Have you ever wondered how to effectively evaluate the performance of your investments while taking into account the potential losses? Enter the Sortino Ratio, a powerful tool that helps investors make informed decisions by focusing on downside risk. Join us on this journey as we explore the concept, calculation, interpretation, and practical applications of this remarkable ratio.

Short Summary

The Sortino Ratio is a risk-adjusted performance measure that focuses on downside deviation (i.e. the negative movements in market prices), offering more precise returns than other ratios.

It can be used to effectively measure and compare the downside risk-adjusted returns of different investments or funds.

Factors such as data accuracy, volatility measurement, and time horizon must be taken into consideration when using the Sortino Ratio to assess investment strategies based on downside risk.

Concept of Sortino Ratio

The Sortino Ratio is a risk-adjusted performance measure that emphasizes only the downside risk, offering a more precise assessment of potential returns when compared to other ratios such as Sharpe and Treynor. Named after economist Frank A. Sortino, this ratio is used to measure the risk-adjusted return on a portfolio that compares performance relative to the downside deviation, rather than the overall standard deviation, of a portfolio’s returns.

Importance of Downside Risk

Downside risk is a vital concept for investors as it accounts for the potential for losses or bad risk. Downside risk explains a worst-case scenario for an investment and indicates how much the investor stands to lose. Downside risk measures are considered one-sided tests since the potential for profit is not considered.

While other ratios consider both upside and downside risks, the Sortino Ratio zeroes in on downside volatility, making it a beneficial tool to help investors prioritize the avoidance of losses, allowing them to make more informed decisions in selecting investments.

Calculating the Sortino Ratio

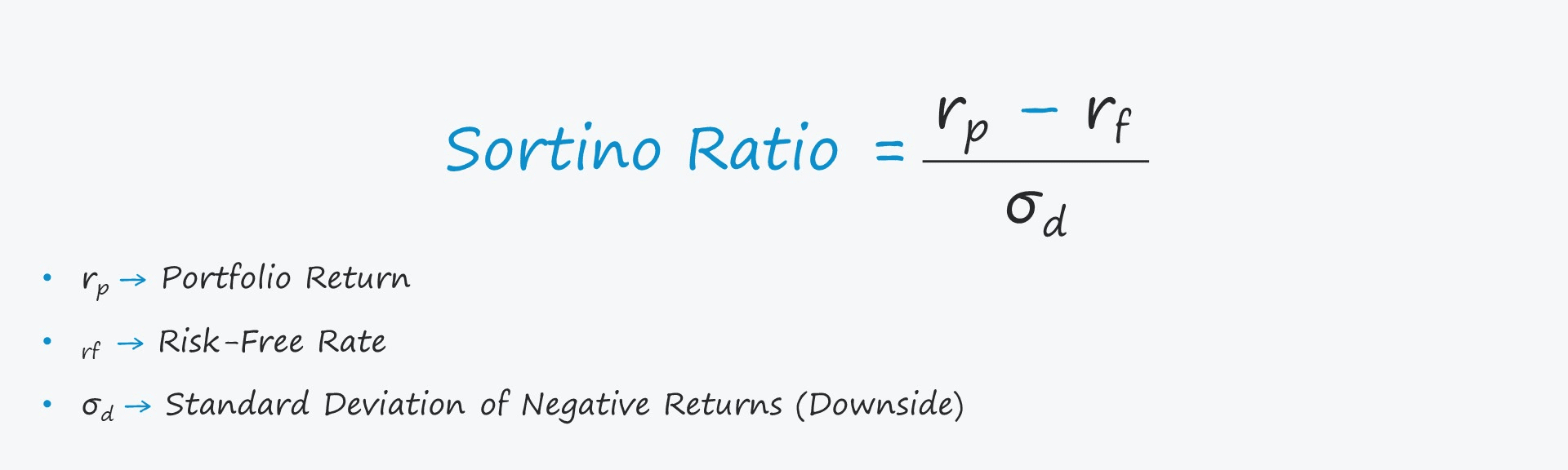

The Sortino Ratio calculation involves an analysis of expected returns, risk-free returns, and downside deviation, providing an accurate assessment of an investment’s risk-adjusted performance. The simplified version of the Sortino Ratio formula can be expressed as:

Sortino Ratio = (Rp – Rf)/d, where Rp represents the portfolio return, Rf denotes the risk-free rate, and d signifies the standard deviation of negative returns.

Formula Components

To better understand the Sortino Ratio formula, let’s break down its components:

Portfolio Return (Rp): The return on a portfolio, either on a historical basis (i.e. actual results) or the expected returns according to the portfolio manager.

Risk-Free Rate (rf): The risk-free rate is the return received on default-free securities, e.g. U.S. government bond issuances.

Downside Standard Deviation (σd): The standard deviation of solely the investment’s or portfolio’s negative returns, i.e. the downside deviation.

By dividing the excess return by downside deviation, the Sortino Ratio provides a clear picture of an investment’s risk-adjusted performance.

Calculation Example

Let’s consider an example to demonstrate how to compute the Sortino Ratio for two investment portfolios with different returns and risks. Portfolio A has an expected return of 10%, a risk-free rate of 2%, and a downside deviation of 4%. Portfolio B has an expected return of 14%, a risk-free rate of 2%, and a downside deviation of 7%.

To calculate the Sortino Ratio for Portfolio A, we use the formula:

(10% – 2%) / 4% = 2.0. For Portfolio B, the calculation is: (14% – 2%) / 7% = 1.71.

From this example, we can observe that Portfolio A has a higher Sortino Ratio, indicating better performance per unit of downside risk.

