Are you an investor looking to level up your trading experience? With the ever-growing popularity of Robinhood, you might be wondering, “is Robinhood Gold worth it?” as you consider upgrading in 2023. In this comprehensive guide, we will delve into the features, benefits, costs, and potential drawbacks of this premium subscription service to help you make an informed decision about whether it’s worth the investment.

Related Article: How To Close A Robinhood Account In 2023: A Comprehensive Guide

Key Takeaways

Robinhood Gold is a premium subscription service offering advanced market data, larger instant deposits and margin trading with access to professional research.

Evaluate the benefits of Robinhood Gold such as interest on uninvested cash, in-depth research & analysis and convenience of bigger deposits against potential drawbacks like limited mutual fund offerings & margin trading risks.

Compare features of Robinhood Gold to other platforms for an informed decision about suitability for individual investment needs.

Understanding Robinhood Gold

A Robinhood Gold account is a premium subscription service that offers members:

Advanced market data

Larger instant deposits

Access to professional research

This tier of membership caters to more experienced investors. Since its inception in 2013, Robinhood has aimed to democratize investing and make financial markets accessible to all, not just the affluent. With over 11 million Robinhood customers as of 2023, the Robinhood platform continues to grow and offer innovative features.

Whether Robinhood Gold is worth it or not depends on your trading style, investment strategy, and borrowing requirements. We’ll examine each feature, along with its associated costs and potential drawbacks, to aid your decision on upgrading to Robinhood Gold.

The Cost of Robinhood Gold

Robinhood Gold’s cost includes a $5 monthly subscription fee and additional costs for margin trading, depending on usage. As mentioned, the subscription fee provides access to advanced market data, larger instant deposits, and margin trading.

In the following sections, we will further break down these costs to help you determine if upgrading to Robinhood Gold is worth the investment.

Monthly Subscription Fee

Compared to other premium investment services, the $5 monthly subscription fee fee is relatively affordable and may be a suitable option for investors looking to access advanced features without breaking the bank.

Additional Costs

For those who engage in margin trading, additional costs may apply. Robinhood Gold charges daily interest based on the amount borrowed, with the first $1,000 of margin being free of interest and any amounts above $1,000 being subject to an 8% rate.

Consider these additional costs when evaluating if Robinhood Gold merits the investment for your trading aspirations.

Evaluating the Benefits

Robinhood Gold offers a range of benefits for subscribers, including earning interest on uninvested cash, access to in-depth research and analysis, and the convenience of larger instant deposits. Each of these benefits can provide value to different types of investors, depending on their trading strategies and financial goals. So, is Robinhood Gold worth considering? It depends on your individual needs and preferences as an investor.

We will delve deeper into these benefits in the subsequent sections to assist you in assessing if Robinhood Gold suits your investment preferences.

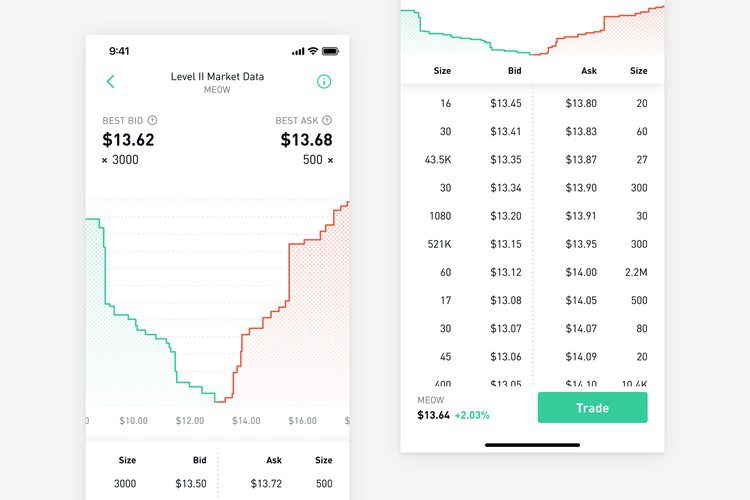

Advanced Market Data

One of the key benefits of Robinhood Gold is the access to Level II market data from Nasdaq TotalView. This advanced market data provides a comprehensive view of stock transactions and price movements, displaying multiple bid and ask prices for any security. Level II market data, offering deep insights into stock availability at various price points, aids in making informed trading decisions.

However, keep in mind that Robinhood Gold’s Level II market data exclusively covers stock orders on the Nasdaq exchange. This means that while you have access to valuable information on Nasdaq-listed stocks, you won’t be getting the same level of detail for stocks listed on other exchanges.

Interest on Uninvested Cash

Gold subscribers can earn a higher APY on uninvested cash through Robinhood’s cash sweep program, which utilizes uninvested brokerage cash. This program allows you to make the most out of your idle funds by earning a higher interest rate compared to the standard rate offered to non-Gold subscribers.

Upgrade your membership to Gold and you can receive up to 4.9% with high yield savings accounts. This represents a 3.15% increase in your cash sweep rate. This benefit is particularly attractive for passive investors who want to optimize their uninvested cash without actively trading.

