In the world of investing, understanding what the risk-free rate of return is can be the key to unlocking the secrets of the market and making informed decisions. The risk-free rate serves as the foundation upon which investors build and optimize their portfolios. Join us as we unravel the intricacies of the risk-free rate and discover its influence on investment strategies and financial models.

Key Takeaways

The risk-free rate is an essential component of investment analysis, providing investors with the information needed to make informed decisions.

Risk-free assets such as U.S. Treasury bills are used as examples and proxies for the risk-free rate to help compare potential returns from more hazardous investments.

The real risk free rate accounts for inflation while financial models like CAPM and Sharpe ratio use it to assess expected returns on investments and guide decision making in capital allocation strategies

Defining the Risk-Free Rate

The risk-free rate represents the minimum return an investor expects from an investment with zero risk, often symbolized by government bonds or Treasury bills. In practice, the risk-free rate is generally equated with the interest rate paid on short-term government debt, such as three-month U.S. Treasury bills, due to their negligible default risk.

The risk-free rate serves as a crucial benchmark for evaluating the potential returns of riskier assets and for calculating the cost of capital for businesses.

Related Article: Understanding Warrants Vs Options: A Comprehensive Guide

Why It Matters

A thorough comprehension of the risk-free rate proves crucial when assessing investments or maneuvering through different market scenarios. As a cornerstone of investment analysis, the risk-free rate is used to:

Calculate the equity risk premium, which helps investors determine risk-adjusted returns for their entire investment portfolio

Set the stage for measuring systemic risk

Gauge the return investors demand for taking on more risk

In March 2020, for instance, the market’s fast recovery from its lowest point heavily relied on the risk-free rate, even in the face of negative yields. As such, a firm grasp of the risk-free rate equips investors with the tools necessary to make judicious decisions in fluctuating market scenarios.

Risk-Free Assets: Examples and Proxies

Risk-free assets, such as U.S. Treasury bills, are considered the closest to zero-risk investments due to their safety and liquidity. The market’s confidence in the U.S. government’s ability to fulfill its obligations and the size and liquidity of the market make U.S. Treasury bills a popular proxy for the risk-free rate.

Investors with assets in either euros or Swiss francs could use highly rated countries’ short-term government bills as a proxy for their risk-free rate. Examples include Germany and Switzerland. The risk-free rate, as derived from these assets, establishes a reference point for juxtaposing potential returns of more hazardous investments and in the regulation of risks during investment decision-making.

Real vs. Nominal Risk-Free Rates

Real and nominal risk-free rates differ in a critical aspect: the real rate accounts for inflation, while the nominal risk free rate does not. The real risk-free rate is determined by subtracting the inflation premium from the nominal rate, providing investors with protection against inflationary risks.

To calculate the real risk-free rate, investors can follow these steps:

Subtract the current inflation rate from the yield of the Treasury bond corresponding to the investment duration.

This rate reflects the returns an investor would need to protect their investment from inflation.

Consequently, if inflation rates remain steady or go down, then this rate is applicable.

In cases where inflation surpasses the nominal rate, the real risk-free rate will be negative, posing a challenge for investors who seek to retain their purchasing power. This highlights the importance of understanding the distinction between real and nominal risk-free rates when evaluating investments and managing risks.

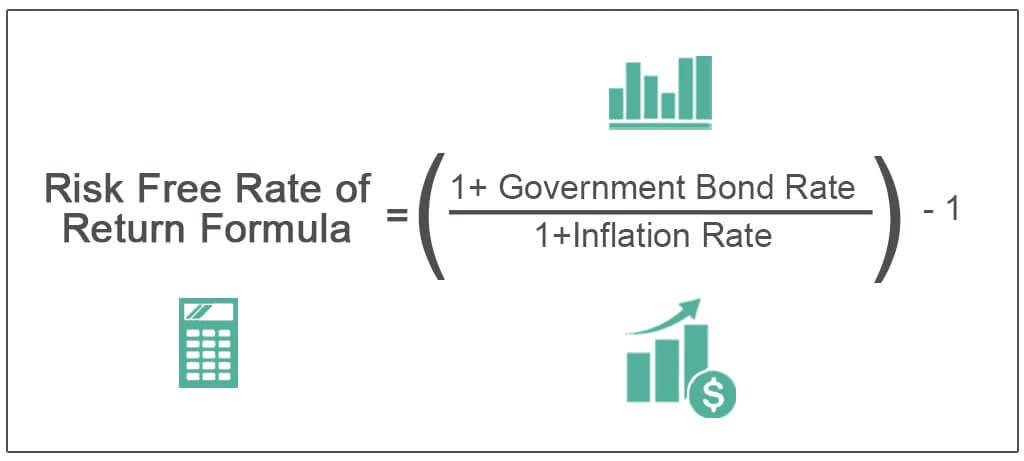

Calculating the Risk-Free Rate

Source: WallStreetMojo

The risk-free rate can be calculated using the yield of a 3-month T-bill or by subtracting the inflation premium from the nominal rate. The resulting value acts as a standard for contrasting the expected returns of ventures with higher risk and assessing the possible yields of investments carrying inherent risks.

