Imagine a financial instrument so powerful that it can provide anonymity to its holder, be transferred with ease, and yet be fraught with security risks and regulatory challenges. Welcome to the intriguing world of bearer bonds. In this journey, we will explore the history of these once-popular debt securities, their decline, and the challenges they pose in today’s financial landscape.

Key Takeaways

Bearer bonds are physical debt certificates that lack specific association and have become less popular due to security concerns.

Bearer bonds, once popular for their anonymity, now face declining popularity due to increased regulations and the emergence of more secure financial instruments.

Their anonymous nature has led to a preference for registered bonds with enhanced security and transparency. There is potential revival or continued decline depending on regulatory changes in the future.

Bearer Bonds Defined

Bearer bonds, physical bond certificates that represent debt, lack association with any particular individual or entity. Their transferability by mere exchange of the physical certificate made them a tempting investment option in previous years, especially when compared to paper treasury marketable securities.

However, their very nature has led to various security issues and a decline in popularity.

Types of Bearer Bonds

There are five types of bearer bonds:

Government bonds: Bearer treasury bonds were once issued by some governments, including the United States, but they are no longer issued due to concerns about money laundering and tax evasion.

Municipal bonds: Municipal bonds, which are debt securities issued by local governments or their agencies, were once issued in bearer form.

Corporate-investment grade bonds: Issued by companies with strong credit ratings and offer relatively lower risks to investors, have become less common in recent years.

High-yield bonds: Also known as junk bonds, are more likely to be issued in bearer form because they offer higher yields and anonymity to investors. This is because the ownership of bearer bonds is not registered, so the investor’s identity is not disclosed.

Zero-coupon bonds: A type of debt security that does not pay interest until maturity. Instead, they are issued at a discount to their face value, and the investor earns their return by the difference between the purchase price and the face value at maturity. Bearer zero-coupon bonds are similar to other bearer bonds in that they are not registered to a specific owner, and can be transferred by physical delivery. However, unlike other bearer bonds, bearer zero-coupon bonds do not require the submission of coupons to claim interest payments.

Anonymity and Ownership

The allure of bearer bonds for past investors lay in their feature of anonymity. Ownership is determined by possession, not registration, allowing for a high level of privacy. This characteristic was once common in various types of bonds, including municipal bearer bonds and corporate bearer bonds.

Despite the allure of anonymity, laws such as the Fiscal Responsibility Act have been implemented. Acts have played a part in the decline of bearer bonds’ popularity. The changing financial landscape has sparked an increase in registered bonds, known for their electronic records of ownership, increased transparency, and enhanced security.

Coupon Payments and Maturity Date

Bearer bonds are designed to provide a fixed income for investors through periodic interest payments, with the principal amount due upon the bond’s maturity date. To receive interest payments, the bondholder must present the attached coupons to the issuer or a registered agent.

While the coupon payments and maturity dates system once made bearer bonds a favored choice for capital raising, the risks inherent in their anonymity have steered the preference towards registered bonds, known for their increased security and transparency.

Related Article: Secured Bond: An Overview For Investors In 2023

History and Decline of Bearer Bonds

The popularity of bearer bonds in the 19th and 20th centuries can be attributed to their anonymity and simplicity of transfer.

However, due to various security concerns and regulatory changes, their popularity has waned, making them a rare sight in today’s financial landscape.

Popularity in the Past

Bearer bonds were widely utilized during the 19th and 20th centuries for financing endeavors, with their popularity surging during the US Civil War and the period surrounding it. The anonymity and ease of transfer that these bonds provided were highly appealing for raising capital and facilitating global finance.

However, their prevalence abated in the late 20th century due to growing security concerns and the emergence of more secure financial instruments, such as registered bonds.

Regulatory Changes and Shift to Registered Bonds

In the 1980s, regulatory changes necessitated the issuance of securities as registered securities instead of physical certificates, leading to the shift away from bearer bonds. Registered bonds are electronic records of ownership, providing a more secure and transparent alternative to the bearer bonds of the past. One example of such a security is a registered bond.

This shift was driven by the need to combat the use of bearer bonds for illicit activities, such as money laundering. Regulatory and law enforcement entities enacted more stringent regulations and surveillance to impede bearer bonds from being employed for such purposes.

Bearer Bond Security Issues

Bearer bonds, due to their anonymity, are susceptible to a host of security issues that have contributed to their decline in popularity.

Let’s uncover the assorted risks tied to these formerly popular financial tools.

Tax Evasion and Money Laundering

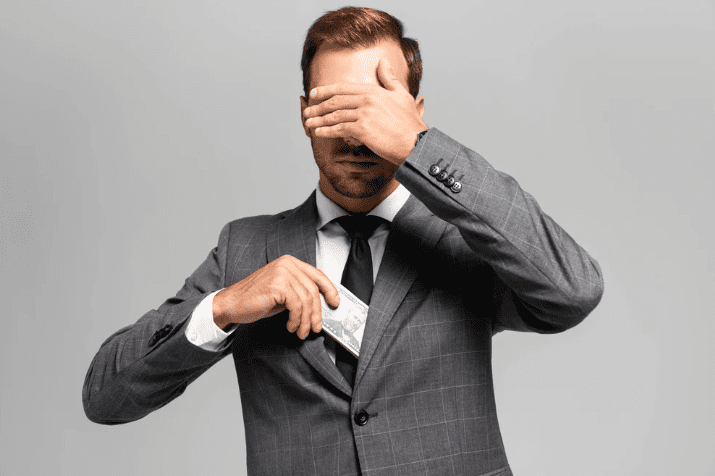

Bearer bonds have been used for tax evasion and money laundering, as profits generated from them are typically not reported to tax authorities. The anonymous nature of these bonds allows their owners to conceal the source of their funds, thus facilitating such illicit activities.

