In this guide, we’re studying everything about strangle options

By the end of the guide, you’ll learn:

- What strangle options are

- How they differ from other types of options

- Pros & Cons

Let’s get going.

Strangle Option Explained

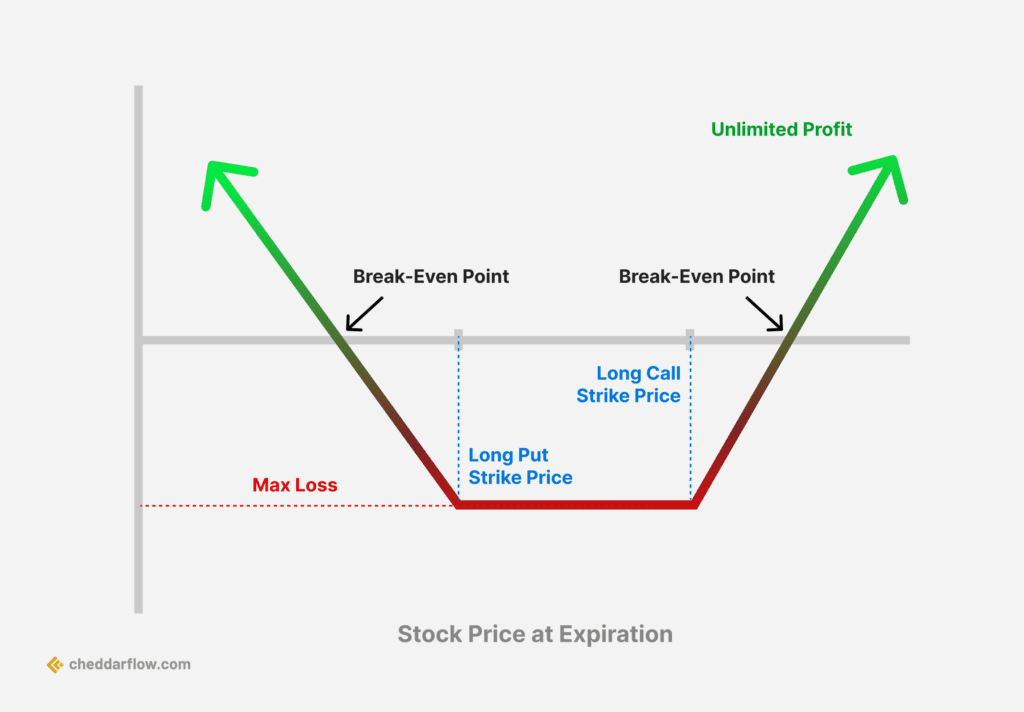

Long Strangle Options Strategy

A strangle option is a popular options strategy that involves holding both a call and a put on the same underlying asset. This strategy is used to profit from a large move in the price of the underlying asset, regardless of whether the move is up or down.

- Strangles are often used by traders who believe that the underlying asset will experience a large price swing, but they are not sure in which direction the price will move.

- Strangles are also used by traders who are trying to hedge their portfolios against large price swings.

Now you know the basis. Let’s see how they work!

How Does A Strangle Option Work?

The goal of a strangle is to profit from a large move in the price of the underlying asset, regardless of whether the move is up or down.

Suppose this: A trader buys a call option with a strike price of 100 and a put option with a strike price of 80 for a stock that is currently trading at 90.

- If the stock price rises above 100, the call option will increase in value, and the trader can sell it for a profit.

- If the stock price falls below 80, the put option will increase in value, and the trader can sell it for a profit.

However: If the stock price remains between 80 and 100 on the expiration date, the options will expire worthless, and the trader will lose their entire investment.

Discerning Strangle Options

Below are the most frequently asked questions about strangle options. We’ve answered 4 of them to make sure you properly understand what strangle options really are.

1. What is the difference between a straddle and a strangle?

| Feature | Straddle | Strangle |

|---|---|---|

| Strike prices | Same | Different |

| Betting on | Direction of the price move | Magnitude of the price move |

| Strangle width | Narrow | Wide |

| Risk | Lower | Higher |

| Profit potential | Lower | Higher |

- Straddle: A straddle involves buying a call option and a put option with the same strike price and expiration date. This implies that the trader is speculating on a substantial movement in the price of the underlying asset, without having a specific prediction about the direction of the price change.

- Strangle: A strangle is similar to a straddle, but the strike prices of the call and put options are different. The difference between the strike prices is called the strangle width. A wider strangle width means that the trader is betting on a larger move in the price of the underlying asset.

