Have you ever wondered why certain stock prices seem to gravitate towards specific points just before the options expiration date? If so, you might be intrigued by the max pain options theory, a fascinating concept in options trading that may hold the key to unlocking potential profits. In this blog post, we’ll delve into the world of max pain options theory, demystifying its concepts, applications, and limitations, and provide you with valuable insights and tips to enhance your options trading strategies.

Short Summary

Max Pain Theory provides traders with a valuable tool to understand market sentiment and identify potential trades.

Market manipulation by market makers attempting to maximize their profits may have implications for traders, so it is important to be aware of these risks when trading options.

Max Pain charts can be used in combination with other tools and strategies to optimize profits while mitigating risk in the options markets.

Demystifying Max Pain Theory

At its core, max pain theory postulates that stock prices tend to gravitate towards a strike price where the maximum number of options traders experience financial losses. This notion is based on the idea that market makers, who write options contracts, have a vested interest in pushing the underlying asset price towards the strike price where the highest number of options contracts expire out of the money, thereby maximizing their profits.

This controversial theory has sparked debates among traders and market analysts, questioning its validity and potential for market manipulation. The max pain price, a critical component of the theory, represents the price that would result in the highest number of option holders experiencing monetary losses upon expiration. To calculate this price, the max pain formula incorporates strike prices and open interest of both call and put options for a particular stock or index.

Despite its contentious nature, max pain theory is estimated to have some validity, as option sellers are likely to make money in more than 80% of cases.

The Role of Max Pain in Options Trading

Max pain theory serves as a valuable tool for options traders, helping them navigate the complex world of options trading and potentially predict market sentiment and price movements. By recognizing the strike price where the maximum number of options traders experience financial losses, max pain theory offers insights into the market dynamics, enabling traders to make informed decisions and potentially capitalize on emerging opportunities.

Max pain theory can be used to identify potential entry and exit points for options trades, as well as to gauge the sentiment of the market. By understanding the strike price where the maximum number of options traders experience financial losses, traders can gain a better understanding of the strike price.

Market Manipulation and Max Pain

Market manipulation concerns arise due to the potential influence of market makers on stock prices to maximize their profits. These powerful financial institutions may attempt to push the underlying asset price towards the strike price where the highest number of options contracts expire out of the money, thereby optimizing their profits for option buyers.

While this aspect of max pain theory is controversial, it’s essential to consider its potential implications and remain vigilant when trading options.

Max Pain Calculation: A Step-by-Step Guide

Calculating the max pain point requires a thorough understanding of the options market and the various factors that influence its dynamics. To determine the max pain point, start by aggregating the value of the put and call options outstanding for all the strike prices. Strike prices and open interest of both call and put options must be considered for any particular stock or index. These details can help in better determining the investment potential of the security in consideration. By examining the open interest at varying strike prices, you can identify the max pain point where the maximum number of options traders stand to incur financial losses.

It’s crucial to take note of the difference between the max pain price and the current stock price, especially when the difference is substantial. The maximum pain price can change hourly or daily, so monitoring this difference can help you stay informed about potential market movements and adjust your trading strategies accordingly. Keep in mind that the effects of max pain on stock prices may be inconsequential until expiration approaches.

Related Article: Understanding Option Volume Vs Open Interest

Factors Influencing Max Pain Calculations

Max pain calculations are influenced by several factors, including the price of the underlying security, time, volatility, interest rates, dividends, and the strike price. The underlying security price is a principal factor in the calculation, as its current price can significantly impact the outcome. Time also plays a vital role, with a longer duration until expiration allowing for greater potential movement in the underlying security and affecting the max pain calculation.

Other factors, such as volatility, interest rates, dividends, and the strike price, must also be taken into account when performing a max pain calculation. Volatility affects the probability that the underlying security will reach the strike price, while interest rates, dividends, and the strike price influence the cost of the option.