Interpreting the Sortino Ratio

Interpreting the Sortino Ratio helps investors understand the risk-adjusted return of an investment, with higher values indicating better performance per unit of downside risk. A higher Sortino ratio indicates a higher return per unit of downside risk, while a negative ratio suggests that the investment has a poor risk-adjusted performance.

However, since the ratio is calculated using past data, it is still a flawed indicator of future performance.

By understanding and utilizing the Sortino Ratio, investors can make more informed decisions about their investments and ensure that they are protected.

Good vs. Bad Sortino Ratios

A good Sortino Ratio is typically above zero, with most analysts preferring a score of 2 or more. A ratio higher than 2 is considered very good, and a ratio of 3 or higher is considered excellent. On the other hand, a Sortino Ratio below 2 is typically regarded as poor, with ratios lower than 1 considered very poor, and ratios of 0 or lower considered extremely poor.

In other words, the higher the Sortino Ratio, the better because a higher value indicates that the portfolio is more efficient and does not take on unnecessary risk without being rewarded with higher returns. When the Sortino Ratio is very low or negative, it means that the investment does not get rewarded for taking on additional risk.

Comparing Sortino Ratio and Sharpe Ratio

Sortino Ratio and Sharpe Ratio differ in their approach to risk measurement. The Sortino Ratio quantifies only downside deviation, whereas the Sharpe Ratio considers both upside and downside deviation. This distinction makes Sortino Ratio more suitable for portfolios with high volatility, as it focuses on downside risk, which is a primary concern for investors. The Sharpe ratio tends to be more applicable to portfolios with low volatility.

In short, both ratios determine an investment’s return through risk-adjusted methods, but in using the Sortino Ratio and focusing on downside risk, you’re likely to receive a more accurate assessment of risk.

Advantages of Sortino Ratio

One of the primary advantages of the Sortino Ratio is its focus on downside risk. This emphasis makes it particularly pertinent for investors who prioritize the avoidance of losses and more appropriate for strategies with positive skew.

By concentrating on downside risk, the Sortino Ratio provides a more accurate reflection of an investment’s risk-adjusted performance, enabling investors to make better decisions related to risk in selecting investment strategies and portfolios.

Practical Applications of Sortino Ratio

The Sortino Ratio has a variety of practical applications, such as the analysis of mutual funds and the evaluation of portfolio performance. Let’s take a look at each of these further.

Mutual Fund Analysis

In the realm of mutual fund analysis, the Sortino Ratio allows investors to identify better-performing funds by comparing their downside risk-adjusted returns. By concentrating on downside risk, investors can better assess the potential losses associated with various mutual funds. This information can be vital in helping investors make informed decisions when selecting funds that align with their risk tolerance and investment goals.

Investors can use the Sortino Ratio to compare funds and determine which ones offer the best risk.

Portfolio Performance Evaluation

Portfolio performance evaluation using Sortino Ratio helps investors and portfolio managers assess the effectiveness of their investment strategies in achieving specific goals. By focusing on downside risk, the Sortino Ratio provides valuable insights into the potential losses associated with various investment strategies.

This information can be critical in helping investors and portfolio managers make adjustments to their strategies to better align with their risk tolerance and investment objectives.

Related Article: Understanding Unrealized Gains

Tips for Using Sortino Ratio Effectively

To use the Sortino Ratio effectively, it’s essential to consider data from multiple years and take into account a full business cycle. By doing so, investors can obtain a more accurate assessment of an investment’s risk-adjusted performance.

Let’s explore some data considerations and the importance of time horizon when using Sortino Ratio.

Data Considerations

When utilizing the Sortino Ratio, it’s crucial to ensure data integrity and consistency, as well as the selection of appropriate benchmarks for calculation. Accurate and reliable return data, as well as the identification and measurement of downside volatility, are essential for obtaining meaningful results.

By maintaining data integrity and consistency, investors can obtain more reliable and accurate calculations.

Time Horizon

Time horizon, the period of time one expects to hold an investment until they need the money back, is critical when utilizing the Sortino Ratio, as taking into account an entire business cycle can offer a more precise illustration of an investment’s risk-adjusted performance. Considering the investment’s time horizon assists in assessing the ideal holding period and risk tolerance level of an investment scheme.

Related Article: A Comprehensive Guide To Topline Vs Bottomline

Summary

In conclusion, the Sortino Ratio is a powerful tool for investors seeking to evaluate the risk-adjusted performance of their investments with a focus on downside risk. By understanding the calculation, interpretation, and practical applications of this ratio, investors can make more informed decisions when selecting investment opportunities. With the Sortino Ratio as part of their financial toolkit, investors can confidently navigate the world of investments and achieve their financial goals.

Frequently Asked Questions

Which is better Sortino ratio or Sharpe ratio?

Sortino ratio is preferred by investors as it takes into account their specific goals and objectives, and only considers the downside risks when assessing returns.

Sharpe ratio is simpler to calculate, but only determines returns based on total volatility in the market, which includes both upside and downside risks.

Do you want a high or low Sortino ratio?

It is generally better to aim for a high Sortino ratio as this suggests a higher reward compared to the risks taken with an investment. A higher Sortino ratio results indicates that an investment earns more return per unit of the bad risk it takes on.

What is the Sortino ratio in simple terms?

The Sortino ratio is a variation of the Sharpe ratio that measures an investment’s return relative to its downside risk by taking into account only the negative movements in market prices. It helps differentiate harmful volatility from total overall volatility by using the asset’s standard deviation of negative portfolio returns.

What is the Sortino ratio of the S&P 500?

The Sortino ratio of the S&P 500, as measured by the SPDR SP 500, is 0.0907. This indicates a relatively low risk-adjusted return for this investment asset.

What are some practical applications of the Sortino Ratio?

The Sortino Ratio has many practical uses, such as analyzing mutual funds and evaluating portfolio performance.