What are Zero days to expiration options (0DTE)

Zero days to expiration or 0DTE options are contracts with less than one day to expiration or in other words, same-day expiration. Although most common with day traders trying to make a quick buck, asset managers have steadily adopted 0DTE strategies. Most commonly through premium harvesting or better known as call and put writing.

The other common reason large asset managers and market participants will use these 0DTE contracts is for cheap portfolio hedges. Given how liquid the 0DTE option chain is, buyers of these contracts can enter and exit the trades with a usually tight bid-ask spread. We will take a deep dive into the cause and effect of 0DTE options on daily market operations.

The Rise of 0DTE

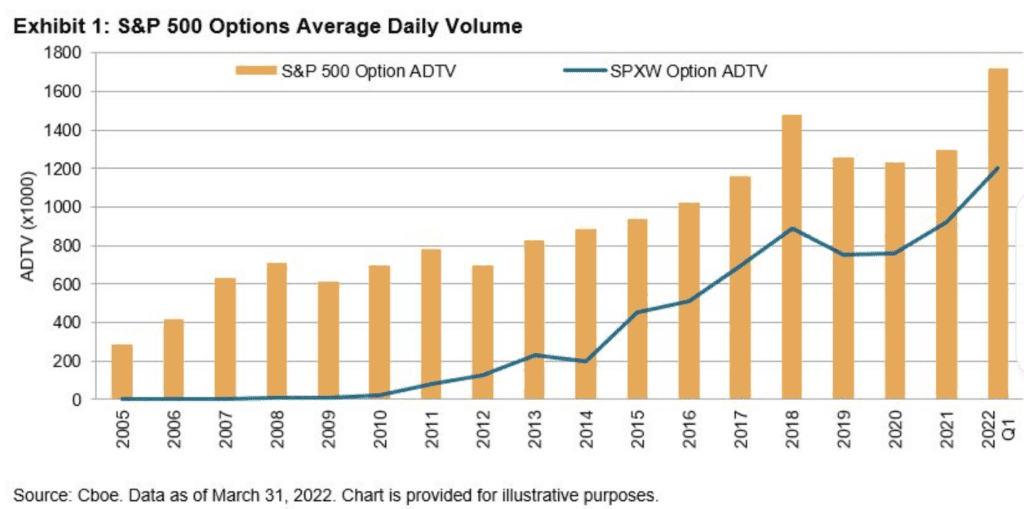

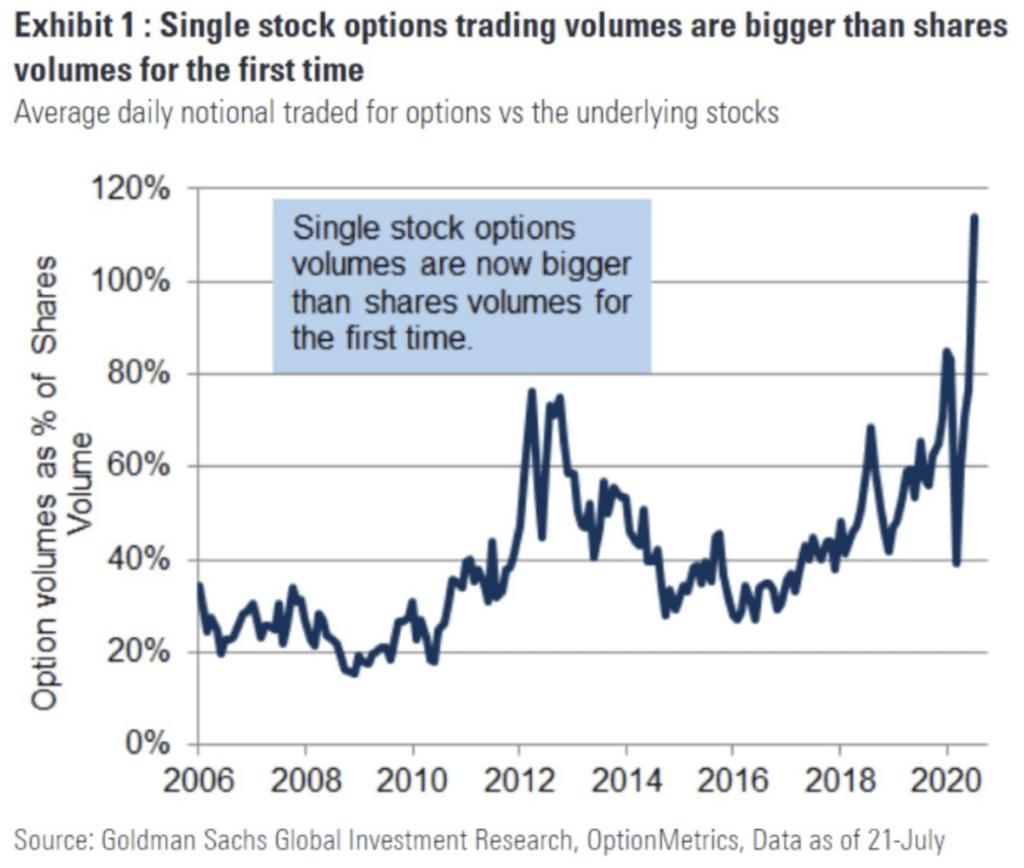

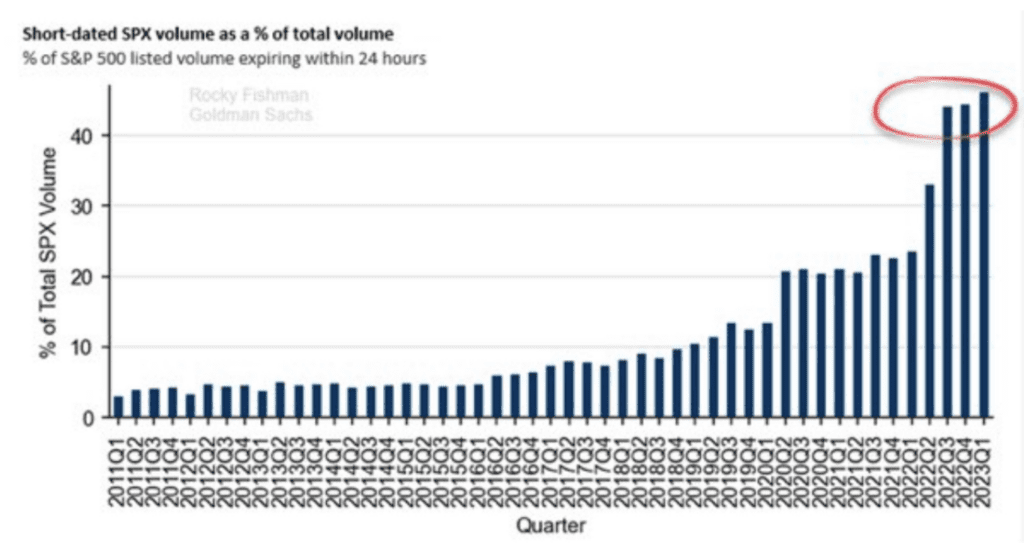

CBOE or the Chicago Board Options Exchange debuted SPX (S&P500) index options in 1983. The rapid adoption of options into asset managers’ portfolios grew exponentially. There was so much demand that in 2005, CBOE introduced SPXW or weekly option expirations. From there, Monday and Wednesday expirations were introduced, and in 2022, Tuesday and Thursday expirations.

A CBOE study in 2021 showed that with five days a week expirations, the total volume activity with less than 5 days to expiration was close to 50% or $470BN in value per day. Along with this, the rise of commission free trading, and more specifically Robinhood, has allowed for retail traders to adopt options trading which adds to overall liquidity in the options market. This in turn, with everyday expirations, has fueled the options market frenzy leading to over 41 million contracts being traded every day.

How Market Makers Hedge 0DTE

The role of a market maker is to provide liquidity to the markets while profiting from the bid-ask spread. A market maker isn’t required to hedge but they will do so in order to stay delta-neutral. Delta is simply defined as the theoretical value of an options premium price in a $1 move of the underlining. Gamma is the second-order derivative of delta. It measures the rate of change of an options delta for every point move in the underlining.

Market makers will take the opposite side of your trade. For instance, if you buy a call option with a 30 delta, the market maker who sold you that option will need to buy up 30 shares of the underlining in order to pay when you sell and to stay delta neutral. It works the same way when you write options. Market makers will sell the equivalent delta of the option from their inventory to stay delta neutral.

