about a potential liquidity injection in the market starting tomorrow throughout April. This is not the same as quantitative easing, but it will have implications on the market. Price action is expected to be fairly strong this week because of this news, but it could still fade around the time of FOMC as well as the Wednesday expiration. It will be interesting to see how things fare in the coming weeks.

Make sure to catch our full weekly recap video below: