If you’re inquiring about Epic Games stock, we provide clarity on the subject. As equities from this gaming titan are not publicly traded, this article introduces potential routes to investment interest in Epic Games. Get the insight you need on the avenues open to you, from strategic stakeholder investment to pre-IPO platforms.

Related Article: Who Owns Ally Bank? Exploring The History And Milestones Of Ally Financial

Key Takeaways

Epic Games is a privately held company known for its Unreal Engine and hit titles like Fortnite, with a valuation of $32 billion, and investing directly in its stock is not an option for retail investors.

Investors can gain indirect exposure to Epic Games by investing in companies like Tencent, which holds a 40% stake, or through pre-IPO share platforms for accredited investors such as EquityBee and Linqto.

While direct investment in Epic Games is challenging, retail investors have alternative options like investing in major gaming companies such as Tencent Holdings, Electronic Arts, and Activision Blizzard to participate in the gaming industry’s growth.

Understanding Epic Games: A Brief Overview

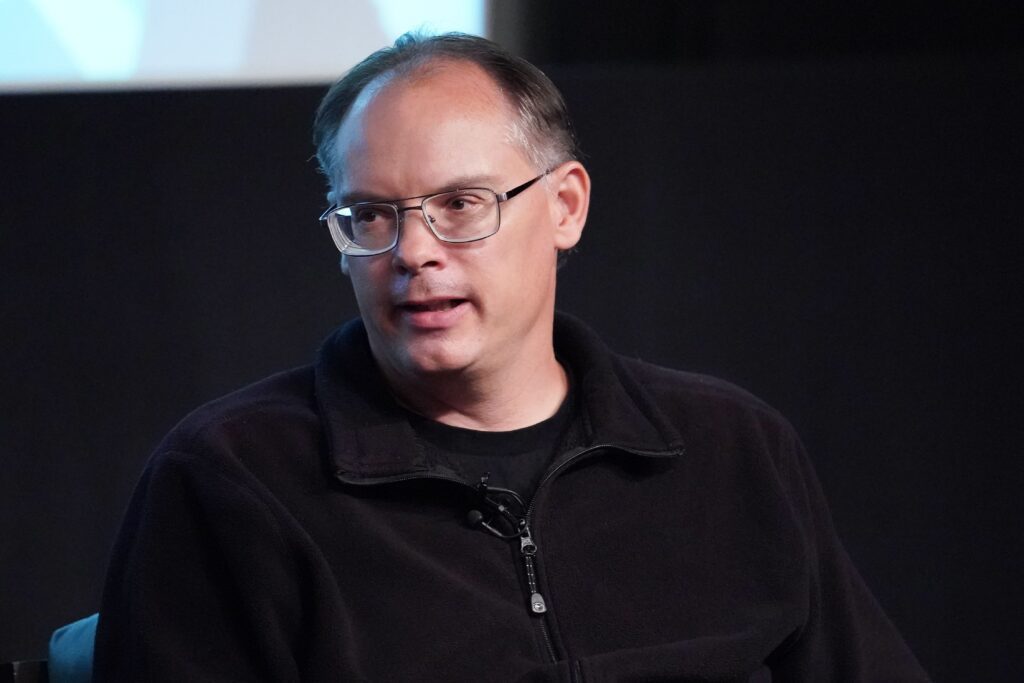

Founded in 1991 by Tim Sweeney, who owns Epic Games, the company has grown into a leading game development and software company. Based in Cary, North Carolina, the company is known for its Epic Games Store and the Unreal Engine, a powerful game development tool. Over the years, Epic Games has developed approximately 40 games and published over 20 more, solidifying its position as a major force in the gaming industry. Epic Games reported success in both their store and engine, contributing to their growth and reputation.

Among the company’s well-known game titles are Fortnite Battle Royale, Fortnite Creative, and The Matrix Awakens. The success of these games, among others, has contributed significantly to the company’s current valuation of $32 billion.

The Current State of Epic Games Stock

Purchasing Epic Games stock can be a challenge for retail investors as the company is privately held and currently not publicly traded. Nonetheless, there are still ways for those interested in how to buy epic games stock and invest in Epic Games.

Consider alternative methods to invest in Epic Games’ market. One such strategy involves investing in companies like Tencent, which holds a significant stake in Epic Games. Another option includes exploring pre-IPO share platforms, offering potential access to private shares.

Related Article: Investing In NFL Stock: How To Get In The Game

Key Players in Epic Games Ownership

Examining Epic Games’ ownership structure, we find key stakeholders contributing to the company’s value. CEO Tim Sweeney, holding a 28% equity stake, is the majority owner of the company.

Another key player is Tencent, a Chinese multinational conglomerate, which holds a 40% stake in Epic Games. Tencent’s investment in Epic Games has not only influenced the company’s valuation but also provided an indirect way for investors to gain exposure to Epic Games.

Other significant investors include Sony, which has invested in Epic Games to expedite the development of the Metaverse and establish interactive spaces for player engagement.

Navigating the Private Investment Landscape

Pouring money into private firms such as Epic Games might pose some challenges. However, accredited investors might find opportunities to buy Epic Games stocks through platforms like EquityBee or Linqto. EquityBee, for instance, enables investors to provide funding for private company shares in return for a certain fee.