2. Is a strangle bullish or bearish?

A strangle in finance is neither inherently bullish nor bearish. It’s a neutral strategy used in options trading. This strategy involves buying a put option and a call option with the same expiration date but different strike prices.

| Aspect | Description in a Strangle Strategy |

|---|---|

| Nature | Neutral (not directly bullish or bearish) |

| Option Types | Involves both a put option and a call option |

| Expiration Date | Both options have the same expiration date |

| Strike Prices | Strike prices are different for the put and call |

| Market Expectation | Significant price movement in the underlying asset, direction unknown |

| Profit Scenario | Profitable if the asset’s price moves substantially either up or down |

| Risk | loss if the price of the underlying asset remains stable, leading to a loss of the premiums |

This table has the main characteristics of a strangle strategy in options trading.

3. How risky is a short strangle?

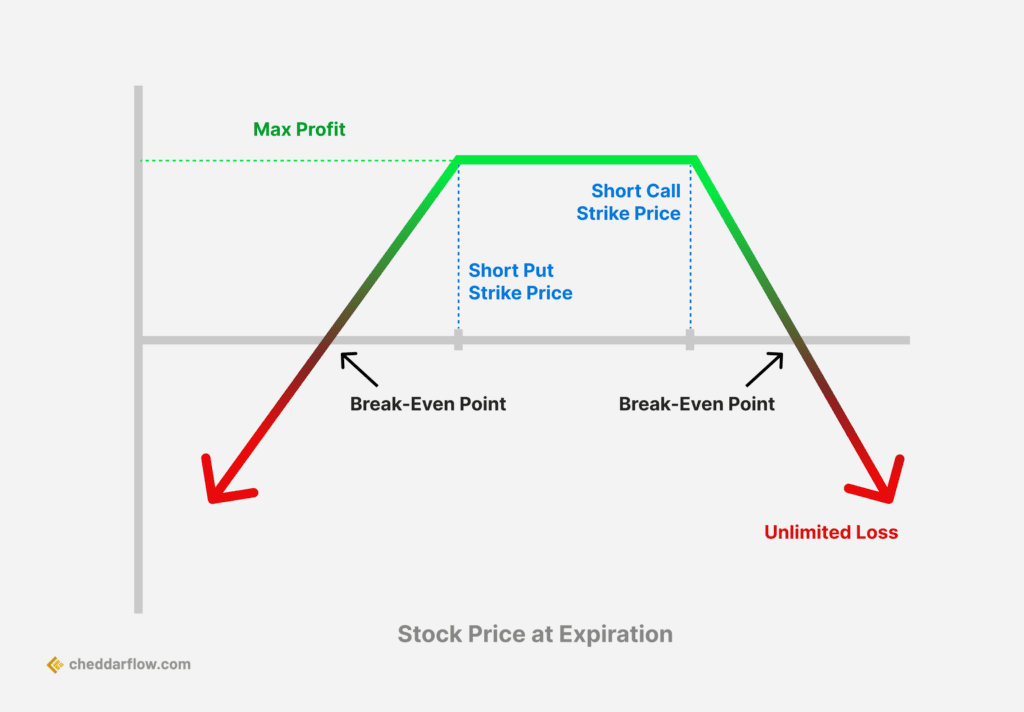

Short Strangle Options Strategy

A short strangle is a high-risk options strategy that can involve substantial losses, even if the underlying asset’s price doesn’t move much. The maximum loss for a short strangle is the difference between the two strike prices minus the premiums received for the call and put options.

4. Is strangle always profitable?

No, a strangle is not always profitable. It is a option strategy that profits from a large price move in the underlying asset, whether it moves up or down.

- The maximum profit from a strangle is the difference between the strike prices minus the premiums paid for the call and put options.

- However, this profit is only possible if the price of the underlying asset moves significantly in either direction.

- If the price of the underlying asset stays flat, the premiums will decay and the strangle will lose money.

Therefore, a strangle is a risky strategy that is best used when an investor is confident that the underlying asset will experience a significant price move. If the investor is not confident in their prediction, they may want to consider a different strategy, such as a straddle or a butterfly.

Pros & Cons: Strangle Options

| Pros | Cons |

|---|---|

| Can profit from a large move in the price of the underlying asset, regardless of whether the move is up or down. | Can be expensive to implement. |

| Can be used to hedge portfolios against large price swings. | May not be profitable if the underlying asset does not experience a large price swing. |

Before using strangle options, it is important to understand the risks involved. Strangles can be risky strategies, and it is possible to lose money. If you are considering using strangle options, it is a good idea to speak with a financial advisor to get personalized advice.