In response to these concerns, financial institutions must now enforce stringent know-your-customer (KYC) and anti-money laundering (AML) protocols, diminishing the appeal of bearer bonds for those prioritizing anonymity and easy transfer.

Loss, Theft, and Forgery

One of the major drawbacks of bearer bonds is their vulnerability to loss, theft, and forgery. Since there is no way to trace or recover them, the rightful owner may suffer significant financial loss if a bond is stolen or misplaced.

This shortfall in investor protection and potential for fraud have factored into the waning popularity of bearer bonds. Today, registered bonds present a safer and more transparent alternative in the financial market.

Redeeming and Processing Old Bearer Bonds

While bearer bonds are a rare sight today, there are still old bearer bonds in circulation, as well as existing bearer bonds. Redeeming these bonds can be a challenging process, often requiring expert assistance.

Nevertheless, with appropriate guidance, successful redemption of such bonds is achievable.

Steps to Redeem Old Bearer Bonds

To redeem old bearer bonds, the bondholder must follow the issuer’s instructions or consult the Treasury for guidance. This process typically involves:

Presenting the bond certificate and any attached coupons to a bank or registered agent

Following the instructions provided by the issuer or consulting the Treasury for guidance

Receiving payment for the redeemed bonds

Bear in mind, the redemption process for old bearer bonds can be intricate due to factors like the issuer, country of origin, and prevailing regulations.

Related Article: Understand The Sortino Ratio: Formula, Calculation, And Definition

Challenges and Expert Assistance

The challenges associated with redeeming old bearer bonds include potential issues related to tax evasion, money laundering, and a lack of investor protection. Additionally, the only evidence of value and redemption is the physical paperwork of the bond, making the process more complicated.

In light of these challenges, seeking advice from a financial advisor or lawyer can ensure proper conduct of the process and adherence to all legal responsibilities.

Bearer Bonds in Today’s Financial Landscape

Bearer bonds are heavily regulated and maintain a restricted presence in today’s financial landscape.

Let’s examine their current legal status and possible future.

Legal Status and Regulations

The legal status of bearer bonds varies by jurisdiction, with some countries restricting or banning their use due to the risks associated with their anonymous nature. In the US, stringent regulations require the reporting of the issuance and transfer of bearer bonds, and financial institutions must implement rigorous KYC and AML protocols.

Despite the regulatory challenges, some countries still permit the utilization of bearer bonds, such as the Bank of England for financing its foreign exchange position. However, the risks associated with bearer bonds make them a less attractive option for investors compared to registered bonds.

Potential Revival or Continued Decline

The future trajectory of bearer bonds is uncertain, with possible resurgence or sustained decline hinging on changes in regulations and market demand. While there have been discussions about the possibility of issuing bearer bonds in electronic form, the overall trend has been towards the decrease of bearer bonds due to the security risks and emergence of new financial instruments.

Regulatory amendments, a surge in market demand, and the emergence of novel financial instruments could potentially spur a resurgence of bearer bonds. However, it remains to be seen whether the allure of anonymity and ease of transfer will be enough to outweigh the security concerns and regulatory challenges.

Summary

Bearer bonds, once a popular investment vehicle, have experienced a decline in popularity due to their inherent security risks and regulatory challenges. While their anonymity and ease of transfer were attractive features in the past, the rise of registered bonds and new financial instruments have made them a less attractive option in today’s financial landscape.

As regulations continue to evolve and market demands shift, the future of bearer bonds remains uncertain. Investors should carefully consider the risks associated with these instruments and explore more secure alternatives, such as registered bonds, to protect their investments and navigate the ever-changing financial landscape.

Frequently Asked Questions

Do bearer bonds exist anymore?

Bearer bonds have not been issued in the United States since the 1980s due to the Tax Evasion and Fiscal Responsibility Act (TEFRA) of 1982, which effectively eliminated their use.

These bonds can no longer be bought, but those that were issued prior to 1982 can still be redeemed if the issuer exists.

Are bearer bonds a good investment?

Bearer bonds can be an attractive investment for those looking for anonymity and easy transferability; however, they come with a heightened risk of loss or theft due to their stricter regulatory scrutiny.

What are bearer bonds for dummies?

Bearer bonds are a type of fixed-income security issued by corporations or governments, where the owner is whoever has physical possession of the bond certificate and attached coupons.

The holder receives coupon payments and must turn in the physical certificate to get the full value when the bond matures.

Are bearer bonds tax free?

Bearer bonds are not tax free, as evidenced by the Tax Equity and Fiscal Responsibility Act of 1982, which implemented an excise tax for issuers of bearer bonds and prevented them from deducting interest costs from taxable income.

However, with no IRS notification about profits from such bonds, individuals can easily avoid paying taxes to the government.

What is the purpose of a bearer bond?

Bearer bonds have been used since the 1800s to raise capital by governments and corporations for business expansion, acquisitions, or financing other projects. They offer anonymity and easy transferability, but are now mainly associated with money laundering and tax evasion concerns.