Analyzing Max Pain Charts

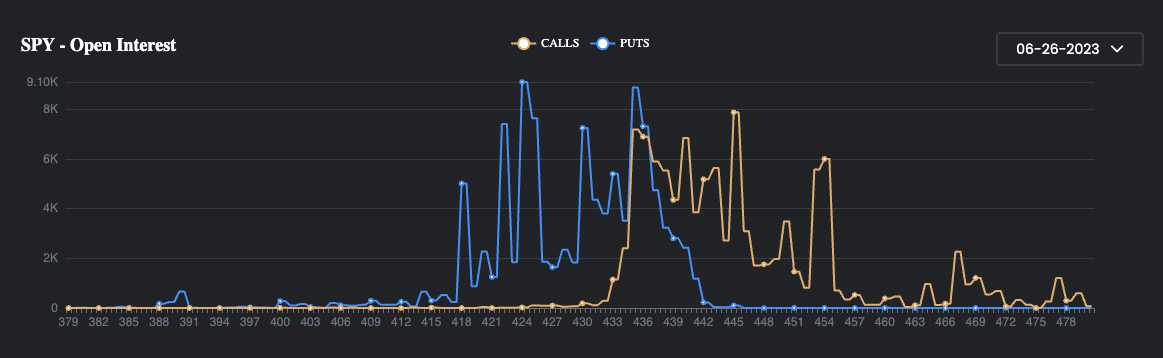

Image Source: Swaggystocks

Max pain charts offer a visual representation of the max pain point, making it easier to analyze market sentiment and potential price movements. By examining the open interest at varying strike prices, you can gain insights into the probable direction in which the market is likely to move. Utilizing a max pain chart can help detect potential price movements by inspecting the strike prices where the open interest is most prominent.

These charts can be instrumental in identifying trends and potential areas of support and resistance, providing valuable context for your trading decisions.

Using Max Pain Charts for Strategic Decision-Making

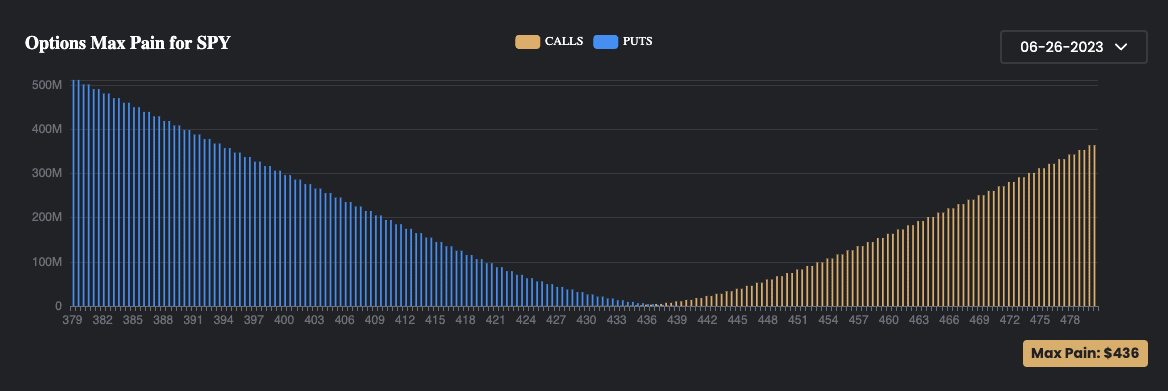

Image Source: Swaggystocks

Strategic decision-making using max pain charts involves comparing the max pain point with the current stock price and anticipating potential market movements. By identifying the strike price at which there is the most significant discomfort for purchasers of options, traders can use this information to determine the most suitable entry and exit points for their trading strategies.

It’s important to remember that max pain theory is not foolproof, and its effectiveness may vary depending on market conditions and other factors. As such, it’s crucial to use max pain charts in conjunction with other trading tools and strategies to ensure a well-rounded and comprehensive approach to options trading.