Titan is another platform that facilitates the purchase of pre-IPO shares. Individuals can open new accounts with a minimum investment of $500, potentially gaining access to Epic Games stock IPO opportunities. To be considered an accredited investor, individuals must meet specific financial criteria, including certain wealth and income thresholds.

Alternative Investment Options for Retail Investors

Although direct investment in Epic Games might be a hurdle, multiple avenues allow retail investors to delve into the gaming industry. Companies like Tencent Holdings, Electronic Arts, and Activision Blizzard present viable alternative investment options. Each of these companies has a substantial presence in the gaming industry and has demonstrated favorable returns, offering investors varied exposure to the gaming sector.

1) Investing in Tencent Holdings (TCEHY: OTCMKTS)

Tencent Holdings, a Chinese multinational conglomerate, holds a significant stake in Epic Games and is also the world’s foremost video gaming company. Investment in Tencent Holdings offers an indirect pathway for investors to reap benefits from Epic Games’ success.

Tencent’s 40% stake in Epic Games has had a positive influence on its stock performance, providing an indirect share in Epic Games’ success. This strategic investment has not only bolstered Tencent’s position in the gaming industry but also offered a way for investors to gain exposure to Epic Games.

2) Diversifying with Electronic Arts (EA: NASDAQ)

Electronic Arts, a formidable rival in the gaming industry, serves as another appealing alternative investment avenue. Known for successful titles like Battlefield, Need for Speed, and The Sims, Electronic Arts provides a diversified investment option with significant growth potential.

In recent years, Electronic Arts has seen a favorable financial trajectory with steady revenue growth. In fiscal year 2023, the company reported record net bookings were up 11 percent year-over-year, demonstrating its financial stability and potential for future growth.

3) Betting on Activision Blizzard (ATVI: NASDAQ)

Activision Blizzard, famed for its popular titles like World of Warcraft and Call of Duty, presents itself as a strong investment option in the video game industry. The company has experienced consistent annual revenue growth over the last five years, marking it as a strong contender in the gaming industry.

Despite significant controversies and setbacks in recent years, Activision Blizzard has proven its resilience. The company holds an estimated market share of 8.3% in the Video Game Software Publishing industry, demonstrating its significant influence in the gaming sector.

Tracking Epic Games’ Financial Performance and Growth

A thorough analysis of Epic Games’ financial performance and growth is crucial in comprehending its prospective future value, which is directly related to the epic games valuation. Despite a decrease in revenue from $5.6 billion in 2018 to $4.2 billion in 2019, the company is expected to recover, with an estimated projection of $5.8 billion in gross revenue in 2024.

Epic Games’ growth strategy is further evidenced by its recent strategic acquisitions and partnerships. The company has completed 22 acquisitions, spanning different sectors, including Enterprise Software and PC & Console Gaming. Strategic partnerships with companies like LVMH, Autodesk, and Mail.Ru Games Ventures have also demonstrated Epic Games’ commitment to innovation and growth.

Speculating on an Epic Games IPO

The prospect of an Epic Games Initial Public Offering (IPO) intrigues many investors. Despite no confirmation of an Epic Games IPO date, the likelihood of a future IPO escalates with growing interest from venture capital firms and increasing private share demand.

The decision to go public and become a publicly traded company is influenced by a variety of factors, including:

potential

size

assets

market conditions

decision-making by the management and board of directors

If Epic Games were to become epic games publicly traded, it would provide an opportunity for private investors to realize returns on their investments, making it an attractive prospect for many.

Risks and Considerations for Investing in Gaming Stocks

Like any financial endeavor, investing in gaming stocks is accompanied by its unique risks and factors to consider. Market volatility can significantly impact gaming stocks, with favorable attitudes towards gambling influencing country-level stock price volatility.

Competition in the gaming industry can affect stock prices, as can changes in consumer behavior. The gaming industry is continually influenced by ecosystem dynamics and evolving consumer behavior. In times of economic uncertainty, some consumers may reduce their spending, but historically, the gaming industry has demonstrated resilience.

Summary

Whether you’re a seasoned investor or a newcomer to the gaming industry, investing in Epic Games presents exciting opportunities. Although the company is privately held, there are alternative ways to gain exposure to it. From investing in companies with a significant stake in Epic Games to exploring pre-IPO share platforms, the possibilities are diverse.

Frequently Asked Questions

Is Epic Games a publicly traded stock?

No, Epic Games is not a publicly traded stock. It is a privately held company, and there is no stock symbol for investors to purchase.

What is Epic Games worth?

Epic Games is worth approximately $32 billion.

Who does Epic Games own?

Epic Games is owned by Tim Sweeney, who holds roughly 28% of the company’s shares, and Tencent, a Chinese technology and entertainment company, which holds about 40% of the stock. Additionally, Epic Games owns game developers Psyonix, Mediatonic, and Harmonix and operates studios globally.

How can I invest in private companies like Epic Games?

You can invest in private companies like Epic Games through platforms like EquityBee or Titan, which cater to accredited investors and offer opportunities to buy shares. This can be a good option for accessing private company investments.

What alternative investment options are there in the gaming industry?

Consider investing in well-established companies like Tencent Holdings, Electronic Arts, and Activision Blizzard for alternative investment options in the gaming industry. These companies have shown favorable returns and have a significant presence in the industry.