The risk-free rate holds a prominent position in financial models like the Capital Asset Pricing Model (CAPM), which estimates an investment’s expected return by considering its systematic risk. Therefore, having a precise understanding of the risk-free rate calculation is pivotal for investors aiming to enhance their investment portfolios and administer risks proficiently.

The Role of Risk-Free Rate in Financial Models

The risk-free rate is a pivotal component in financial models like the Capital Asset Pricing Model (CAPM) and the Sharpe ratio. In the context of CAPM, the risk-free rate is used as a benchmark to indicate the minimum return an investor can expect from a risk-free investment, typically associated with the yield of a risk-free asset, such as a short-term government bond.

The CAPM incorporates the risk-free rate as an essential element in computing the anticipated return of an asset, considering the risk it carries compared to the overall market. This helps investors estimate the return they should demand for taking on more risk and guides their capital allocation based on prevailing market conditions.

Similarly, the Sharpe ratio evaluates the risk-adjusted returns of a single security or an entire investment portfolio, using the risk-free rate as a reference point.

Related Article: Understanding Bearer Bonds: What Are They And How Do They Work?

Factors Influencing the Risk-Free Rate

Several factors can influence the risk-free rate, such as central bank policies, economic conditions, and market perceptions. These elements can affect investment decisions by altering the risk-free rate, which acts as a reference for assessing the prospective yields of more hazardous investments.

For instance, central bank policies may involve lowering interest rates to stimulate economic growth, which can affect the risk-free rate and subsequently influence investors’ capital allocation decisions.

By staying informed about these factors, investors can better navigate fluctuating market conditions and optimize their portfolios, as investing involves balancing risk.

Challenges and Limitations

Identifying the authentic risk-free rate can prove difficult because of aspects like precise estimation of the return rate on risk-free assets, market liquidity, and political meddling. Additionally, the applicability of the risk-free rate to various types of risk assessments can be limited by these challenges, complicating investment analysis.

Negative interest rates, for example, can further complicate the calculation of the risk-free rate and its implications for investors. Examples of causes of negative interest rates:

Persistent deflation

A prolonged European debt crisis

The Bank of Japan’s adoption of ultra-low and occasionally negative interest rates to stimulate economic activity.

Congressional political disputes regarding the debt limit can produce a reduced number of bill issuances. This could eventually result in supply deficiencies and deflation.

Managing Risks in Investment Decisions

Investors should take into account the risk-free rate in conjunction with other risk management techniques to make knowledgeable decisions and enhance their investment portfolios. By understanding the risk-free rate and its role in financial models, investors can better evaluate investments and navigate various market conditions.

Incorporating the risk-free rate into investment analysis allows investors to compare the potential returns of riskier investments, manage risks effectively, and optimize their portfolios for maximum returns.

Summary

In conclusion, understanding the risk-free rate is vital for investors seeking to optimize their portfolios and navigate fluctuating market conditions. By considering the risk-free rate alongside other risk management strategies, investors can make informed decisions and maximize their investment returns. As we have seen, the risk-free rate plays a pivotal role in financial models, investment analysis, and risk management.

Frequently Asked Questions

What is the free risk rate?

The risk-free rate is the rate of return on an investment that has a zero chance of loss and serves as the benchmark to measure other investments with an element of risk. It is the yield to maturity (YTM) on default-free government bonds of equivalent maturity as the duration of the projected cash flows. As such, it is the minimum return expected on investments with zero risks by the investor but does not exist in practice due to the inherent risk associated with every investment.

What is the risk-free rate formula?

The risk-free rate formula can be determined by subtracting the current inflation rate from the yield of a Treasury bond that matches the investment duration. This will result in the “real” risk-free rate, which is the expected interest an investor would receive from an absolutely risk-free investment.

What is the risk-free rate CFA?

The CFA risk-free rate is usually derived from government securities or local authority bonds as they can provide a guaranteed rate of return due to the ability of governments to repay their debt.

What is the difference between real and nominal risk-free rates?

The real risk-free rate takes inflation into consideration, whereas the nominal rate does not. This means that the real rate reflects the true purchasing power of a currency, while the nominal rate does not.

How does the risk-free rate play a role in financial models?

The risk-free rate is an essential component of financial models, such as the CAPM and Sharpe ratio, which help to establish the correlation between potential returns and associated risks.