Real-Life Examples of Max Pain Theory in Action

To illustrate the practical application of max pain theory, let’s consider a hypothetical example. Imagine a stock with a current price of $100 and options contracts with various strike prices. By examining the open interest at each strike price, you might observe that the max pain point lies at $105, indicating that the stock price may gravitate towards this point as the options expiration date approaches. Armed with this information, you can adjust your trading strategies to capitalize on this potential movement and maximize your profits.

In another real-life example, you may notice that a particular stock consistently moves towards its max pain point before the options expiration date, suggesting that market makers are actively pushing the stock price in that direction to optimize their profits and let some options expire worthless.

Pros and Cons of Using Max Pain Theory

Max pain theory offers several advantages for options traders, most notably the potential to predict market sentiment and price movements based on the strike price where the maximum number of options traders incur financial losses. This information can be invaluable for option sellers, who stand to generate the greatest returns by pushing the underlying asset price towards the max pain point.

However, maximum pain theory states that this concept, also known as max pain theory, has its drawbacks and limitations. For one, option holders may encounter significant financial detriment, as the theory endeavors to delineate how options traders may experience losses if the spot price of the underlying asset coincides with the strike price. Additionally, max pain theory may not prove efficacious in all market conditions, underscoring the importance of using it in conjunction with other trading tools and strategies.

When Max Pain Theory Works Best

Max pain theory works best in specific market conditions, particularly in markets with a high concentration of options sellers. As such, it’s essential to evaluate the market environment and consider factors such as market sentiment, volatility, and open interest when employing max pain theory in your trading strategies.

Tips for Trading with Max Pain Theory

First, monitor the open interest and volume of options contracts to identify potential trading opportunities. Second, understand the limitations of max pain theory and ensure that you employ it as a supplementary tool in a comprehensive trading strategy.

Balancing Max Pain Theory with Other Trading Tools

Balancing max pain theory with other trading tools involves understanding its limitations and using it as a complementary tool in a well-rounded trading strategy. For example, you can combine max pain theory with other options trading strategies, such as the Bull Call Spread, to diversify your portfolio and mitigate risk.

By utilizing max pain theory to recognize the strike price with the most significant pain, traders can use this information to determine the most suitable entry and exit points for other options trading tactics, such as the Bull Call Spread strategy.

It’s essential to recognize that max pain theory is not a panacea and should not be relied upon as the sole basis for your trading decisions. Instead, use it as a supplementary tool in conjunction with other trading instruments to develop a robust and comprehensive options trading strategy.

Summary

In conclusion, max pain theory offers a fascinating perspective on options trading, suggesting that stock prices tend to gravitate towards the strike price where the most options traders experience financial losses. By understanding the concepts, applications, and limitations of this theory, traders can potentially capitalize on emerging opportunities and enhance their options trading strategies.

As you continue to explore the world of options trading, remember to balance max pain theory with other trading tools and strategies to ensure a well-rounded and comprehensive approach. By doing so, you can unlock the benefits of max pain theory, navigate the complexities of the options market, and ultimately, achieve greater success in your trading endeavors.

Frequently Asked Questions

What does Max pain mean in options?

Max pain is an important concept in options trading and represents the price at which the largest number of traders are likely to suffer losses on their positions.

This is determined by looking at the open interest levels for various strike prices.

What is the max pain for S&P 500 options?

According to expert analysis, the Max Pain for S&P 500 options expiring on Jun 26, 2023 is calculated to be $4,330.00.

This is the point at which all option holders experience the maximum amount of pain.

How accurate is max pain?

Max pain is not an exact science and there’s no way to definitively measure its accuracy. However, based on what we know about the concept, it could be seen as a tool that can help traders make decisions.

Thus, while it’s impossible to guarantee accuracy, it can certainly increase the chances of success.

Does max pain theory work?

Yes, max pain theory can work depending on how much traders are familiar with options prices and the volatility of assets. However, it is important to understand that trading options is a risky venture and no method is foolproof.

Therefore, one should always do their due diligence before making any decisions.