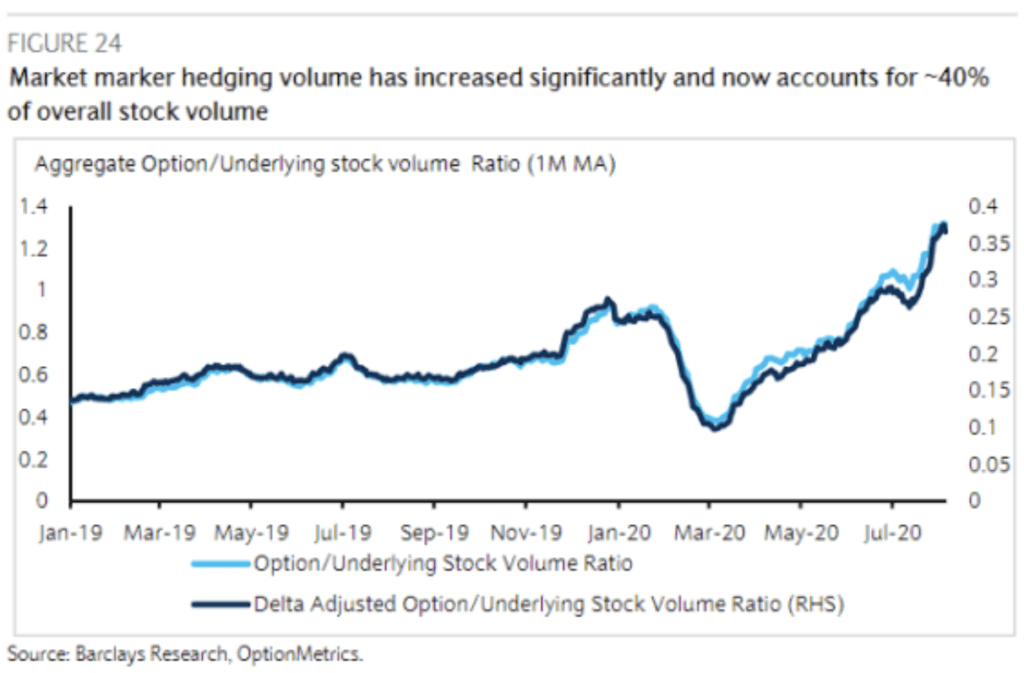

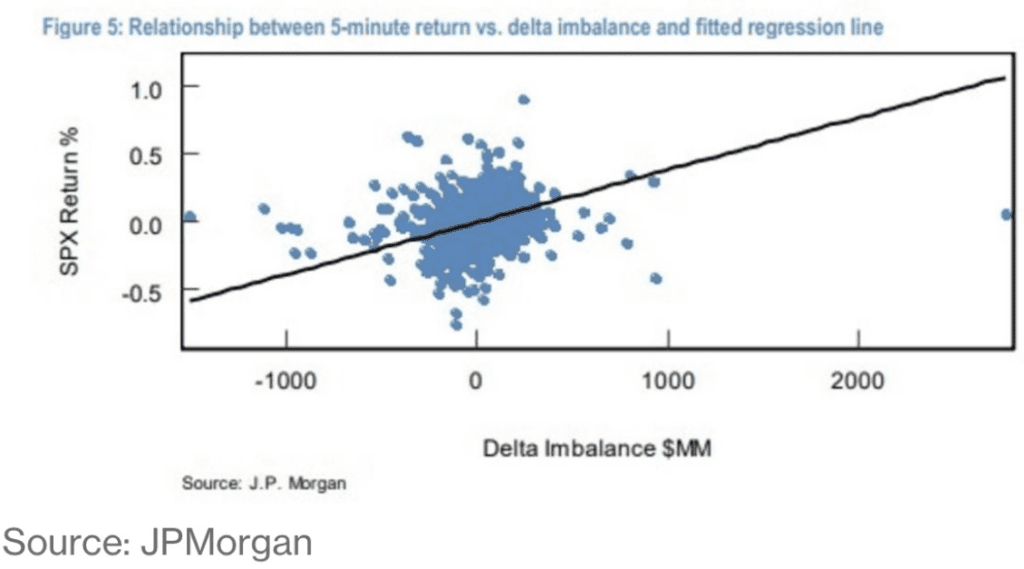

To quantify how this actually looks, in 2021 Goldman Sachs stated that for every 1% move up or down in the S&P 500, market makers have to buy or sell around $1 billion worth of shares. So, with the rise of 0DTE, market makers will have to hedge these call and put options much more aggressively. Notice in the chart below, 40% of stock volumes can be attributed to market maker hedging.

