From predicting the subprime mortgage crisis to making bold bets on GameStop, Michael Burry has established himself as a hedge fund manager with an uncanny ability to identify lucrative investment opportunities. But how did this mysterious figure make his fortune, and what moves has he made to stir up controversy in the world of finance? Join us as we delve into the life and investments of Michael Burry, revealing the secrets behind his impressive Michael Burry net worth.

Short Summary

Michael Burry’s estimated net worth of between $200 million and $300 million is a result of his successful hedge fund ventures and savvy investments.

His investments in subprime mortgages, GameStop, gold, water, farmland have been instrumental in building his fortune.

He has remained skeptical about cryptocurrencies but is investing in tech stocks to create a resilient portfolio that can withstand market volatility.

Unraveling Michael Burry’s Net Worth

When it comes to the world of finance, few names are as synonymous with success as Michael Burry. With an estimated net worth of between $200 million and $300 million, Burry has built his fortune on the back of his hedge fund ventures, Scion Capital LLC and Scion Asset Management. As the mastermind behind some of the most prescient market predictions in recent history, Burry’s rise to prominence is a testament to his keen understanding of financial markets and investment strategies.

In this section, we’ll explore the genesis of Michael Burry’s net worth, delving into the history of his hedge fund ventures and the key investments that have shaped his fortune. From his early days at Scion Capital LLC to the rebirth of Scion Asset Management, we’ll examine the strategies that have propelled this enigmatic investor to the very top of his game.

Hedge Fund Beginnings: Scion Capital LLC

Before the world knew him as the man who predicted the subprime mortgage crisis, Michael Burry was a young investor with a keen eye for value. In 2000, he founded his own hedge fund, Scion Capital LLC, with the aim of capitalizing on his unique insights into the financial markets. Burry’s savvy investment strategies paid off almost immediately. In its first full year, Scion Capital saw a staggering 55% increase while the S&P 500 decreased by 11.88%. His knack for identifying undervalued stocks and predicting market trends would become a hallmark of his success at Scion Capital.

One of the most notable achievements during Burry’s tenure at Scion Capital was his ability to short overvalued tech stocks and accurately predict the 2008 housing market crash. These moves garnered significant profits for the hedge fund and paved the way for Burry’s ascent in the world of finance.

However, following the 2008 financial crisis, Burry decided to liquidate Scion Capital LLC to focus on personal investments.

Scion Asset Management: The Rebirth

Michael Burry’s investment journey didn’t end with the dissolution of Scion Capital LLC. In 2013, he founded Scion Asset Management, a financial services firm with a renewed focus on investments in gold, water, farmland, and tech stocks such as Facebook and Alphabet Inc. This new venture allowed Burry to continue building on his previous success and expand his investment portfolio.

With Scion Asset Management, Burry has made strategic investments in a variety of sectors, diversifying his portfolio and positioning himself for continued growth in the ever-changing financial landscape. This rebirth of Burry’s investment career has further solidified his reputation as a shrewd investor with a unique ability to identify lucrative opportunities in the market.

Key Investments Shaping Burry’s Fortune

Over the years, Michael Burry has made a series of key investments that have played an instrumental role in shaping his fortune. These investments include betting against subprime mortgages, taking a position in GameStop, and diversifying his portfolio with gold, water, and farmland. Each of these moves has contributed to Burry’s impressive net worth and solidified his reputation as a visionary investor.

Betting Against Subprime Mortgages

Perhaps the most well-known aspect of Michael Burry’s investment career is his bet against the subprime mortgage industry. Recognizing the impending collapse of the housing market, Burry convinced large firms such as Goldman Sachs to provide him with credit default swaps against the subprime deals he identified as vulnerable. This bold move earned Burry and his investors over $700 million, catapulting him to fame and cementing his status as a financial visionary.

Burry’s successful bet against subprime mortgages showcased his ability to identify and capitalize on market inefficiencies. This high-stakes wager not only contributed to his impressive net worth, but also demonstrated his willingness to challenge conventional wisdom and pursue unconventional investment strategies.

GameStop Investment

Another key investment that has contributed to Michael Burry’s fortune is his position in GameStop. In March 2020, Burry acquired 3 million shares of the video game retailer, later reducing his position to 1.7 million shares over the next six months. At its peak, Burry’s investment in GameStop could have been worth $816 million when the stock briefly hit $480 per share.

This successful investment further demonstrates Burry’s ability to identify undervalued assets and capitalize on market opportunities.

Diversified Portfolio: Gold, Water, and Farmland

In addition to his high-profile bets against subprime mortgages and his investment in GameStop, Michael Burry has also sought to diversify his portfolio with investments in gold, water, and farmland. These investments have allowed Burry to secure a steady stream of income and protect his wealth from market fluctuations.

Burry’s Controversial Market Moves

While Michael Burry has undoubtedly enjoyed a great deal of success in the world of finance, his investment strategies have not been without controversy. Notable examples include his decision to short Tesla and his unpredictable Twitter activity. These moves have generated a great deal of debate and have further solidified his status as a polarizing figure in the financial world.

Shorting Tesla

In December 2020, Michael Burry initiated one of the largest short positions against Tesla, predicting that the electric car manufacturer would experience a decline similar to that of the housing market following the subprime mortgage crisis. This bold move drew the attention of Tesla CEO Elon Musk, who referred to Burry as a “broken clock”, implying that his success was limited to declining markets.