In-Depth Research and Analysis

Access to professional research from Morningstar helps Gold members make more informed investment decisions. These in-depth research reports analyze the company’s business strategy, leadership, and fair market value, providing valuable insights for investors who rely on fundamental analysis.

Access to such professional research can significantly impact some investors, as it aids in discovering under-the-radar opportunities and avoiding potential stock market pitfalls. Nonetheless, balancing the costs against the benefits is crucial in deciding if this feature is valuable for your specific investment needs.

Convenience of Bigger Instant Deposits

The convenience of larger instant deposits allows gold customers to capitalize on market opportunities more quickly. With access to instant deposits of up to $50,000, Gold subscribers can seize market opportunities without waiting for funds to settle from their bank accounts.

In volatile market conditions where timing is paramount to maximize returns, this feature proves beneficial. Yet, swift investments of large capital should be made with caution, as market volatility can cause sudden drops in stock value and potential investment losses.

Potential Drawbacks of Robinhood Gold

While Robinhood Gold offers several advantages for investors, it’s important to consider the potential drawbacks and risks associated with the premium subscription. Some of these drawbacks include limited mutual fund offerings and the risks associated with margin trading.

We’ll delve deeper into these potential drawbacks in the subsequent sections to aid your well-informed decision on whether Robinhood Gold suits your investment requirements.

Limited Mutual Fund Offerings

One potential drawback of Robinhood Gold is that it does not offer mutual fund trading. Mutual funds can be an attractive investment option for investors seeking diversified portfolios, as they provide exposure to a wide range of assets in a single investment.

This limitation may be a disadvantage for some investors who want to include mutual funds in their portfolios. If mutual fund trading is a crucial part of your investment strategy, you may need to consider alternative investment platforms, such as a brokerage account, that offer this feature.

Margin Trading Risks

Margin trading, also known as margin investing, while offering increased purchasing power, comes with risks such as potential losses and margin calls. If the value of the securities purchased with borrowed funds decreases, potential losses could exceed the amount initially invested.

Additionally, a margin call can be a distressing event for investors, as it may require them to deposit additional funds or securities to cover potential losses. If you are unable to fulfill the margin call, the broker may sell some or all of your securities to cover the losses. Being conscious of these risks and practicing responsible margin trading is imperative.

Comparing Robinhood Gold to Alternatives

Comparing Robinhood Gold to alternative investment platforms can help investors determine if the subscription is worth it for their needs. Each platform offers different features and benefits, which may be more suitable for certain investors.

In the subsequent sections, we’ll examine various alternative investment platforms and compare their features with Robinhood Gold, facilitating your decision on whether upgrading to Robinhood Gold matches your investment objectives.

Competitor Platforms

Competitor platforms like Schwab, Fidelity, Acorns, and Moomoo offer different features and benefits, which may be more suitable for certain investors. For example, Schwab and Fidelity provide a broad array of investment options such as stocks, ETFs, mutual funds, and options, along with extensive research and analysis tools and access to professional advisors.

On the other hand, Acorns and Moomoo offer a more user-friendly interface with a variety of educational resources, making them more appealing to beginner investors. By evaluating your personal requirements and comparing the features of each platform, you can decide if Robinhood Gold fits your needs.

Comparison of Features

Comparing the features of Robinhood Gold to other platforms can help investors decide if the subscription is worth the cost and if it aligns with their investment goals. However, other platforms may provide additional features that better suit your needs.

A careful evaluation of each platform’s features, balanced against the costs and benefits, enables a well-informed decision on upgrading to Robinhood Gold in alignment with your investment needs.

Summary

In conclusion, Robinhood Gold offers several benefits for investors, including advanced market data, larger instant deposits, margin trading, and access to professional research. However, it’s important to consider the potential drawbacks and risks, such as limited mutual fund offerings and margin trading risks. By comparing Robinhood Gold to alternative investment platforms and evaluating its features, costs, and benefits, you can make an informed decision about whether upgrading to Robinhood Gold is worth it for your specific needs and investment goals.

Frequently Asked Questions

Can you make money on Robinhood gold?

Yes, you can make money with Robinhood Gold. It increases the amount of interest you earn on your uninvested cash up to 4.90% APY, and the money is insured by the FDIC for up to $250,000 per program bank and up to $1.5 million in total.

What is the benefit of Robinhood gold?

Robinhood Gold is an advanced subscription that provides access to premium trading tools, 4.9% interest on uninvested brokerage cash, bigger instant deposits, and professional research from Morningstar, as well as a 5% margin rate on margin over $1,000 instead of the 9% regular customers get.

What is the catch for Robinhood gold?

The catch for Robinhood Gold is that it costs $5 a month, or $60 a year. Members gain access to perks like instant deposits, professional research, and even real time data, plus a higher interest rate on uninvested cash. However, margin trading is risky and investors should be aware of the risks before opting in.

Does Robinhood Gold give you $1000 dollars?

No, Robinhood Gold does not give you $1000 dollars. It gives you access to up to $50,000 instantly depending on your account balance and status. The first $1000 of margin trading is covered by the Gold membership, but any other margin utilized will be subject to a 5% annualized interest rate.

What is the cost of Robinhood Gold?

Robinhood Gold costs $5 per month, plus additional fees for margin trading.