0DTE Effects on Greeks (Gamma Squeezes)

0DTE options expire the same day. Day traders like to buy these because of the inexpensive pricing of said options. But because they expire the same day, traders need large moves in order for the payoff to meet the risk.

As mentioned in the “How Market Makers Hedge 0DTE” section, it is extremely important to understand this, as it is the basic premise behind a gamma squeeze scenario. So, here is how it works. Market makers need to stay delta neutral at all times, when the share price of SPY rises, all of the 0DTE call options become closer to being in the money which rapidly increases the delta and gamma. As the price of SPY rises and the options become closer to being in the money (delta of 1), market makers have to now buy more shares of the underlining to remain delta neutral. When SPY continues to rise, more and more traders buy calls, forcing dealers to buy millions of shares in a short period of time. This causes a positive feedback loop into the market, and hence, we have a gamma squeeze.

The infamous short squeeze of GameStop can also be partly attributed to gamma. Another and more recent example of such gamma squeeze is the October 2022 CPI intraday reversal. It’s important to note that Vanna corresponds with gamma here but for the sake of simplicity, we are only focusing on gamma.

Common misconceptions

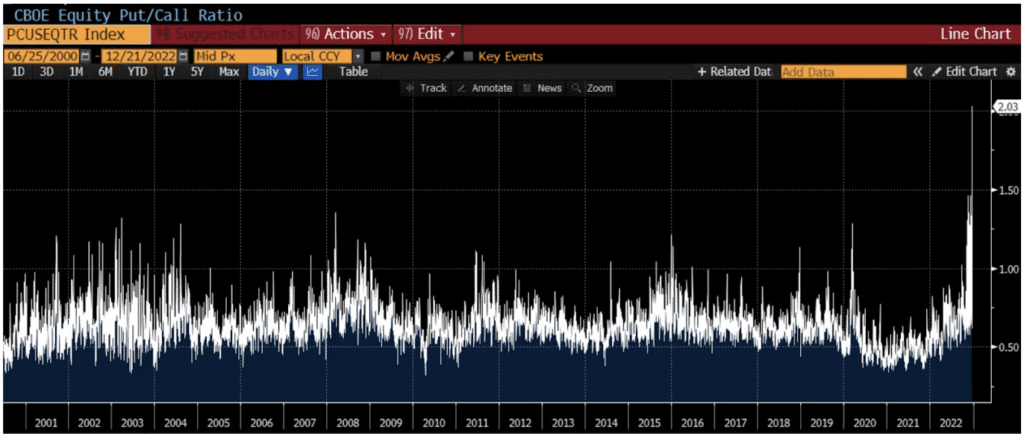

One of the largest misconceptions is the put to call ratio being skewed. With a rising interest rate environment, the frequency of exercising deep in the money puts has changed lately. A trader will buy a 100 delta deep in the money put option to take advantage of the Greek Rho (price sensitivity to interest rates). This is one of the arbitrage strategies that has grown in popularity thanks to 0DTE. This will skew the P/C ratio to make it seem as if traders are bearish on the underlining when in reality, it is simply an arbitrage trade.

The other major misconception is that retail traders are to blame for the 0DTE frenzy. Well, that just isn’t the case.A study from JP Morgan found that about 5.6% of all volume in such short-dated options in the past month can be attributed to retail market orders. Along with this despite the large volume traded, only a small percentage of the trades are kept until expiration. JPM estimates that only around 6% of the options are kept open until maturity. So as we can see, retail traders are not fully fueling the 0DTE rush, and it’s a majority of institutional investors trading these options.

In Conclusion

With the rise of 0DTE taking up the majority of option volume daily, along with five days a week expirations, we can only speculate as to the long-term ramifications of this. The risks of flash crashes and over the top moves linger in the background while traders are trying to capitalize on these options. One thing is for certain, the rapid adoption of 0DTE options provides room for market dislocations.