While Burry’s bet against Tesla has generated a great deal of controversy and criticism, it also serves as a reminder of his willingness to challenge the status quo and pursue unconventional investment strategies. Whether or not his wager against Tesla ultimately pays off, it has undeniably contributed to his reputation as a daring and innovative investor.

Related Article: Cathie Wood Net Worth

Twitter Activity

Michael Burry’s novel Twitter activity has also been a source of controversy, as he is known to regularly post about his market positions and subsequently delete those tweets if they don’t prove to be successful. This unpredictable behavior has drawn both praise and criticism from the financial community, with some applauding his transparency while others question his credibility.

Regardless of the opinions surrounding his Twitter presence, it’s clear that Burry’s unconventional approach to sharing his market insights has only added to his mystique as a polarizing figure in finance.

Personal Life and Background

Behind bold market predictions and controversial investment strategies lies the personal life and background of Michael Burry. Born and raised in San Jose, California, Burry faced adversity early in life when he lost his left eye to retinoblastoma. Despite this challenge, he went on to attend prestigious educational institutions, including Vanderbilt University and the University of California, Los Angeles where he pursued economics and pre-med.

During his off-duty hours as a resident at Stanford University Medical Center, Burry devoted his time to studying financial investing. His passion for the stock market and value investing eventually led him to abandon his medical career and pursue a path in finance, ultimately becoming a hedge fund manager and founding his own hedge fund, Scion Capital LLC. Interestingly, this journey began during his days at Santa Teresa High School, where he first developed an interest in finance.

Family Life

On a more personal note, Michael Burry is happily married to his wife Cassandra, whom he met on Match.com. Together, they have a son who has been diagnosed with Asperger’s Syndrome.

Despite his high-profile career and controversial market moves, Burry maintains a relatively private family life, focusing on the well-being of his loved ones and continuing to build his impressive fortune.

Michael Burry’s Market Predictions

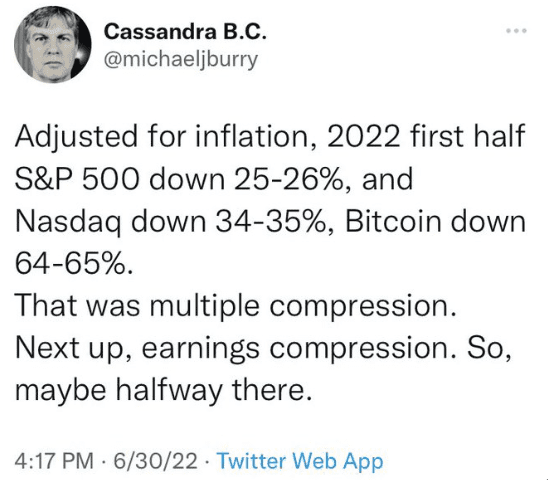

As a successful American investor known for his accurate market predictions, many are keen to learn about Michael Burry’s outlook on the future of financial markets. While he has expressed skepticism towards cryptocurrencies and has not disclosed any forthcoming investment strategies, his predictions regarding inflation, the economy, and the S&P 500 provide valuable insights into his current market perspective.

Cryptocurrency Skepticism

Although cryptocurrencies have gained significant attention in recent years, Michael Burry remains skeptical of their long-term viability. He has expressed concerns about the speculative nature of cryptocurrencies and their susceptibility to government opposition.

However, Burry does acknowledge Bitcoin as a potential hedge in certain economic scenarios, suggesting that he is not entirely dismissive of the potential value of digital assets.

Future Investment Strategies

In terms of future investment strategies, Michael Burry is anticipated to focus on gold, water, farmland, and tech stocks. These investments are expected to augment his net worth further and provide a stable source of income in the face of a predicted economic downturn in 2023.

By concentrating on these sectors, Burry demonstrates his commitment to building a resilient and diversified investment portfolio that can weather market fluctuations. As the financial landscape continues to evolve, it will be interesting to see how Burry adapts his investment strategies to capitalize on new opportunities and navigate potential challenges.

Summary

From betting against subprime mortgages to investing in GameStop, Michael Burry’s journey as a hedge fund manager has been nothing short of extraordinary. His uncanny ability to identify lucrative investment opportunities and navigate the complex world of finance has earned him both admiration and controversy.

As we continue to watch Burry’s investment strategies unfold, one thing remains clear: his keen understanding of financial markets and unwavering commitment to diversification make him a force to be reckoned with in the world of finance.

Frequently Asked Questions

How much did Michael Burry make from the short?

Michael Burry’s short bet on the subprime mortgage market was a success. He made $100 million for himself and $700 million for his investors, proving his insight was right on the money and that he had the foresight to predict the crash of the housing market.

This remarkable feat of financial acumen has been the subject of books, movies, and documentaries, and has cemented Burry’s place in the annals of financial history.

What is Michael Burry investing in now?

Michael Burry’s investment portfolio has seen a shift in recent years, with him choosing to invest in more diverse assets, such as gold, farmland, tech stocks, and private prisons. He is tapping into these markets in order to further increase his wealth beyond his already substantial gains from shorting tech stocks and accurately predicting the 2008 housing market crash.

What is Michael Burry’s estimated net worth in 2023?

As of 2023, the estimated net worth of Michael Burry is approximately $300 million USD, according to widely accepted sources.

What are some of the key investments that have shaped Michael Burry’s fortune?

Michael Burry’s fortunes have been shaped by his savvy investments in the stock market, such as betting against subprime mortgages, investing in GameStop, and diversifying his portfolio with gold, water, and farmland.

These investments have provided him with significant returns and placed him among the ranks of high earners.